What's New in Version 6.0

Welcome to MotiveWave™ version 6.0! There have been many new features and improvements to MotiveWave and we are excited to launch the latest version of our software.

New Product Lineup

As part of Version 6.0, we have streamlined our editions and products to make it easier to choose the product right for you.

We have introduced 2 new editions (Standard, and Elliott Wave Lite).

We have retired 3 editions (Charts, Charts Plus, and Strategy).

All Add-On Modules have been absorbed into one or more editions, so we have also retired the Add-On Modules.

Our product lineup is now simply 5 different editions to choose from.

You can still upgrade to a higher edition at any time (as long as you have active support and updates). We will still put the cost you paid for the lower edition (minus any taxes, discounts or currency conversions) towards the upgrade to the higher edition, so you will only need to pay the remaining difference.

If you own any of the retired editions or modules, don’t worry, they are still supported and you can continue using them. They are just no longer offered for new purchases. Please contact Sales if you have any questions concerning the product lineup change and how it affects you.

Standard Edition

The Standard Edition is our new base charting edition and is a robust, advanced charting platform. The Standard edition features are:

30+ Supported Brokers and Data Feed Providers

One Broker/Data Feed per Workspace

Cloud Workspaces

Comprehensive set of Chart Tools, which include:

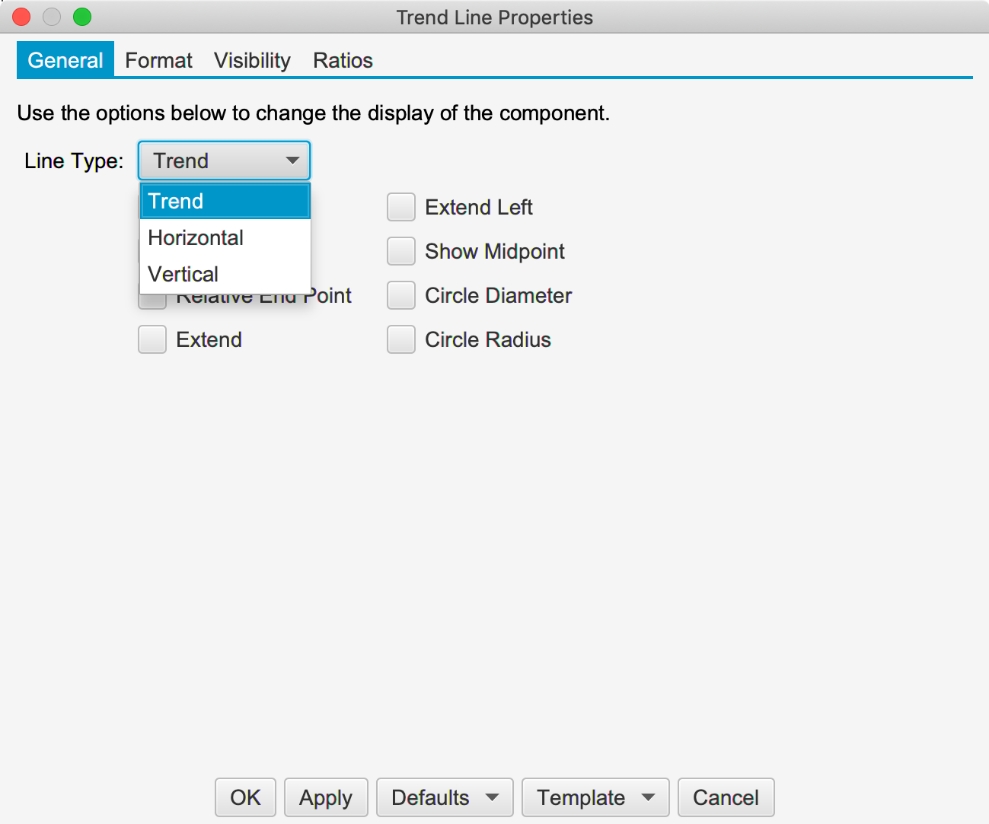

General Analysis Components like Trend Line (and extended), Horizontal Line (and extended), Vertical Line (and extended), Price Labels, Time Labels, Fork, Modified Schiff Fork, Channel (and extended), Range, Time and Price Range, Arrows, Support and Resistance Areas, Support and Resistance Zones, P&L Calculator/PL Targets, Cycle, Time Cycle, Wedges, Angles, Curves, Regression Tools, Circles (Radius, Diameter), Triangle, Quad Polygon, Sine Wave, Quadrant Lines, Tirone Levels, Speed Lines, Cross Line

Fibonacci retracement, extension and expansion tools

Advanced Commentary & Markers like Callouts (Balloon, Line, Box), Annotation, Note, Comment, Ellipse, Boxes, Arrows (Straight, Curved), Shapes, Numbers, Letters

Formatting and Visibility Options

283+ Built-in Studies/Indicators, including Multiple Time Frame Studies, Multiple Instrument Studies (Instrument Overlay/Graph, Spread, Ratio), and ability to Choose a Different Instrument for a Study Graph

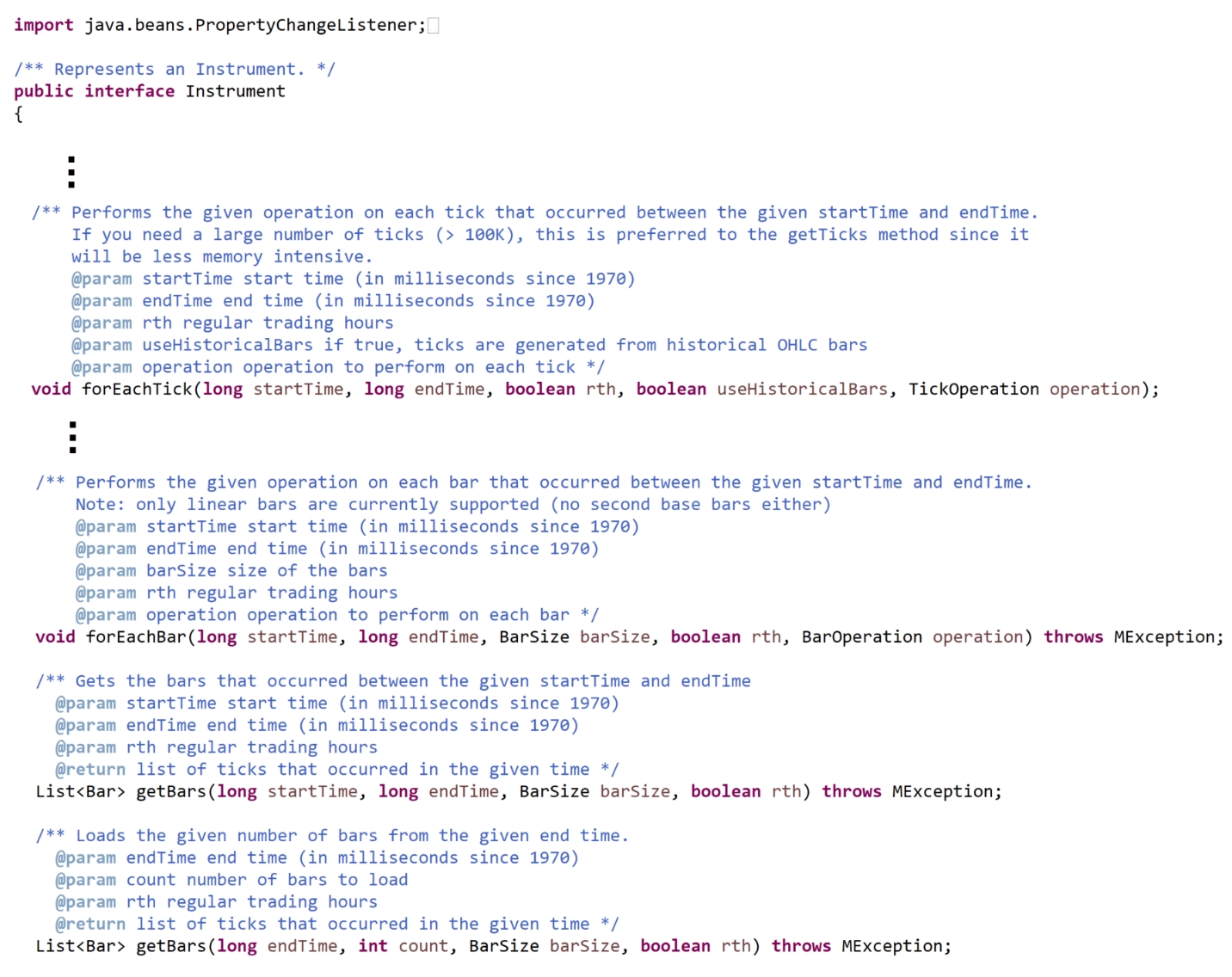

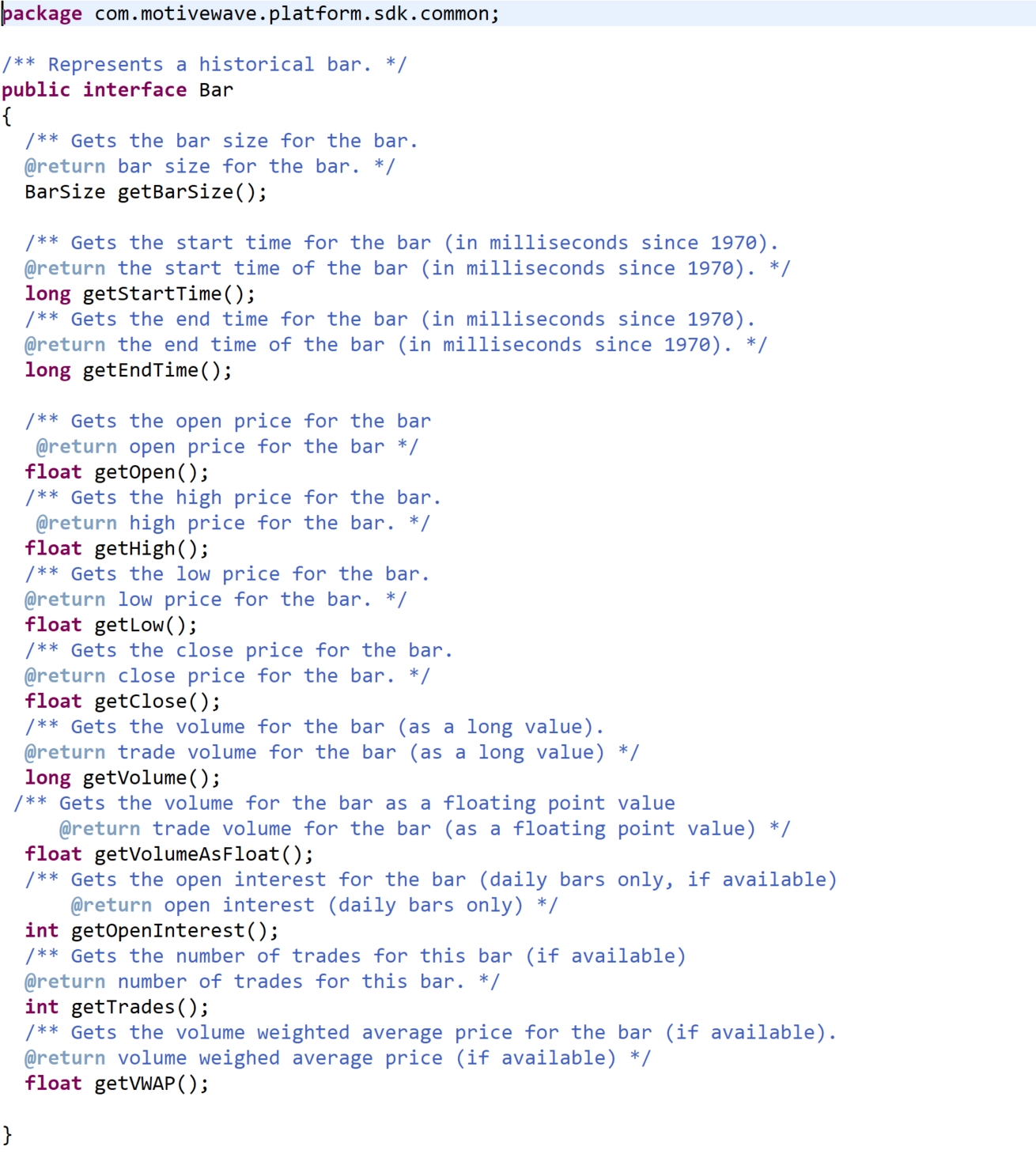

Free Java SDK for programming your own custom studies/indicators/strategies.

Unlimited Chart Templates and Chart Linking

19 Chart Bar Types, which are:

OHLC bars, HLC bars

Candlesticks, Trend Candlesticks, 3D Candlesticks, Hollow Candlesticks, Flat Candlesticks

OHLC Heikin-Ashi, Candle Heikin-Ashi, Trend Heikin-Ashi, Hollow Heikin-Ashi

Percent Change, Line, Line (Shaded), Line (Gradient)

Bars, Flat Bars, 3D Bars, No Bars

Data Import/Export

Repository

Console Pages

Timeframe Visibility Options

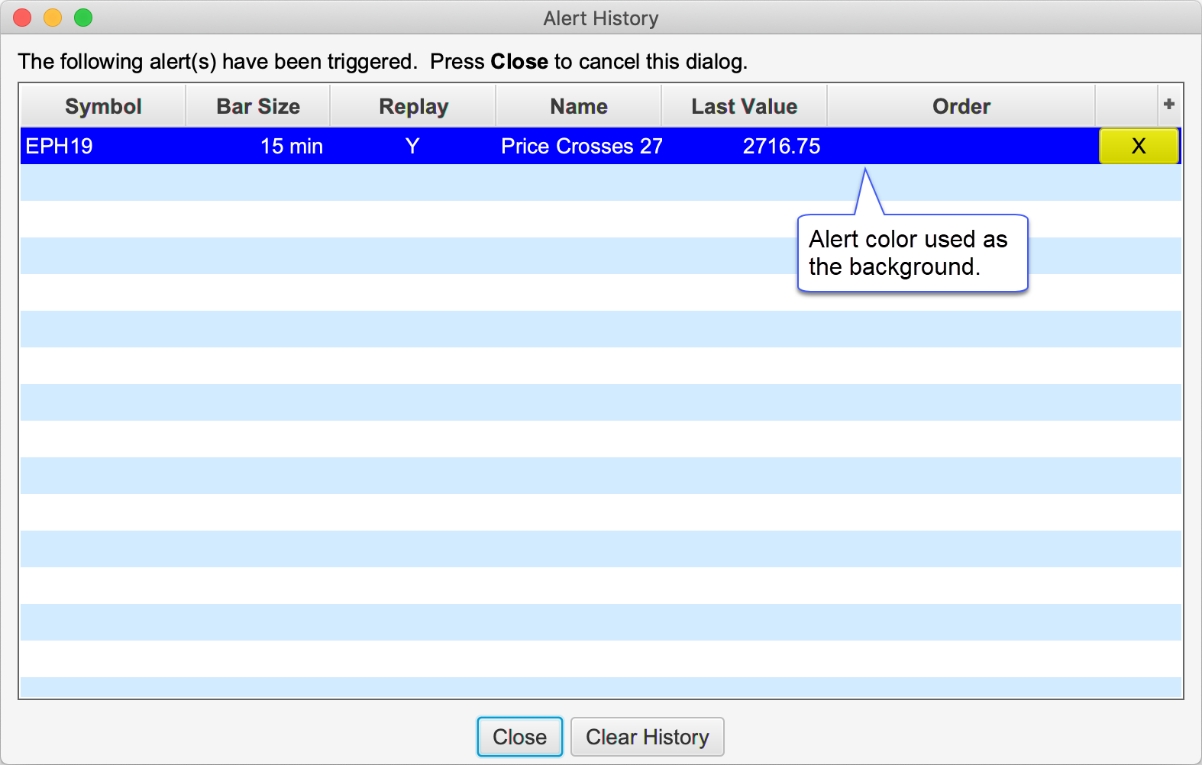

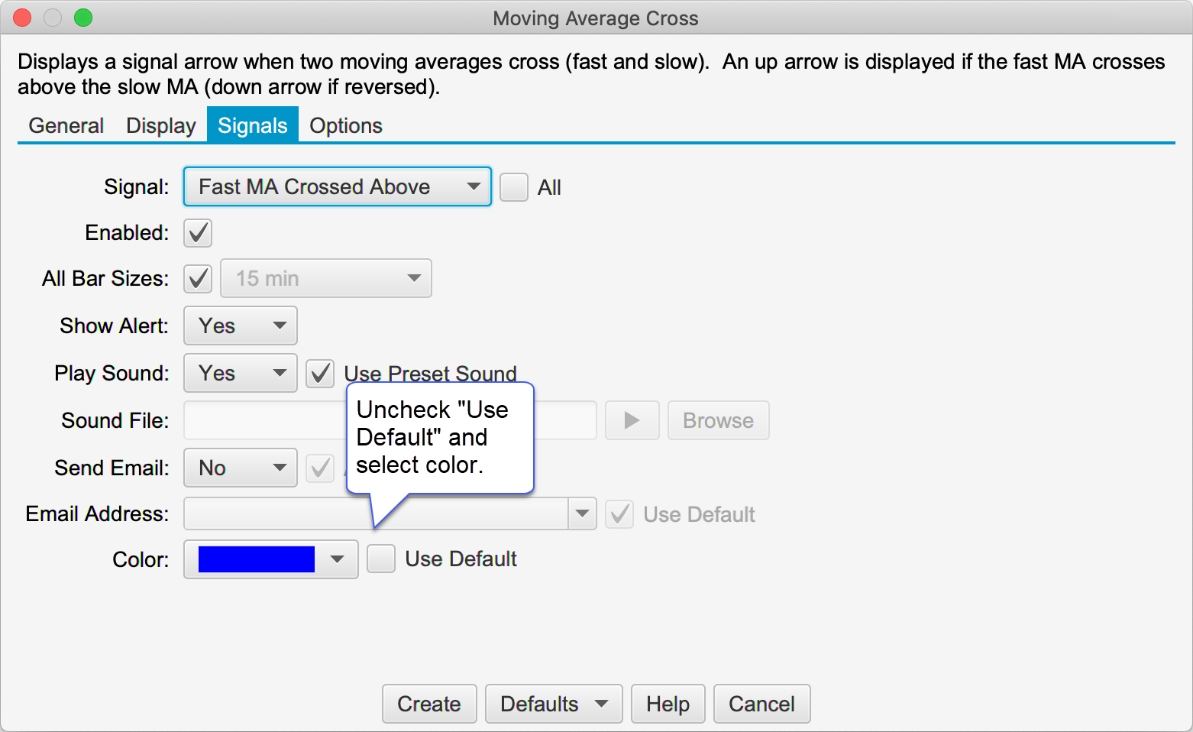

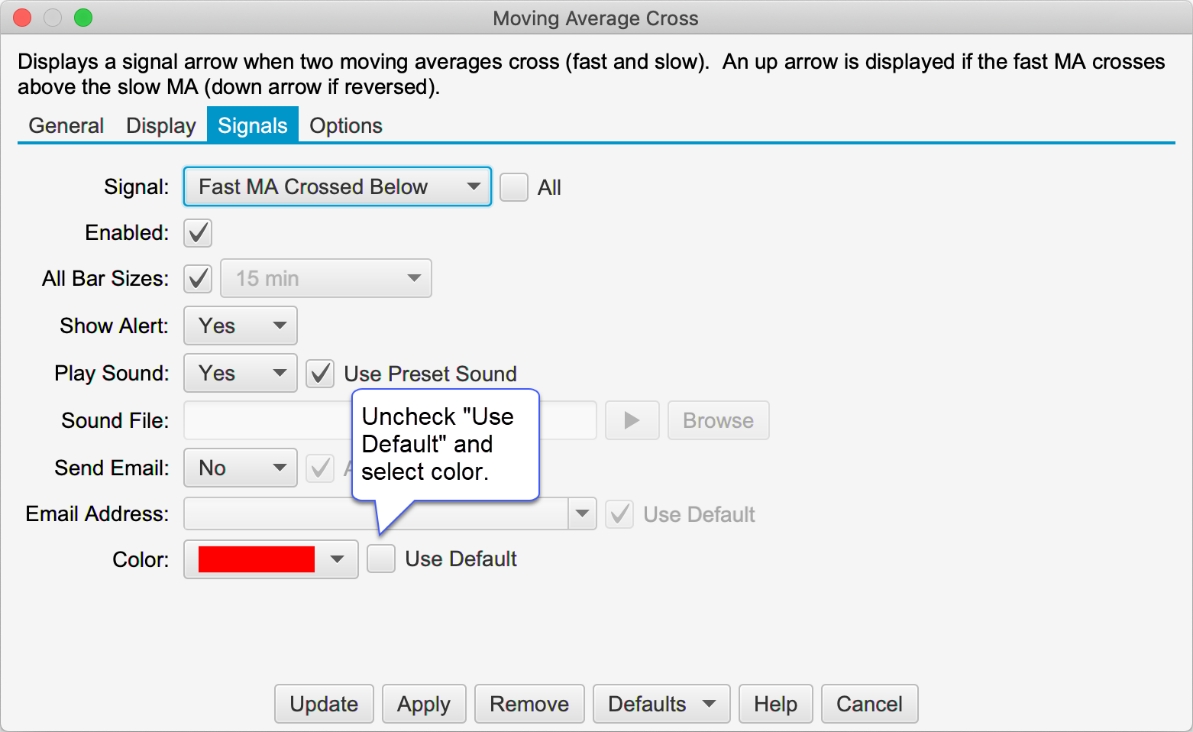

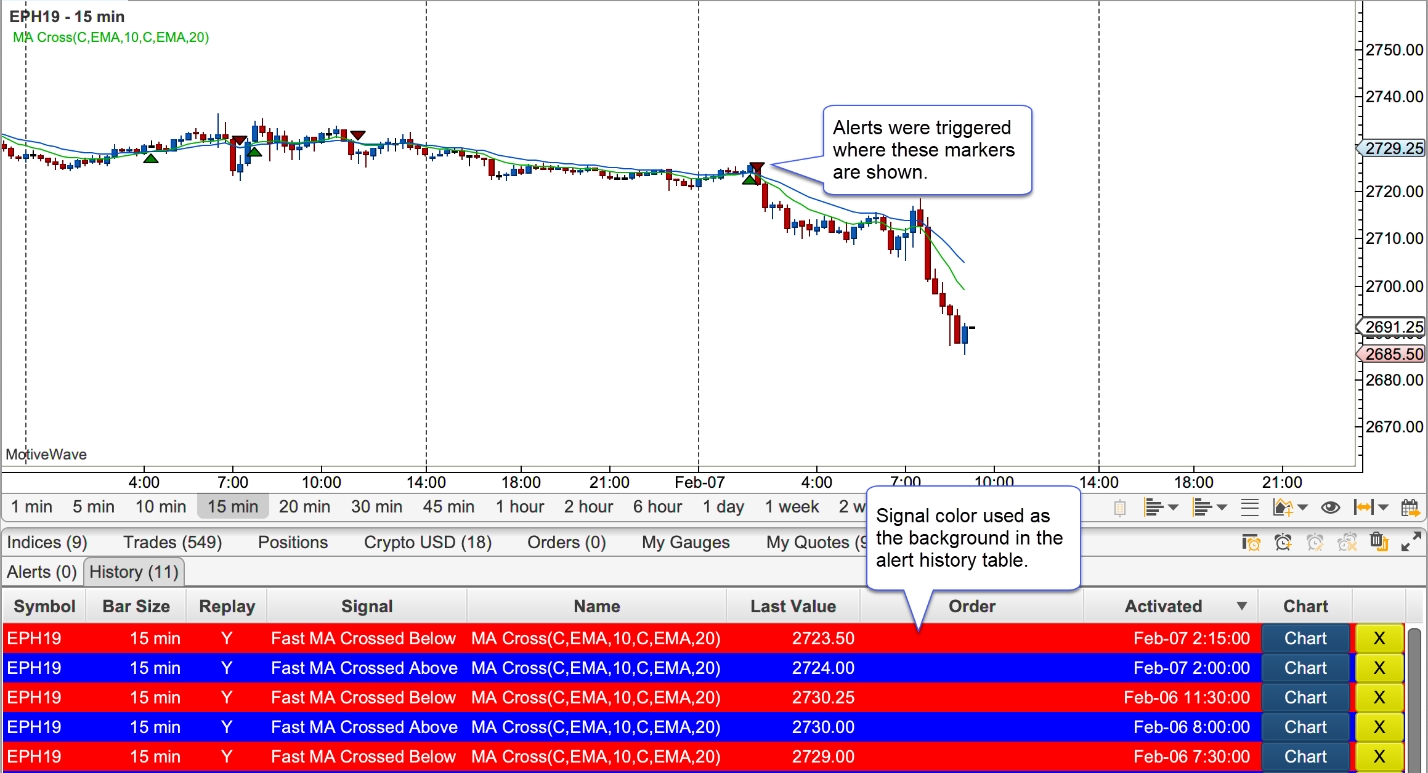

Simple Price Alerts

Replay Mode

Order Flow Tools—only includes Volume Profile (Does NOT include Order Flow 10 Studies Pack -TPO, Depth of Market, Bid/Ask Volume, DOM History, Big Trades Study, DOM Power, Speed of Tape, Speed Gauge, Delta Volume, Cumulative Delta)

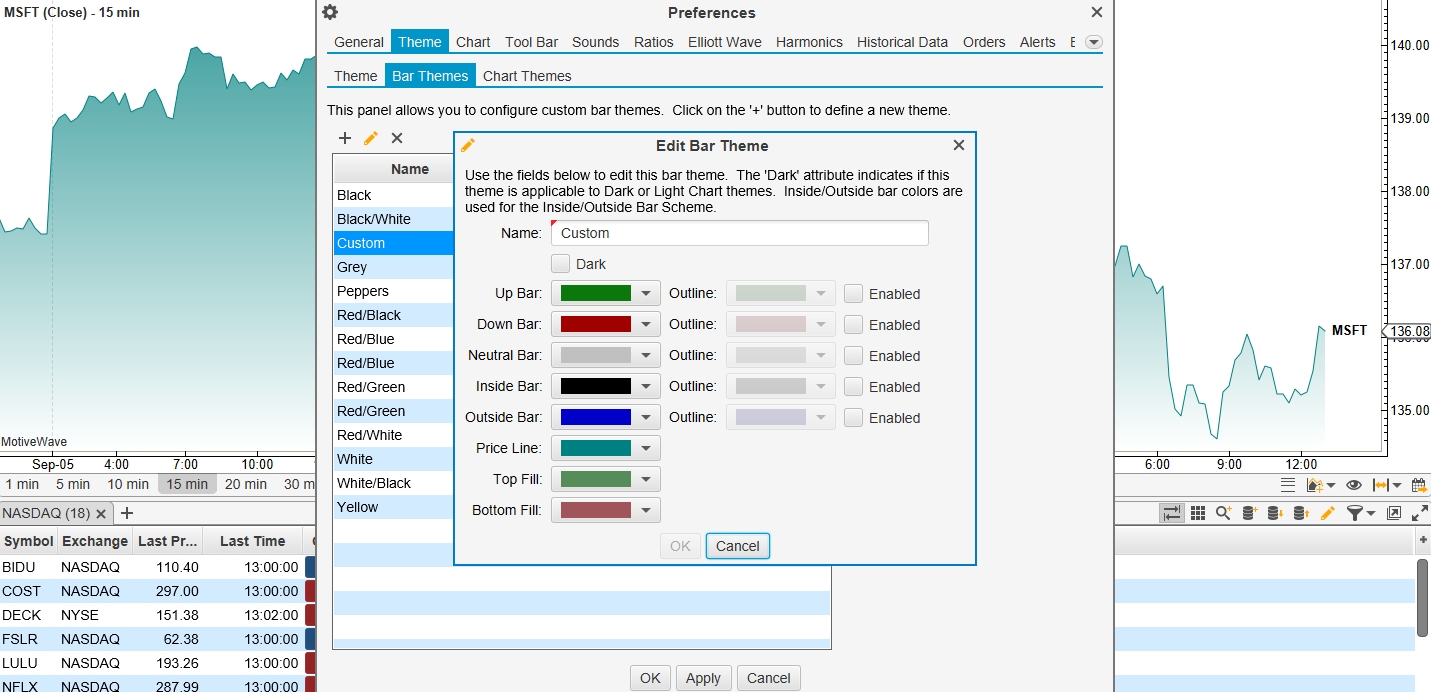

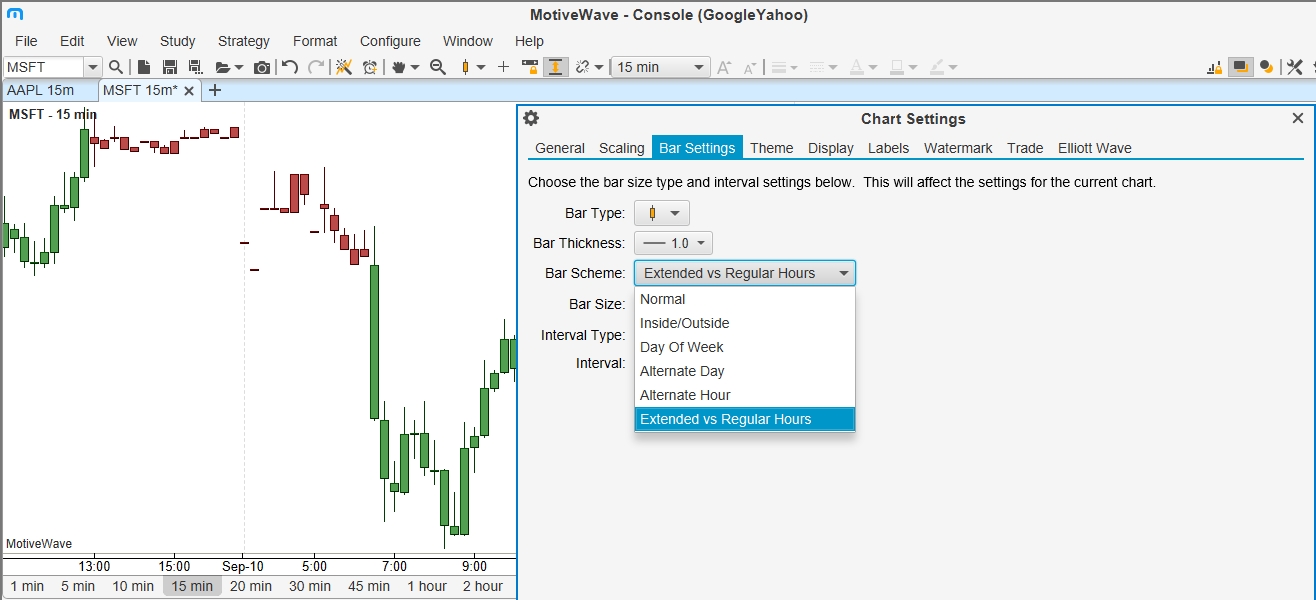

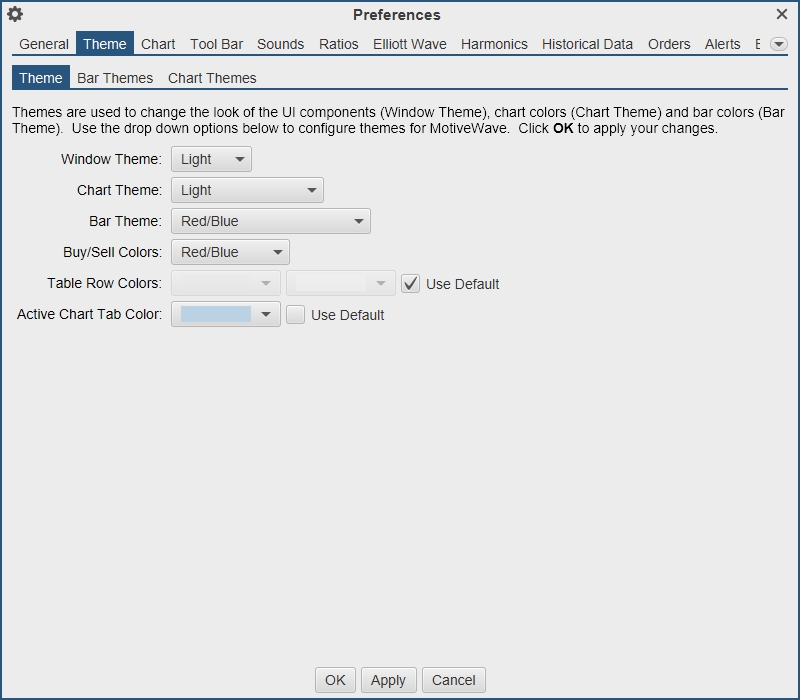

Bar Schemes

Harmonic Components

Bull/Bear versions of manual Harmonic Components like Gartley, Butterfly, Crab, Deep Crab, Bat, Alternate Bat, Shark, Cypher, AB=CD, Alternate AB=CD, 5-0, 3 Drives

Gann Components/Tools

Gann Fan, Wedge, Angles (1x1, 2x1, 3x1, 4x1, 8x1, 16x1, 1x2, 1x3, 1x4, 1x8, 1x16), Arc, Half Arc, Circle, Cross Square, Rotatable Square, Grid, Gann Box, Ratio Grid, Gann time and ratio analysis, Pyrapoint, square price scaling, and more

Elliott Wave Lite Edition

The Elliott Wave Lite Edition is the other new charting platform addition to our product lineup and is perfect for the Elliott Wave market analyst. The Elliott Wave Lite Edition includes everything in the Standard Edition above as well as:

Analysis Packs

Elliott Wave Tools Pack

Manual Elliott Wave Tools

EW Components - Allows you to drag a pattern onto the chart and then 'wire up' the points where you want them. You can readjust where the pattern is at any time.

EW Tools - Simply choose the pattern you want to draw from a dropdown menu, then click on the chart where you want each of the points. As you click the points, MotiveWave will draw in the labels and lines for you. You can readjust where the pattern is at any time.

Elliott Wave Markers - A simpler version of the Elliott Wave components, which may be used to place an Elliott Wave label (just a label, no lines) on the chart. This can be useful for showing an alternative wave count on the same chart as the primary count.

Semi-Automatic Elliott Wave Tools

Auto Wave Tool - Select a section of the chart and MotiveWave will automatically fill in the best patterns within that section. You can adjust where the pattern is at any time.

Auto Analyzer - Need help getting started with a wave count? Auto Analyze will automatically plot Elliott Wave patterns over a specified range of data to a specified level of decomposition on one chart, either based on a Data Window or a Start Date.

Automatic Elliot Wave Tools

Auto Elliott Wave Study - Looking for fully automated wave counts? The Auto Elliott Wave Study will create and automatically update a wave count in real time, as new historical bars are generated.

Wave Ratio and Time Analysis

Fibonacci ratios between waves are an essential tool for forecasting price movements. MotiveWave supports all price and time ratios (examples: 2 vs 1, 4 vs 3, B vs A, C vs A+B, X vs W). Multiple ratios can be displayed at the same time and conveniently accessed using keyboard shortcuts.

Decompose Waves

MotiveWave allows you to easily decompose wave formations to multiple levels on all of our Elliott Wave tools

Depending on the Elliott Wave tool you're using, you can tell MotiveWave to automatically decompose to a specific number of levels, to decompose to all possible levels, or MotiveWave will also highlight the possible patterns available to use to decompose a specific pattern you're looking at, if you want to choose the decompose pattern yourself.

Trade Edition

Along with the many new implemented features and enhancements mentioned below for Version 6.0, we’ve also added these additional features into the Trade Edition (vs. Version 5.4.25), as part of our product lineup change:

Exit Strategies (new name, previously entry/exit strategies)

Unlimited Chart Templates

Unlimited Chart Linking (previously limited to Link All/Red Group)

Replay Mode

Data Import/Export

Heikin Ashi

Percent Change Charts

Console Pages

Square Price Scaling

Bar Schemes

Simple Price Alerts

Timeframe Visibility Options

General Analysis Components

Trend Line (and extended), Horizontal Line (and extended), Vertical Line (and extended), Price Labels, Time Labels, Fork, Modified Schiff Fork, Channel (and extended), Range, Time and Price Range, Arrows, Support and Resistance Areas, Support and Resistance Zones, P&L Calculator/PL Targets, Cycle, Time Cycle, Wedges, Angles, Curves, Regression Tools, Circles (Radius, Diameter), Triangle, Quad Polygon, Sine Wave, Quadrant Lines, Tirone Levels, Speed Lines, Cross Line

Advanced Commentary & Markers

Callouts (Balloon, Line, Box), Annotation, Curly Braces, Brackets, Note, Comment, Ellipse, Boxes, Arrows (Straight, Curved), Shapes, Numbers, Letters

Formatting and Visibility Options

Harmonic Components

Bull/Bear versions of manual Harmonic Components like Gartley, Butterfly, Crab, Deep Crab, Bat, Alternate Bat, Shark, Cypher, AB=CD, Alternate AB=CD, 5-0, 3 Drives

Gann Components/Tools

Gann Fan, Wedge, Angles (1x1, 2x1, 3x1, 4x1, 8x1, 16x1, 1x2, 1x3, 1x4, 1x8, 1x16), Arc, Half Arc, Circle, Cross Square, Rotatable Square, Grid, Gann Box, Ratio Grid, Gann time and ratio analysis, Pyrapoint, square price scaling, and more

Professional Edition

Along with the many new implemented features and enhancements mentioned below for Version 6.0, we’ve also added these additional features into the Professional Edition (vs. Version 5.4.25), as part of our product lineup change.

Exit Strategies (new name, previously entry/exit strategies)

Analysis Packs

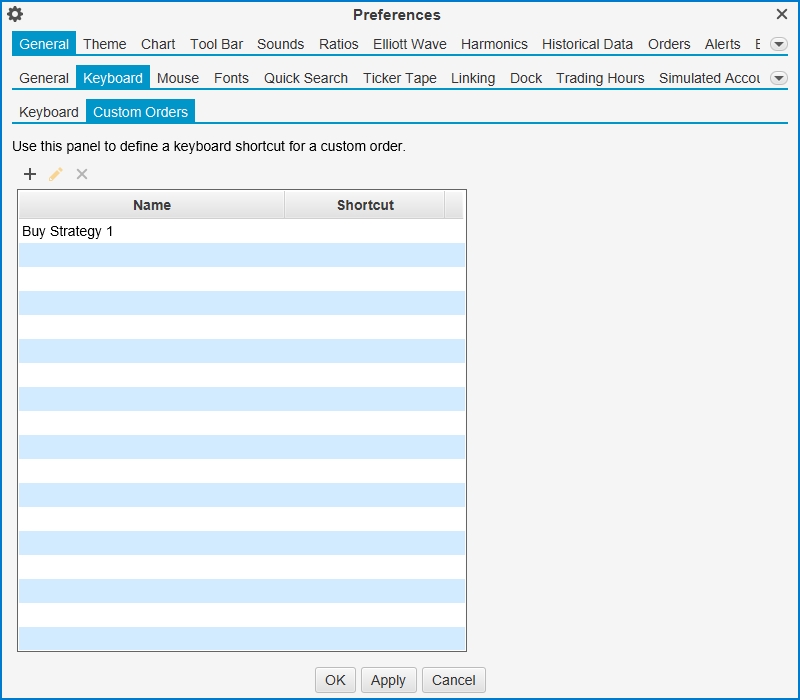

Custom Order Shortcuts

Timeframe Visibility Options

Harmonic Components/Tools

Bull/Bear versions of manual Harmonic Components like Gartley, Butterfly, Crab, Deep Crab, Bat, Alternate Bat, Shark, Cypher, AB=CD, Alternate AB=CD, 5-0, 3 Drives

Auto Gartley tool

Auto AB=CD tool

Auto Harmonic Study

Harmonic Scanner

Gann Components/Tools

Gann Fan, Wedge, Angles (1x1, 2x1, 3x1, 4x1, 8x1, 16x1, 1x2, 1x3, 1x4, 1x8, 1x16), Arc, Half Arc, Circle, Cross Square, Rotatable Square, Grid, Gann Box, Ratio Grid, Gann time and ratio analysis, Pyrapoint, square price scaling, and more

Ultimate Edition

The Ultimate Edition continues to be our top of the line charting, trading, and Elliott Wave platform, which includes all of our features.

The main difference between Professional and Ultimate, is that Ultimate includes all Elliott Wave functionality and Hurst Cycles.

Cloud Workspaces

Cloud workspaces are hosted on MotiveWave’s server and can be accessed from any computer using the same license key. Cloud workspaces hold all of their data in the MotiveWave™ cloud (including settings, instruments analysis etc.) but also hold a local copy so that the workspace can be opened in “offline” mode. Any changes that are made to the workspace in “offline” mode will be synchronized with the cloud workspace the next time you open the workspace in “online” mode.

Synchronization

Workspace synchronization involves uploading new or changed files and removing deleted files from the cloud repository. For efficiency, untouched files will not be included in the synchronization process. Synchronization occurs at the following times:

Startup – When the workspace is first loaded, it will be synchronized with the cloud to ensure that the latest files are loaded to the local disk.

Interval – MotiveWave™ will run the synchronization process at a constant interval (current every minute) to check for changes and upload them to the cloud. This happens in the background and will not affect your usage of MotiveWave™.

Shutdown – When closing the workspace, any remaining changes will be synchronized with the cloud.

Manual – At any point you can force the synchronization to occur by choosing Configure -> Synchronize Workspace from the Console menu bar.

Limitations

Cloud workspaces currently have the following limitations:

Trial Accounts:

Maximum of 1 Cloud Workspace

Maximum workspace size is 50 MB

Paid Accounts:

Maximum of 3 Cloud Workspace

Maximum workspace size is 200 MB

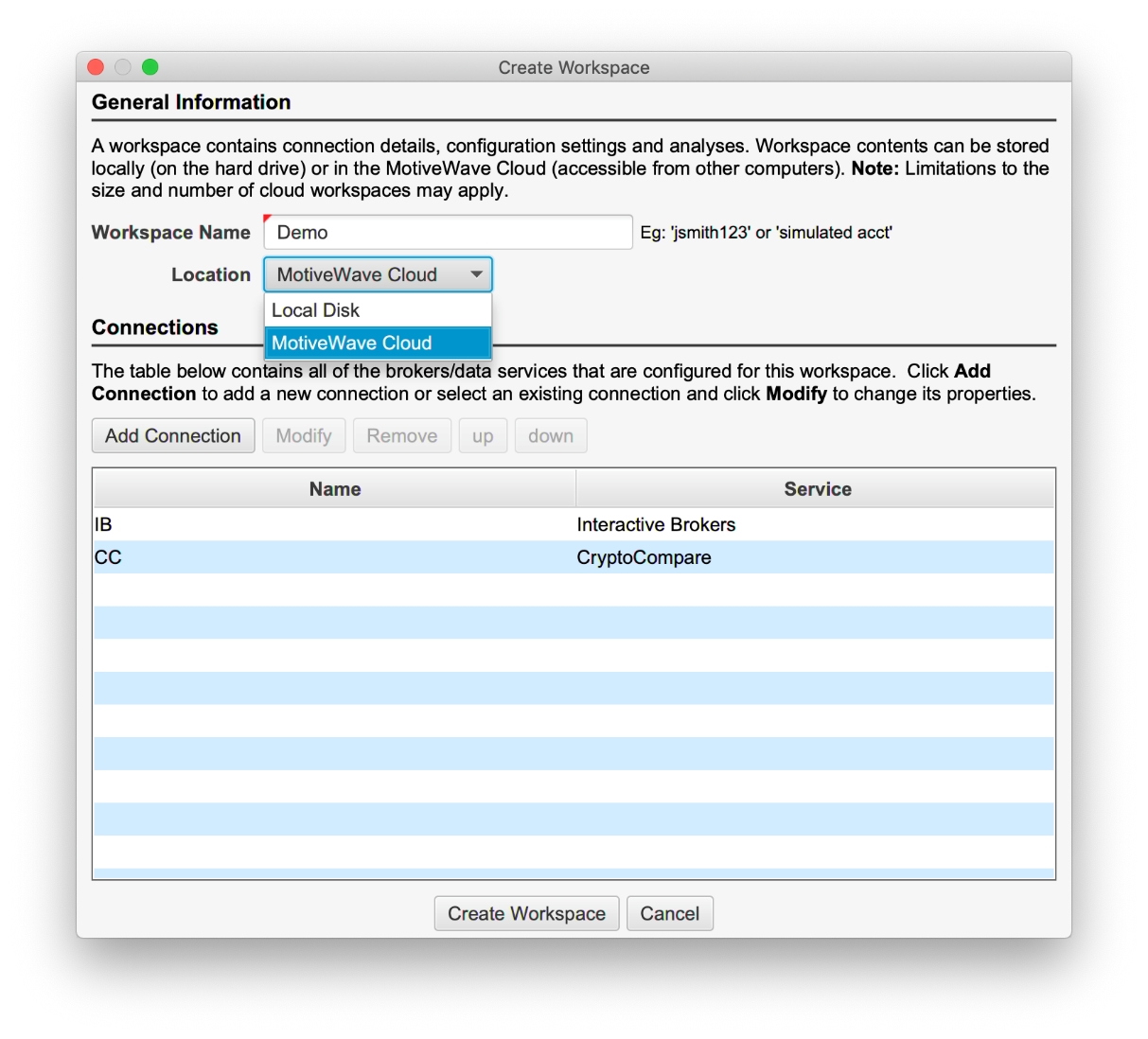

Creating/Editing Cloud Workspaces

A cloud workspace can be created by choosing “MotiveWave Cloud” from the location drop down in the Create Workspace dialog (see screen shot below). Existing workspaces may also be moved to the cloud in the Edit Workspace dialog. Note: you cannot change the name of a cloud workspace.

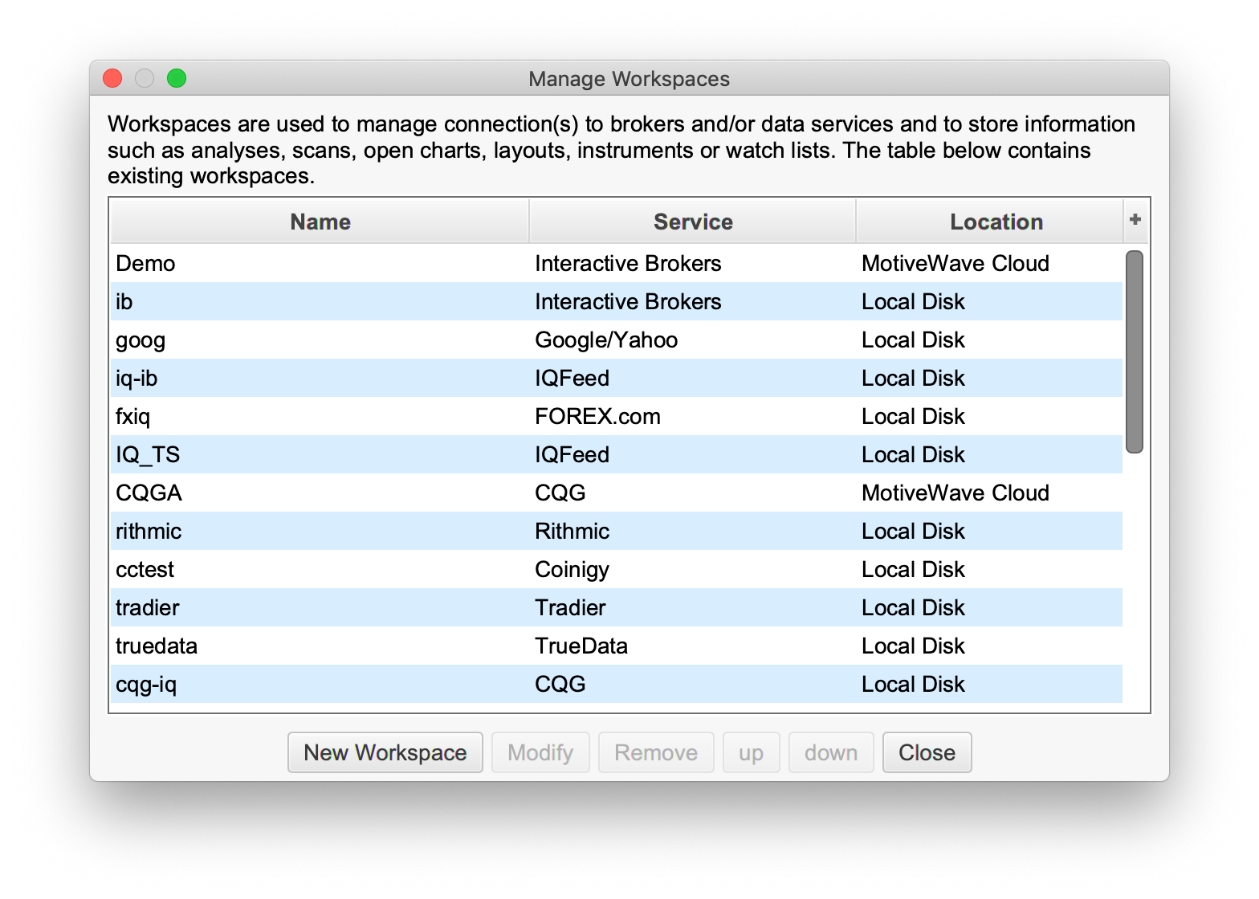

The Manage Workspace dialog has been modified to show local vs cloud workspaces (see below).

Elliott Wave Custom Ratios

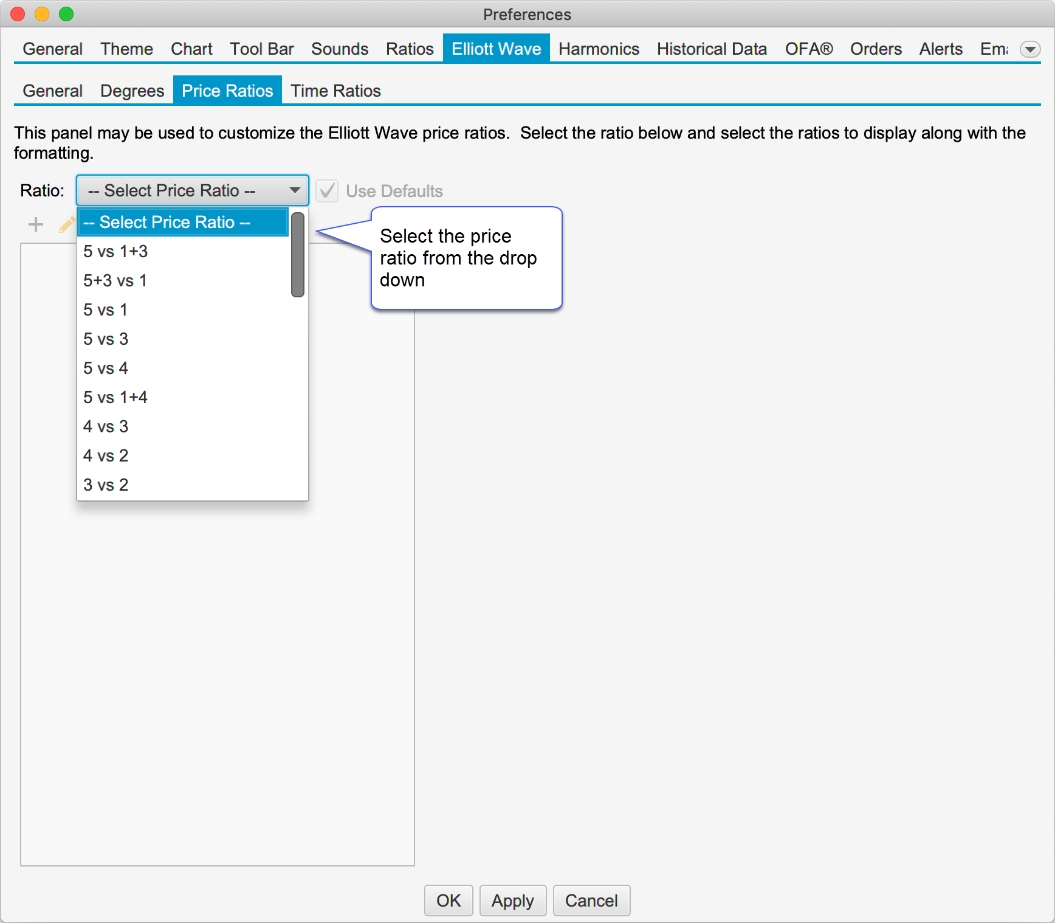

Price and time ratios for Elliott Waves may be customized from the Preferences Dialog (Configure -> Preferences from the Console menu bar, see Elliott Wave tab).

Price Ratios

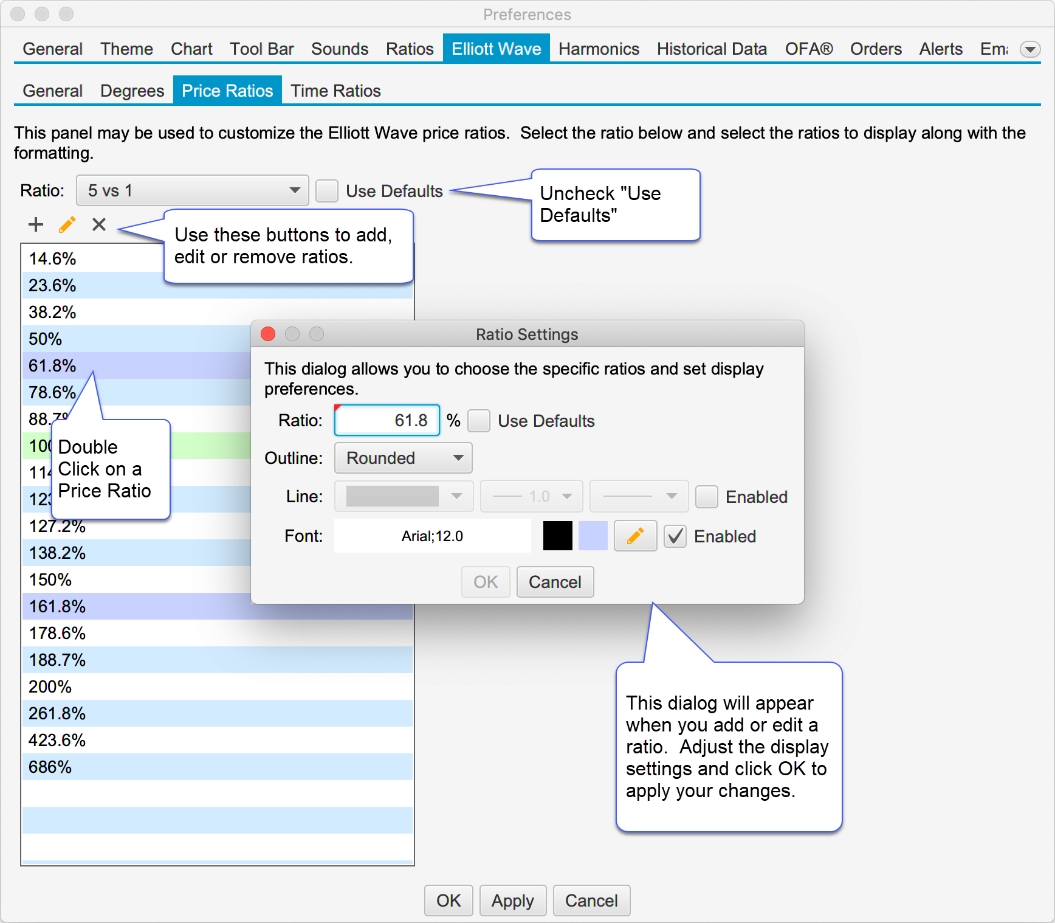

Select the Price Ratios sub tab from the Elliott Wave tab in the Preferences Dialog. Choose a Wave Ratio by selecting it from the drop down.

Once you have chosen a wave ratio, the existing settings will be populated in the list box. Uncheck the “Use Defaults” button to modify these ratios.

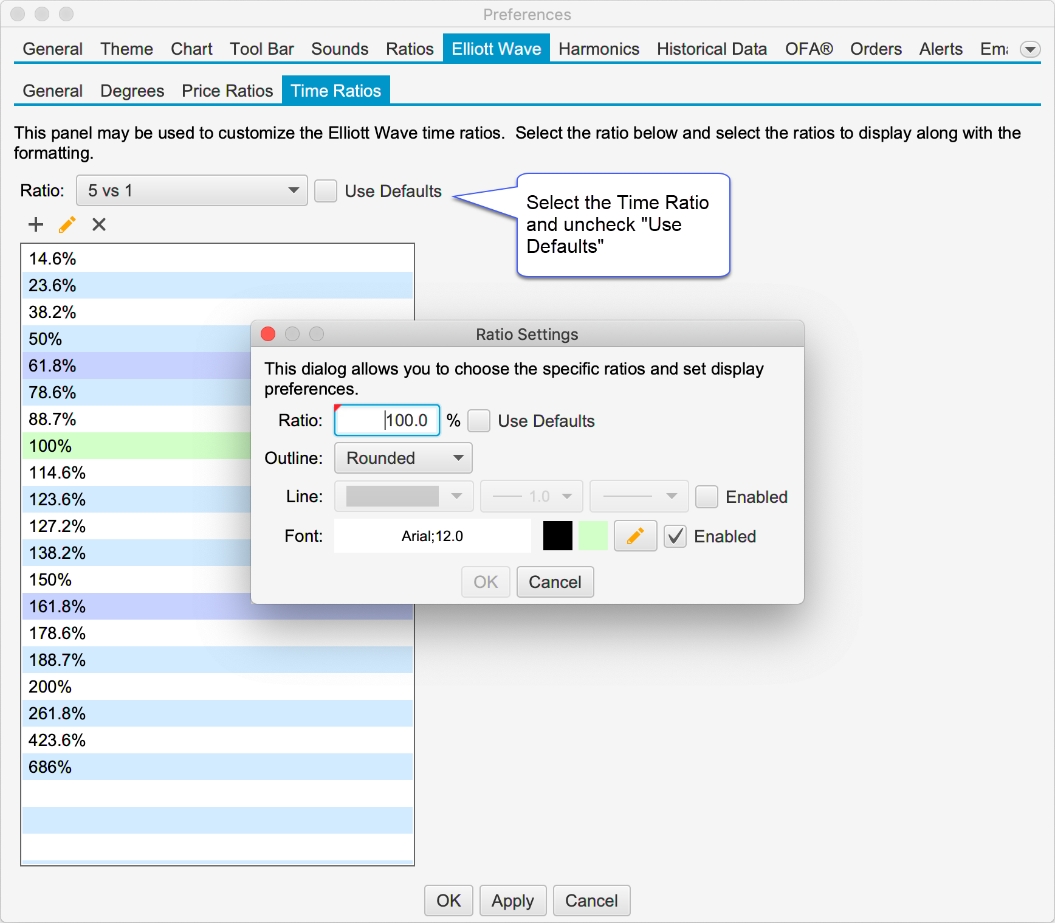

Time Ratios

Similar to the Price Ratios, the Time Ratios can be customized from the Time Ratios tab:

Elliott Wave Enhancements

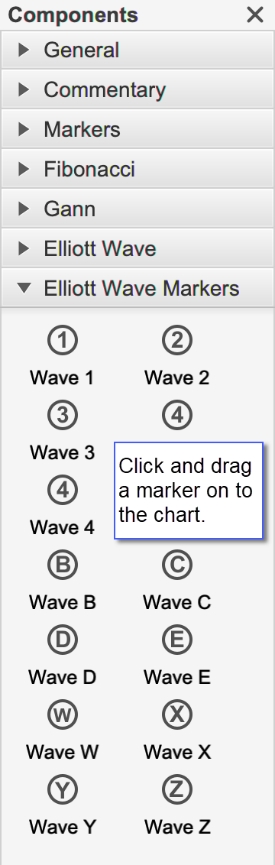

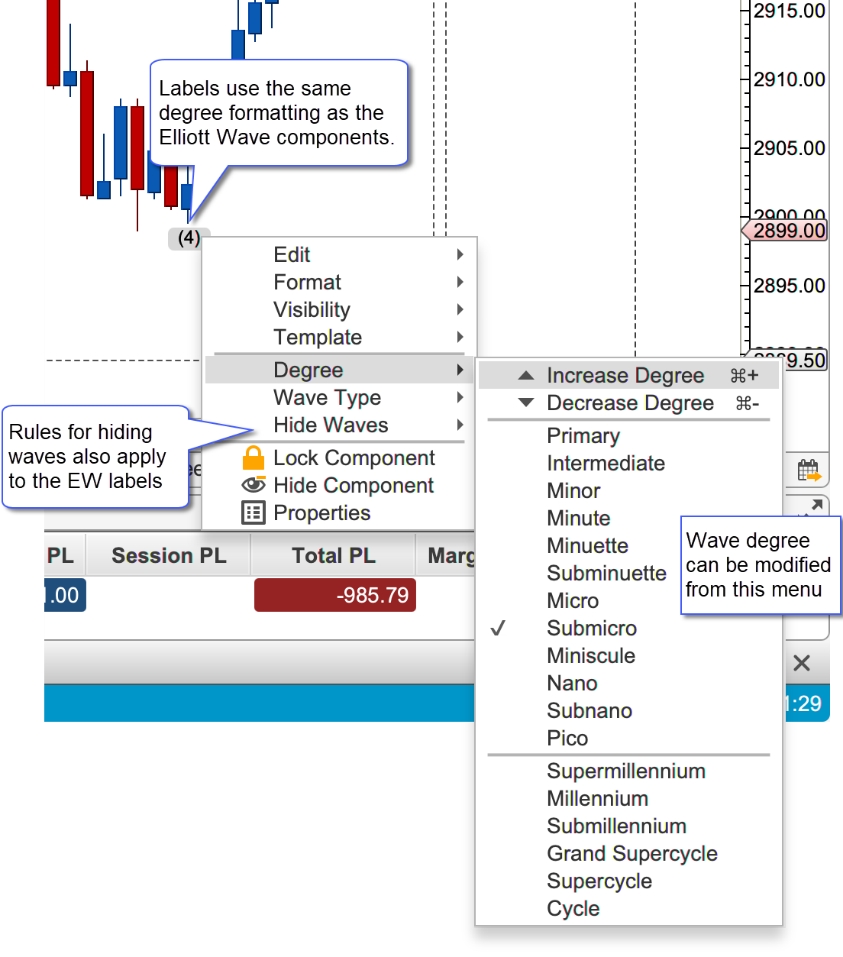

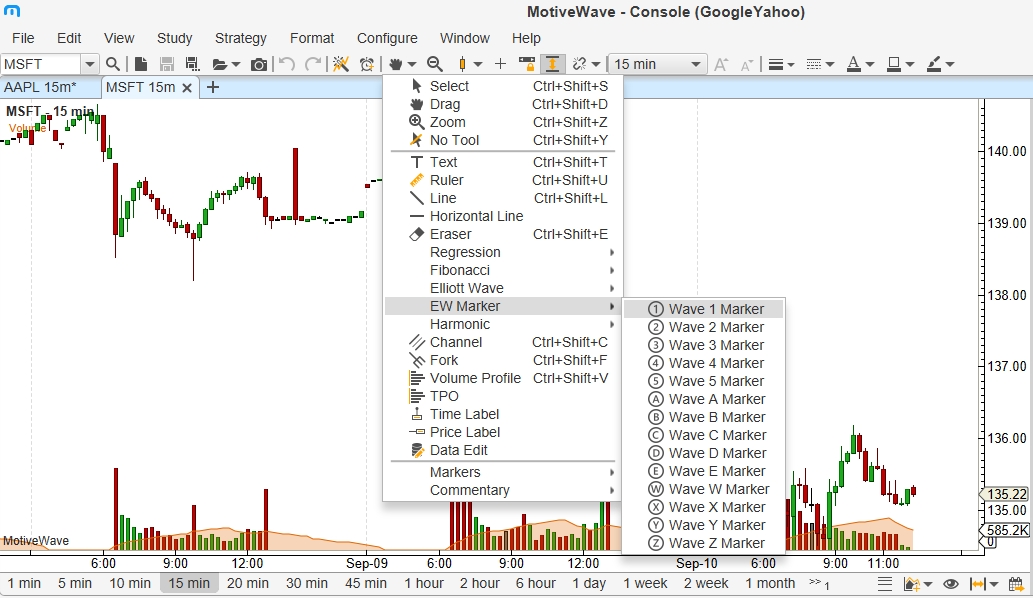

Elliott Wave Markers

Elliott Wave markers are a simpler version of the Elliott Wave components and may be used to place an Elliott Wave label on the chart. This can be useful for showing an alternative wave count on the same chart as the primary count.

The labels use the same degree label formatting as the Elliott Wave components. These labels also use the same rules for hiding waves above or below a specified degree.

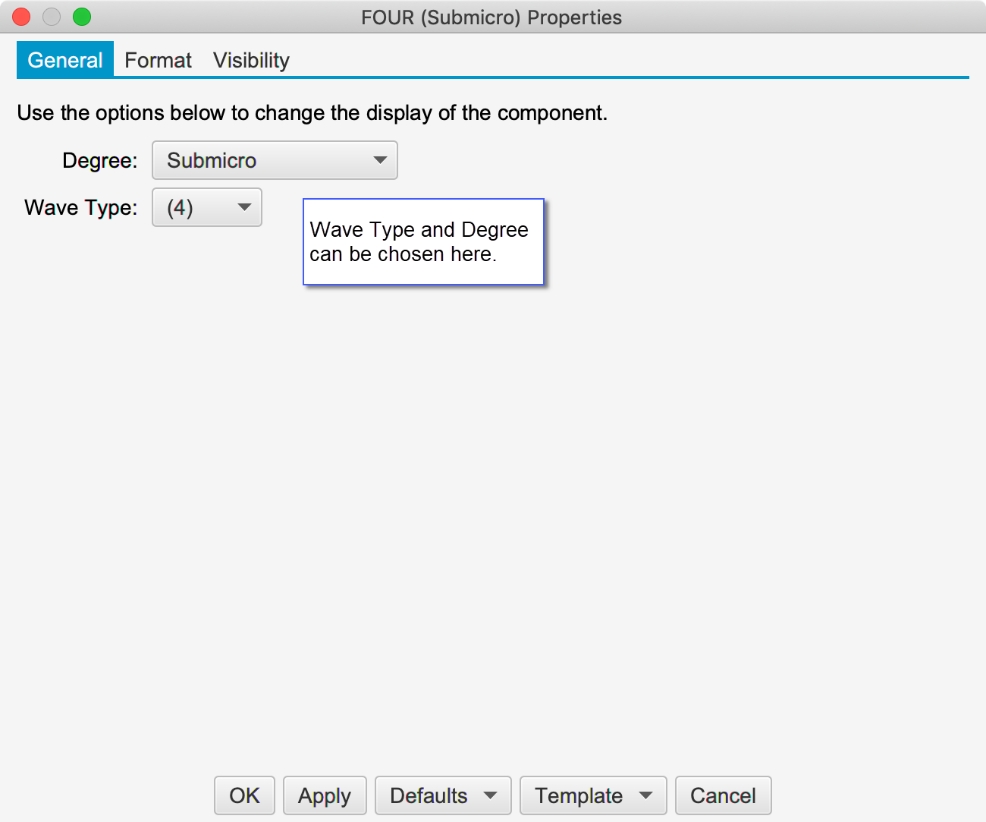

The degree of the label can be chosen from the right click (context) menu or from the Properties dialog (double click on the marker).

Mouse Tools

Mouse tools have been added for the Elliott Wave Markers.

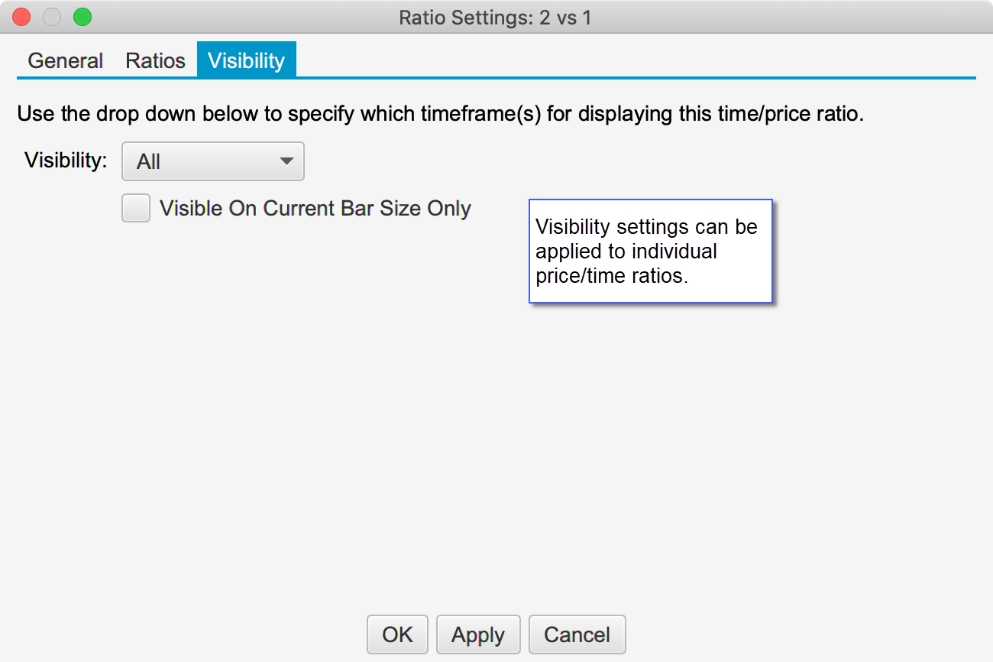

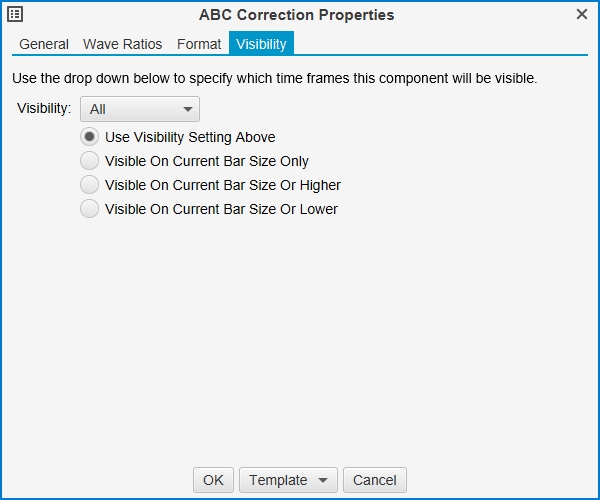

Ratio Visibility

The visibility for individual price and time ratios can be set from the Ratio Properties dialog (double click on a ratio label). This will hide or show ratios depending on the selected bar size for the chart.

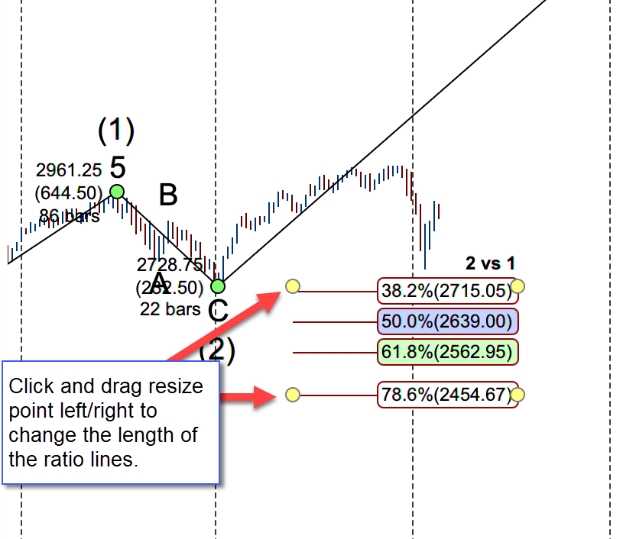

Left Adjust for Ratio Lines

The left side of ratio lines can now be adjusted using the mouse. Two yellow resize points are available on the left side of the ratio lines that can be dragged left or right.

Note: this feature also exists on other ratio components (such as retracements, extensions and expansions).

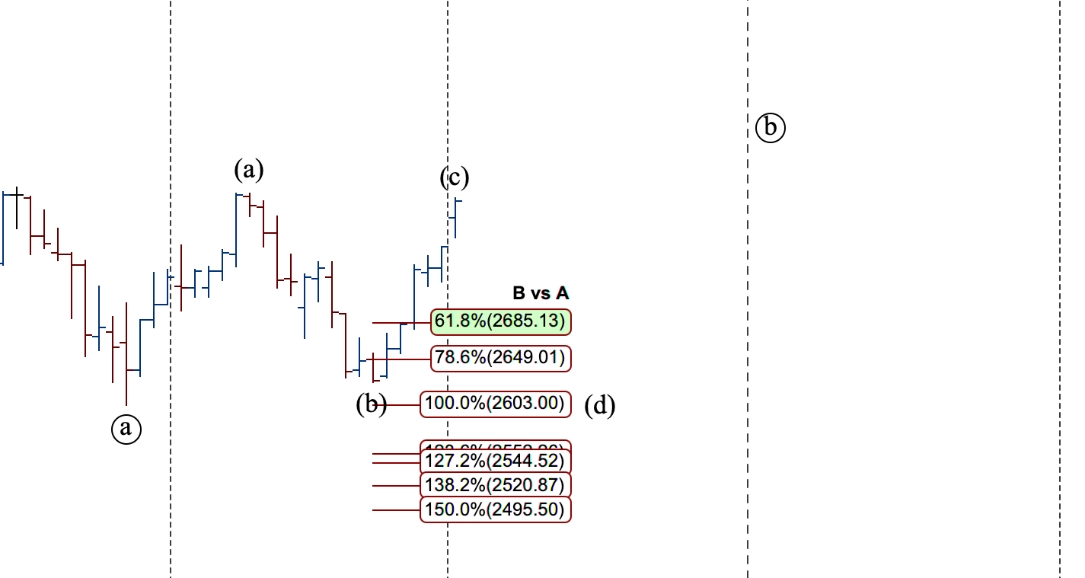

Wave B vs A for Triangles

The price wave ratio B vs A has been added for triangle patterns. The main purpose of this ratio is to monitor a developing triangle that may turn into an ABC correction.

Analysis Packs

The Analysis Packs feature provides a more convenient method for sharing or transferring a set of analyses from one computer to another. This is similar to the import/export analysis feature but allows you to include multiple analyses across one or more instruments.

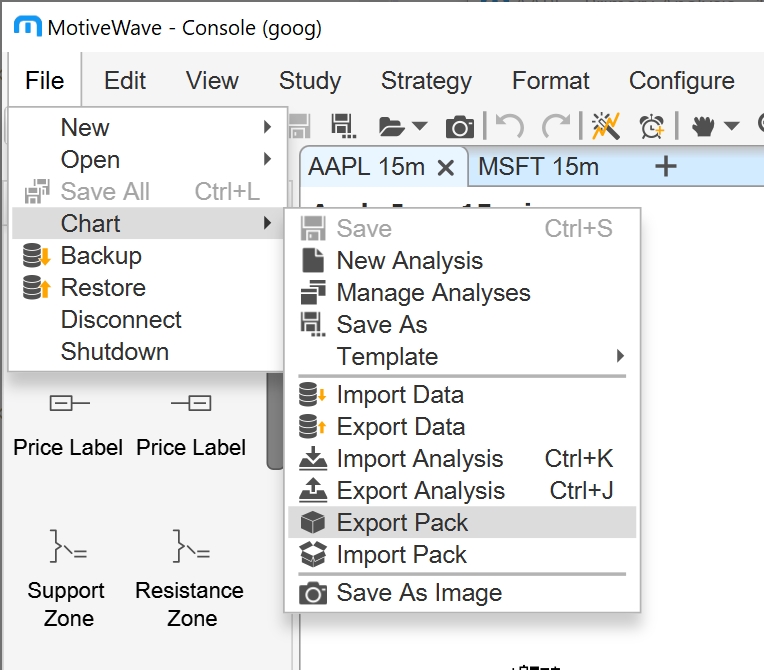

The Export/Import Pack options can be found under the File -> Chart menu of the Console menu bar:

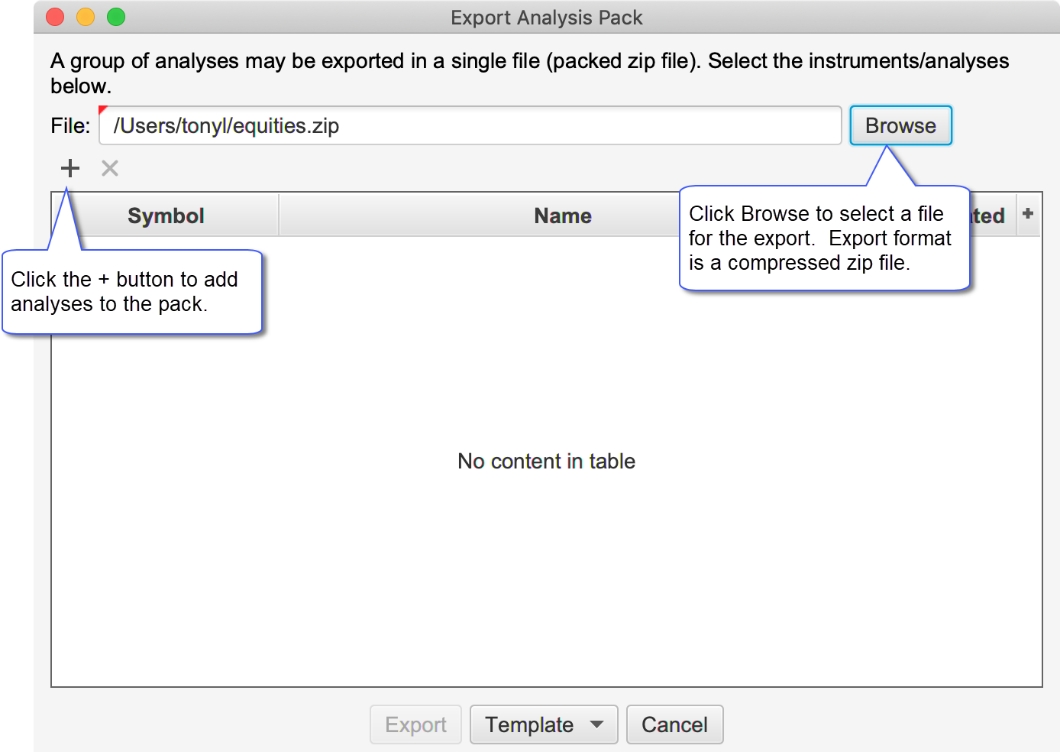

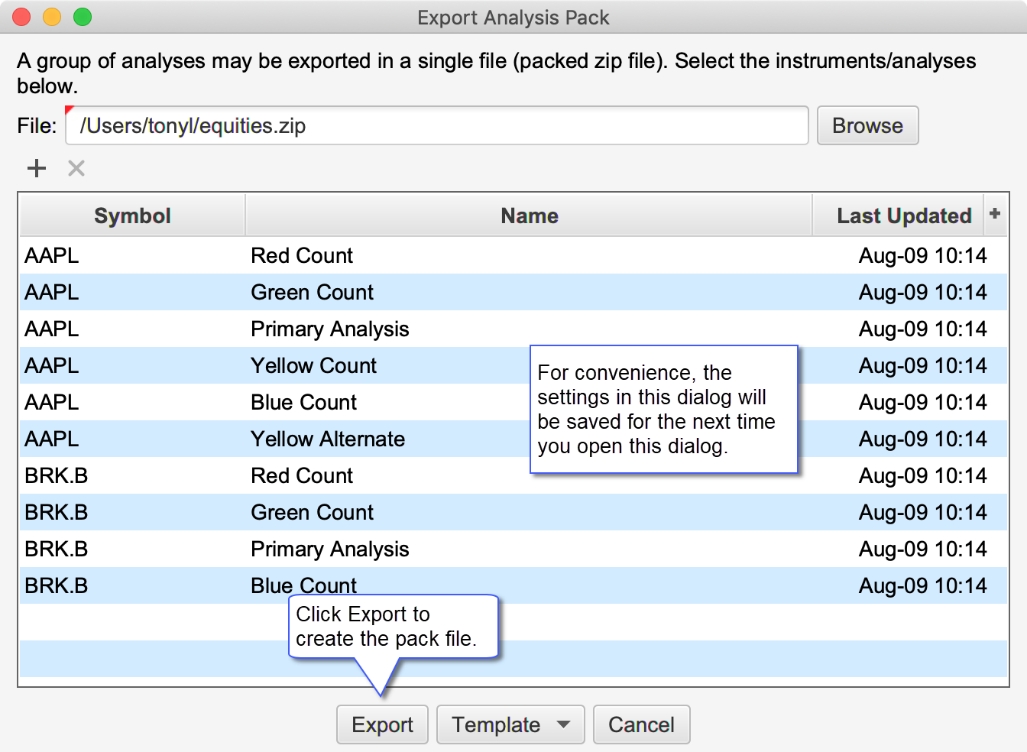

Exporting a Pack

Use the Export Analysis Pack dialog (see below) to select a set of analyses and create a pack file. The pack file is a compressed zip file. Click on the + button to select analyses to add to the pack.

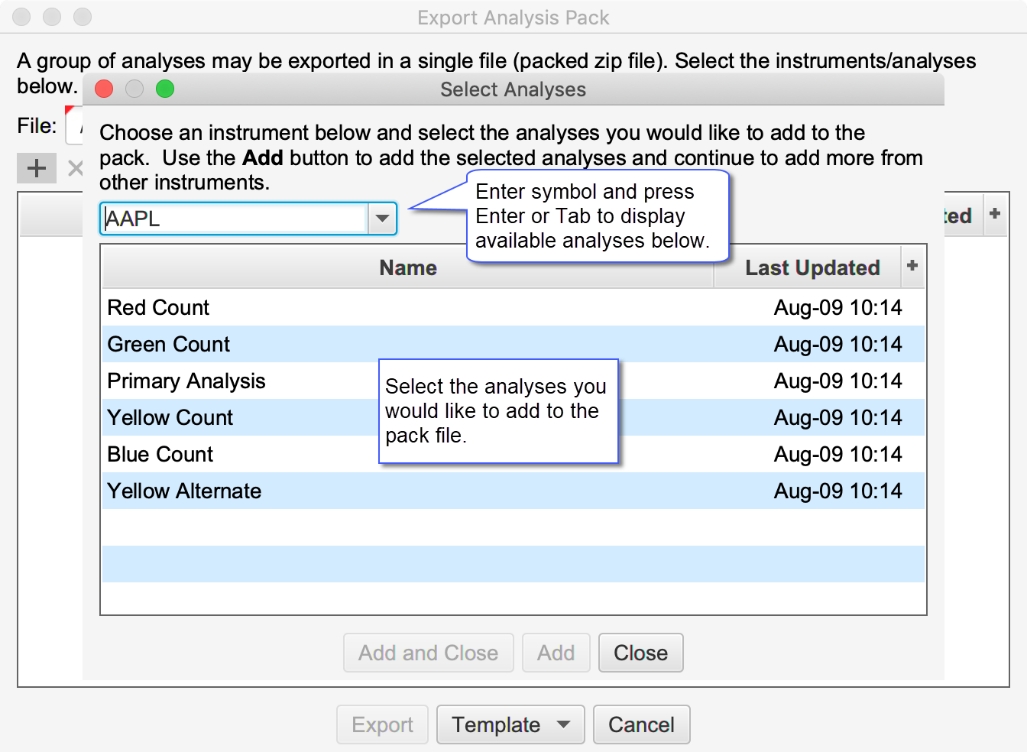

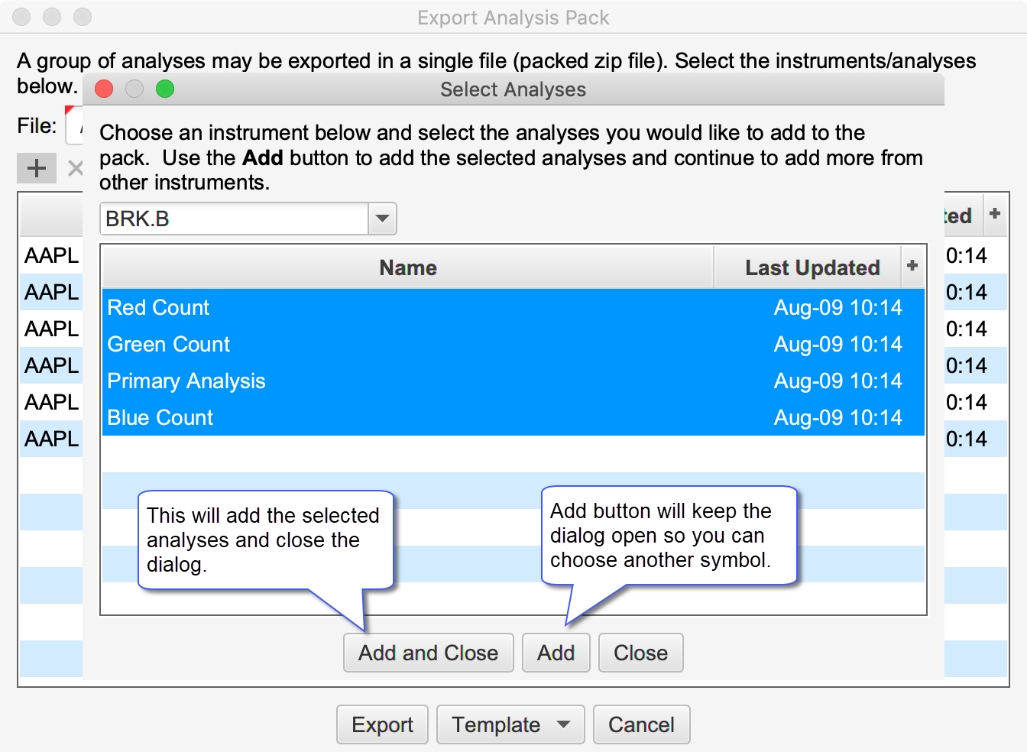

When you click on the + button the Select Analyses dialog will be displayed (see below). Type the symbol in the input box and press Enter or Tab to display the available analyses. Select the analyses you would like to include and press the Add and Close or the Add button.

For convenience, the Add button will keep the dialog open so you can choose another symbol. When you are finished, click Add and Close to dismiss this dialog.

When you have completed selecting all of the analyses for the pack, click on the Export button at the bottom of the Export Analysis Pack dialog. For convenience all of the settings in this dialog will saved for the next time you use it.

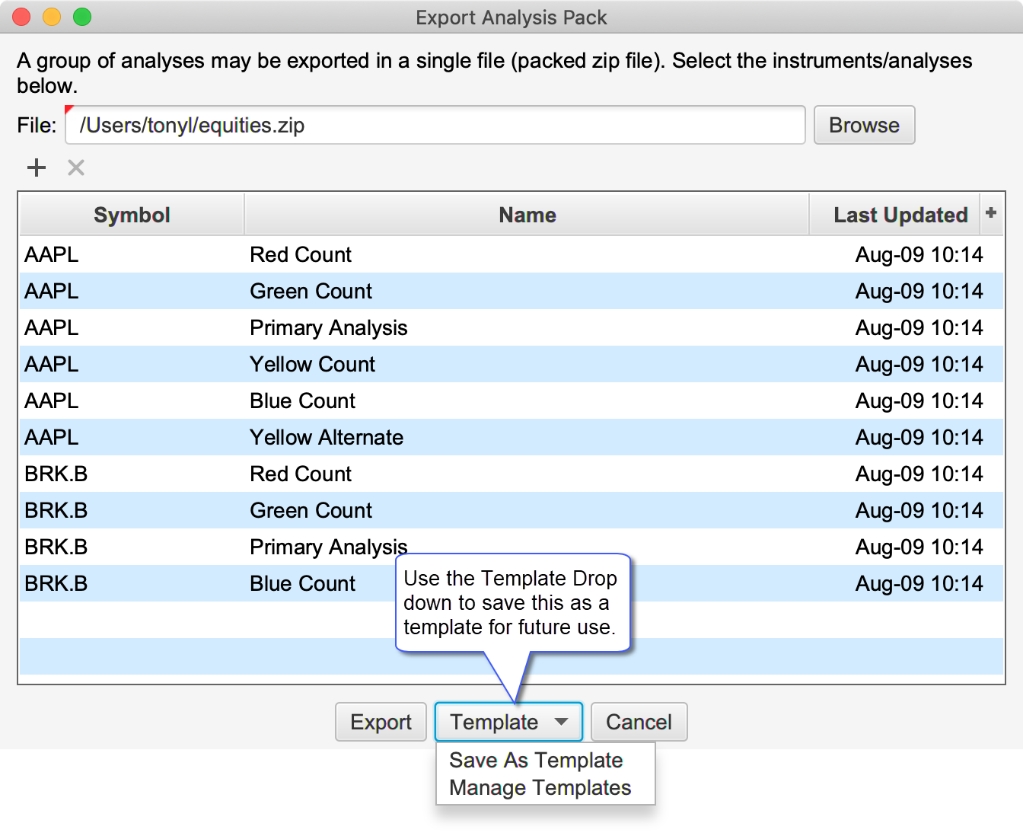

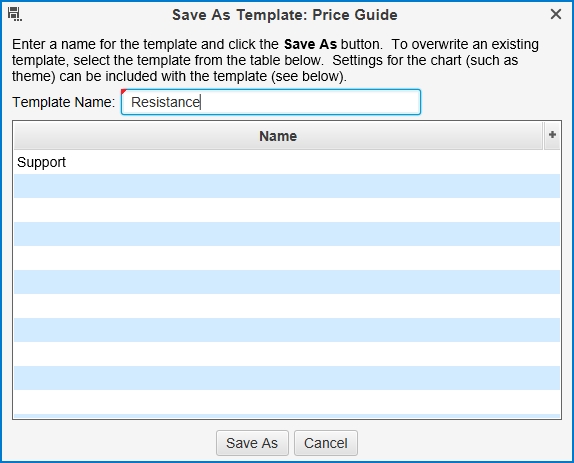

Export Templates

Templates are useful in cases where you frequently export different sets of analyses to one or more users or transfer files between computers.

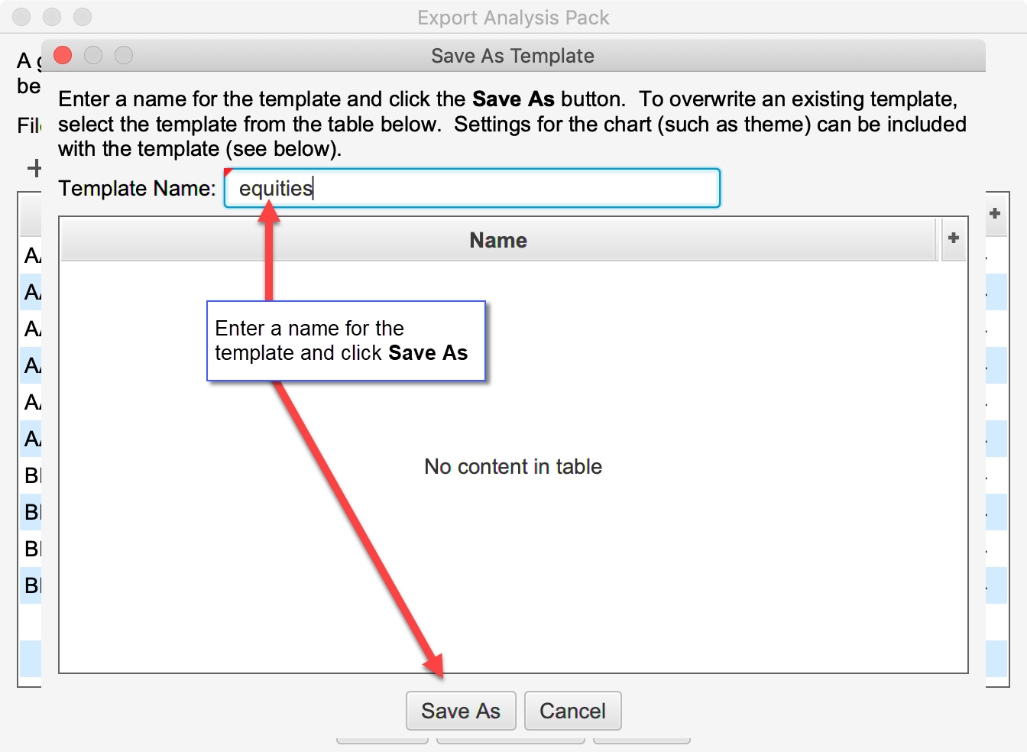

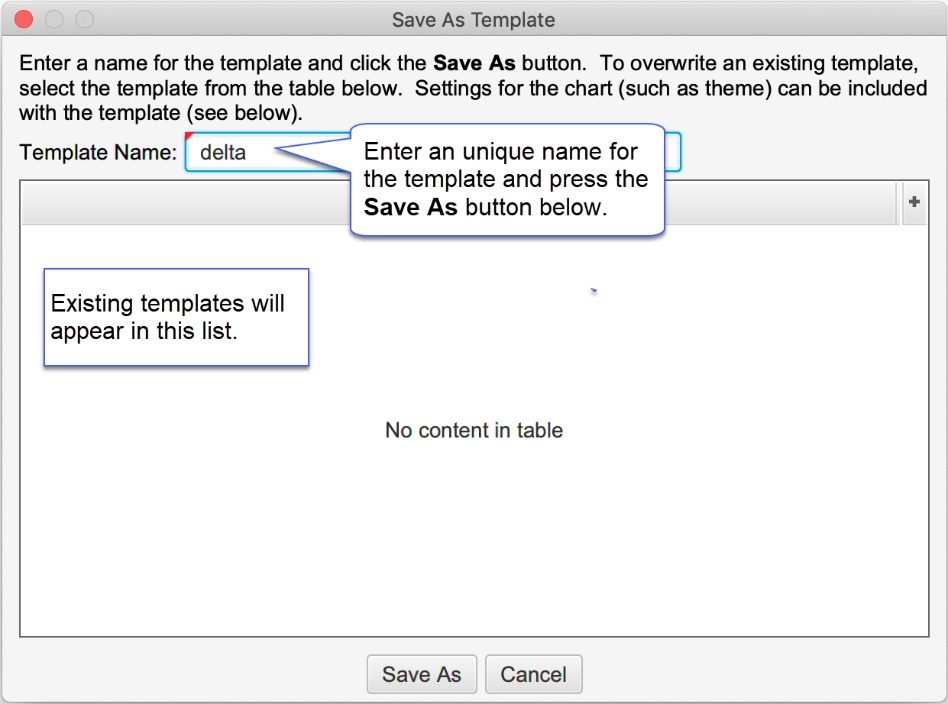

This will launch the Save As Template dialog. Enter a name for the template and click the Save As button (see below).

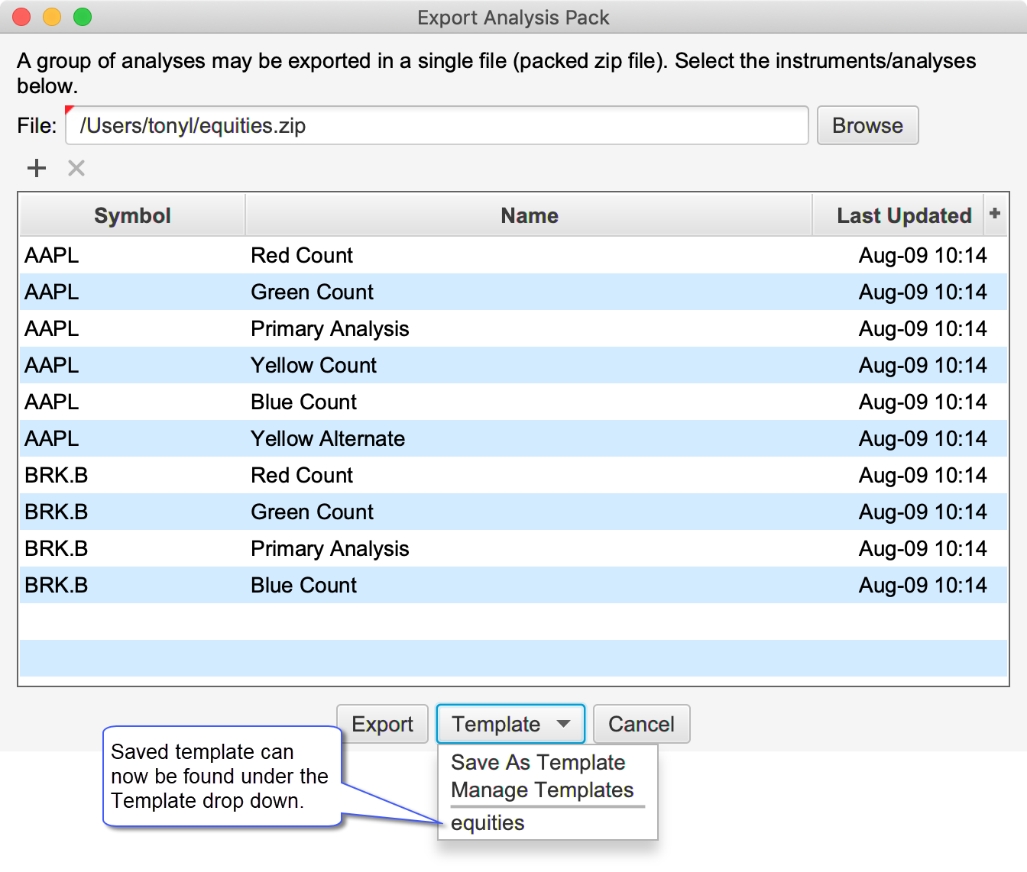

The template can then be applied by choosing it from the Template drop down at the bottom of the dialog.

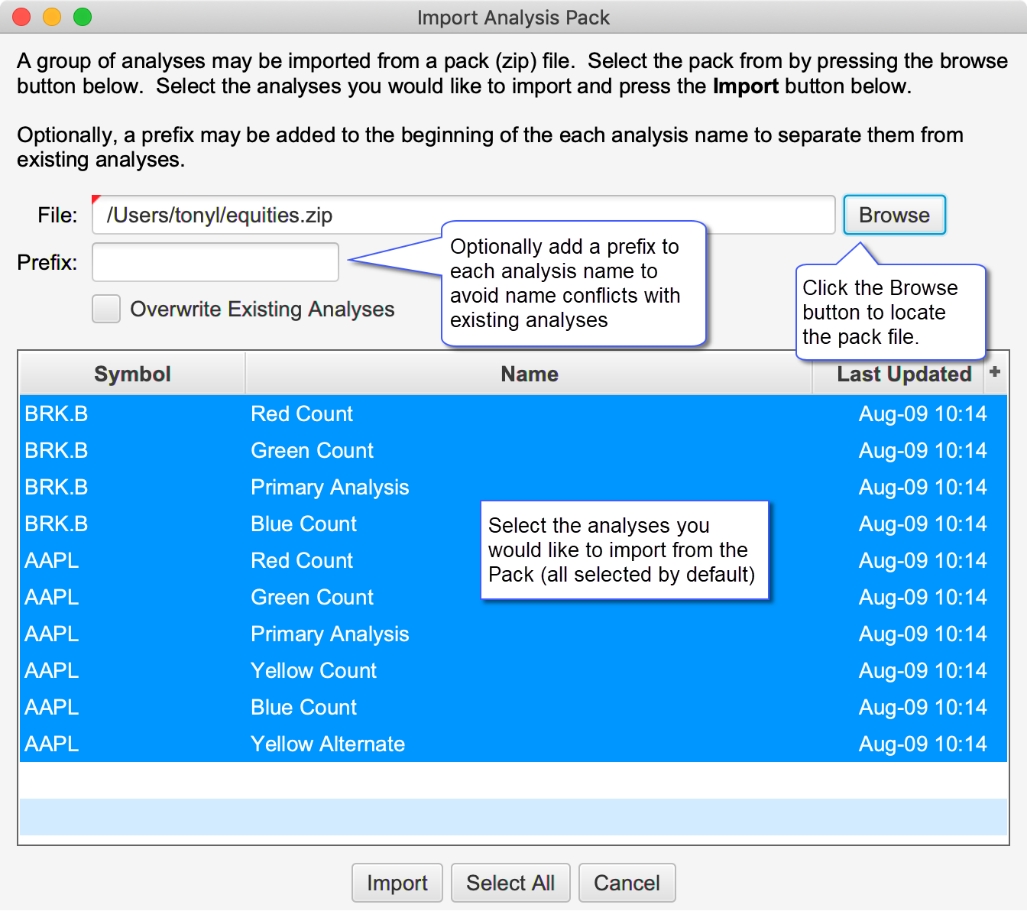

Importing a Pack

Use the Import Analysis Pack dialog to import analyses from a pack into your workspace. A prefix can optionally be added to each analysis. This can be useful to identify where the analyses came from or to avoid naming conflicts with existing analyses in your workspace. You can selectively choose which analyses to import. By default, all will be selected.

Exit Strategies

Exit strategies define how an existing position will be closed using a combination of one or more orders. This new feature replaces the existing Entry/Exit Strategies in previous versions of MotiveWave™.

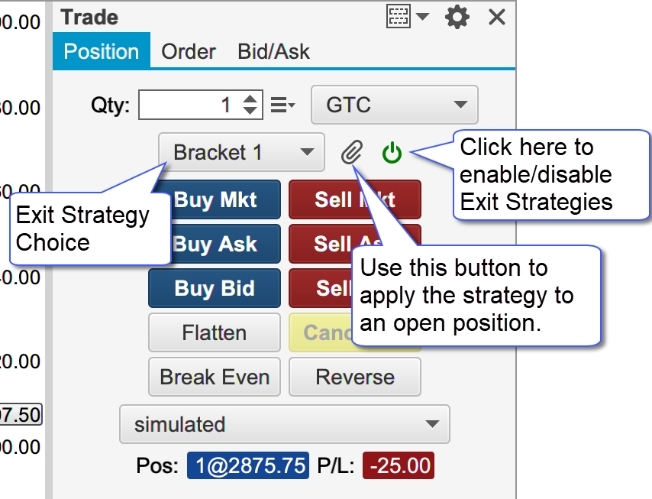

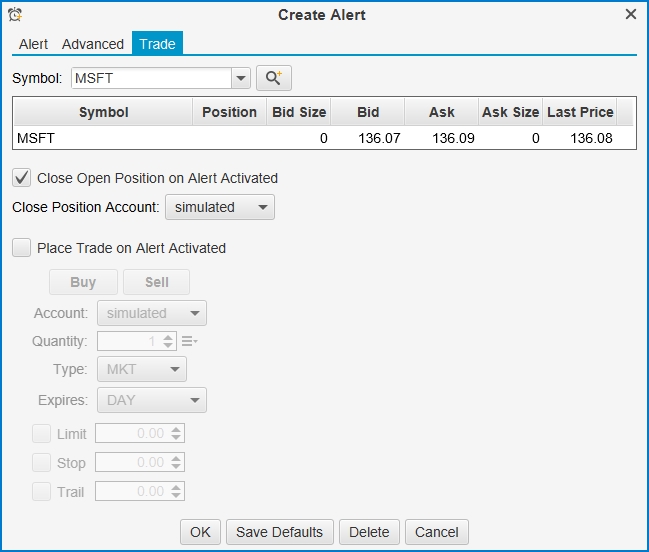

The Exit Strategy control can be found in the Trade Panel as well as the DOM Panel. In the screen shot below, the Exit Strategy control is shown in the Position tab of the Trade Panel.

Executing Exit Strategies

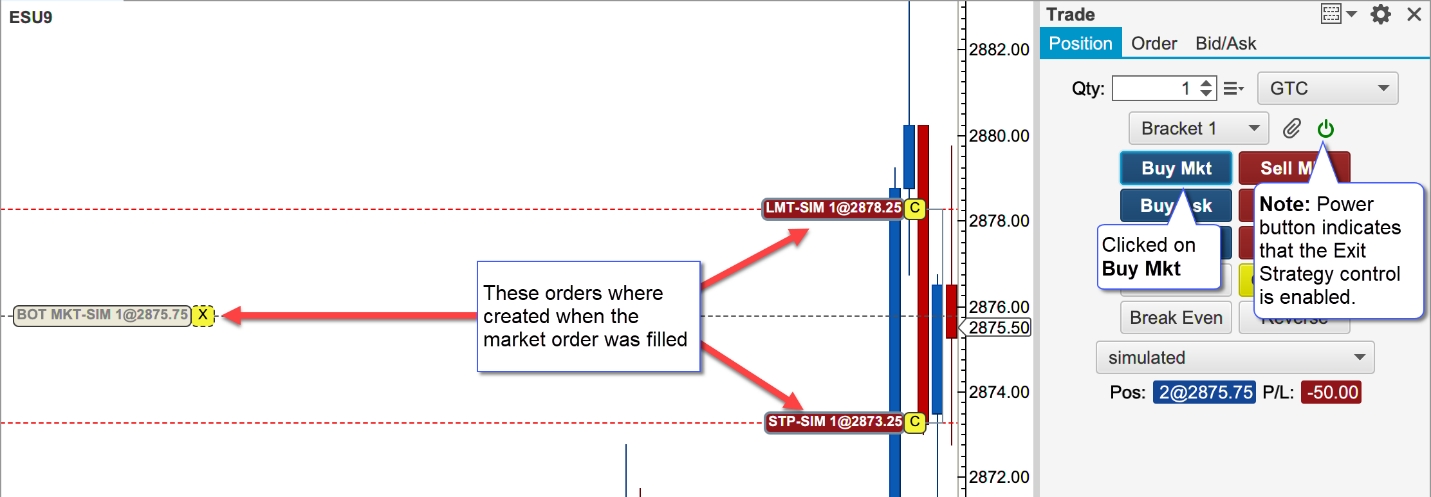

Exit Strategies are applied when clicking on one of the entry order buttons in the panel. Use the green power button in the right-hand side of the control to disable this feature (disabled by default). For example, in the screen shot below if you click on the Buy Mkt button, the Bracket 1 strategy will automatically be applied once the market order is filled.

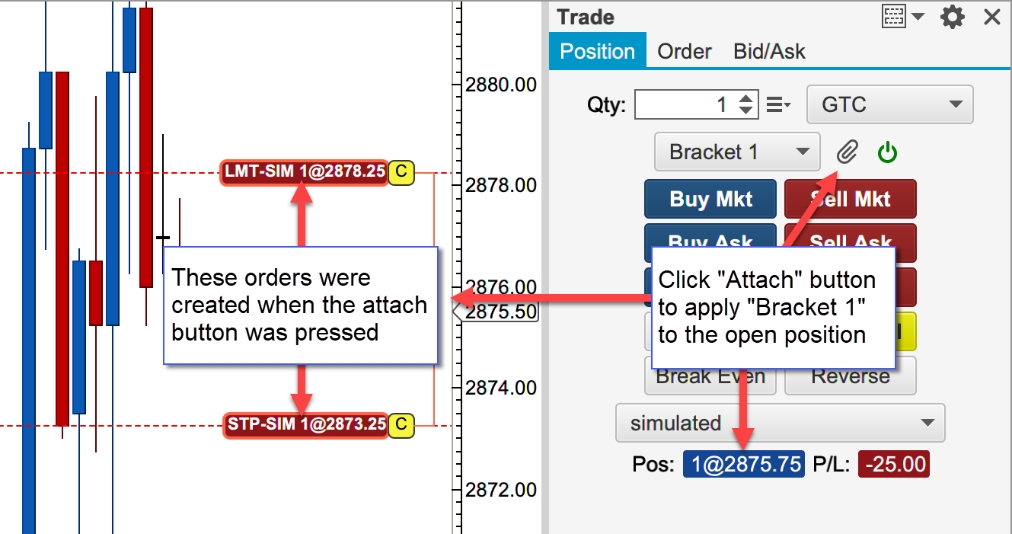

Apply Strategy to Existing Position

In the case where a position already exists, you can press the attach button (paper clip) to apply the selected strategy to the open position. In the screen shot below the Bracket 1 strategy has been applied to the existing open position ([email protected]). This created two orders: a stop and a limit submitted as OCO (One Cancels Other).

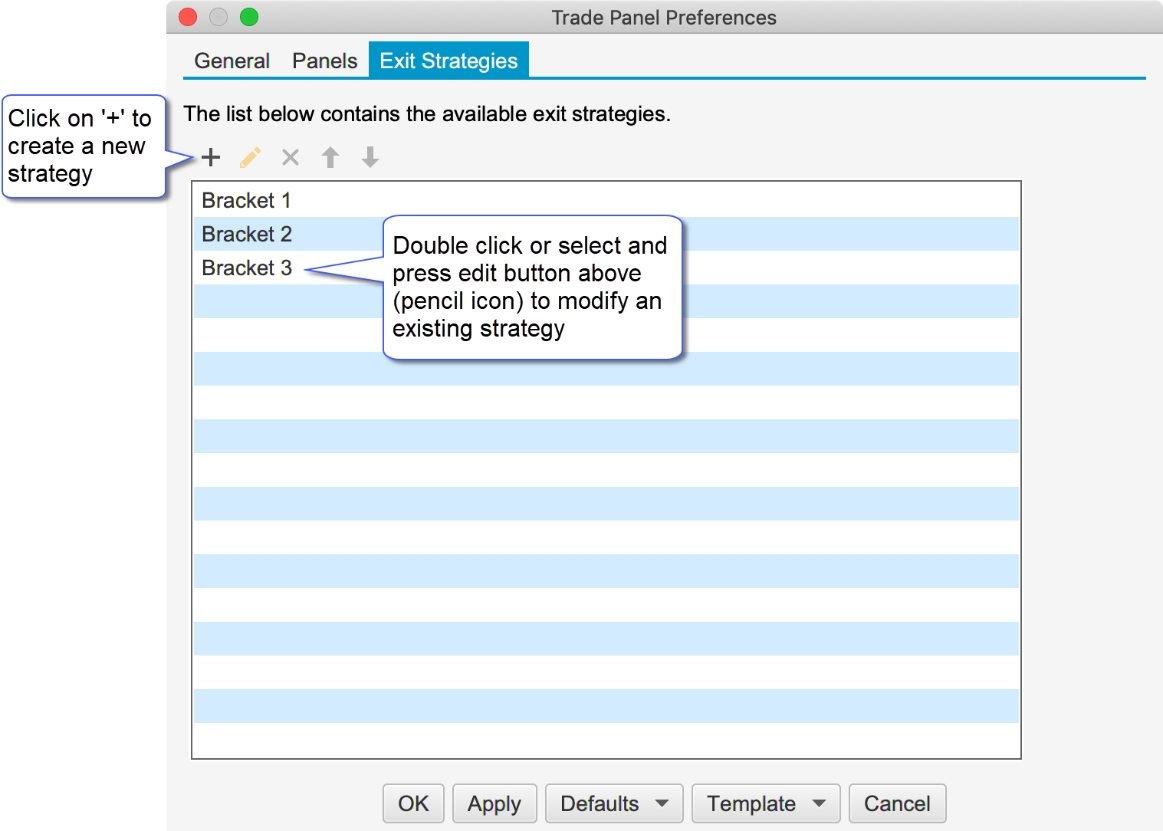

Configuring Exit Strategies

Exit Strategies may be configured from Trade Panel settings or from the DOM Panel settings (see Exit Strategies tab).

Click on the + button to create a new strategy. Existing strategies may be modified by double clicking on them. Three default strategies are available (which may be modified). These strategies implement 1, 2 and 3 bracket orders (stop loss + limit). Existing strategies can also be copied.

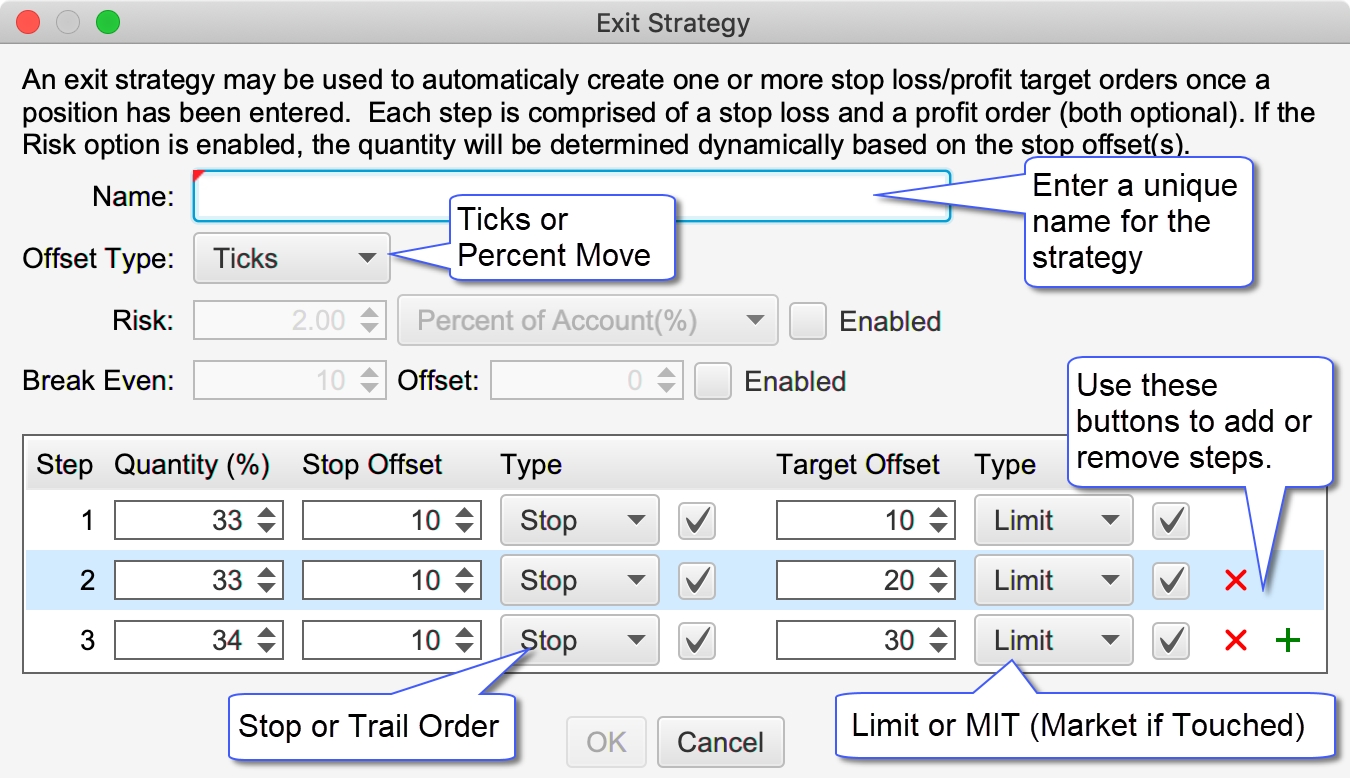

The following dialog is displayed when modifying or creating a new strategy. This dialog has the following options:

Name – Each strategy must have a unique name

Offset Type – Defines the type of offset used (see Stop Offset and Target Offset). There are two options:

Ticks – use a specific number of ticks (minimum price movement for an instrument) from the entry price.

Percent – use a percent of the average entry price. This is often used for stocks. For example, if you set an offset of 1 percent and your average entry on a stock was $10, then the offset would be $10 x 0.01 = 0.10.

Risk – Use these options to automatically set the size (quantity) based on a risk value. There are two risk options that may be used:

Percent of Account (%) – Dynamically calculates the maximum loss based on a percentage of current account balance.

Fixed Amount - Sets the maximum stop loss to the given amount.

Break Even – Sets the number of ticks/percent for the trade to move in a positive (profit) direction before moving the stop loss to break even.

Offset - An additional offset may be specified to set the stop loss above/below the entry price (often used to account for commissions and or spreads).

Step Table – Use this table to define the number of steps (order levels) in this strategy. Each step may have a stop loss and/or target (profit) orders. If both a stop and target order are defined for a step, these orders are submitted as an OCO (one cancels other) order. When one of the orders gets filled the other will be cancelled.

Quantity (%) – This defines the size (quantity) of the order as a percentage of the entry quantity. Quantities are rounded to the minimum step size for the instrument. If all of the steps add up to 100% of the entry quantity then the remaining quantity is assigned to the last step.

Stop Offset – Offset from the average entry price where the stop/trail order will be placed. For a buy (long) position this will be the avg entry – stop offset. For a sell (short) position this will be the entry + stop offset.

Type (Stop Loss) – Two options are available for the stop loss order:

Stop – Regular stop order. When the stop price is hit the order will be filled at market price

Trail – Trailing stop order. The order will follow the price to maintain a maximum of the stop offset away.

Check Box – Use this option to enable or disable the stop order for this step

Target Offset – Offset from the average entry price where the target order will be placed. For a buy (long) position this will be the avg entry + target offset. For a sell (short) position, this will be the avg entry – target offset.

Type (Target) – Two options are available for the target order:

Limit – Limit order. This type of order guarantees the fill price but does not guarantee that the order will be filled when the target price is reached (limit orders are typically filled in the order that they are received by the broker).

MIT – Market if Touched order. This type of order guarantees that the order will be filled when the price is reached. However, the fill price is not (filled at market price).

Check Box – Use this option to enable or disable the target order for this step.

‘+’ or ‘x’ button – use these buttons to add or remove steps.

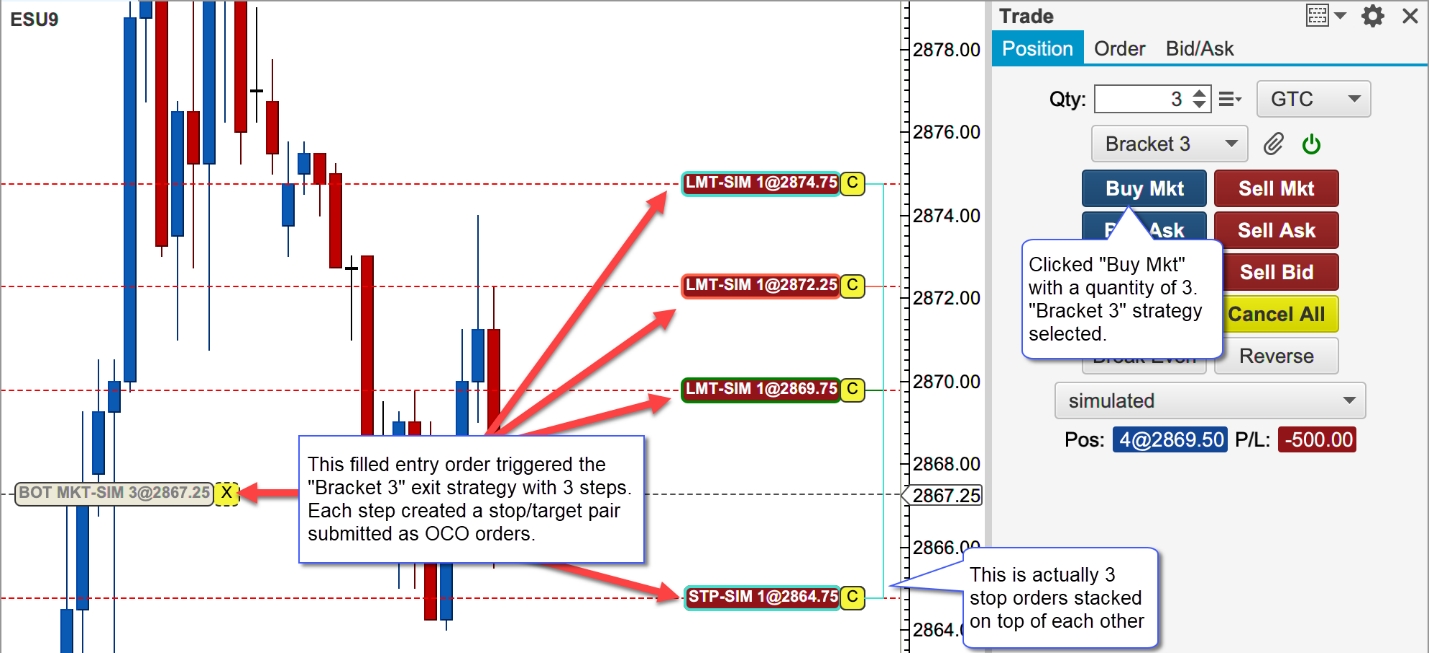

The screen shot below shows the Bracket 3 strategy executed from the Buy Mkt button in the Trade Panel. Three stop/target order pairs were created using the offsets defined above (10 ticks for each stop and 10, 20, 30 ticks for the target orders). Offsets are placed from the average entry price for the filled market order.

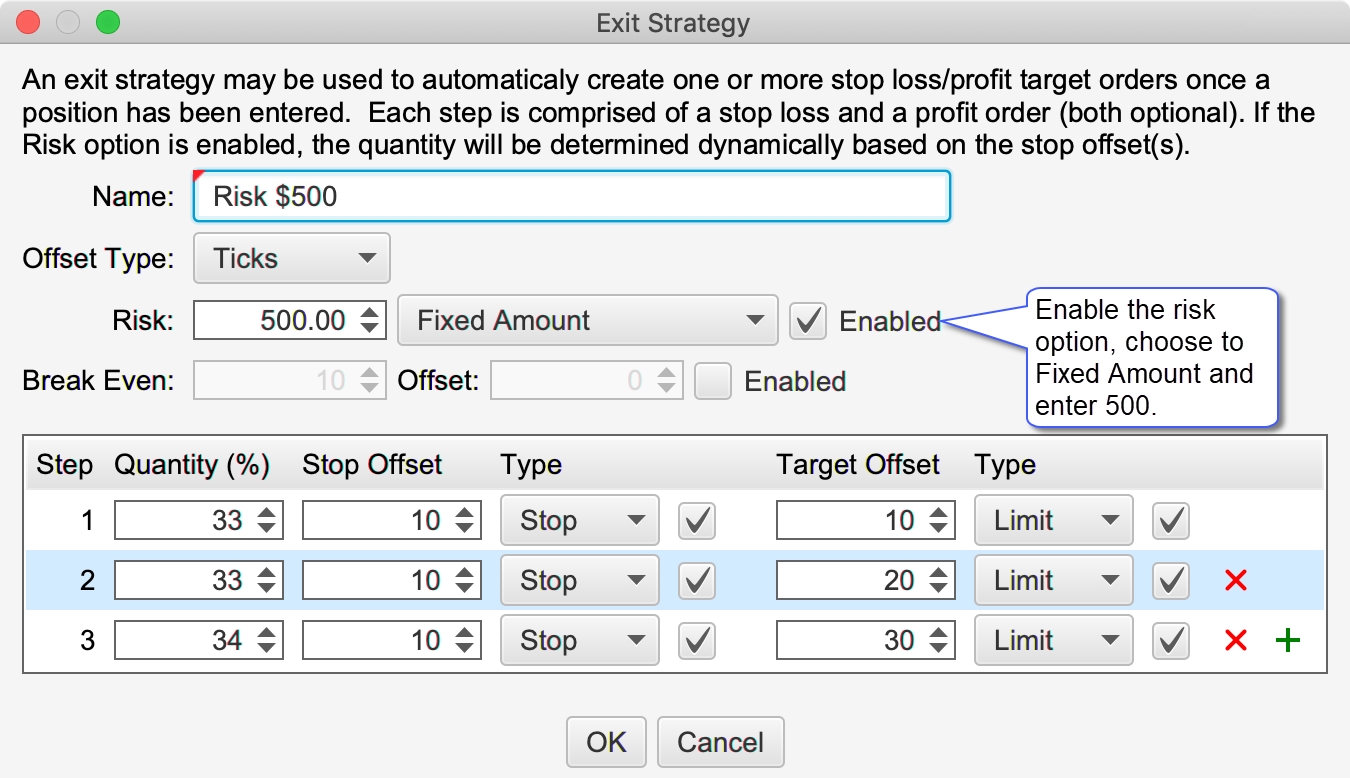

Risk Based Strategies

Risk based Exit Strategies are useful for controlling the amount of capital at risk during a trade (see Risk field in the Exit Strategy dialog in the previous section). The risk is controlled by automatically choosing the quantity when placing an entry order. There are two types of risk-based strategies:

Percent of Account – The amount at risk is a percentage of the active account balance. For example, if you had an account balance of $50K and the risk setting for the strategy was 2%, then the amount at risk would be 50K x 0.02 = $1000.

Fixed Amount – With this option you can specify exactly how much money you want to risk in a trade (ie: $500).

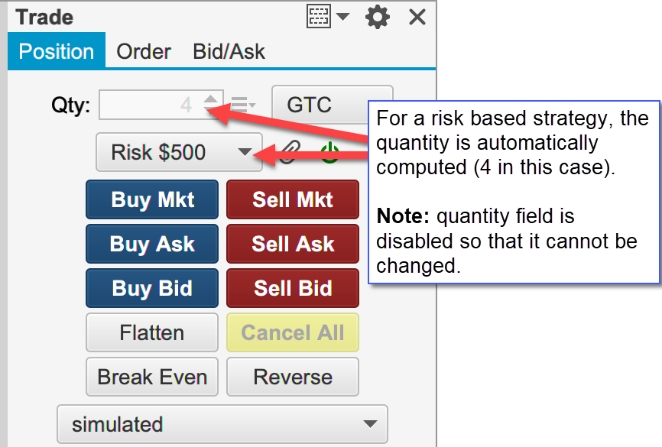

The example below displays the settings for an Exit Strategy that risks a maximum of $500.

The quantity will be automatically computed when a risk-based strategy is chosen. The quantity field is also disabled so that it cannot be changed. In the screen shot below the “Risk $500” strategy that we defined above has been chosen. Using the stop offsets in the strategy, a quantity of 4 is computed and set in the Qty field.

Depending on the instrument you are trading (and your stop offset settings), it may not be possible to set a quantity that will match exactly the risked amount. In cases like these the quantity value will be rounded down to the nearest valid quantity.

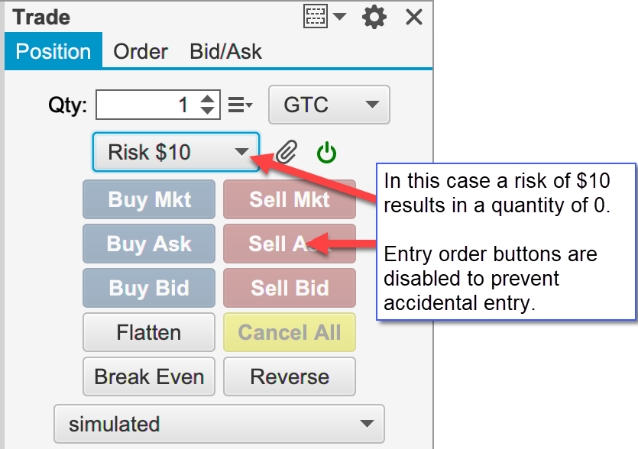

If the risk amount is too low, the quantity may work out to 0. In this case the order entry buttons will be disabled to prevent placing an order since the maximum risk amount cannot be met.

Trade Panel

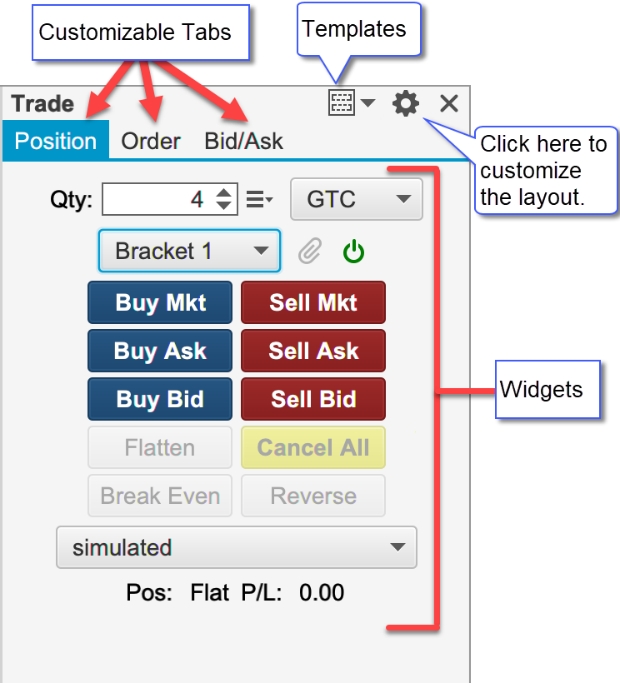

Note: Customizable features (including defaults and templates) are only available in the Professional Edition and above. Editions below this will use the default trade panel layout.

Default Layout

The default layout is very similar to the layout in previous versions of MotiveWave™. This layout consists of three tabs:

Position – Used to create and manage open positions. Several new buttons have been added to this layout. A Time in Force choice and Exit Strategy control have also been added.

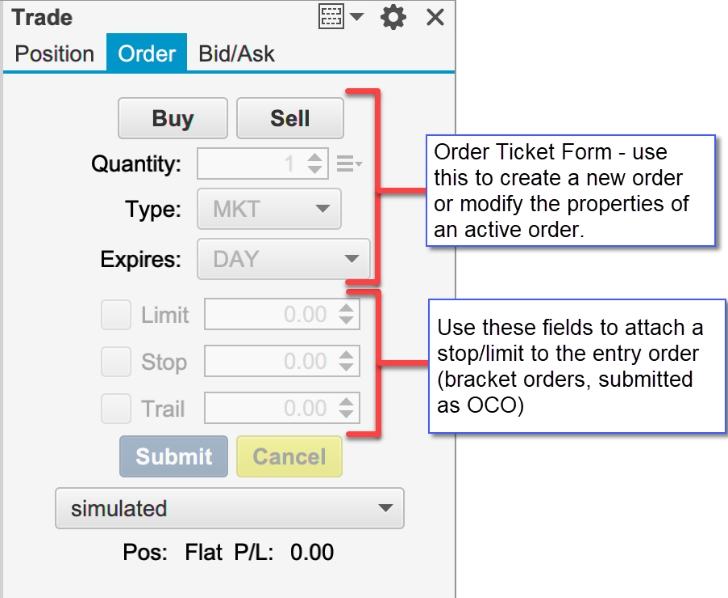

Order – Use this tab to place and modify existing orders. Stop/Trail and Limit orders can also be attached for a stop loss and profit target.

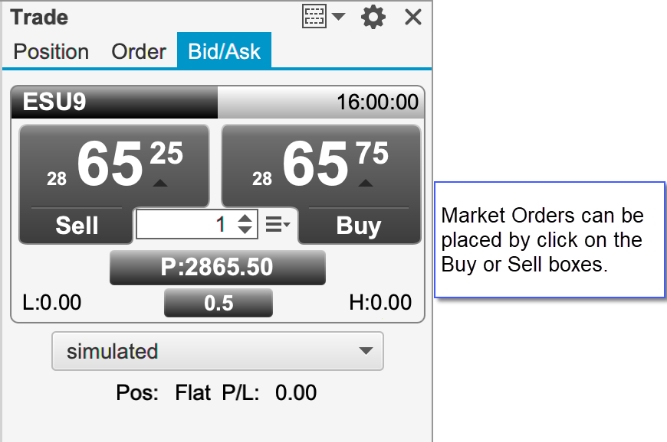

Bid/Ask – This tab contains a buy/sell box for quickly placing market orders.

Trade Panel Preferences

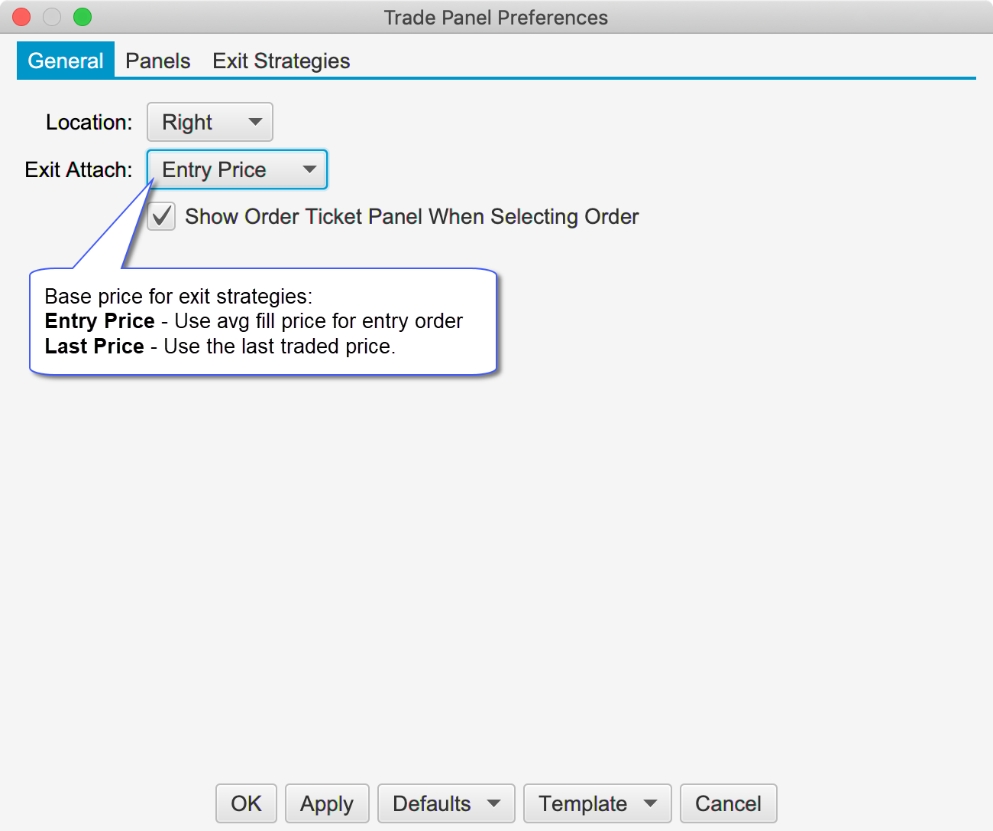

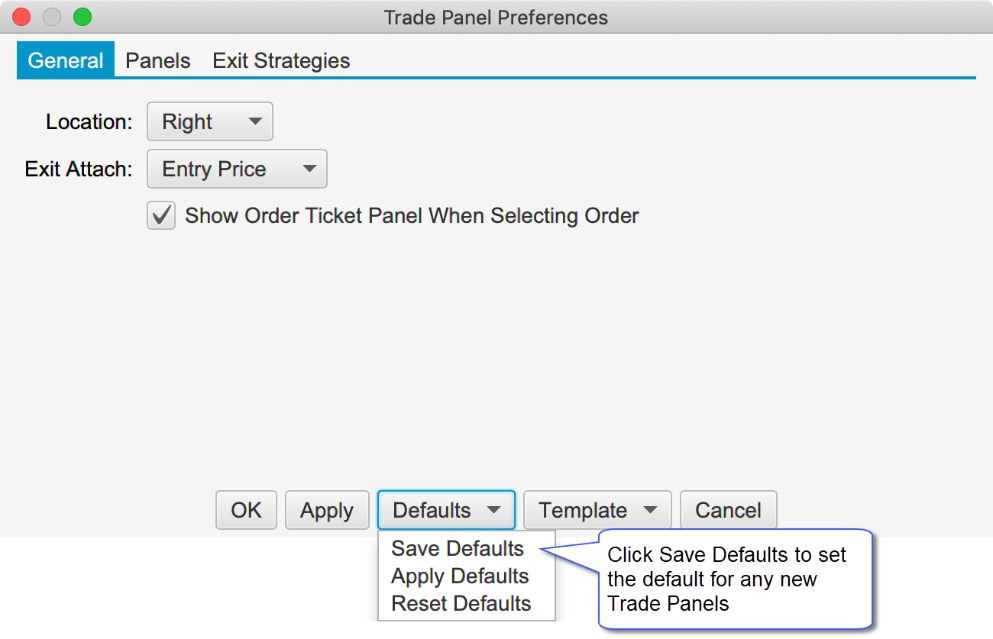

Click on the preferences icon (gear) in the top right corner of the Trade Panel to modify the preferences.

The General tab contains the following options:

Location – Left or Right side of the chart

Exit Attach – Determines the base price for computing offset values in the Exit Strategies:

Entry Price – Average Entry Price for the Position. this is the same as the average fill price for an entry order.

Last Price – Last traded price

Show Order Ticket Panel When Selecting an Order – If this is checked, the Order tab will be shown when an order is selected in the chart. The order ticket form will be filled with the order properties.

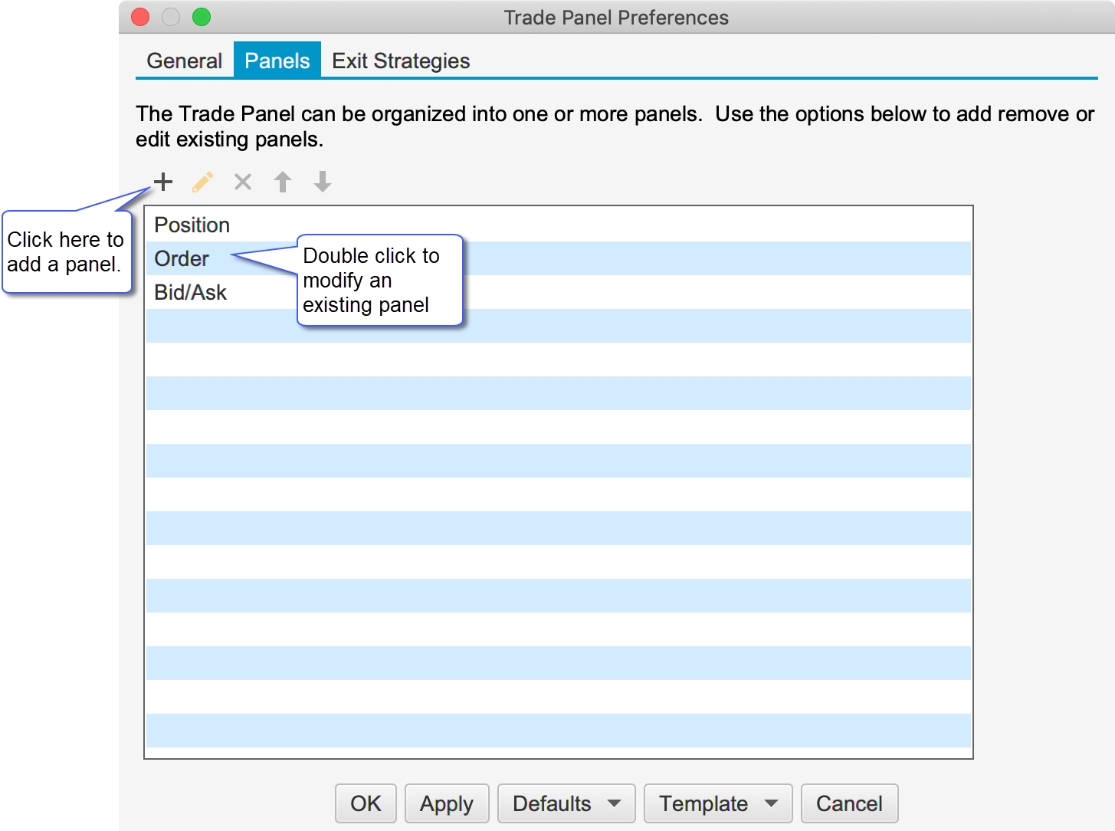

Customizing the Layout

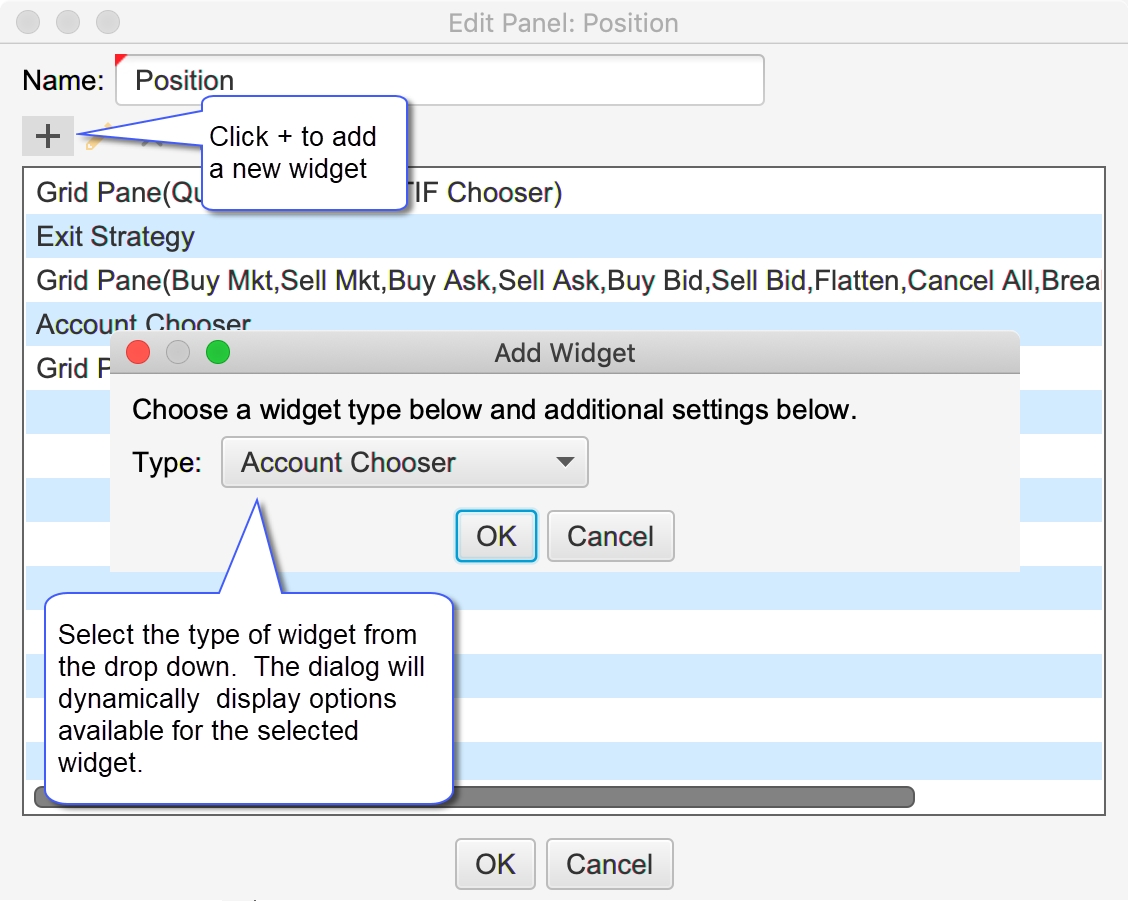

The layout of the Trade Panel can be customized from the Panels tab. Existing panels can be modified or deleted. New panels can be added by clicking on the + button.

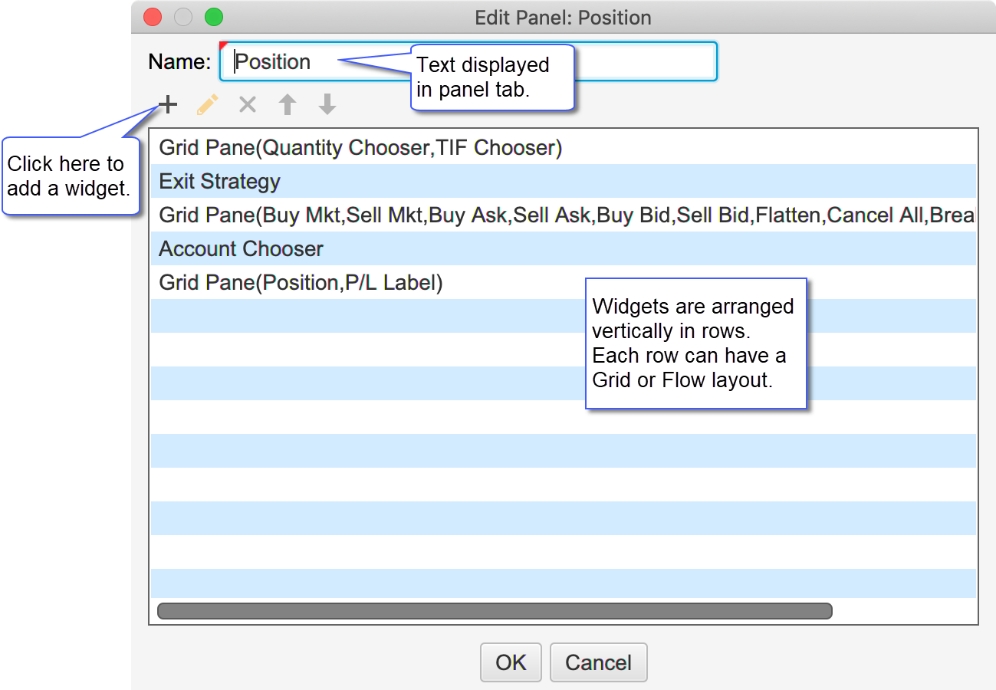

The Edit Panel dialog contains a table of widgets (form controls). Each row in the table represents a row in the panel (arranged vertically). Optionally a row can have one of the following layouts:

Grid – Widgets within the grid are centered in the row with a fixed number of columns. Optionally a widget may span multiple columns.

Flow – Widgets are arranged from left to right in a row. If there is not enough space, the widgets are wrapped around to the next line.

The screen shot below shows the Edit Panel dialog for the existing Position panel. Rows may be added to the layout by clicking on the + button. Existing rows may be modified or removed by selecting and pressing the edit/delete buttons.

The screenshot below shows how to add a new widget to a panel. The vertical order of the widgets can be adjusted by dragging them up/down or selecting and using the up/down arrow buttons.

Widgets

A widget is a generic name for a control, button, label or layout/formatting that can be added to a panel. The following widgets are currently supported:

Controls

Controls are used to execute actions or set properties. The following controls are currently supported:

Account Chooser – Selects the active account for the chart. This account will used for placing, modifying or cancelling active orders.

Buy/Sell Box – Buy/Sell box for placing market orders. This control also contains a quantity chooser and labels for display information such as Day High/Low/Last Price etc.

Exit Strategy – Selector for the active exit strategy and buttons for attaching to an existing position and enabling/disabling the control

Order Ticket – Order ticket form. This may be used to create new orders or modify/cancel existing orders

Quantity Chooser – Allows you to set the quantity for placing an order.

Quantity Selector – Contains preset quantities (in horizontal tab format) for quickly selecting a quantity for order placement.

TIF Chooser – Selects the Time in Force attribute for placing new orders.

Buttons

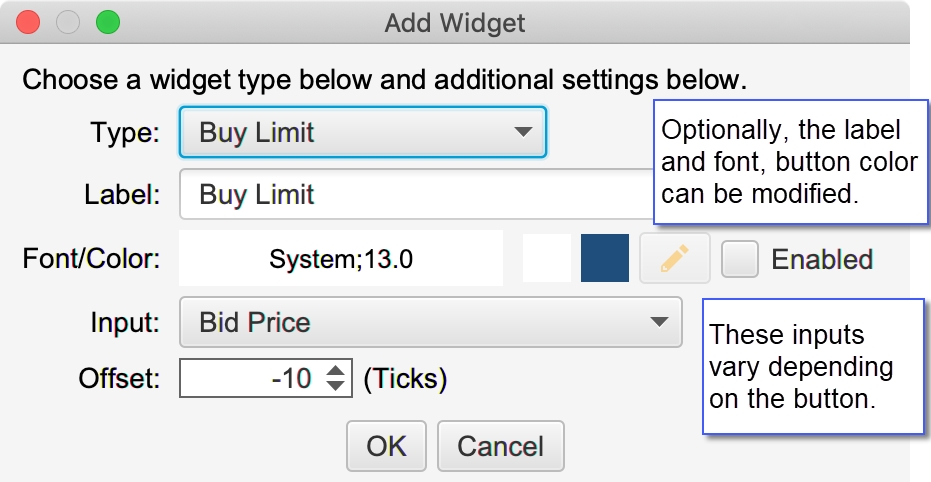

Buttons are used to execute an action such as placing or cancelling an order. The label, font and color can be customized for any button. Some buttons include additional parameters (such as offset) for customizing the behavior.

Break Even – Creates a stop or limit order at the break-even price for an open position (stop if you are showing a profit, limit if showing a loss). The optional Offset will add an offset (in ticks) to your breakeven price, this can be used for breakeven +1 tick to cover commission costs.

Breakout – Creates two stop orders above and below the current market price with the given offset. When one of the orders is filled the other is canceled (OCO orders). This may be used to enter the market in the direction of trend when it breaks out of a fixed range.

Break Down/Fade Up – Creates a sell stop order below the market and a sell limit above the market with the given offset. These orders are submitted as OCO (One Cancels Other)

Break Up/Fade Down - Creates a buy stop order above the market and a buy limit below the market with the given offset. These orders are submitted as OCO (One Cancels Other)

Buy Ask – Submits a buy limit order at the ask price. Optionally an offset may be set to place the order a given number of ticks below the ask.

Buy Bid – Submits a buy limit order at the bid price. Optionally an offset may be set to place the order a given number of ticks below the bid.

Buy Limit – Submits a buy limit order at a given number of ticks from the input value (Bid Price, Ask Price, Last Price, Day High, Day Low, Open or Previous Close)

Buy MIT – Similar to Buy Limit, but places a Market If Touched order instead.

Buy Mkt – Places a Buy Mkt order

Buy Stop – Similar to Buy Limit, but places stop order instead.

Cancel All – Cancels all active orders for the given instrument and account.

Cancel Buys – Cancels all active buy orders for the given instrument and account.

Cancel Sells – Cancels all active sell orders for the given instrument and account.

Fade – Creates a Sell Limit above the market and Buy Limit below the market using a given number of offset ticks (submitted as OCO orders). This may be used to trade an instrument that is range bound (stays within a given price range).

Flatten – Closes an open position at market price (for the given instrument and account).

Flatten All – Same as Flatten, but also cancels active orders.

Reverse – Closes an open position and opens a new position in the opposite direction (with the same quantity).

Sell Ask – Similar to Buy Ask, but submits a Sell order instead.

Sell Bid – Similar to Buy Bid, but submits a Sell order instead.

Sell Limit – Similar to Buy Limit, but submits a Sell order instead.

Sell MIT – Similar to Buy MIT, but submits a Sell order instead.

Sell Mkt – Similar to Buy Mkt, but submits a Sell order instead.

Sell Stop – Similar to Buy Stop, but submits a Sell order instead.

The screen shot below shows an example of a button dialog. The available parameters (such as input or offset) will be different depending on which button is selected.

Labels

Labels display live information:

P/L Label – Current Profit/Loss for the given instrument and account.

P/L Price Label – Current Profit/Loss measured in price movements instead of a dollar amount.

Position – Current open position and entry price for the given instrument and account.

Spread – Difference between the best bid and best ask prices for the given instrument.

Formatting

Formatting widgets are useful for controlling how the other widgets are arranged on the panel:

Flow Pane – Contains a set of widgets that are arranged from left to right. When there is no more room to display on the current row, the remaining widgets are wrapped onto the next line.

Grid Pane – Contains a set of widgets that are arranged in a grid with a fixed number of columns. The number of rows depends on how many widgets are in the pane.

Horizontal Spacer – Adds horizontal space between widgets

Divider – Draws a horizontal divider (typically displayed on a single row)

Vertical Spacer – Adds vertical space between rows.

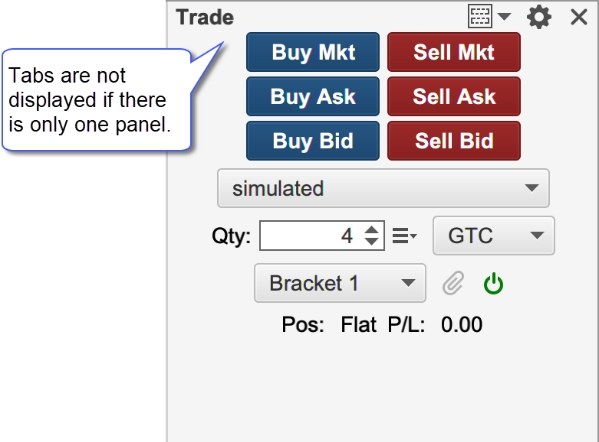

The screen shot below shows an example of customizing the trade panel. In this case there is only one panel, so the tabs are not displayed.

Cancel Existing Orders

An option has been added to cancel existing orders on the same account before executing a button action. This applies to the following custom buttons in the Trade Panel/DOM: Break Even, Flatten and Reverse.

Defaults

When the trade panel is modified, the changes are only applied to the active trade panel within the chart. The default layout can be modified from the Preferences Dialog (click on the gear icon in the top right corner of the trade panel). At the bottom of the dialog, click on the Defaults button. This will set the default for any new Trade Panels that are created (but will not affect existing Trade Panels).

Reverse Button

The functionality of this button has been changed to cancel all open orders (for the instrument/account) before reversing the position.

Templates

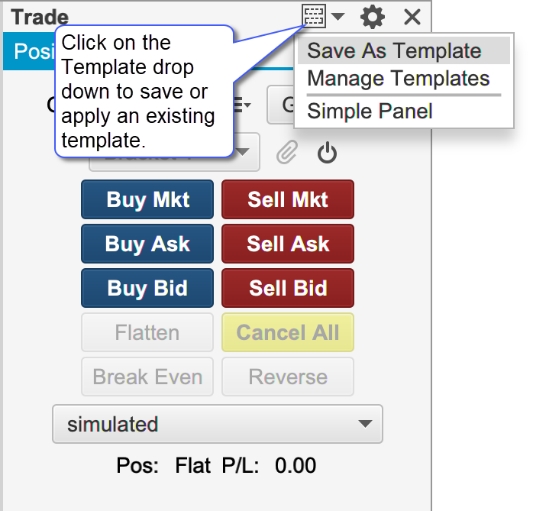

Templates can be very useful for creating and applying multiple layouts. If you are trading different instruments you may want to have one or more Trade Panel layouts. From the template drop down button at the top of the Trade Panel there are options to Save, Manage or apply templates (there is also a Template button at the bottom of the Trade Panel Preferences dialog).

In the screen shot below we are saving the customized Trade Panel that we created in a previous section as “Simple Panel”. This new template can then be applied to another trade panel by selecting it in the Templates button drop down.

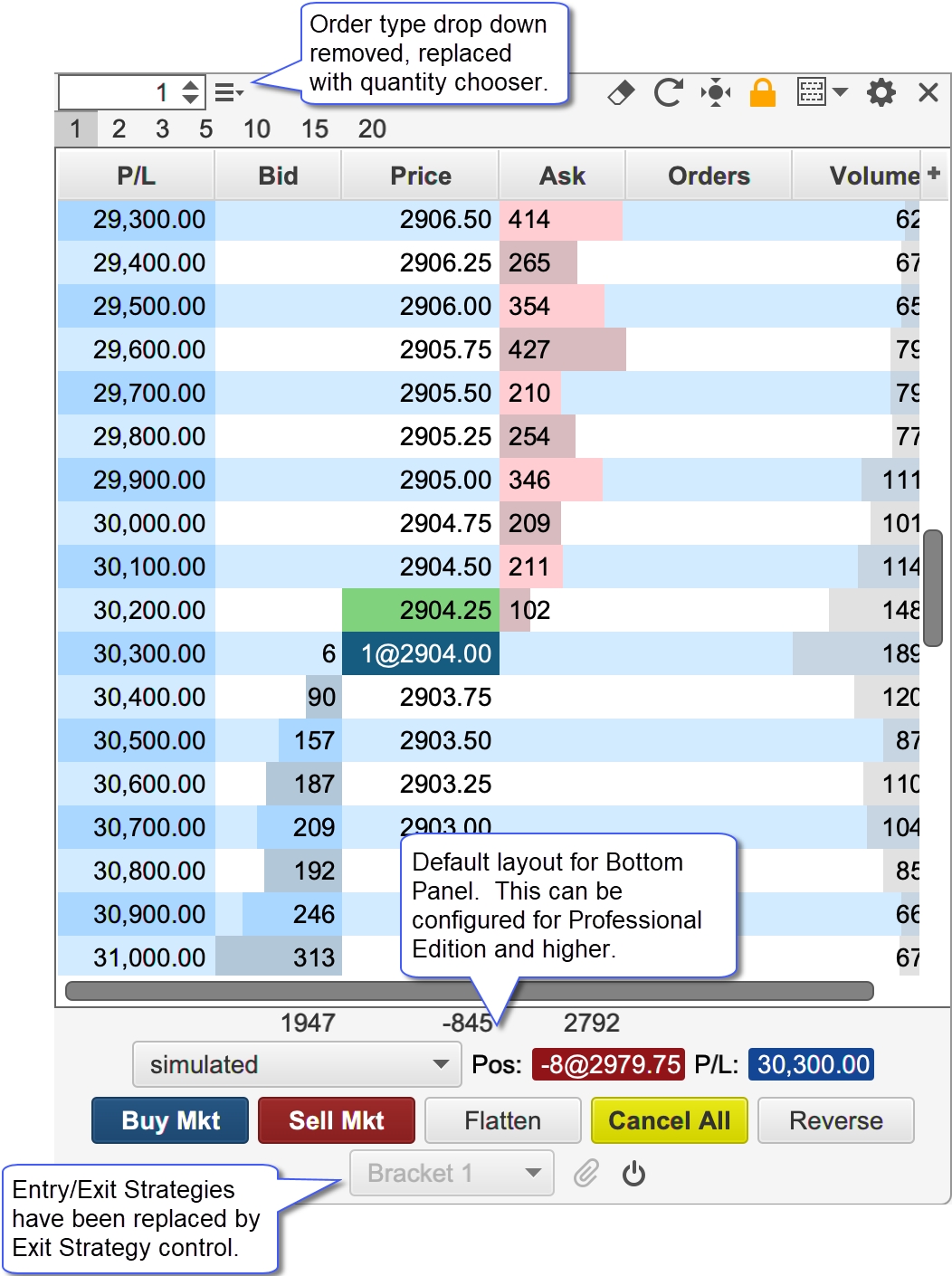

Advanced Depth of Market (DOM)

Some significant enhancements have been added to the Depth of Market panel (DOM). The default DOM layout is similar to the version 5 DOM with the exception of a single order column and 3 extra buttons added to the tool bar.

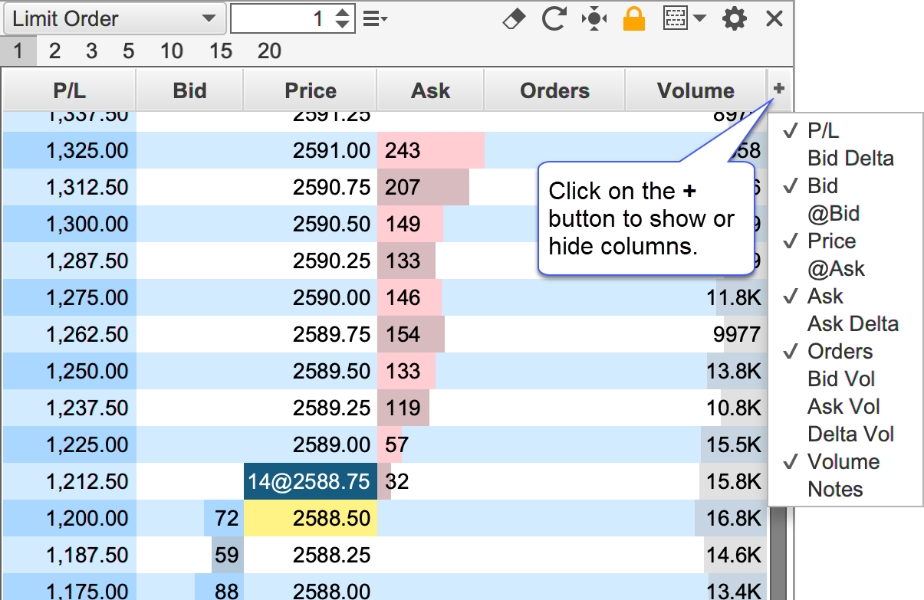

DOM Columns

Columns may be added/removed from the DOM table by click on the ‘+’ button in the top right corner of the table (to the right of the column headers).

The following columns are available:

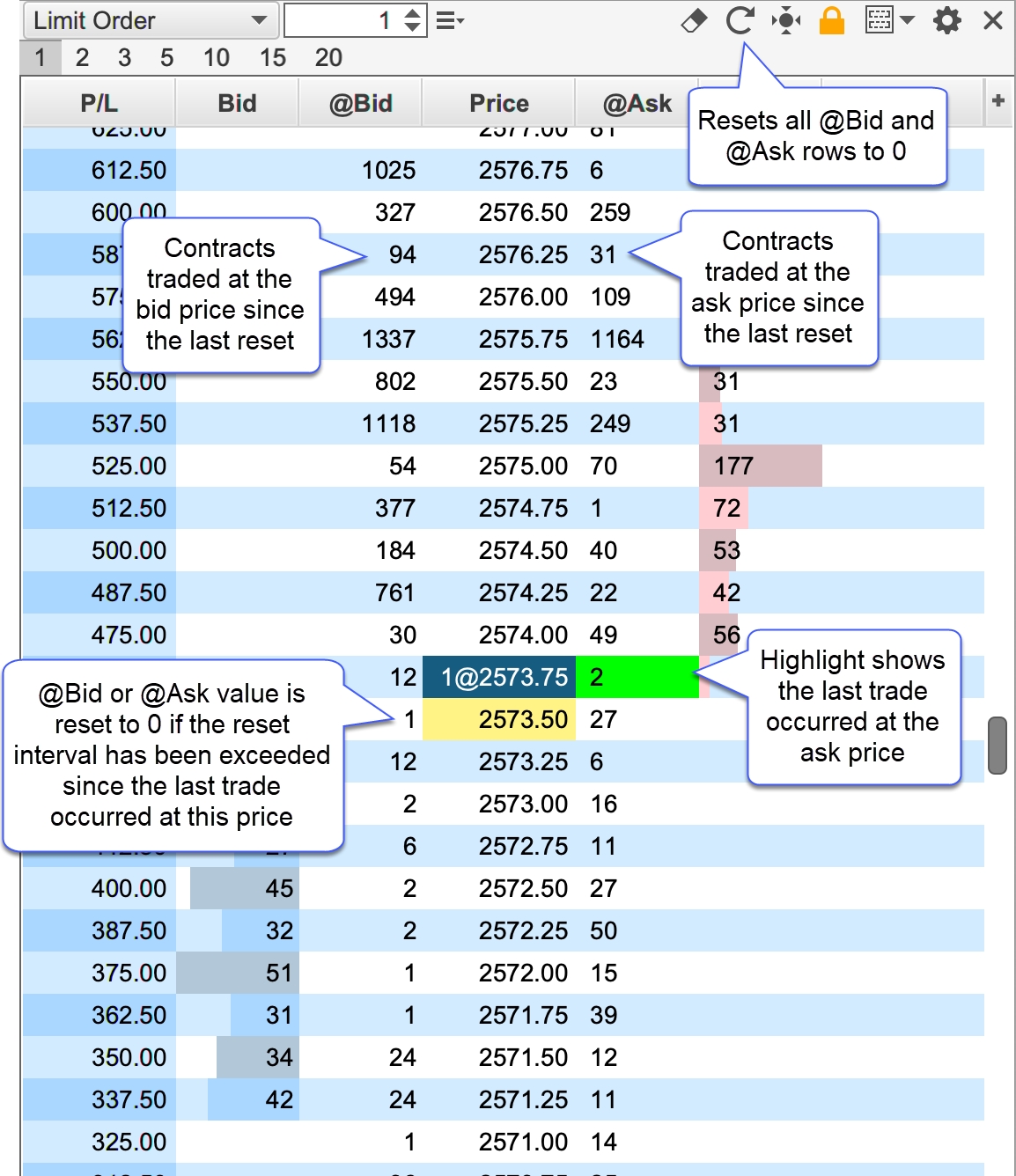

P/L – Profit/Loss calculated for each price level using the current open position.

Bid Delta – Tracks the difference in contracts added/removed from the current bid size (see Bid column) for all depth levels in the DOM book (see bid column). These values are calculated on every DOM book update and are reset when the last price changes.

Bid – Displays the quantities of the current buy orders at the given price.

@Bid – Tracks the contracts traded at the bid price since that last reset (see reset button on the tool bar).

Price – Displays the price level for the row. If “Show Pips Only” is enabled (see General tab of the Properties dialog), this will be rounded to the nearest pip (FOREX only).

@Ask - Tracks the contracts traded at the ask price since that last reset (see reset button on the tool bar).

Ask – Displays the quantities of the current sell orders at the given price.

Ask Delta - Tracks the difference in contracts added/removed from the current ask size (see Ask column) for all depth levels in the DOM book (see bid column). These values are calculated on every DOM book update and are reset when the last price changes.

Orders – Displays active orders at each price level. If “Single Order Column” is unchecked (see General tab of the Properties dialog below), then there will be two of these columns (buy and sell orders).

Bid Vol – Daily volume traded at the bid price.

Ask Vol – Daily volume traded at the ask price

Delta Vol – Difference between the ask and bid volume at the given price.

Volume – Daily volume traded at the given price.

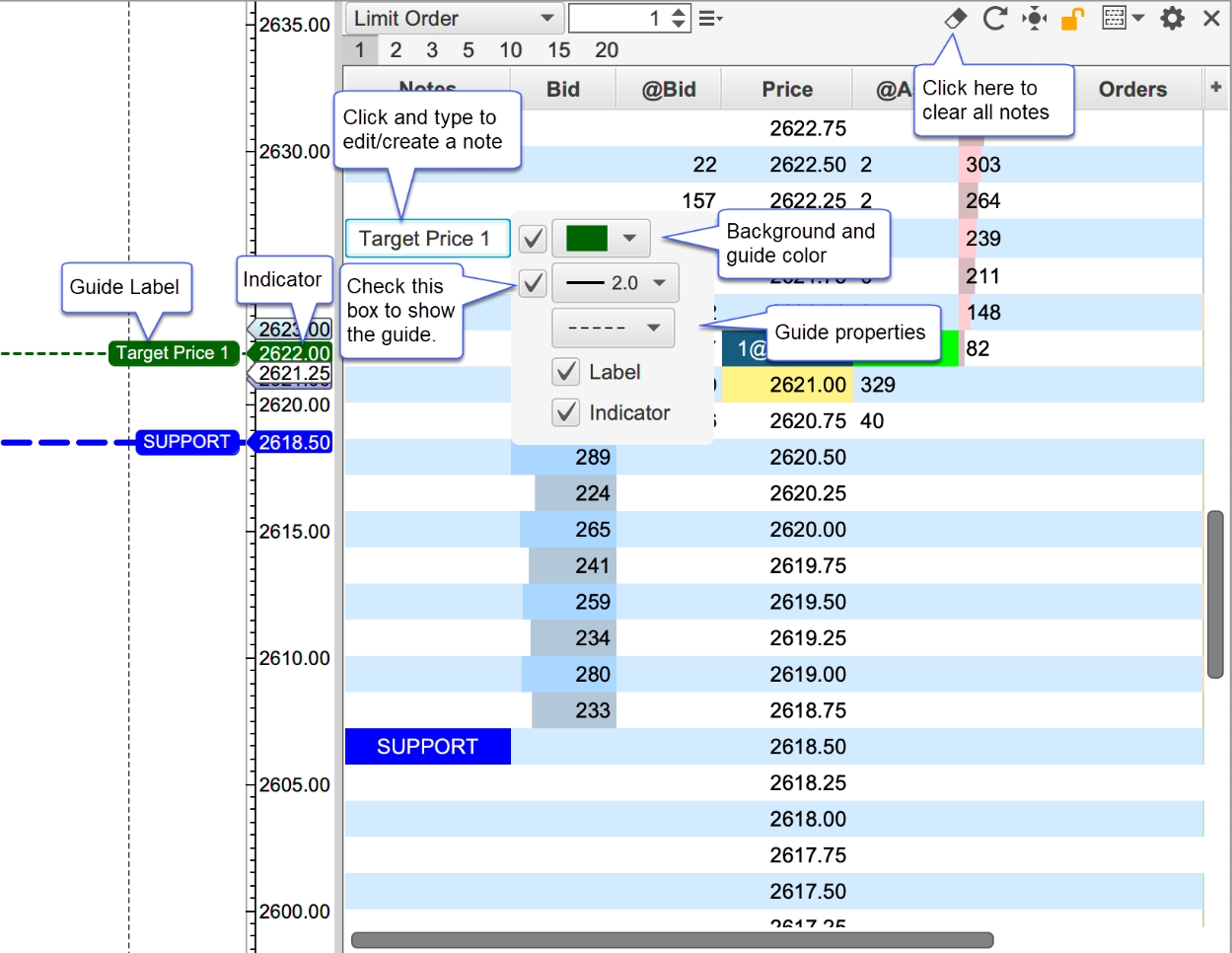

Notes – Displays a text note that you can add to each price level (click on the field and type). All notes can be removed by pressing the eraser button on the tool bar.

Preferences

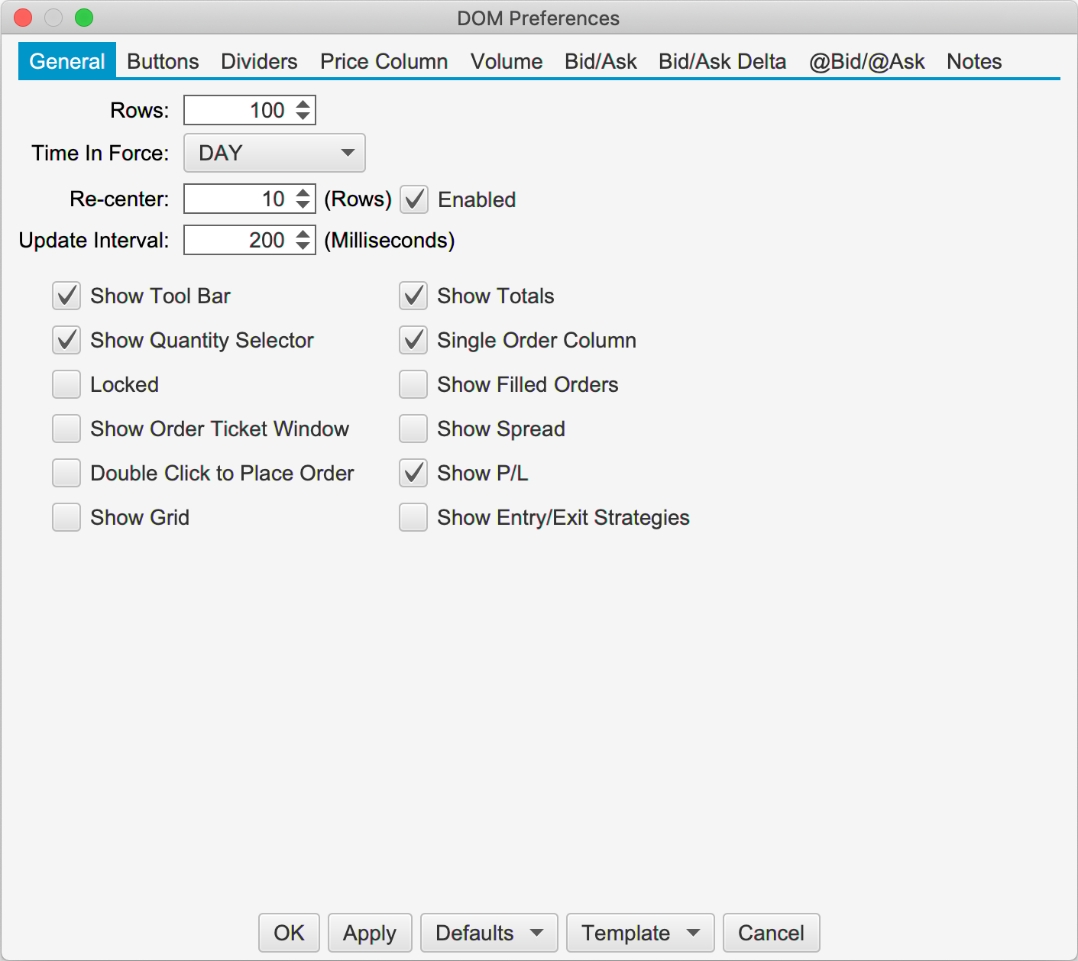

Configuration information for the DOM panel can be found in the DOM Preferences dialog (click on the gear icon in the toolbar). The dialog contains several tabs which are described in the following sections.

General Preferences

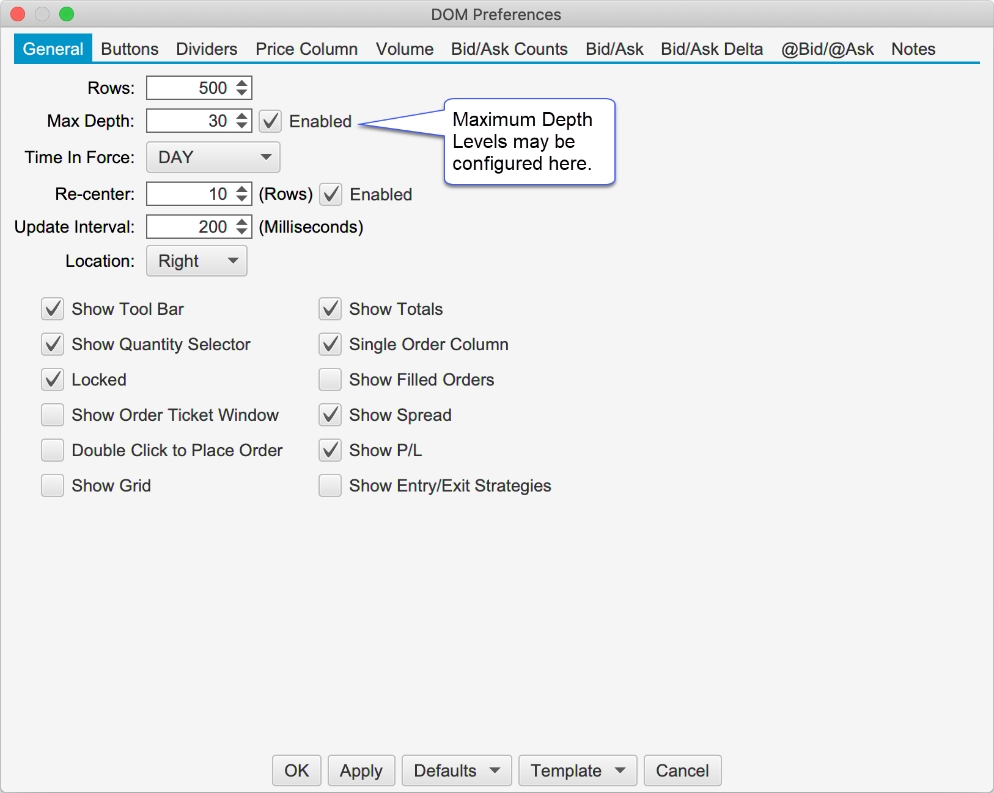

The following configuration options are available from the General tab:

Rows – Number of rows to display in the DOM (default 100).

Time in Force – Time in force setting for orders placed from the DOM.

Re-center – Defines the range (number of rows above/below the current center) for resetting the center point for the DOM. When the last price (or midpoint) crosses the top or bottom of the range the DOM will be centered on the current price.

Update Interval – Sets the update threshold for depth of market updates (bid/ask quantities). By default, the table will be updated a maximum of once every 200 milliseconds.

Show Tool Bar – Toggles the display of the tool bar at the top of the DOM panel. If this is turned off, the preferences button (gear icon) will display in the button bar at the bottom.

Show Quantity Selector – Toggles the display of the preset order quantities.

Locked – If the DOM is locked, you cannot place or modify orders. Uncheck this option if you want to manage orders in the DOM.

Show Order Ticket Window – Displays the order ticked window when placing an order from the DOM.

Double Click to Place Order – Place orders on double click (as opposed to single click).

Show Grid – Toggles the display of the grid in the DOM table.

Show Totals – Toggles the display of the totals for Bid/Ask Sizes and the delta at the bottom of the DOM table.

Show Pips Only – Rounds each price level in the table to the nearest pip. (FOREX only, not shown in the screen shot below).

Single Order Column – Displays all orders in a single column (instead of having separate buy and sell order columns).

Show Filled Orders – Displays filled orders in the order column(s).

Show Spread – Toggles the display of the spread field.

Show P/L – Toggles the display of the current unrealized profit/loss label.

Show Entry/Exit Strategies – Toggles the display of the Entry/Exit strategy panel (for customized order entry/exit).

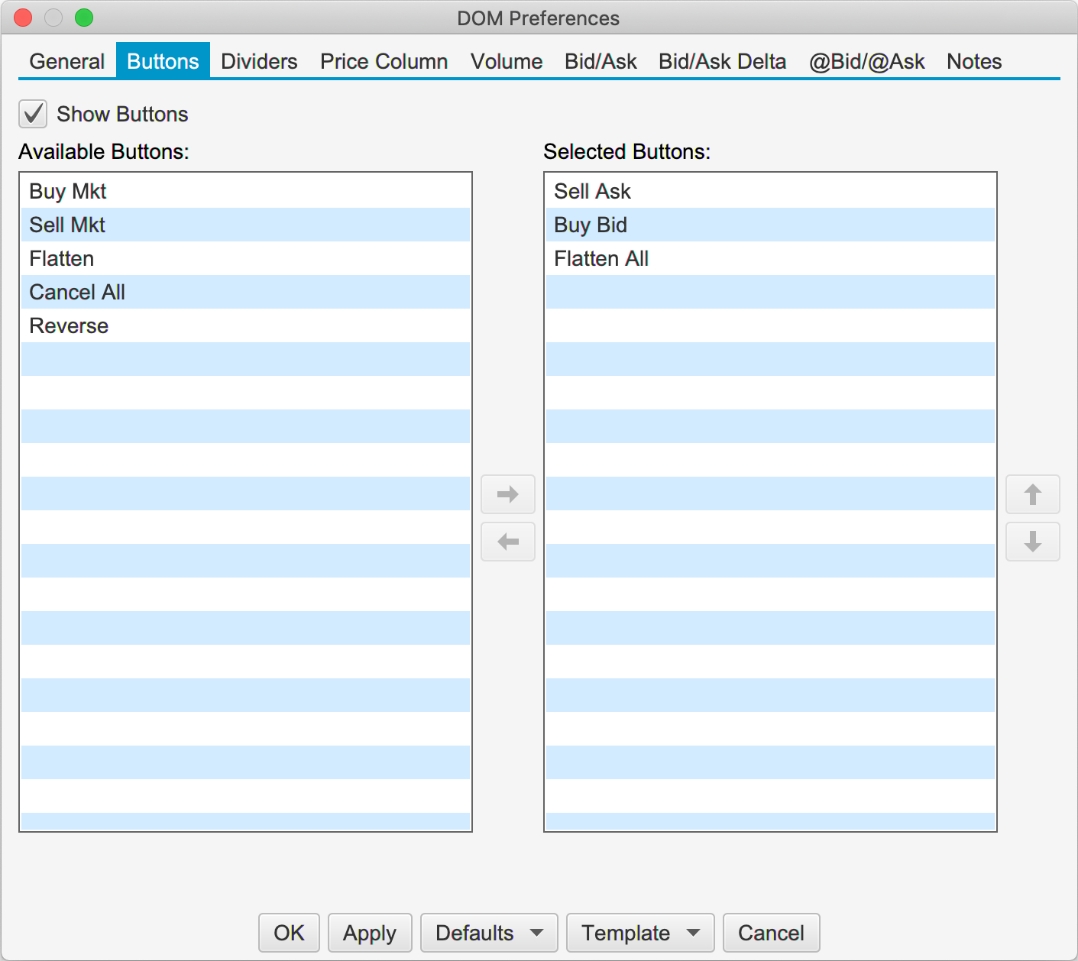

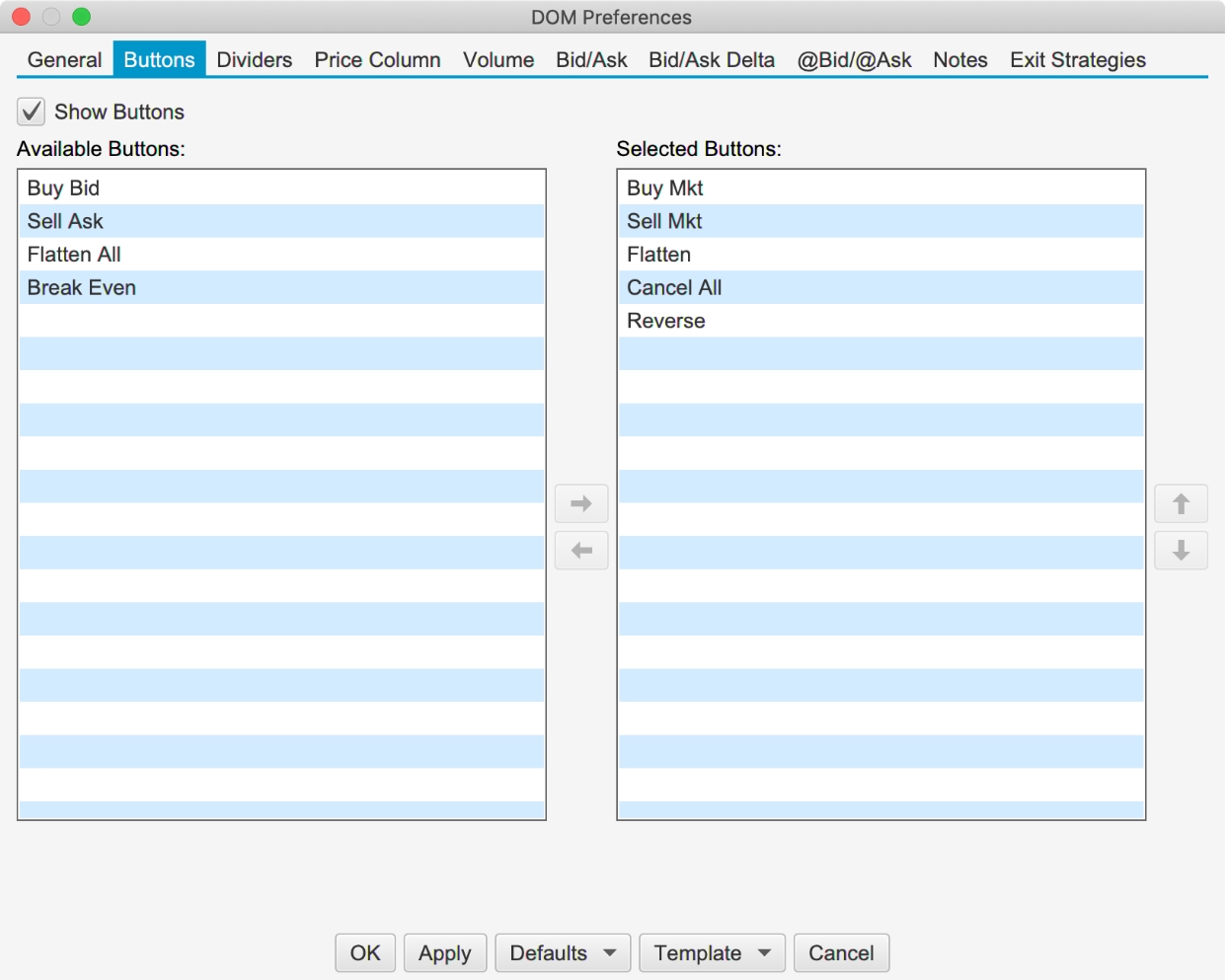

Buttons

The order buttons available at the bottom of the DOM may be customized from the “Buttons” tab of the preferences dialog. Orders placed using these buttons will use the current quantity in the tool bar and the Time in Force setting from the General tab.

Show Buttons – Toggles the display of the order button section (see bottom of DOM panel).

Buy Bid – Creates a limit order at the current bid price.

Sell Ask – Creates a sell limit order at the current ask price.

Flatten All – Cancels all open orders (for the given instrument and account) and closes the open position at market price. This is the same as pressing Cancel All and Flatten (see below).

Buy Mkt – Places a buy market order.

Sell Mkt – Places a sell market order.

Flatten – Closes the open position at market price.

Cancel All – Cancels all open orders for the given instrument and account.

Reverse – Reverses the current position. For example, if you were long 3 contracts, this will close the open position and create a short position of 3 contracts at market price.

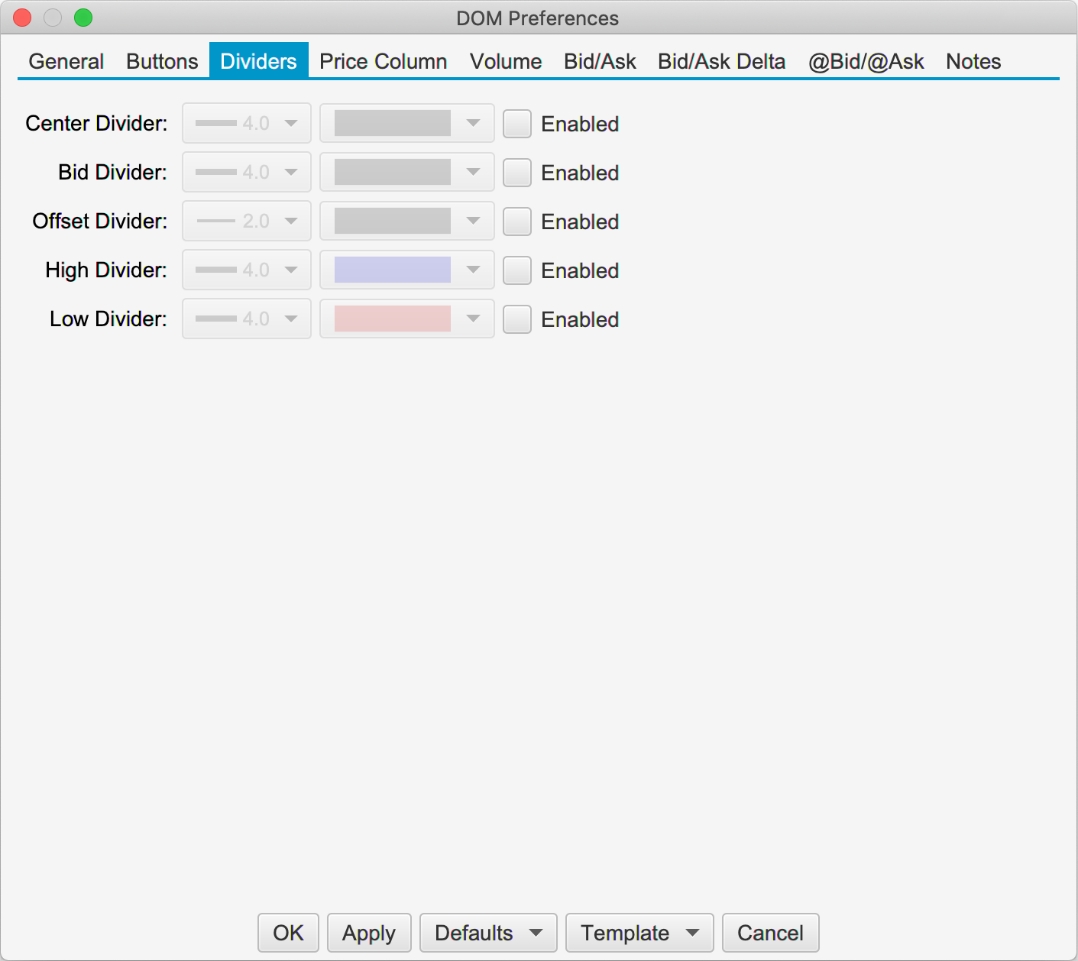

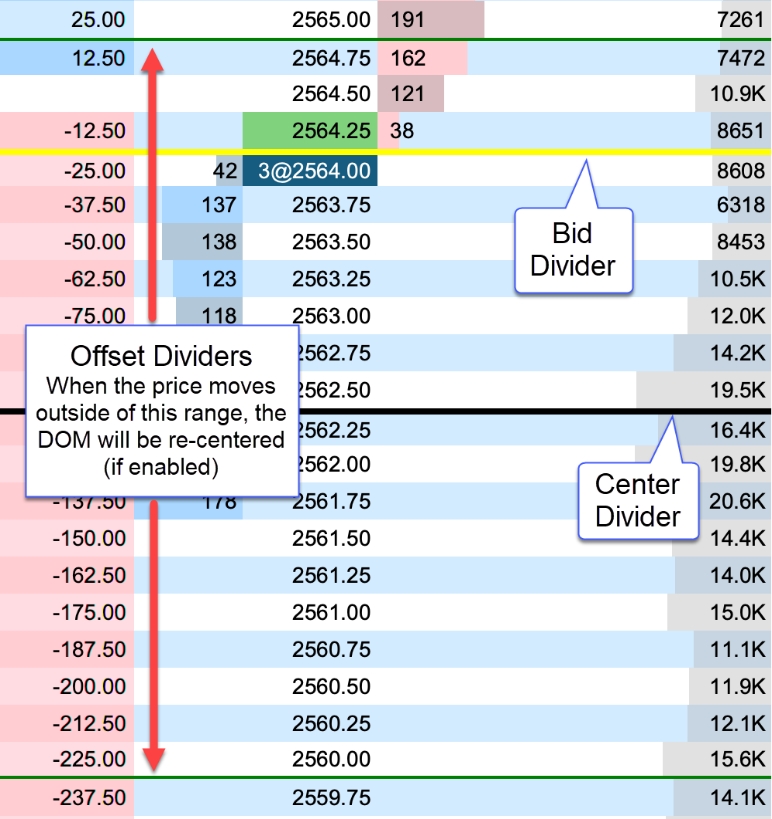

Dividers

Dividers may be used to highlight key price levels in the DOM table. The divider is placed between the rows and can be assigned a thickness and color:

Center – Center of the DOM. This will change when the DOM is re-centered.

Bid – Divider is placed just above the current bid price.

Offset – Shows the re-center threshold above and below the center price (see re-center option in General tab).

High – Daily high price. The divider is placed above this row.

Low – Daily low price. The divider is placed below this row.

The example below shows the bid, center and offset dividers enabled in the DOM. The offset dividers indicate when a re-center will occur (green dividers below).

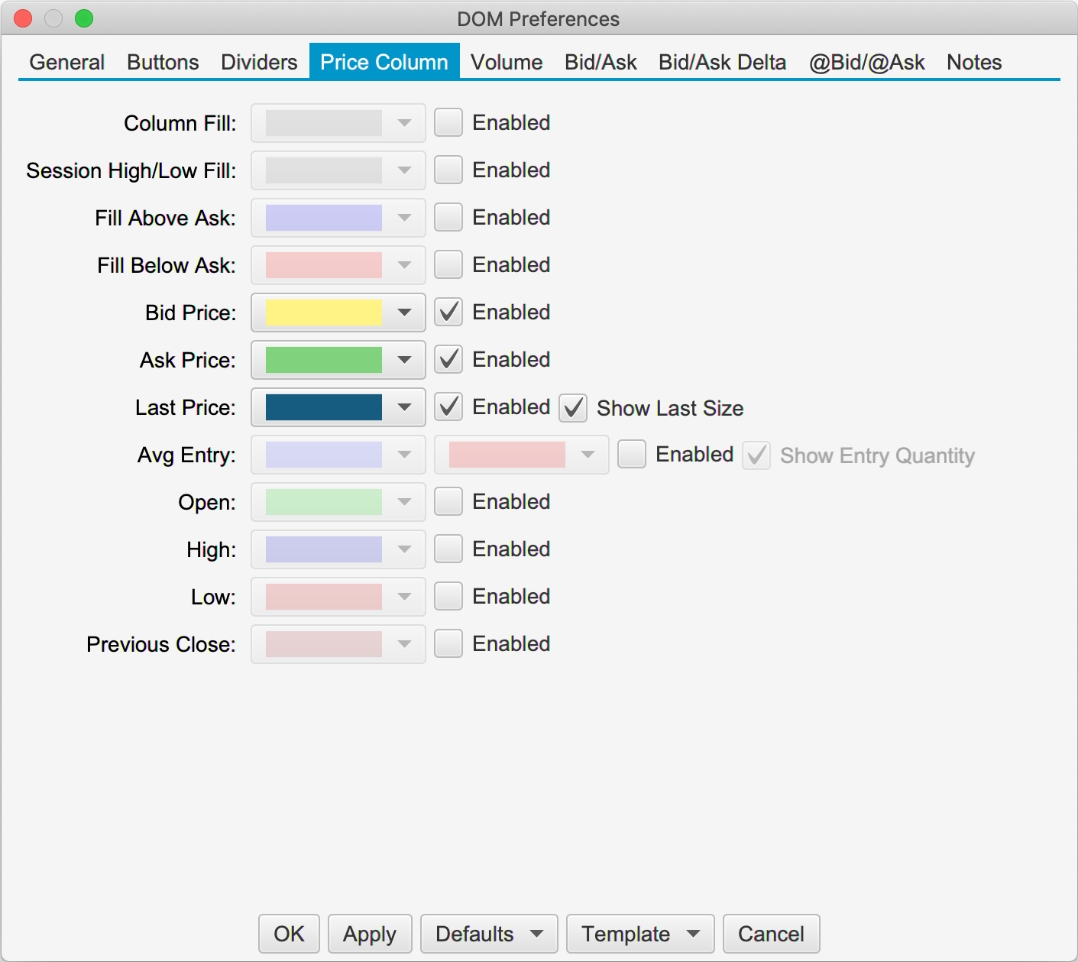

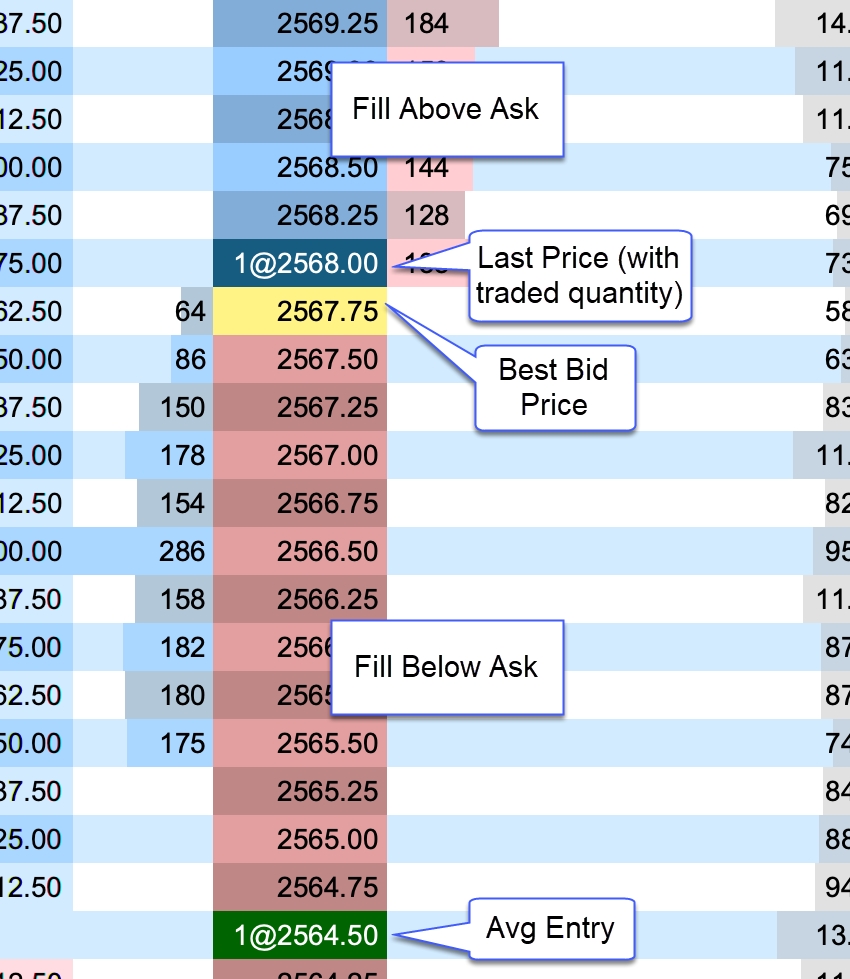

Price Column

Below are the options available for configuring the price column. Note: background fills that span several rows will use striping to help visualize the distinction between rows in the table:

Column Fill – Default background fill for price column. This is the color used to fill the price cells unless they are overridden by another setting.

Session High/Low Fill – Fill for the price rows that are between the high and low for the day’s trading session.

Fill Above Ask – Fill for the prices above the current ask price.

Fill Below Ask – Fill for the prices below the current bid price.

Bid Price – Fill for the cell that contains the current bid price.

Ask Price – Fill for the cell that contains the current ask price.

Last Price – Fill for the cell that contains the last traded price. If “Show Last Size” is enabled, it will be added to the price cell. For example, [email protected].

Avg Entry – Highlight for the price cell that contains the avg entry price for your open position. There are two color options. The first is for a long position and the second is for a short position. If “Show Entry Quantity” is enabled, it will be added to the price cell. For example, [email protected]

Open – Fill for the opening price for the day.

High – Fill for the highest traded price for the day.

Low – Fill for the lowest traded price for the day.

Previous Close – Fill for the closing price from the previous day.

The example below shows some shading options for the price column:

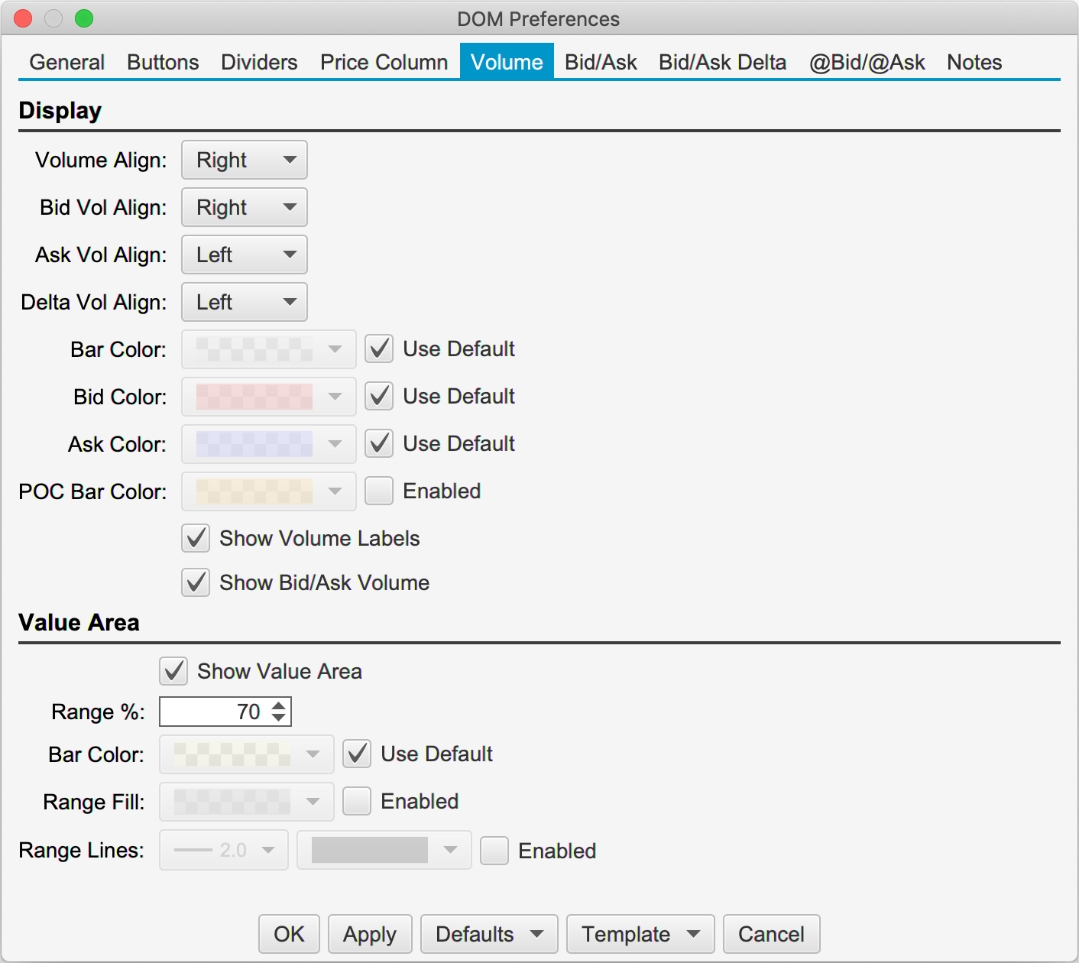

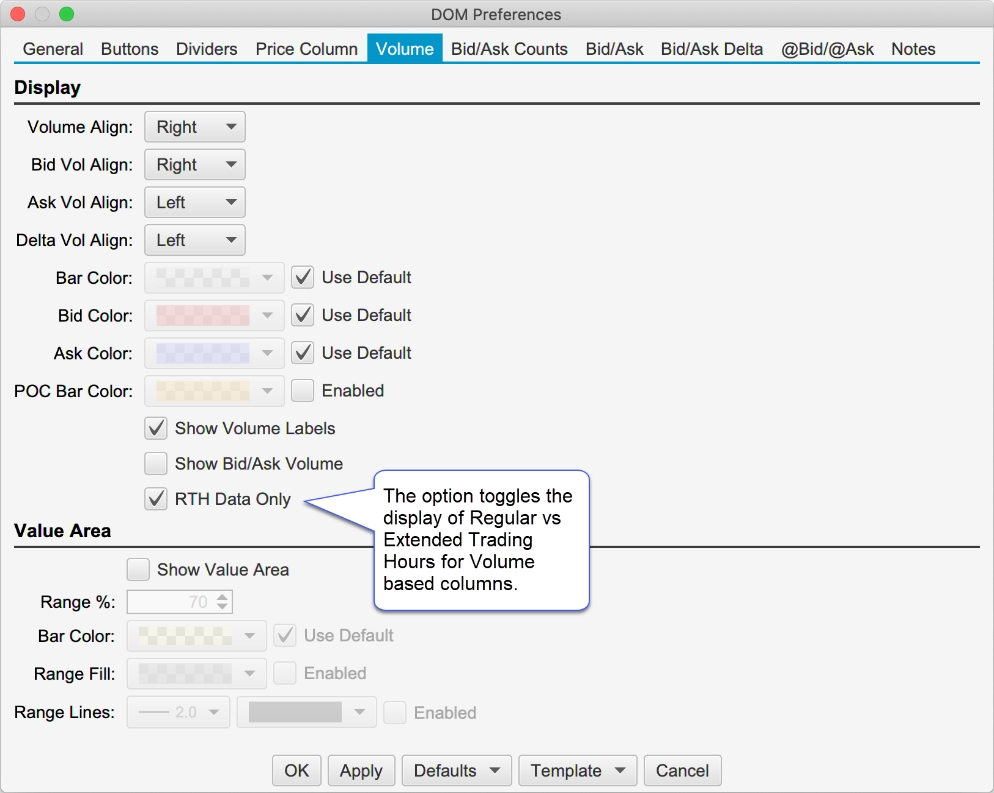

Volume

The volume-based columns (Volume, Bid Vol, Ask Vol and Delta Vol) may be customized from the Volume tab:

Display Section:

Volume Align – Cell alignment for the Volume column.

Bid Vol Align – Cell alignment for the Bid Vol column.

Ask Vol Align – Cell alignment for the Ask Vol column.

Delta Vol Align – Cell alignment for the Delta Vol column.

Bar Color – Bar color for the Volume column. This is not used if Show Bid/Ask Volume is checked

Bid Color – Bar color for the Bid Vol column. If Show Bid/Ask Volume is checked, this will be the fill for the bid volume portion in the Volume column.

Ask Color – Bar color for the Ask Vol column. If Show Bid/Ask Volume is checked, this will be the fill for the ask volume portion in the Volume column.

POC Bar Color – Color for the Point of Control cell (highest volume) in the DOM Table.

Show Volume Labels – Toggles the display of the text labels in the volume columns

Show Bid/Ask Volume – Toggles the display of bid/ask volume for the Volume column. If this is selected each bar in the Volume column will be divided into bid and ask volume.

Value Area Section:

The value area identifies the rows surrounding the Point of Control (POC) (row with the highest volume) that encompass X% (typically 70%) of the total trading volume (for the day).

Show Value Area – Toggles the display of the value area.

Range % - Percentage of the volume to include in the value area.

Bar Color – Shade color for the bars that are part of the value area. Typically, this is a semi-transparent color if you want to highlight bid/ask volume at the same time.

Range Fill – Background fill for the cells that are part of the value area.

Range Lines – Displays dividers at the top and bottom of the value area.

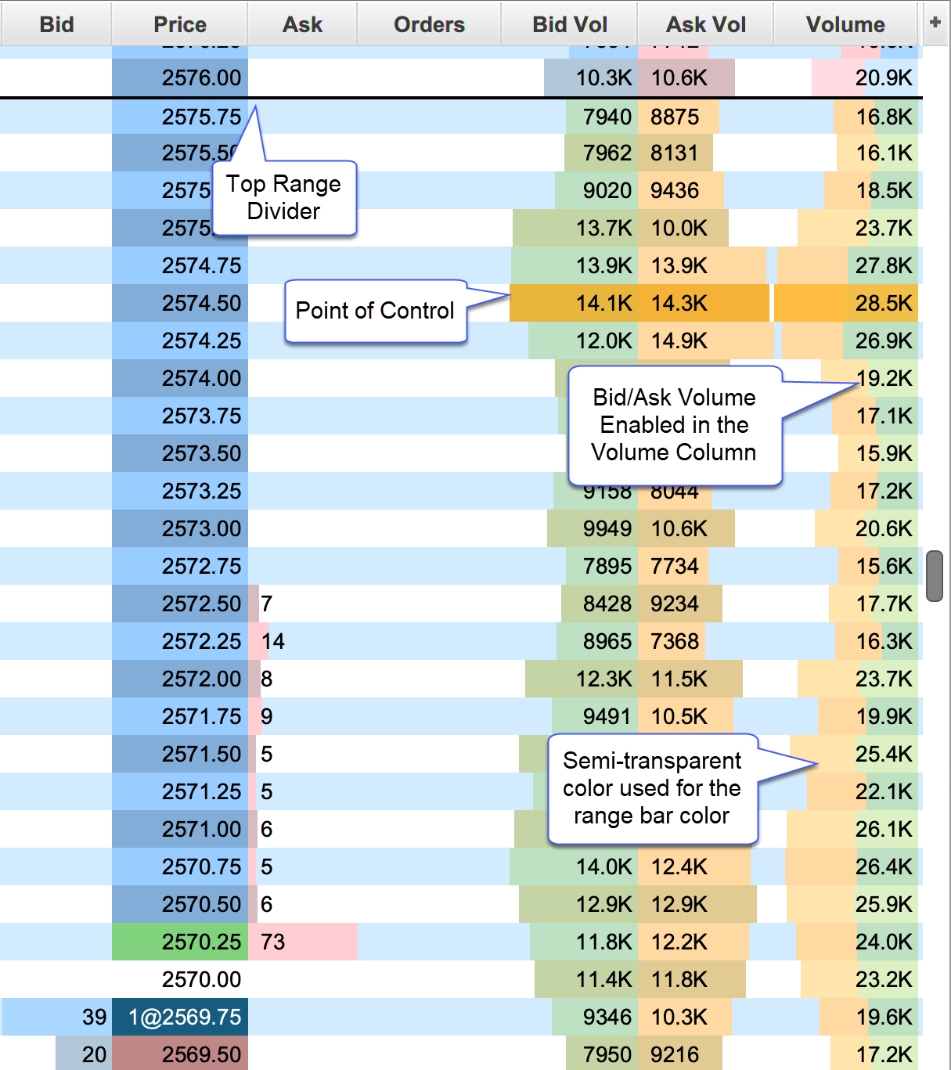

The example below shows the Bid Vol/Ask Vol and Volume columns in the DOM table. The Value Area (Show Value Area check box) has been enabled and the “Show Bid/Ask Volume” has also been enabled for the Volume column.

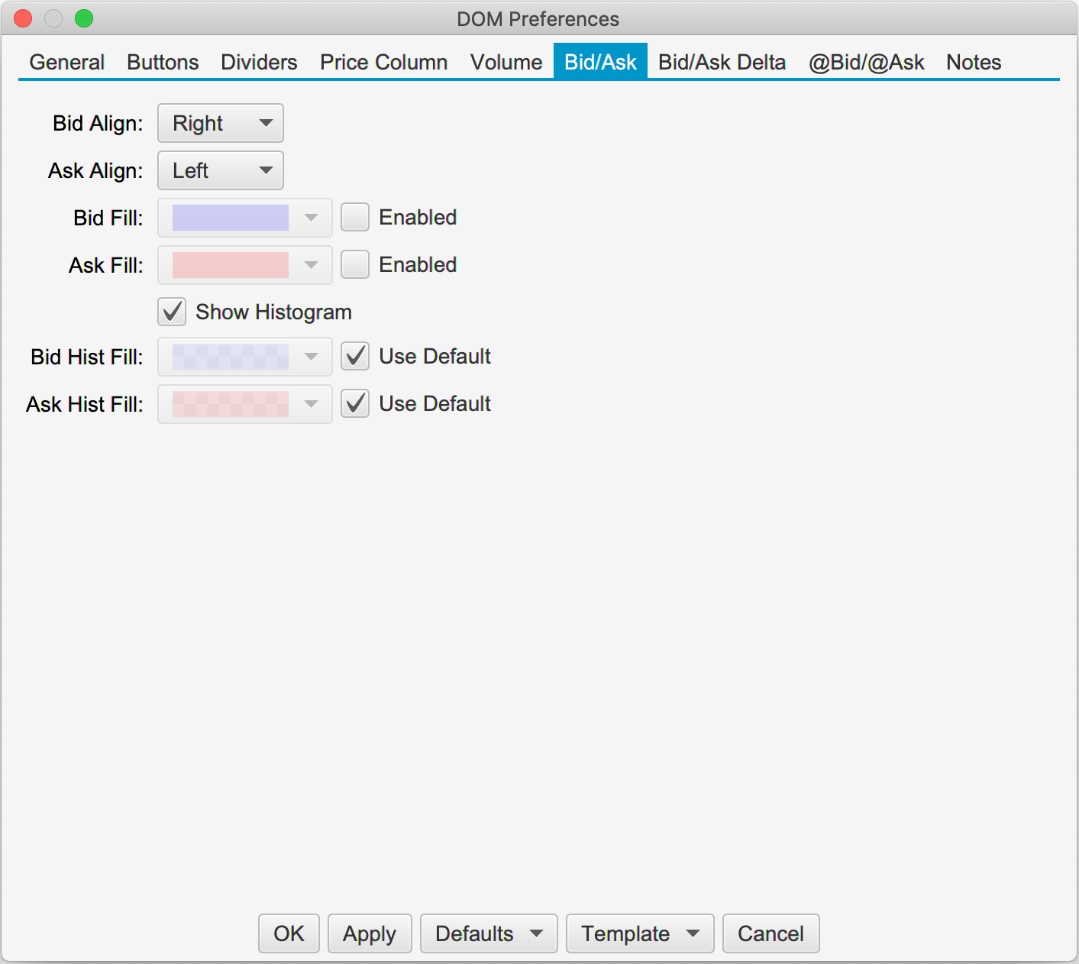

Bid/Ask Sizes

The Bid/Ask columns display total quantity of the active buy and sell orders at each price level. The number of depth rows available depends on the on the instrument, but is typically 10 prices levels for each of the bid and ask columns (total of 20 price rows). An optional histogram can be displayed to help visualize how the quantities are distributed.

Bid Align – Alignment of the Bid column.

Ask Align – Alignment of the Ask column.

Bid Fill – Fill color for the bid column (striping will be applied).

Ask Fill – Fill color for the ask column (striping will be applied).

Show Histogram – Shows the histogram for both the Bid and Ask columns using the Bid/Ask Align settings above.

Bid Hist Fill – Fill color for the Bid histogram.

Ask Hist Fill – Fill color for the Ask histogram.

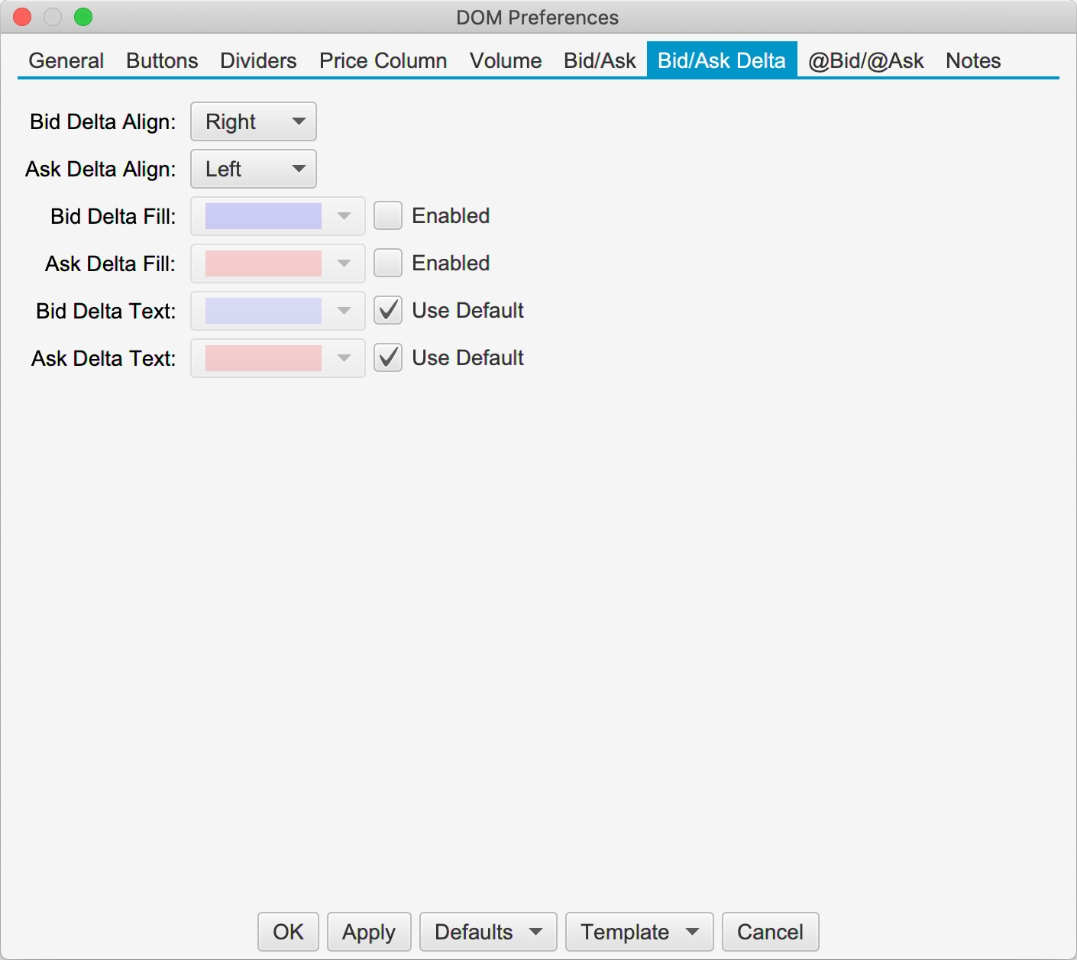

Bid/Ask Delta

The Bid Delta and Ask Delta columns display the difference in the Bid/Ask quantities at each price level since the last price changed. These values are updated with each depth book update.

Bid Delta Align – Alignment for the Bid Delta column.

Ask Delta Align – Alignment for the Ask Delta column.

Bid Delta Fill – Background fill color for the Bid Delta column (striping will be applied).

Ask Delta Fill – Background fill color for the Ask Delta column (striping will be applied).

Bid Delta Text – Text color for the Bid Delta column.

Ask Delta Text – Text color for the Ask Delta column.

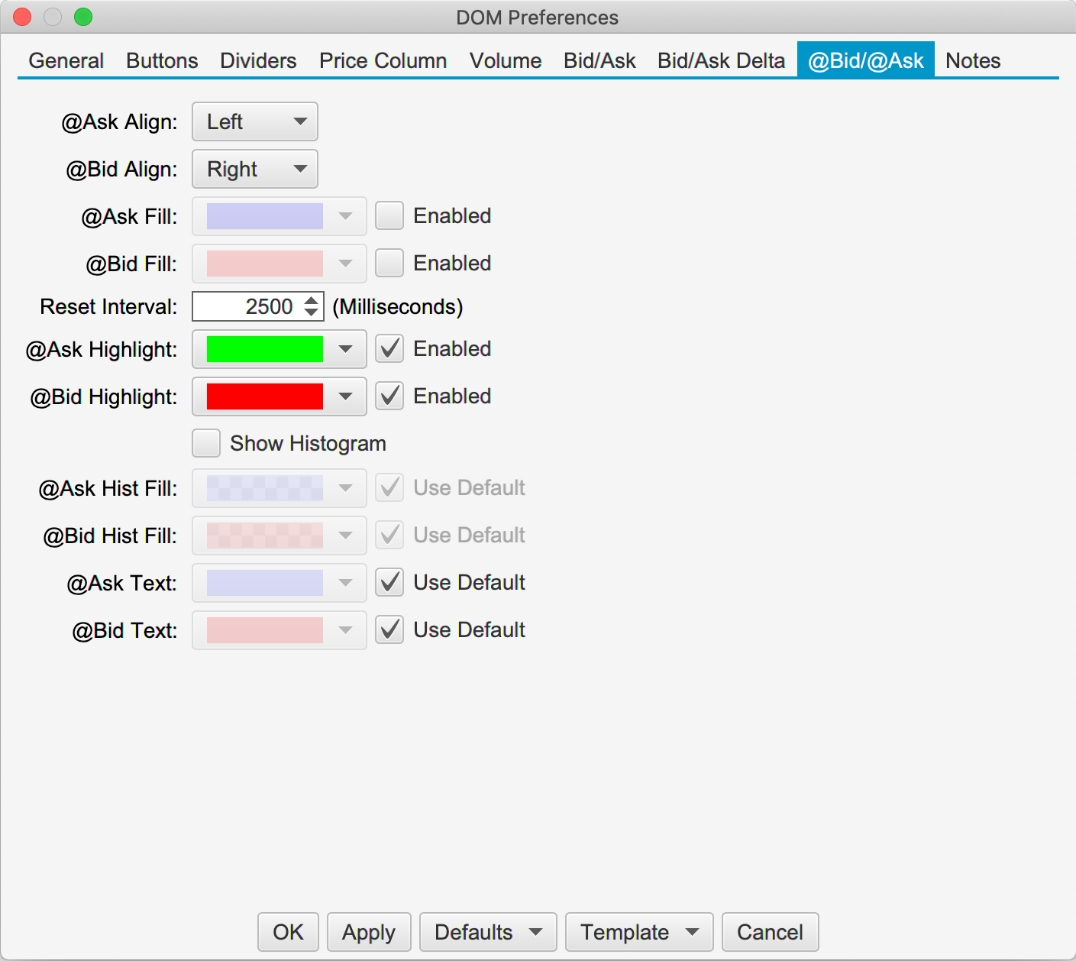

@Bid/@Ask

The @Bid and @Ask columns track the bid and ask volume at each price level since the last reset. These columns can be reset manually by pressing the reset button in the tool bar.

@Ask Align – Alignment of the @Ask column.

@Bid Align – Alignment of the @Bid column.

@Ask Fill – Background fill color for the @Ask column (striping will apply).

@Bid Fill – Background fill color for the @Bid column (striping will apply).

Reset Interval – The DOM panel tracks how long it’s been since a trade occurred at each price level. The @Bid (on bid trade) or @Ask (on ask trade) value is reset to 0 when the elapsed time exceeds the reset interval. For example, consider a case where the DOM panel is showing 1164 contracts traded at an ask price of 2575.50 (since the last reset). When the next trade that occurs at the ask for 2575.50 and the elapsed time exceeds the reset interval, the @Ask value will be reset to 0 before adding the new ask volume.

@Ask Highlight – Highlight color for the @Ask cell when the last trade occurs at the ask price. The highlight is cleared on the next trade.

@Bid Highlight– Highlight color for the @Bid cell when the last trade occurs at the bid price. The highlight is cleared on the next trade.

Show Histogram – Toggles the display of the histogram for the @Bid/@Ask columns.

@Ask Hist Fill – Fill color for the @Ask histogram (striping will apply).

@Bid Hist Fill – Fill color for the @Bid histogram (striping will apply).

@Ask Text – Text color for the @Ask column.

@Bid Text – Text color for the @Bid column.

The example below shows the @Bid and @Ask columns displayed in the DOM panel. Since the last trade occurred at the ask price, the @Ask cell is highlighted green (where the trade occurred).

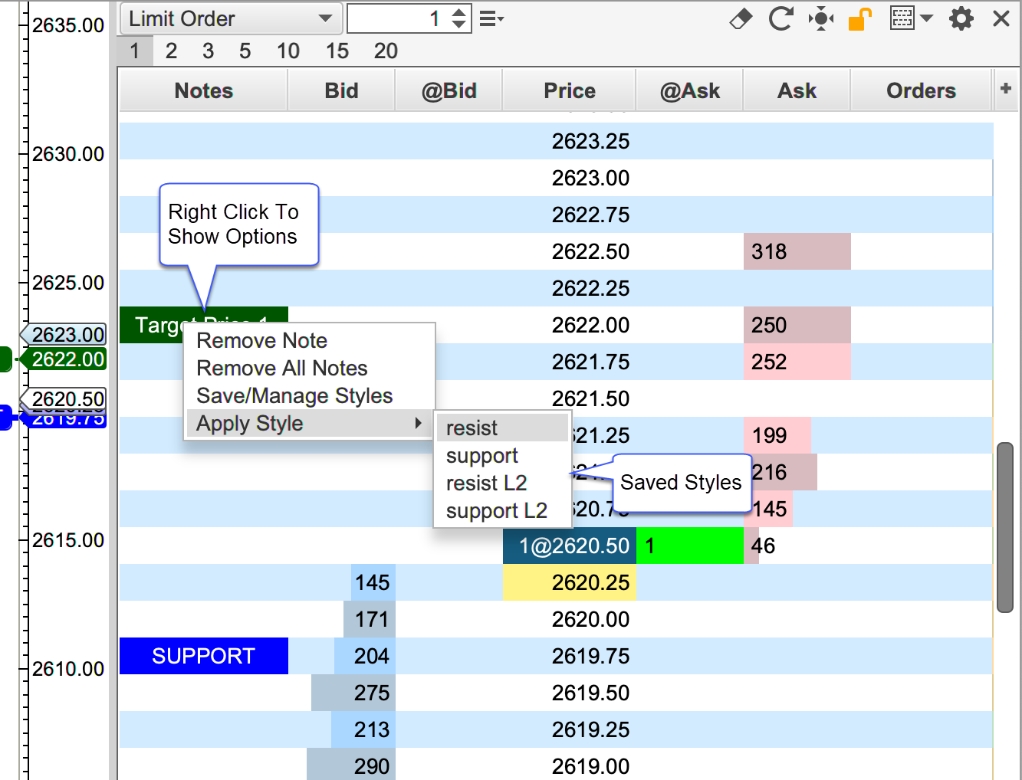

Notes

The Notes column allows you to type a custom note for any price level. Notes are persisted when restarting MotiveWave™. For convenience all notes can be removed by pressing the eraser button in the tool bar (see below). If the DOM is attached to a chart, a guide may optionally be placed in the chart for each note. The guides and notes are synchronized between the DOM and the chart. Moving or removing a guide in the chart will affect the note in the DOM (and vice versa). The screen shot below illustrates some of the options available when adding or editing a note.

Note Styles

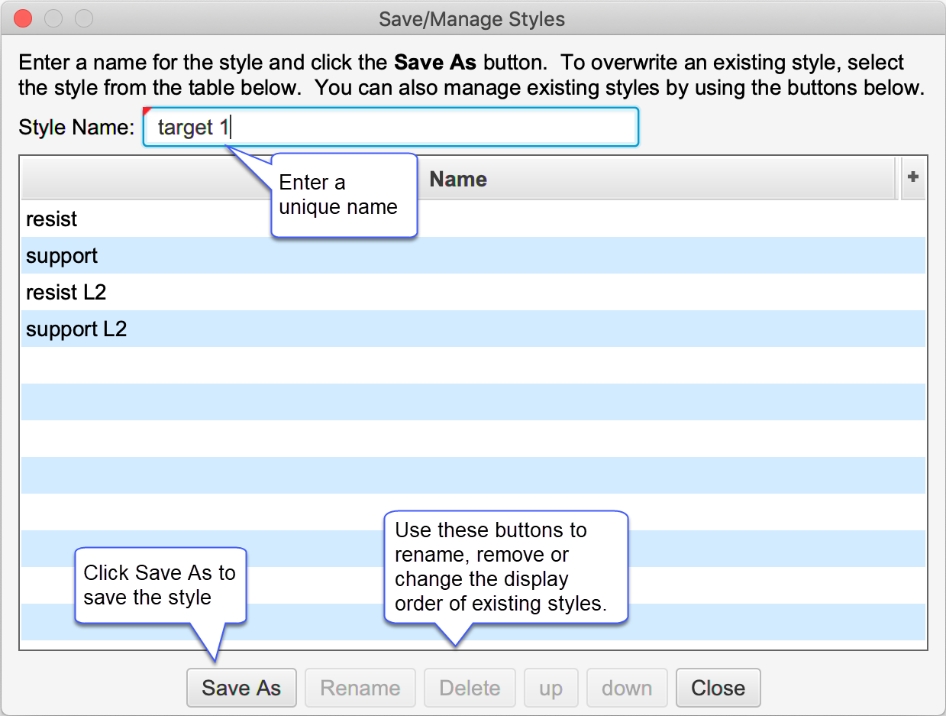

For convenience, notes including their formatting and guide settings may be saved as a style that can be applied later. Right click on an existing note to save or manage existing styles. An existing style can be applied to a note from the Apply Style menu.

The dialog below will appear if you choose the Save/Manage Styles option. From this dialog, you can save a style and or manage existing styles. Use the up/down buttons to change the display order in the Apply Styles menu.

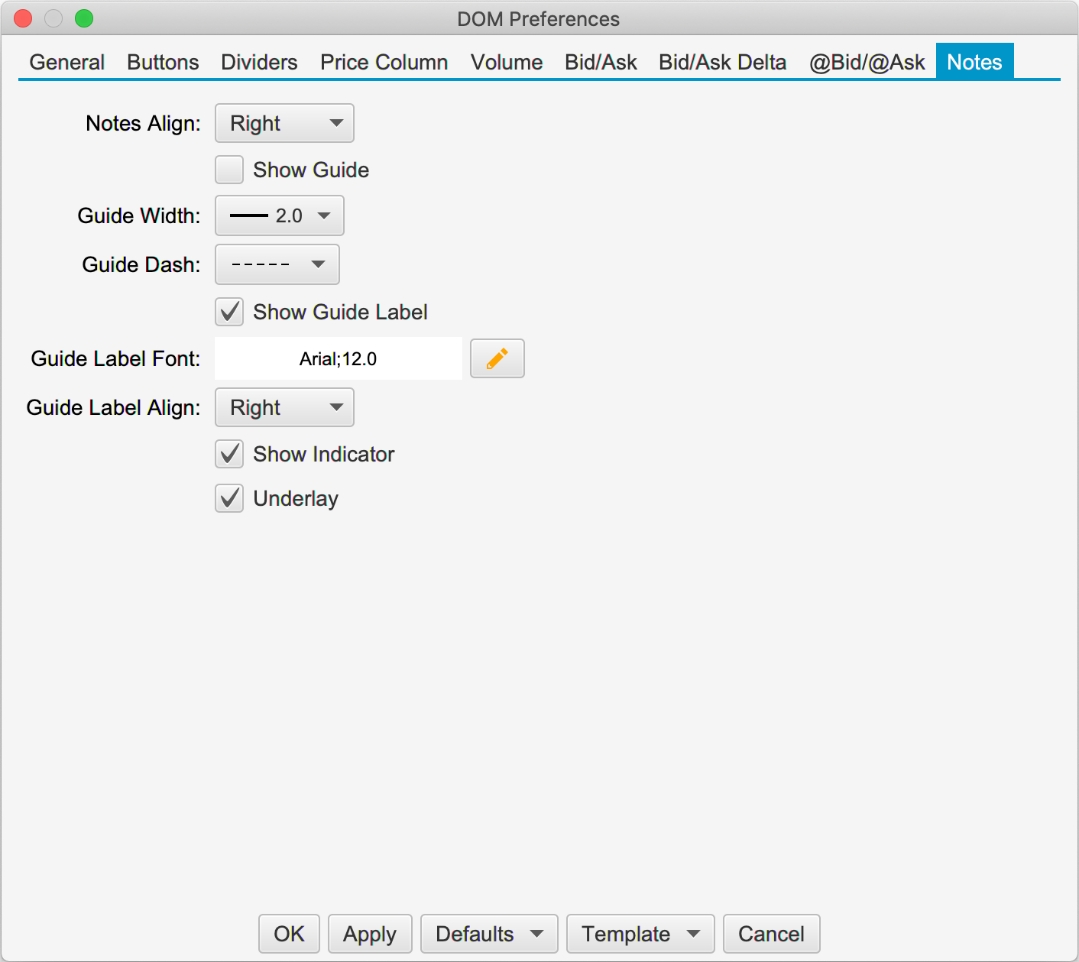

Note Preferences and Defaults

Note settings can be configured in the DOM Preferences dialog under the Notes tab:

Notes Align – Cell alignment for the Notes column.

Show Guide – This is the default setting for the showing the guide in the chart. This only applies to a DOM that is attached to a chart.

Guide Width – Default width for the guide line.

Guide Dash – Default dash pattern for the guide line.

Show Guide Label – Default setting for showing the label in the guide. The label will contain the same text in the Notes column.

Guide Label Font – Font for the guide labels.

Guide Label Align – Alignment for the guide labels.

Show Indicator – Default setting for showing the guide indicator in the price axis.

Underlay – Optionally draws the guides behind the price bars. This will also draw the guide indicators behind the other indicators on the chart.

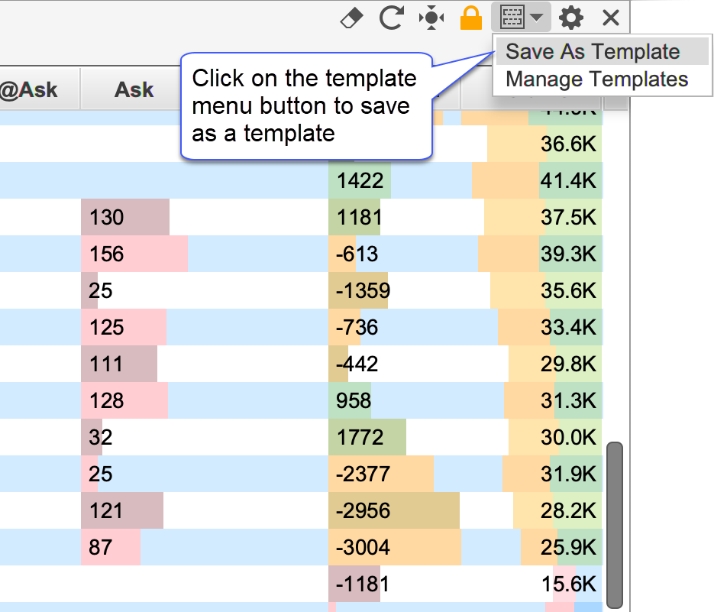

Templates

Templates allow you to save a specific configuration for later use. A DOM template includes the following:

Width – Width of the DOM panel.

Table Columns – Visible table columns and widths.

Configuration Settings – All settings in the DOM Preferences dialog.

Templates can be saved, managed and applied from the tool bar or the DOM Preferences dialog.

Saving Templates

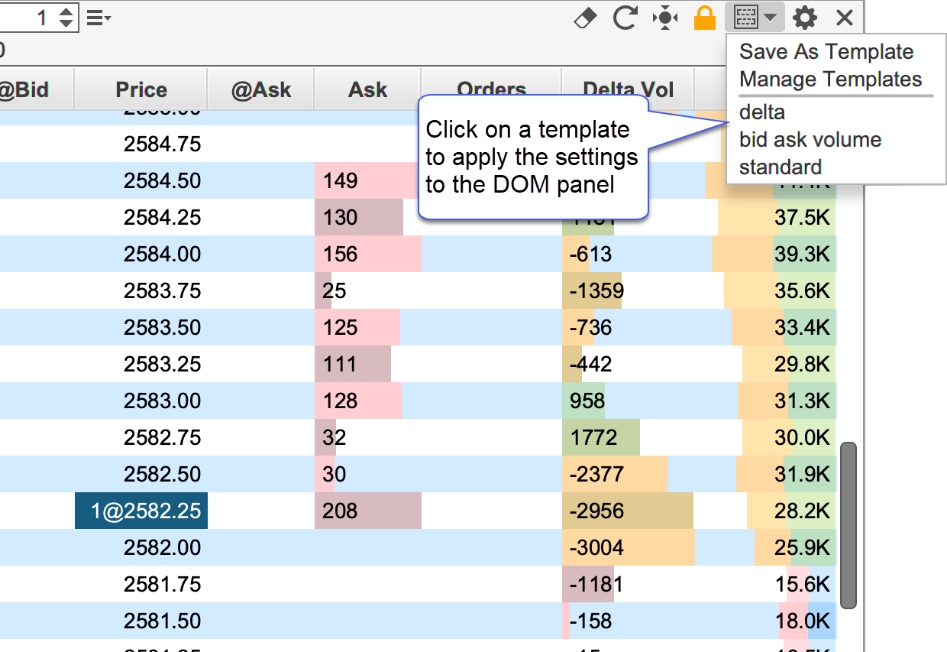

From the tool bar, click on the Templates menu button (see screen shot below) and choose the Save As Template option. Alternatively, this can be done from the DOM preferences dialog (see Template menu button at the bottom of the dialog).

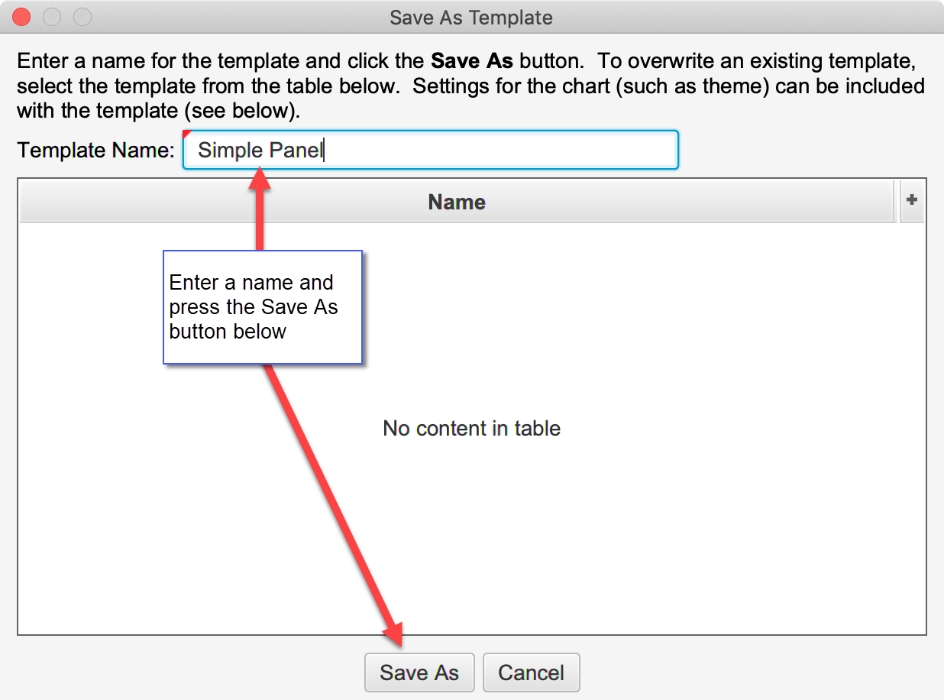

Enter a unique name for the template and press the Save As button at the bottom of the dialog. Existing templates will be displayed in the list box. You can overwrite an existing template by selecting it.

Managing Templates

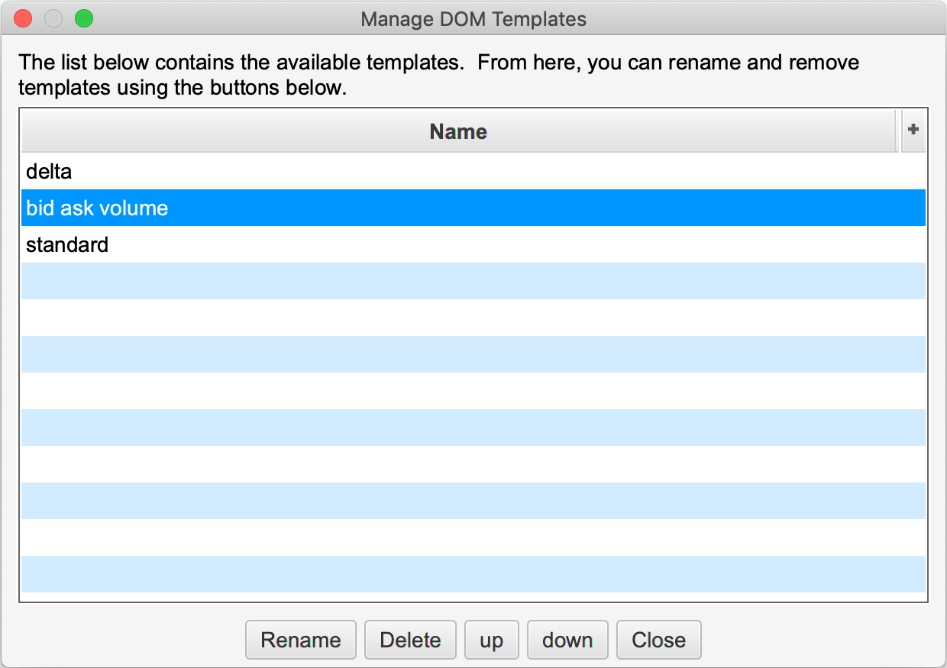

The Manage Templates option will open the dialog below. This dialog will allow to you to rename templates, delete them or change the order in which they appear in the templates drop down.

Applying Templates

A template can be applied to the DOM panel with 2 mouse clicks. Open the templates drop down and select the name of the template you would like to apply. The settings from the template (including the width of the panel and visible columns) will be applied.

DOM Enhancements

Several new enhancements have been added to the Depth of Market (DOM) panel. Note: many of these features are currently exclusive to Rithmic accounts (due to lack of support in other APIs).

Market By Order

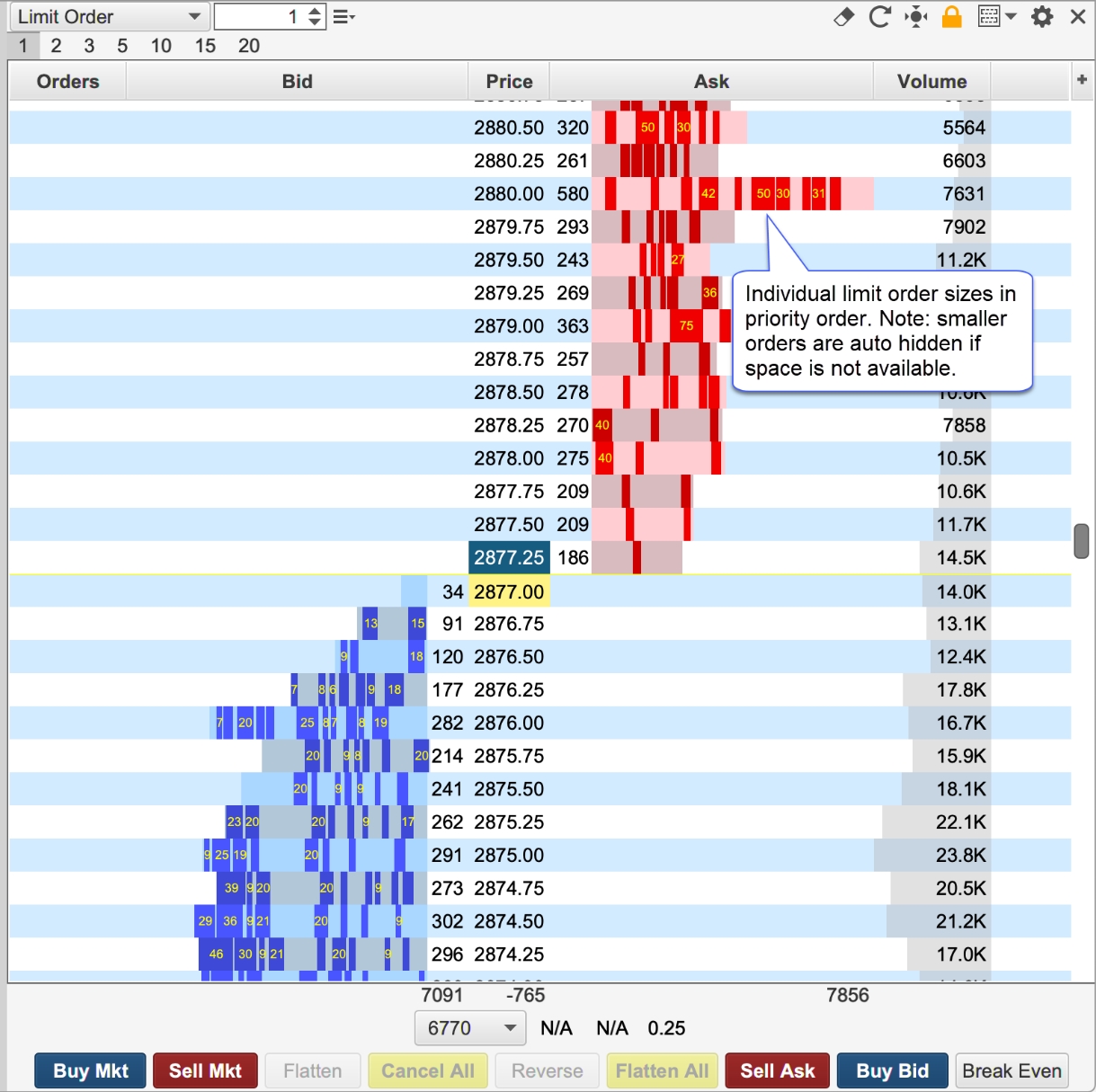

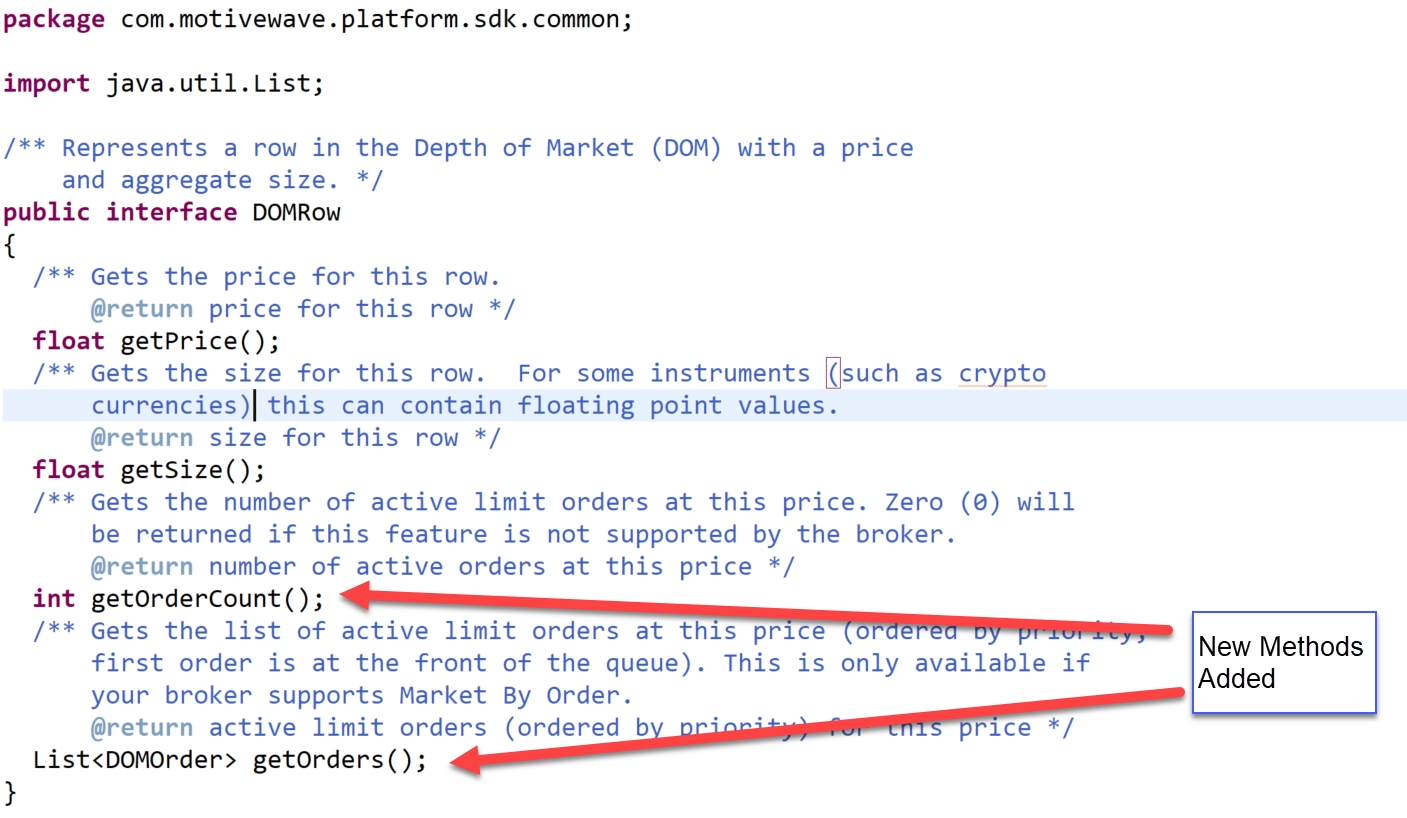

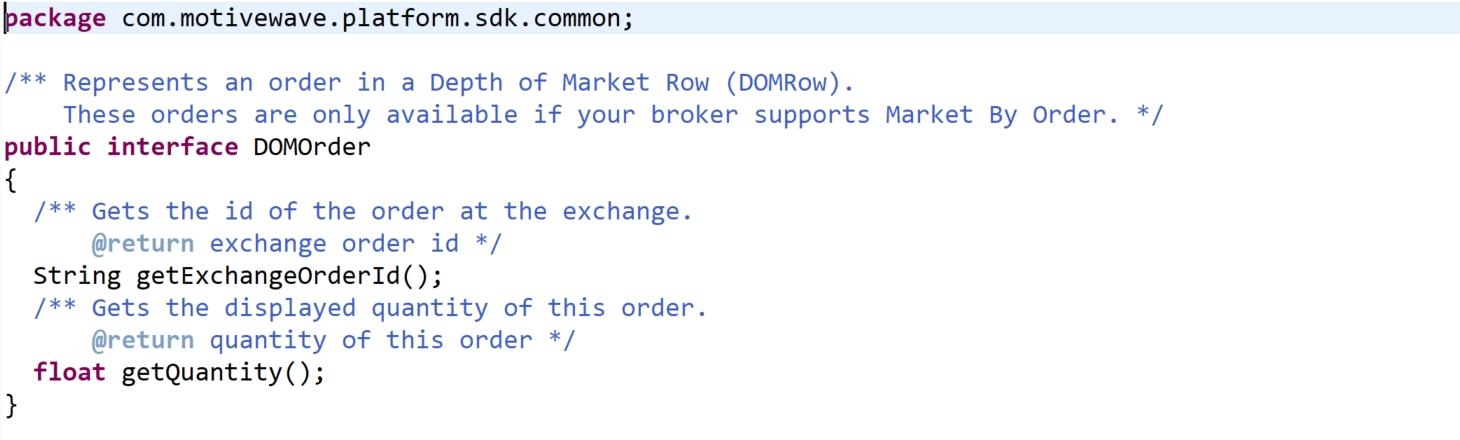

Market by Order displays individual order sizes in the Bid/Ask Columns (Rithmic Only). For more details on Market By Order, see: https://www.cmegroup.com/education/market-by-order-mbo.html Note: this information is also available in the SDK.

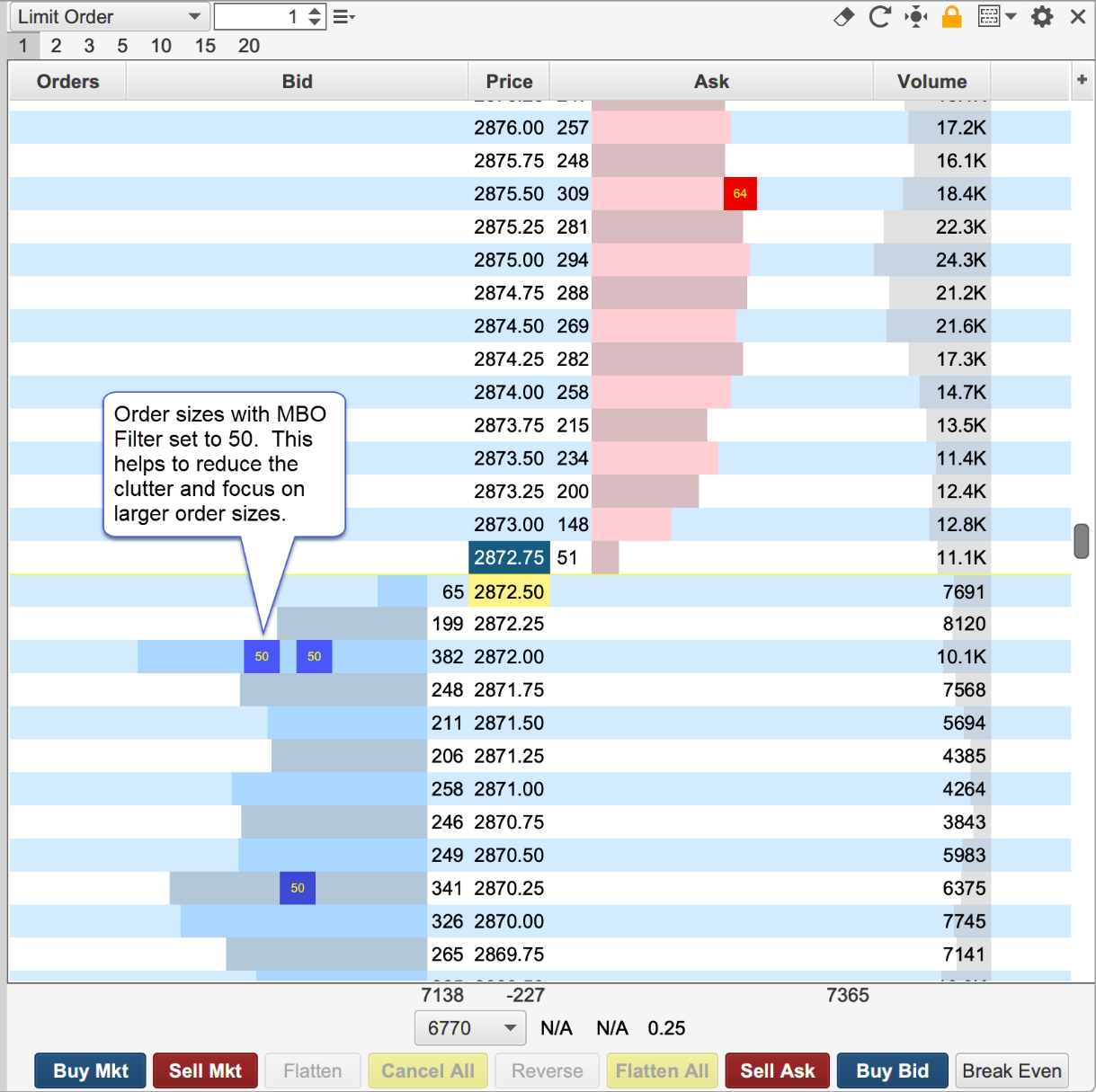

The screen shot below shows an example of the Market by Order feature on the S&P E-

mini contract. Limit order sizes are displayed in priority order. Smaller order sizes are auto hidden for simplicity. If you would like to see more detail, increase the width of the Bid or Ask columns by clicking/dragging the edge of the column in the table header.

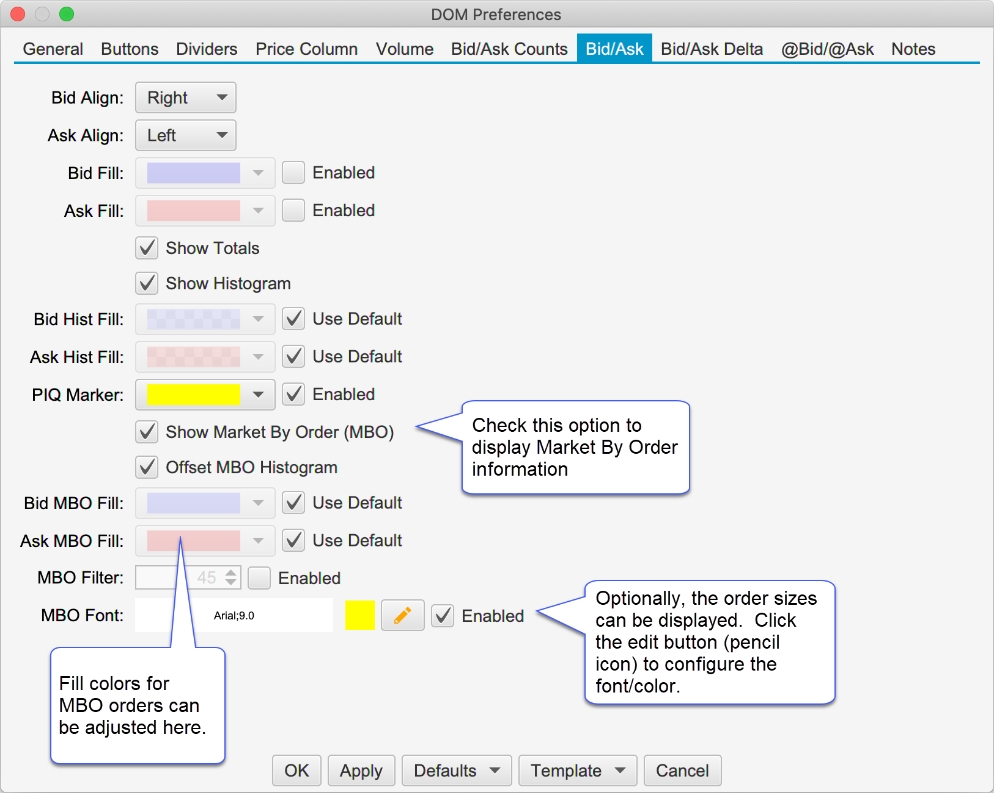

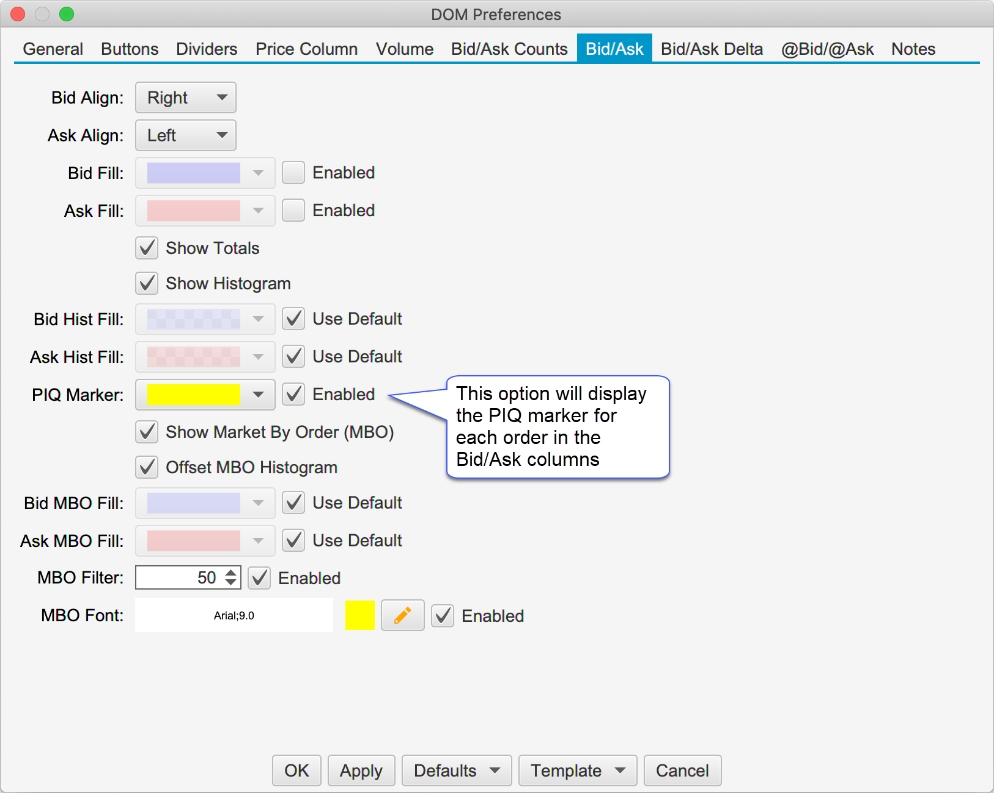

Configuration settings for this feature can be found in the Bid/Ask tab of the DOM Preferences Dialog (click on the Gear icon in the tool bar).

The following options are available for configuring Market by Order:

Show Market by Order (MBO) – Toggles the display of the order sizes in the Bid and Ask columns

Offset MBO Histogram – Offsets the histogram to the left/right of the Bid or ask size to avoid obscuring order sizes at the front of the priority queue.

Bid MBO Fill – Fill color for visible order sizes in the Bid column

Ask MBO Fill – Fill color for the visible order sizes in the Ask Column

MBO Filter – Optionally, filters orders that are smaller than the given size

MBO Font – Optionally display the order size (if space available). Click on the edit button to configure the font size/color.

The screen shot below shows the MBO filter option with the size set to 50:

More Depth Levels

Additional Bid/Ask levels (beyond the standard 10) may be displayed (Rithmic only). See DOM Preferences Dialog, General tab:

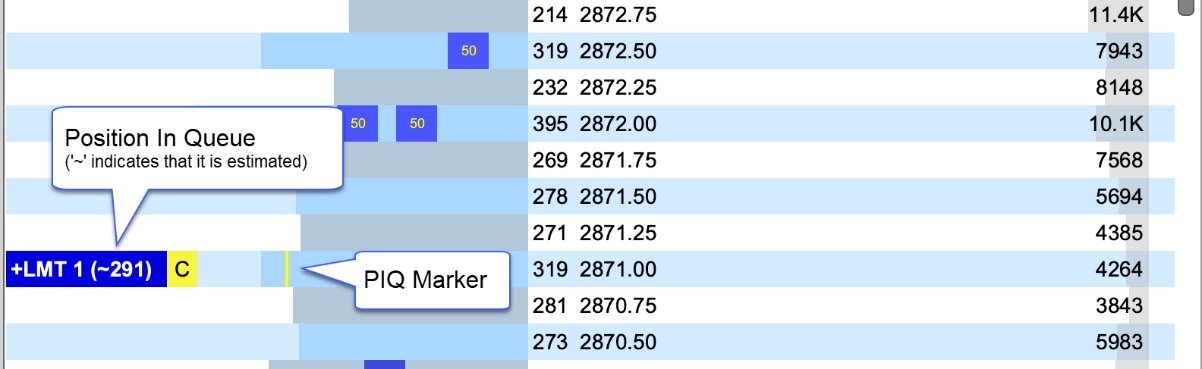

Position in Queue (Limit Orders)

Actual position in queue is available for Live Rithmic accounts only. This makes use of the MBO feature to determine where the limit order is in the queue and calculates the number of contracts ahead of it by adding up the order sizes.

For all other accounts, the estimated position in queue (EPIQ) is displayed (prefixed by ‘~’ in the DOM order column). EPIQ is calculated by monitoring the change in the bid/ask depth levels. When an order is first created it is assumed to be at the back of the queue (ie EPIQ = depth size). When the depth size gets smaller a percentage of that size is removed from the PIQ relative to its current position (i.e. EPIQ = EPIQ - (EPIQ /previous size)*(previous size – new size)).

The following screen shot shows the position in queue in the Order column of the DOM:

The PIQ marker can be configured in the Bid/Ask tab of the DOM Preferences Dialog:

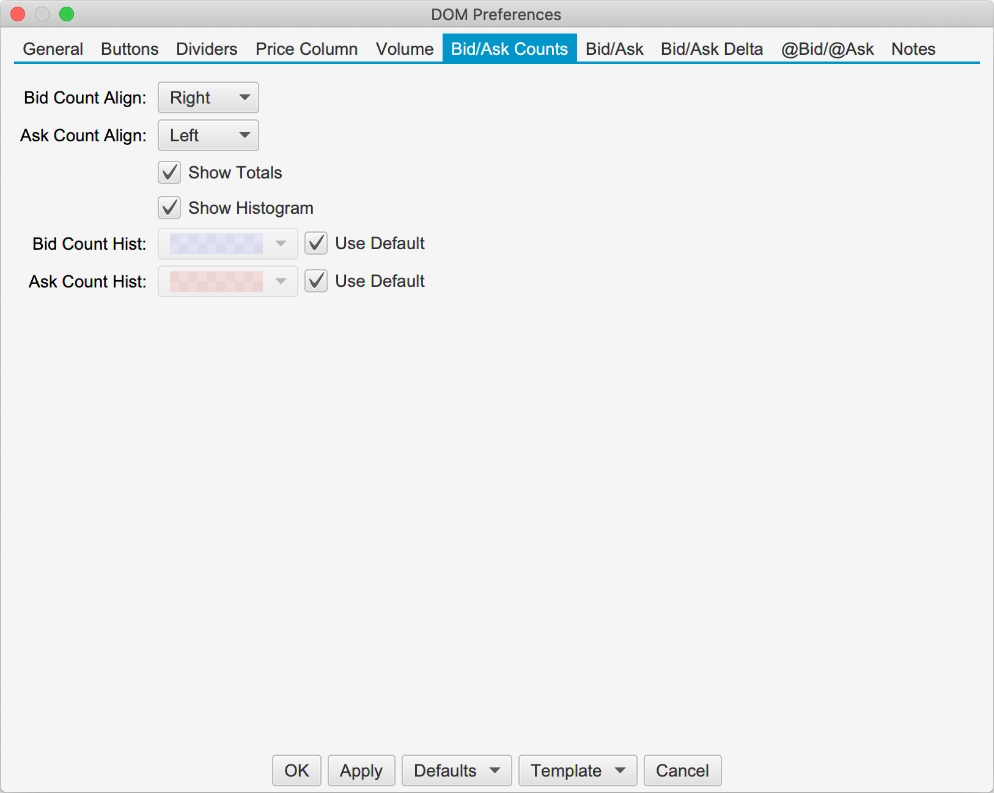

Bid/Ask Counts

The Bid/Ask Counts columns display the number of active orders at each price level (as opposed the depth quantity). Note: these columns are available on Rithmic accounts only.

Regular vs Extended Session for Volume Profile

Optionally the volume profile columns (Volume, Bid/Ask Volume, Delta) may be set to computed from the Regular or Extended trading session. The screen shot below shows where this setting can be found:

Default DOM Layout

The default layout for the DOM has changed in (see screen shot below). The order type chooser has been removed (this functionality is covered by the Exit Strategy feature). The Entry/Exit strategy option has been replaced by the Exit Strategy control (see bottom of DOM).

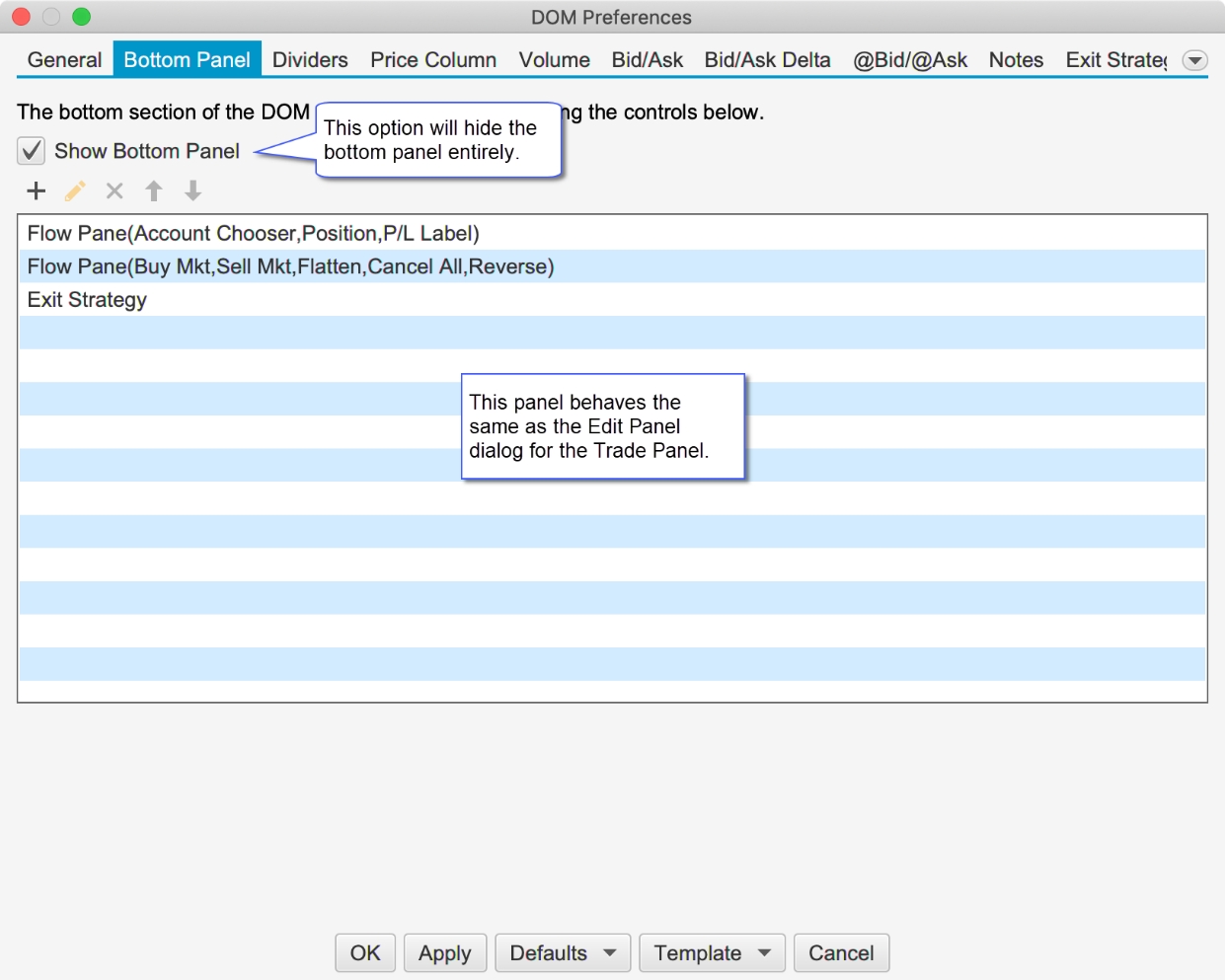

Bottom Panel

Note: This feature is only available in the Professional Edition and higher. Lower editions will be limited to the default layout.

Similar to the Trade Panel, but bottom section of the DOM panel can be customized. This can be done from the Bottom Panel tab in the DOM Preferences dialog (click on gear icon at the top right of the DOM panel).

This panel behaves the same as the Edit Panel dialog in the Trade Panel see Customizing the Layout section.

If you have an edition below the Professional Edition, you can still customize the buttons that are displayed at the bottom of the panel (see below):

DOM Location

This option allows you to display the DOM panel on the left or right side of the chart. See DOM Panel -> Preferences -> General

PL (Price) Column

This is a new column that will display your profit and loss in the instrument price movements eg. 0.25, 0.50, 0.75 etc.

Center DOM Shortcut

Added new keyboard shortcut option “Center on Last Price” (default unassigned). This will re-center the active DOM on the last price.

Center All DOMs

This new option will center all Depth of Market panels when the re-center button is pressed (See DOM Preferences, General Panel). For convenience a Keyboard Shortcut can also be assigned (see General Preferences Dialog, “General” -> “Keyboard” tab).

Rithmic Enhancements

Significant enhancements have been added to our Rithmic connector (some of which have been described in the DOM Enhancements section: MBO, Bid/Ask Counts, Depth Levels and Position in Queue).

Native Order Types

The following native implementations have been added for the following types of orders:

OCO – One Cancels Other

Bracket (Attached) Orders – Limit/Stop orders with attached profile/stop orders

Trailing Stop – Trailing stop orders

LIT/MIT – Limit if Touched/Market if Touched

Iceberg – Limit orders with the actual size hidden

@Bid/@Ask Values for Live Quotes

Live quotes use the “Aggressor Side” flag to determine a live quote was at the bid or ask price instead of relying on the Best Bid/Ask values (which are not guaranteed to be in sync). This will ensure that live quotes are correctly interpreted for Bid vs Ask volume and will match historical tick data.

Latest Rithmic API

We have upgraded to the latest Rithmic API (10.6.0.0).

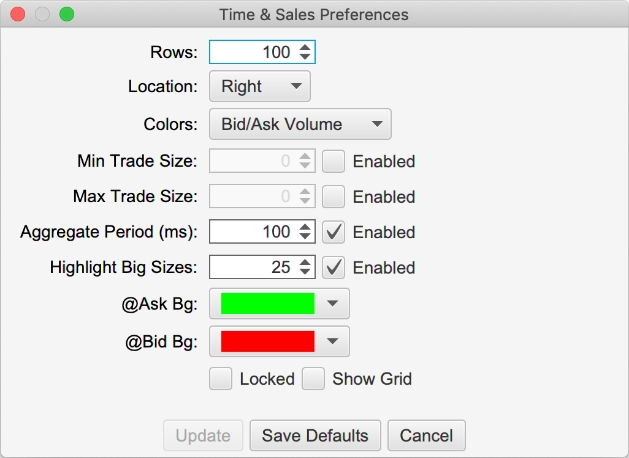

Time and Sales Panel

The following enhancements have been added to the Time and Sales panel:

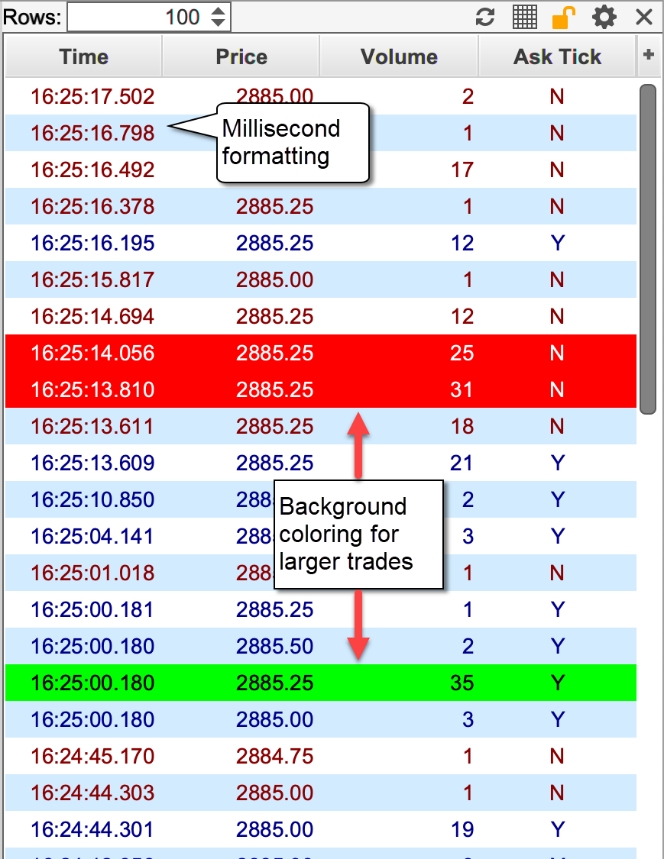

Millisecond Formatting – The time stamp for the tick now shows the milliseconds (ie HH:MM:SS.MMM).

Aggregate Period (ms) – The period for aggregate can be customized (default 100 milliseconds). Trades are aggregated if they occur within the aggregation window, have the same price and them same Ask Tick value. These trades must occur in sequence (no non-matching trades between them).

Highlight Big Sizes – Background highlighting can be applied to larger trade sides.

Location – This option allows you to display the Time and Sales Panel on the left or right side of the chart. See T&S Panel -> Preferences.

Text Color – The text color for the Time & Sales panel can now be configured.

The following screen shot shows the changes that have been made to Time & Sales Preferences dialog (click on the gear icon on the tool T&S toolbar).

In the screen shot below you can see the highlighting applied to rows that have sizes of 25 or higher.

Custom Watch List Column

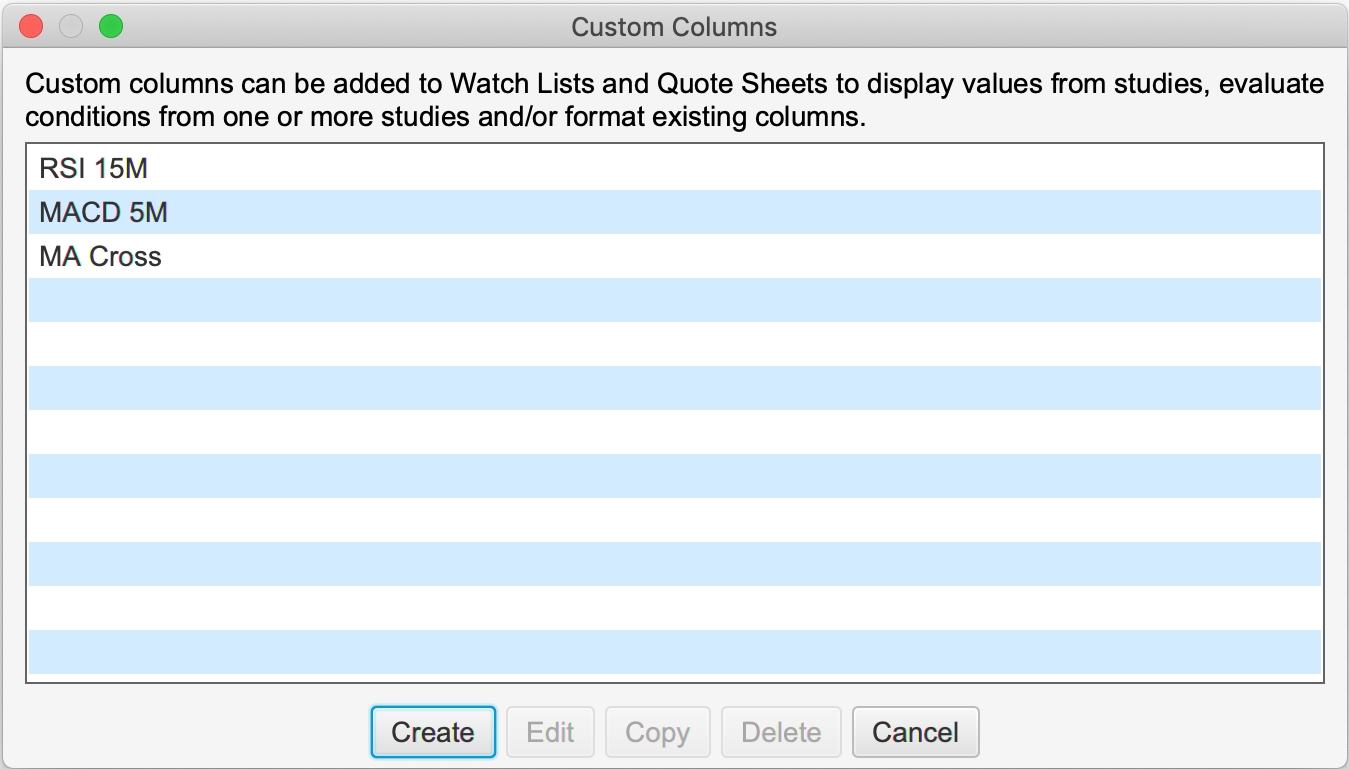

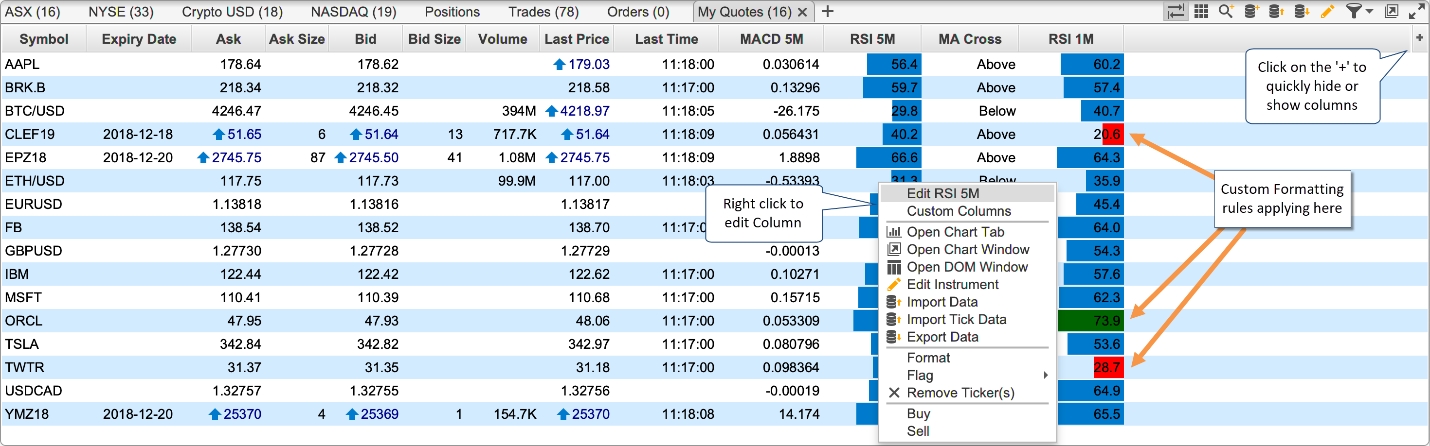

Customized columns may be defined and added to Watch Lists and Quote Sheets. These columns will display a value that is generated by built-in or custom study. Formatting may also be applied to the column cells to make it easier to visualize trading opportunities.

Custom columns can be managed by choosing Configure -> Custom Columns from the Console menu bar.

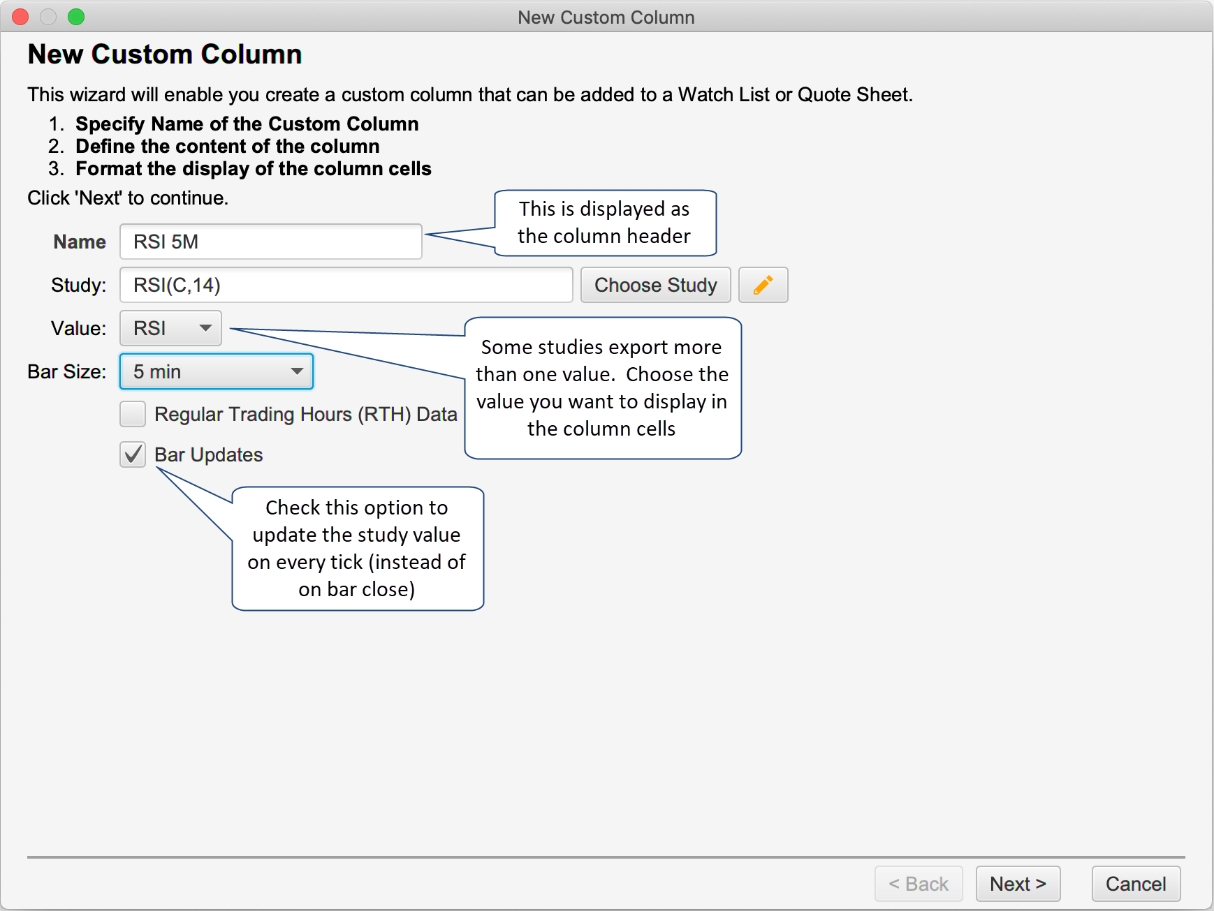

Click on the Create button to create a new custom column. This will open the Create Custom Column wizard to guide you through the steps.

In the example below, we have chosen the RSI study on a 5-minute interval and live updates (instead of on bar close).

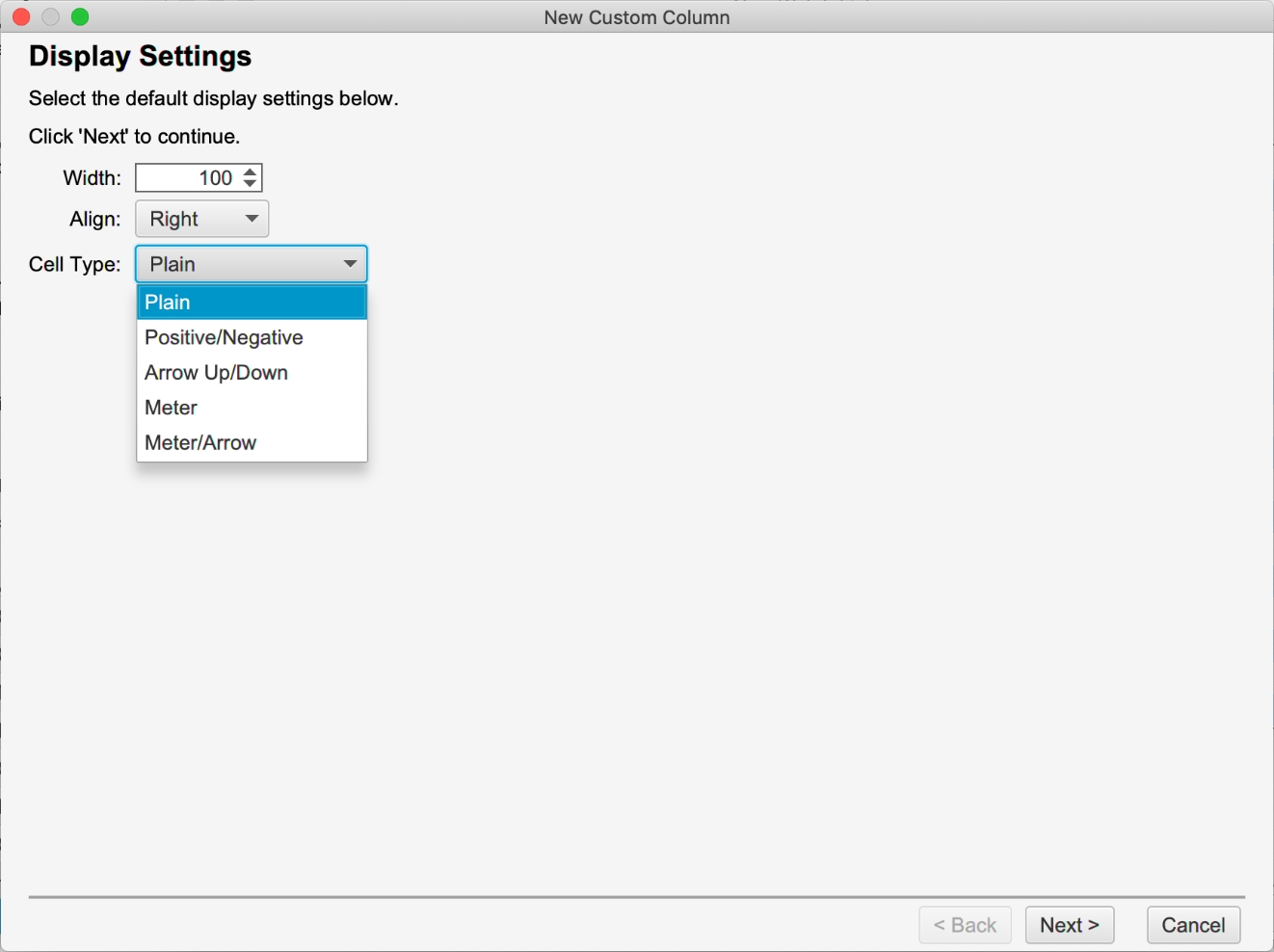

The next panel allows you to change the display of the cells in the custom column. The width attribute is the default width for the column (you can still adjust the column size in the watch list). There are several different cell types to choose from:

Plain – plain cell with no formatting.

Positive/Negative – Displays a blue/green or red background if the value positive or negative.

Arrow Up/Down – Displays an up or down arrow if the latest value is higher/lower than the previous value.

Meter – Fills the background from the left (or right depending on the alignment) with a percentage of the cell width using the current value of the column. For example with an RSI value of 90 (RSI values range from 0 – 100) it would fill 90% of the cell background with the given color.

Meter/Arrow – Combination of the Meter and Arrow types above.

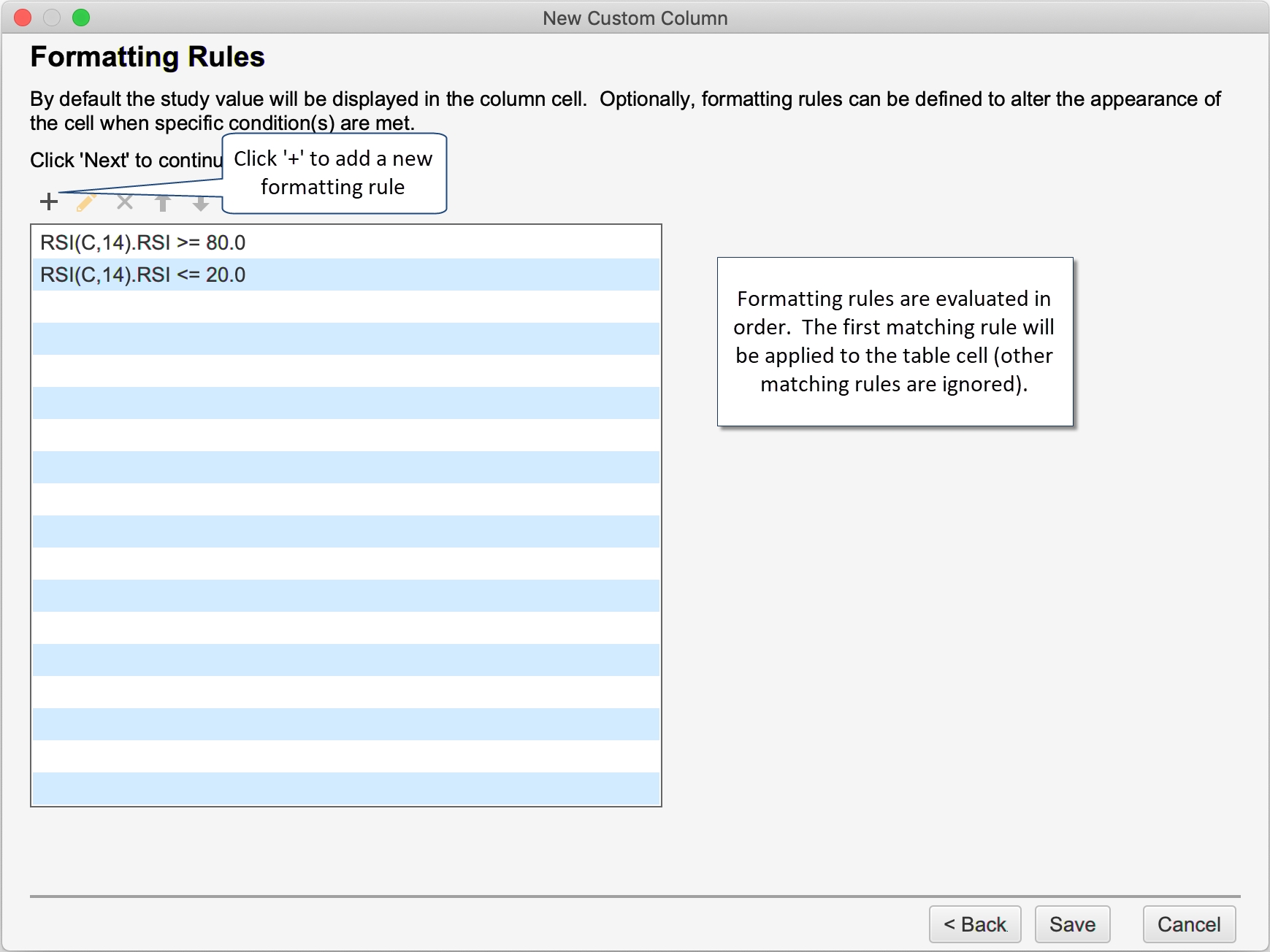

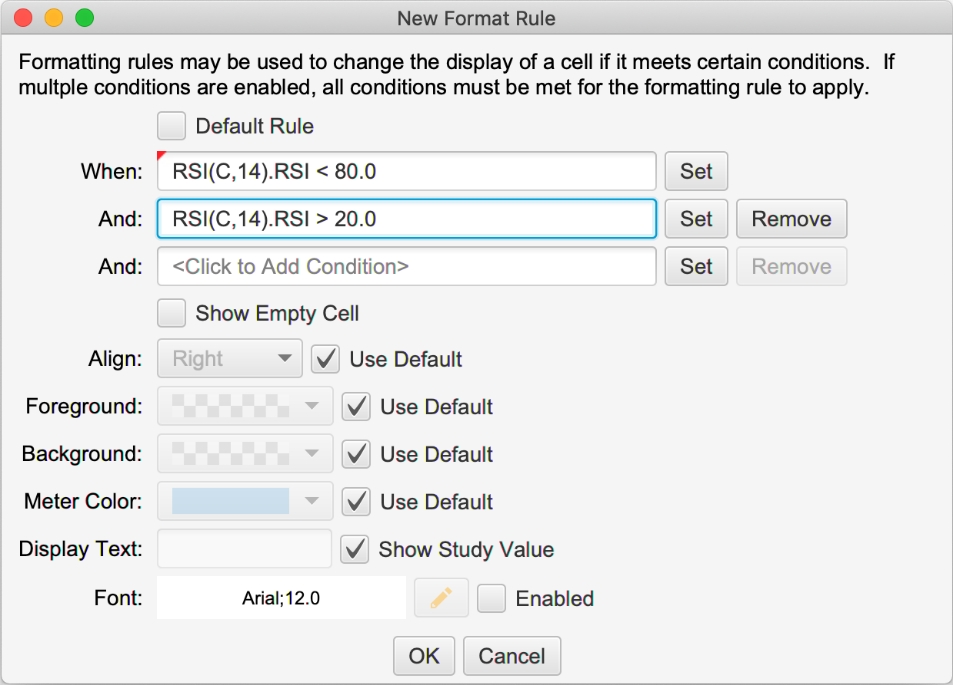

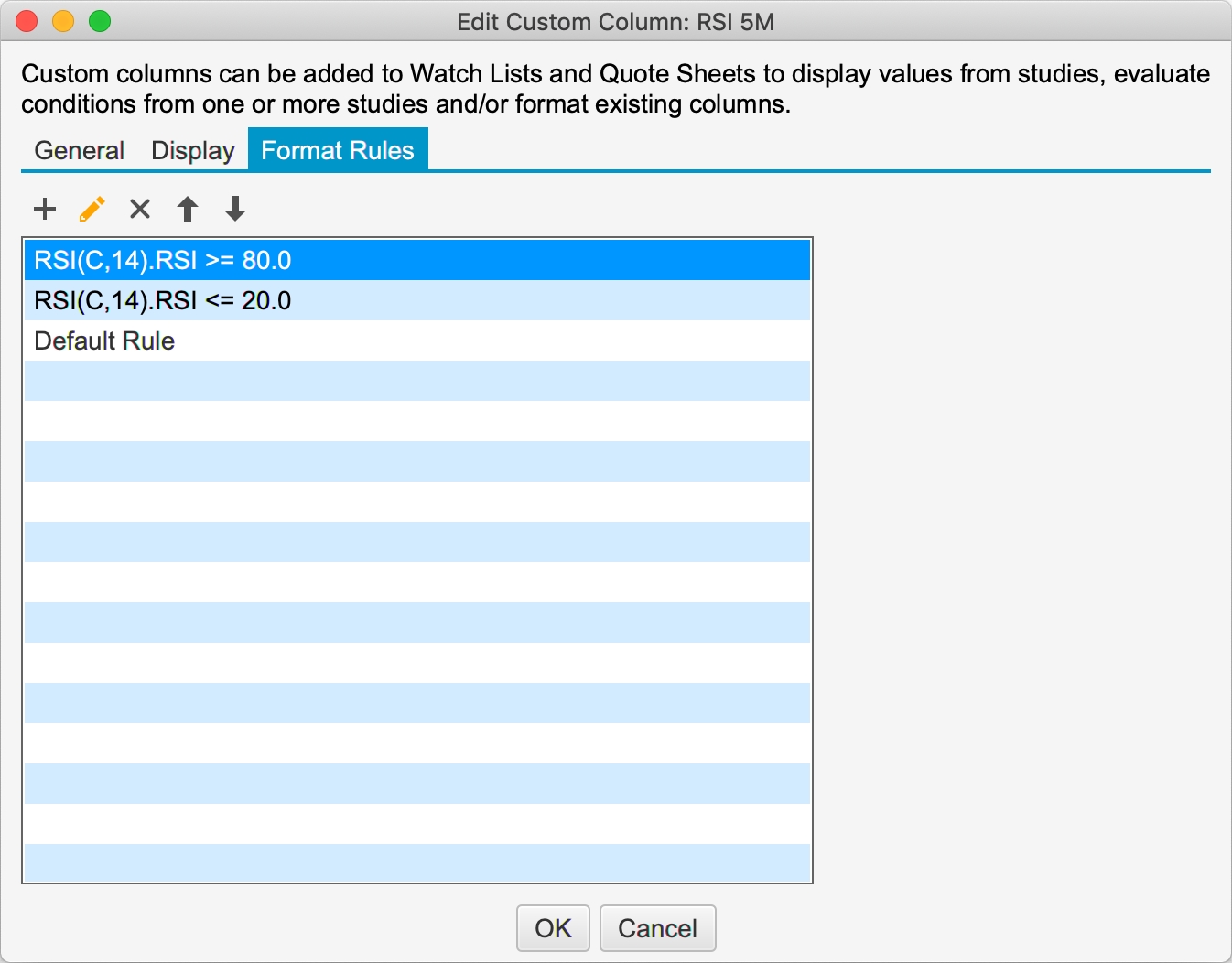

The last panel in the wizard allows you to specify custom formatting rules to change the display of the column based on one or more conditions. These rules are evaluated in order and the first matching rule will be applied to the table cell.

Formatting rules can have multiple conditions. The rule is applicable only if all of the conditions are met. There are several formatting options:

Align – Text alignment (Left, Middle, Right).

Foreground – Foreground color (text color).

Background – Background color for the cell.

Meter Color – Fill color for the meter (only available if cell type if meter or meter/arrow)

Display Text – Optionally the text displayed in the cell can be a static value (instead of the study value). This can be useful if the study value is not important and you want to display a buy or sell message for example.

Font – Override for the default cell font.

In the example below, we are changing the format of the cell when the RSI value is between 20 and 80.

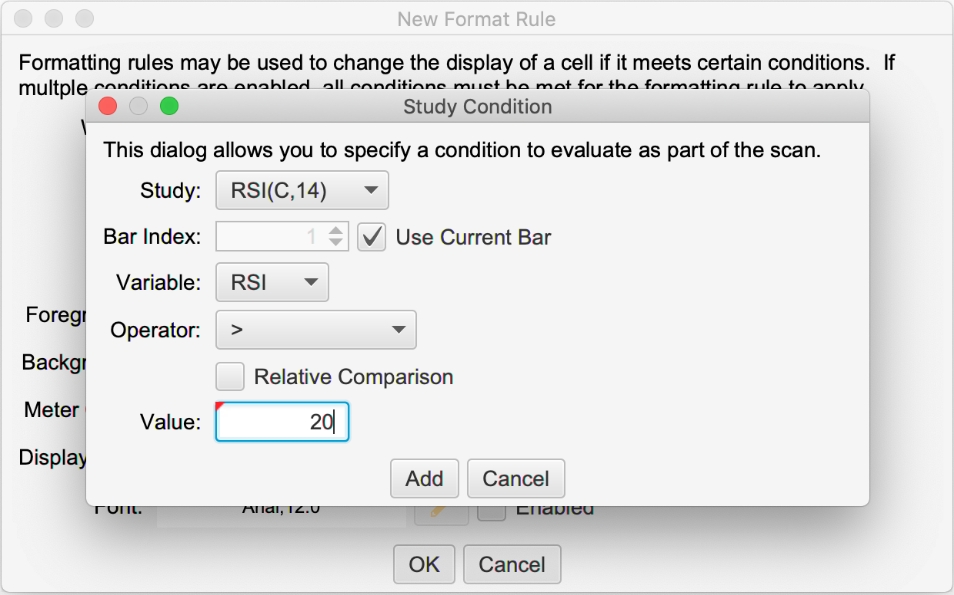

Study conditions can be a simple comparison between a study value and a static value or you can compare it with another study value (choose Relative Comparison). By default, the latest study value is used, but you can use the closing value for older bars by unselecting the Use Current Bar option.

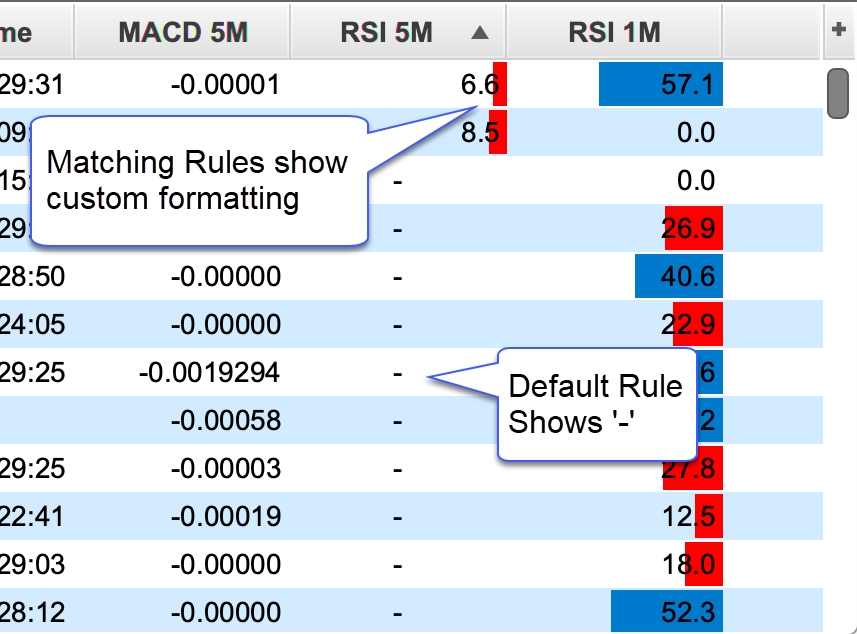

The screen shot below shows a watch list with 4 custom columns displayed. Custom columns can be added to a watch list/quote sheet by clicking the edit button (pencil icon in the top right tool bar section). Alternatively click on the + (plus) button in the top right corner of the table and select the custom columns that you want to display. For convenience you can also right click on a column and edit its properties.

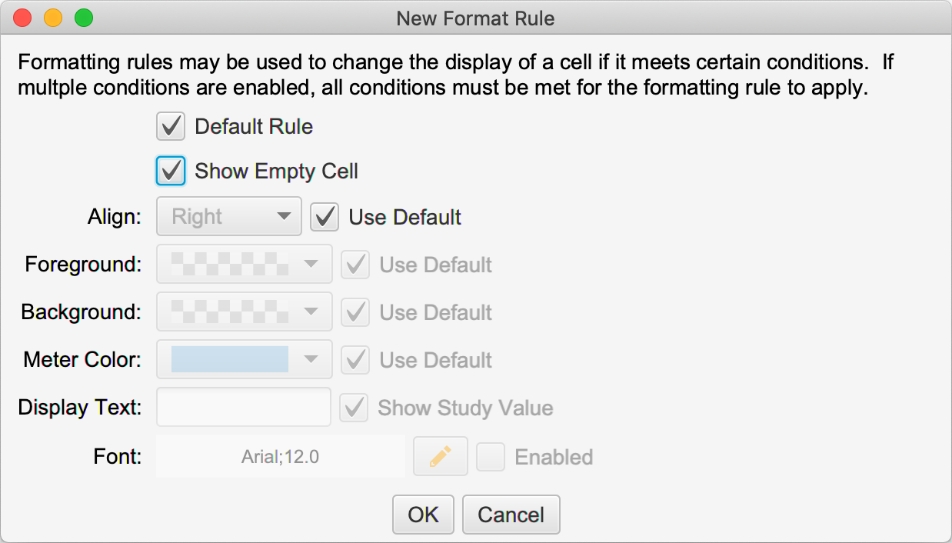

Default Filter

A default filter may be used to apply formatting for cases that don’t match the other filters. This can be particular useful for reducing clutter in the watch list by showing an empty cell for values that are not of immediate interest.

Select the Default Rule option on the Format Rule Dialog to create a default rule. Note: only one default rule can be set for a custom column. The default rule is applied only if there are no other matching rules so the order in the list does not matter.

In the dialog below, we are creating a default rule to show an empty cell (with a ‘-‘). In our example this will match cases where the RSI value is <= 80 and >= 20.

The screen shot below shows all the rules that we have defined for this custom column. Please note that the position of the default rule does not matter. In our case it is the last rule in the list.

The screen shot below shows the default rule applied to the RSI 5M column. Rows that don’t match RSI < 20 and RSI > 80 show a dash. This helps to clean up the watch list and draw your attention to the rows of interest.

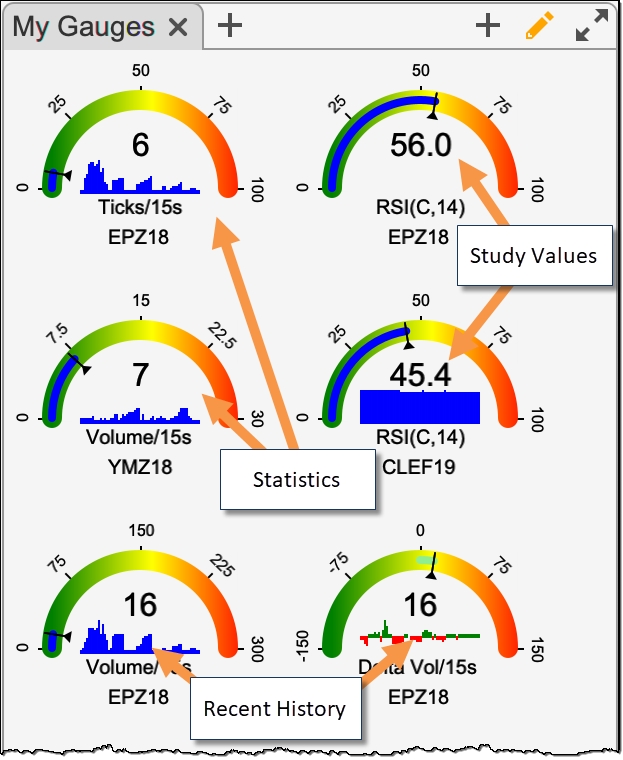

Gauges

Gauges are used to visually display statistics or study values in a panel in the console (or desktop). These gauges are similar to the Speed Gauges study (first introduced in 5.4.0) but are not displayed on a chart and allow built-in or custom study values.

The example below shows study/statistic-based gauges inside a Gauge Panel.

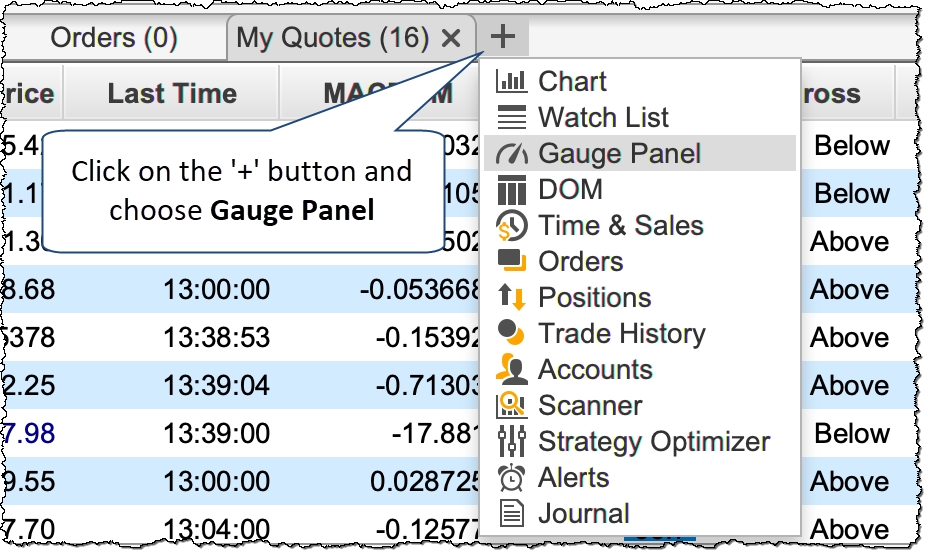

To open/create a Gauges panel, click on the + (plus) button next to an open tab in the Console (or in a desktop) and select Gauge Panel.

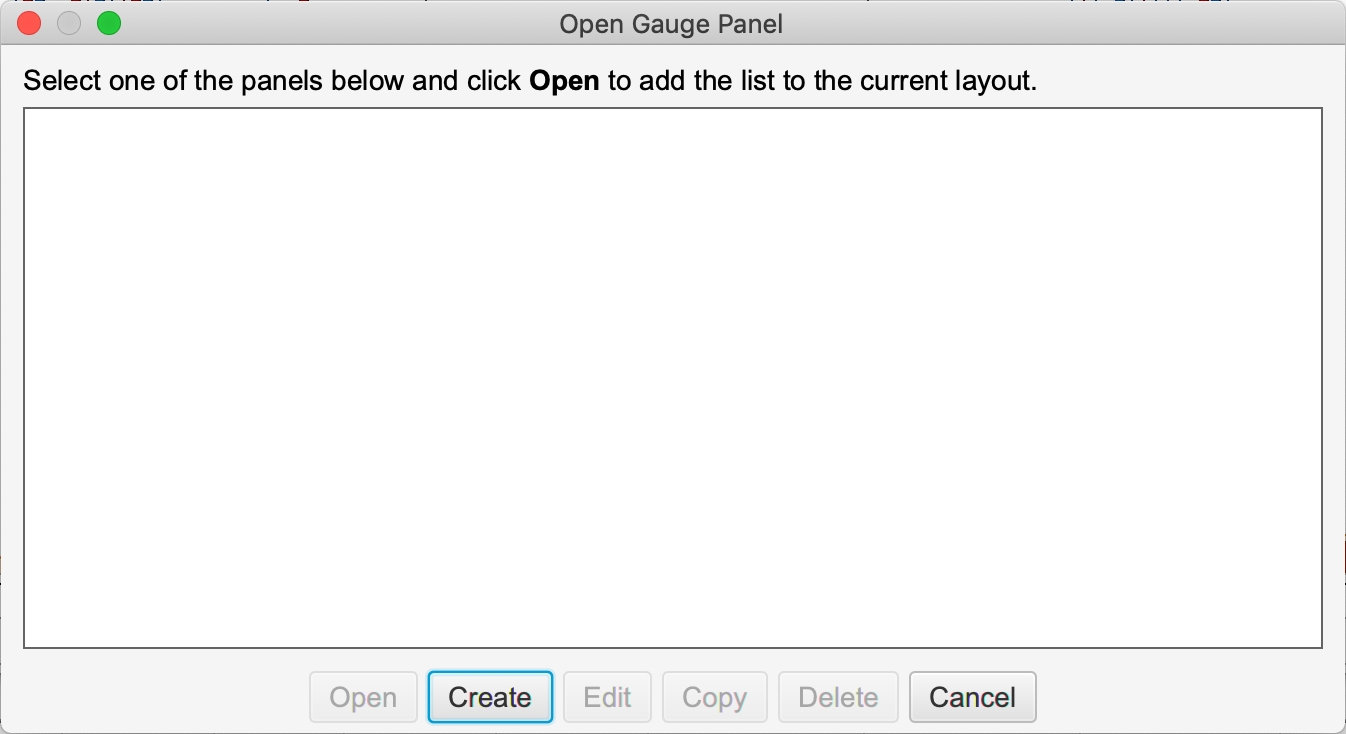

The following dialog will be displayed with your existing gauge panels. Click on the Create button to create a new Gauge Panel.

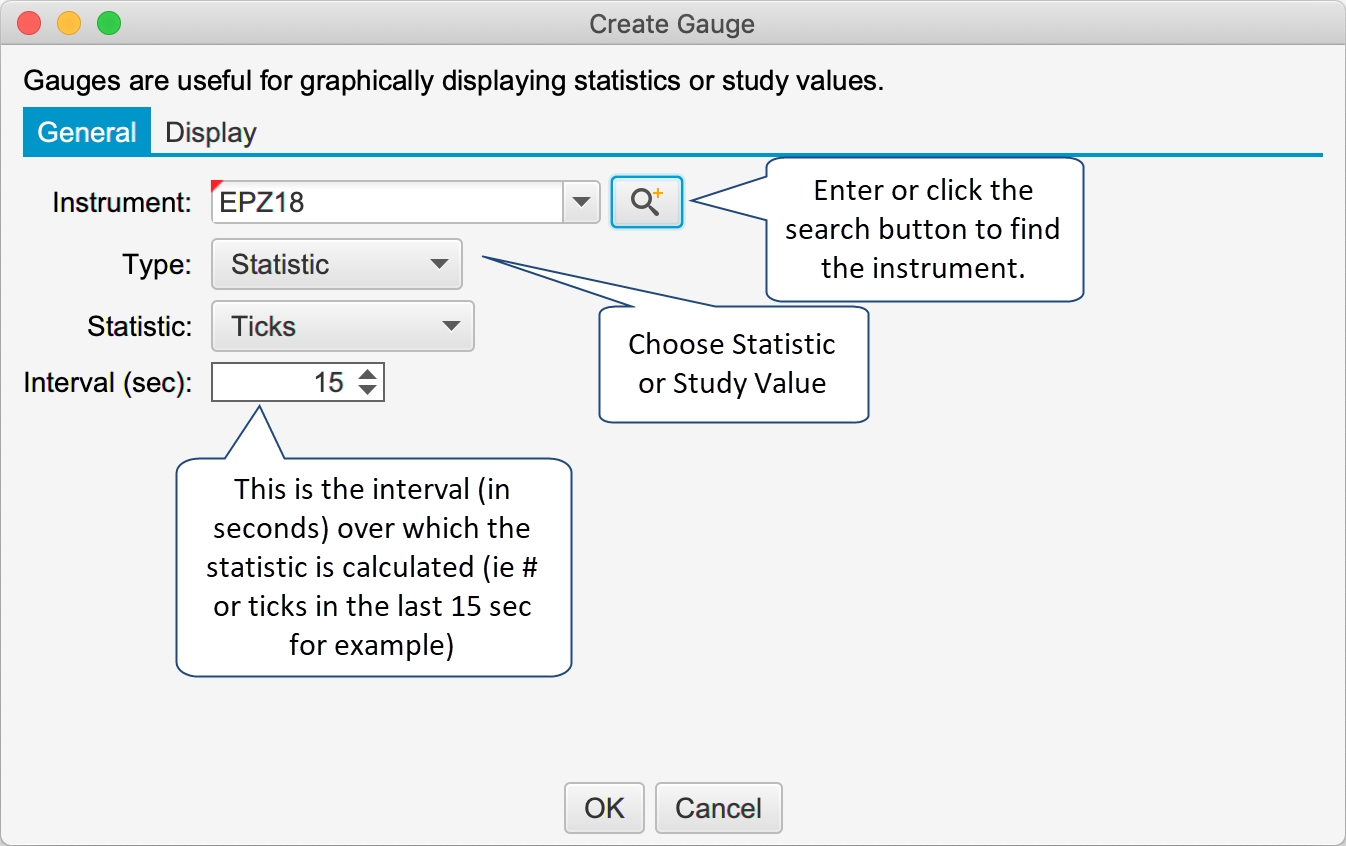

The value for a gauge is computed from a single instrument although you could use a custom instrument to combine multiple instruments.

Statistic Gauges

The following options are available for statistics:

Ticks – Displays number of ticks that occurred over the given interval (in seconds). This is often used to gauge the speed of the market.

Price – Current price.

Volume – Traded volume over the given interval (in seconds).

Bid Vol – Volume that occurred at the Bid Price.

Ask Vol – Volume that occurred at the Ask Price.

Delta Vol – Difference between Bid/Ask Volume (Ask Volume – Bid Volume).

Delta Spread – Difference between the current Best Bid/Ask sizes (Best Bid Size – Best Ask Size).

Delta DOM – Difference between the total Bid/Ask sizes (Total Bid Sizes – Total Ask Sizes) in the Depth of Market (DOM).

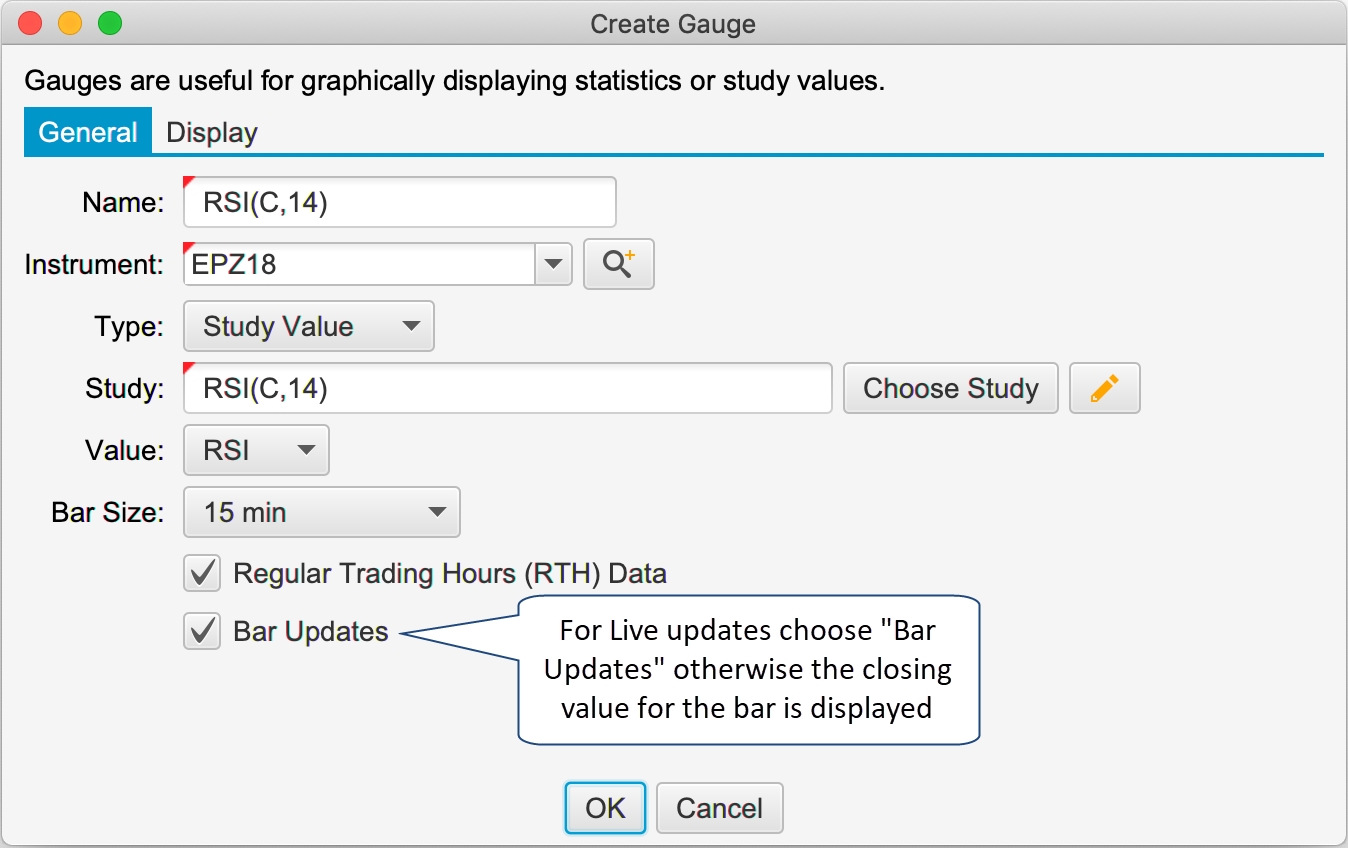

Study Value Gauges

Study Value Gauges display a value (and recent history) from a built-in or custom study. Select/configure a study and choose the value from the study that you would like to display. For live/real time updates select the Bar Updates option.

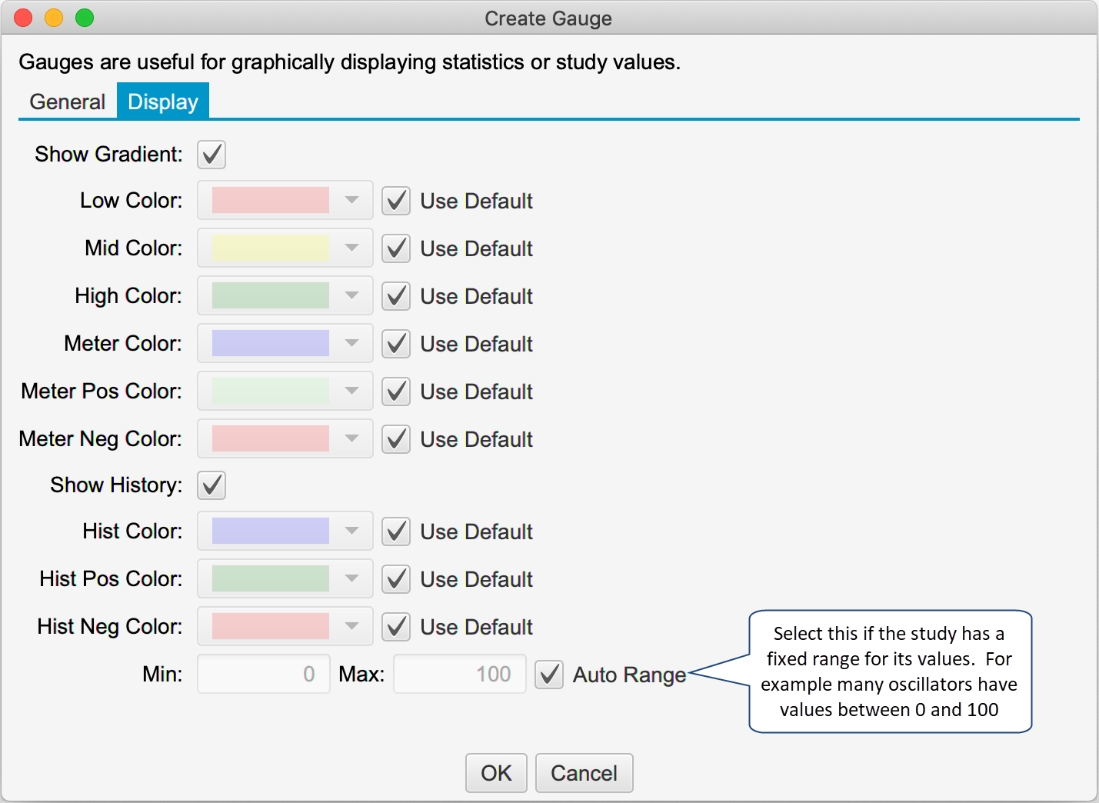

Display options are available for both Study Value and Statistic Gauges under the Display tab:

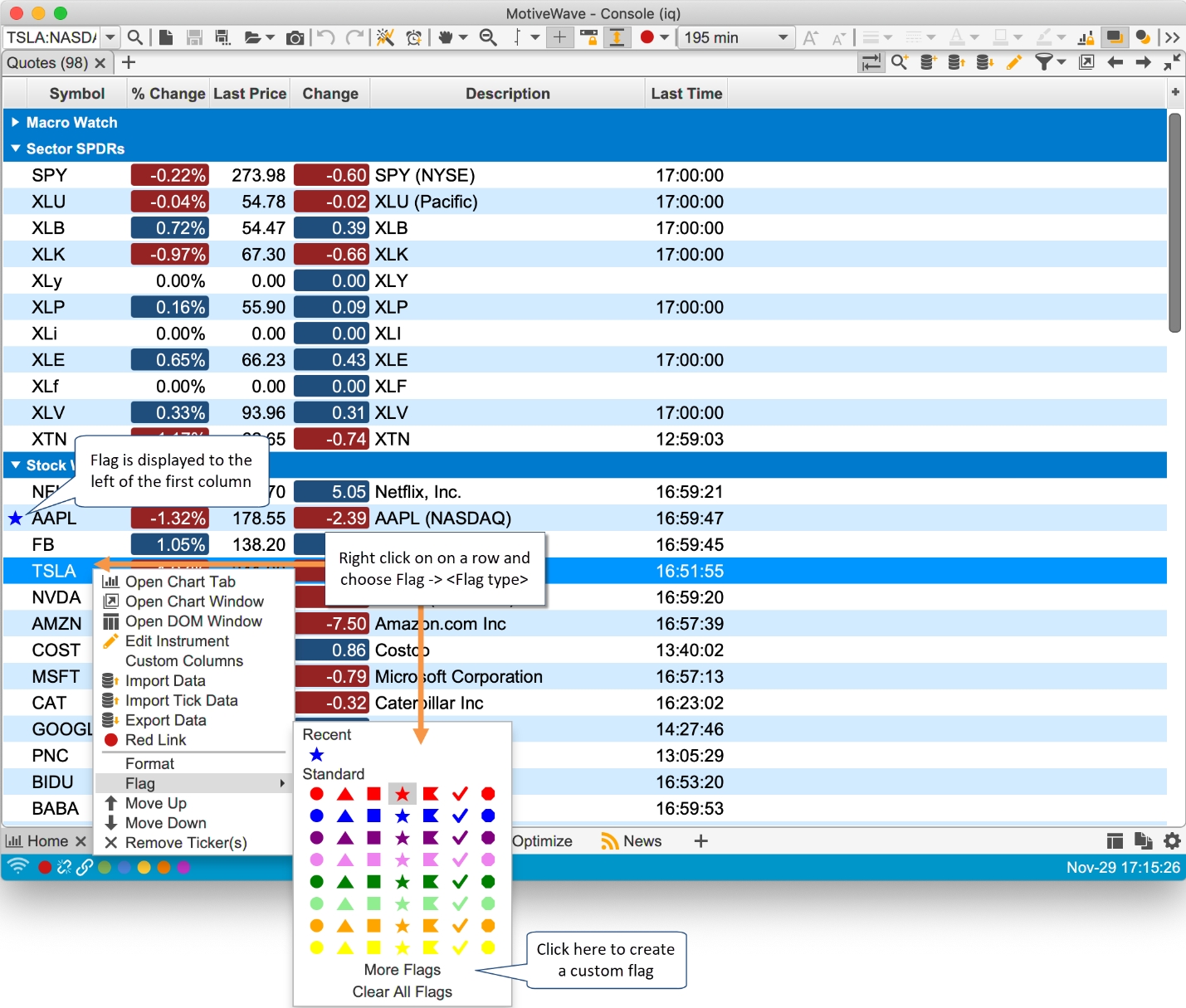

Watch List Flags and Filtering

An icon (or flag) can be displayed on the left-hand side of a Watch List (or Quote Sheet) to highlight important or notable instruments. To assign a flag to an instrument right click on it and choose Flag -> <Flag>. A set of common flags will appear in the menu.

When a flag is assigned, it will appear to the left of the instrument (see below).

The following are the types of flags that are available:

Circle

Triangle

Square

Star

Flag

Check

Octagon

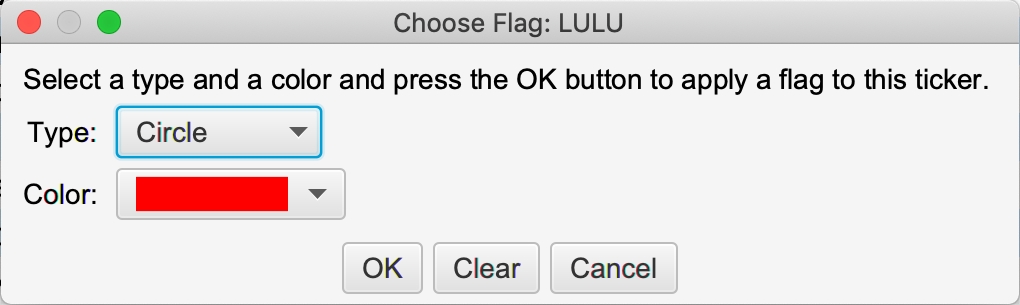

Custom flags can be created by choosing More Flags from the flag menu (see above). In the Choose Flag dialog you can select the type and the color. All recently used flags will appear in the Recent section of the flag menu (for convenience).

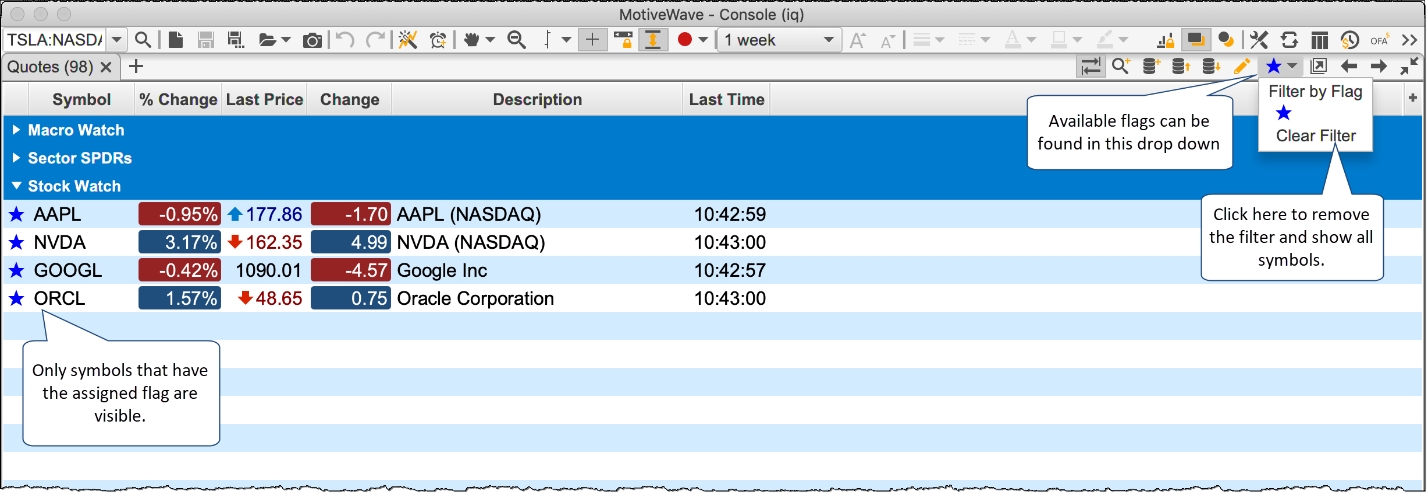

Filtering may also be applied to a Watch List or Quote sheet by selecting the flag from the filter button in the tool bar. Choose Clear Filter to show all instruments.

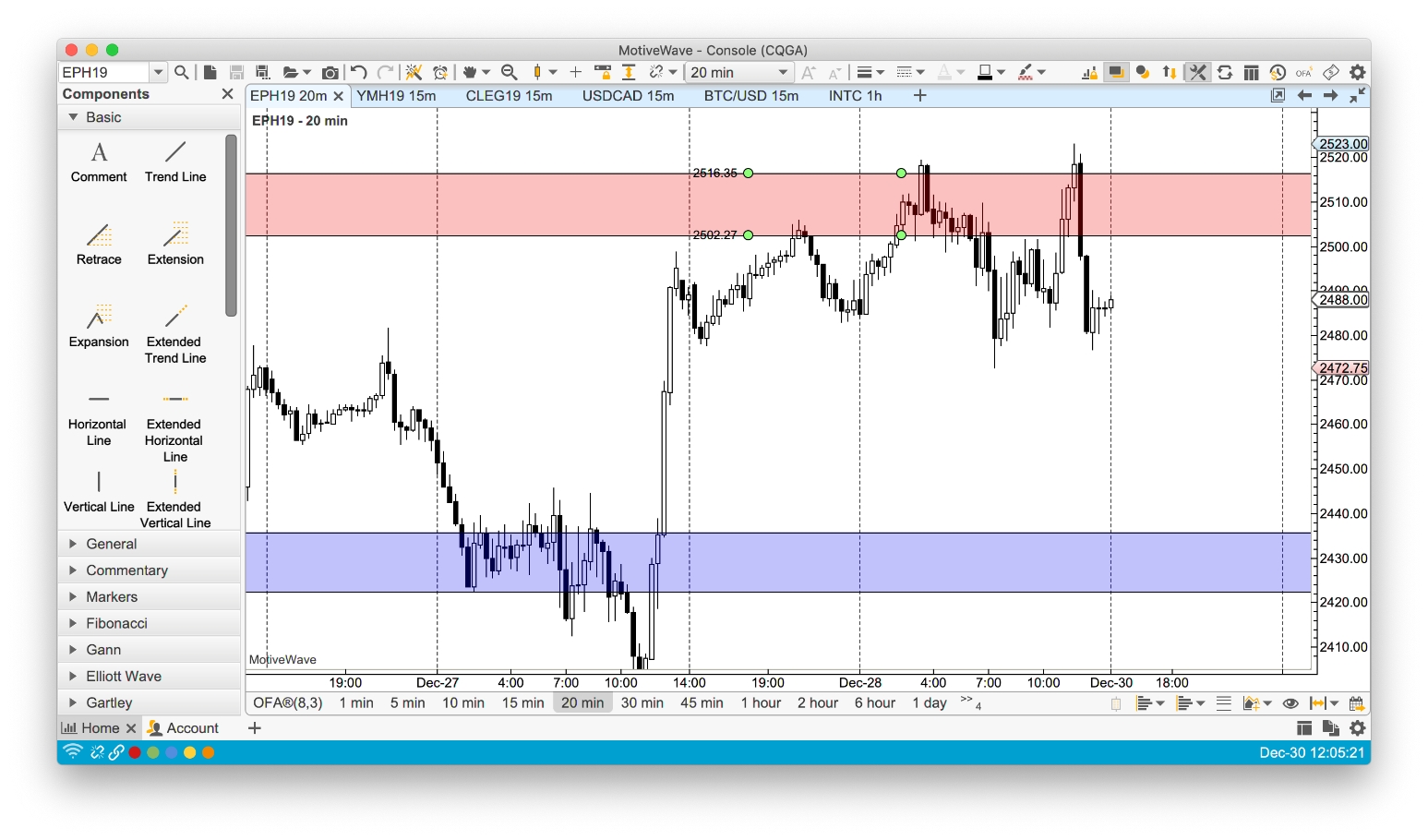

Components

Support / Resistance Zones

Support and Resistance zones are two new components that may be used to highlight an area of support or resistance on a price graph.

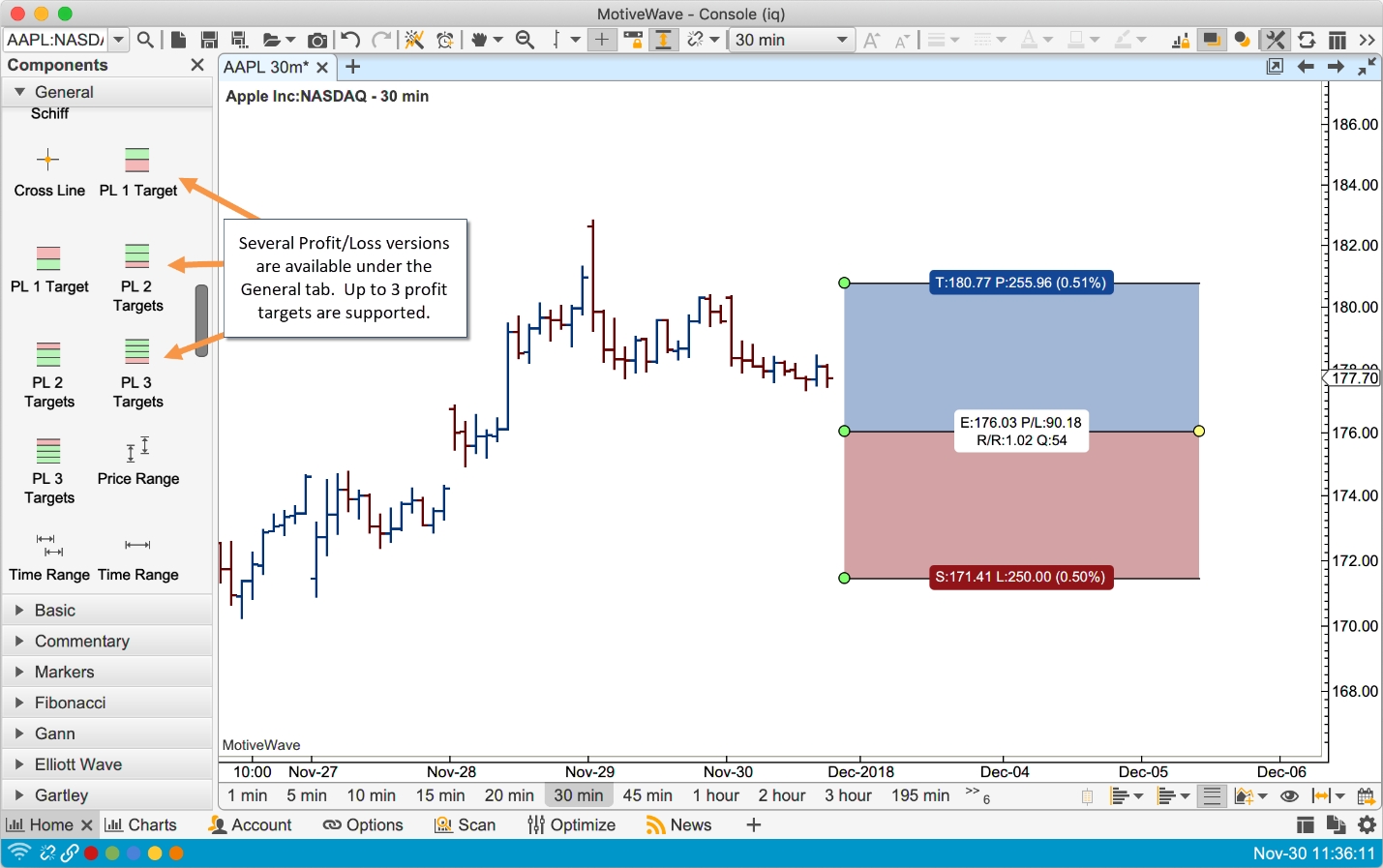

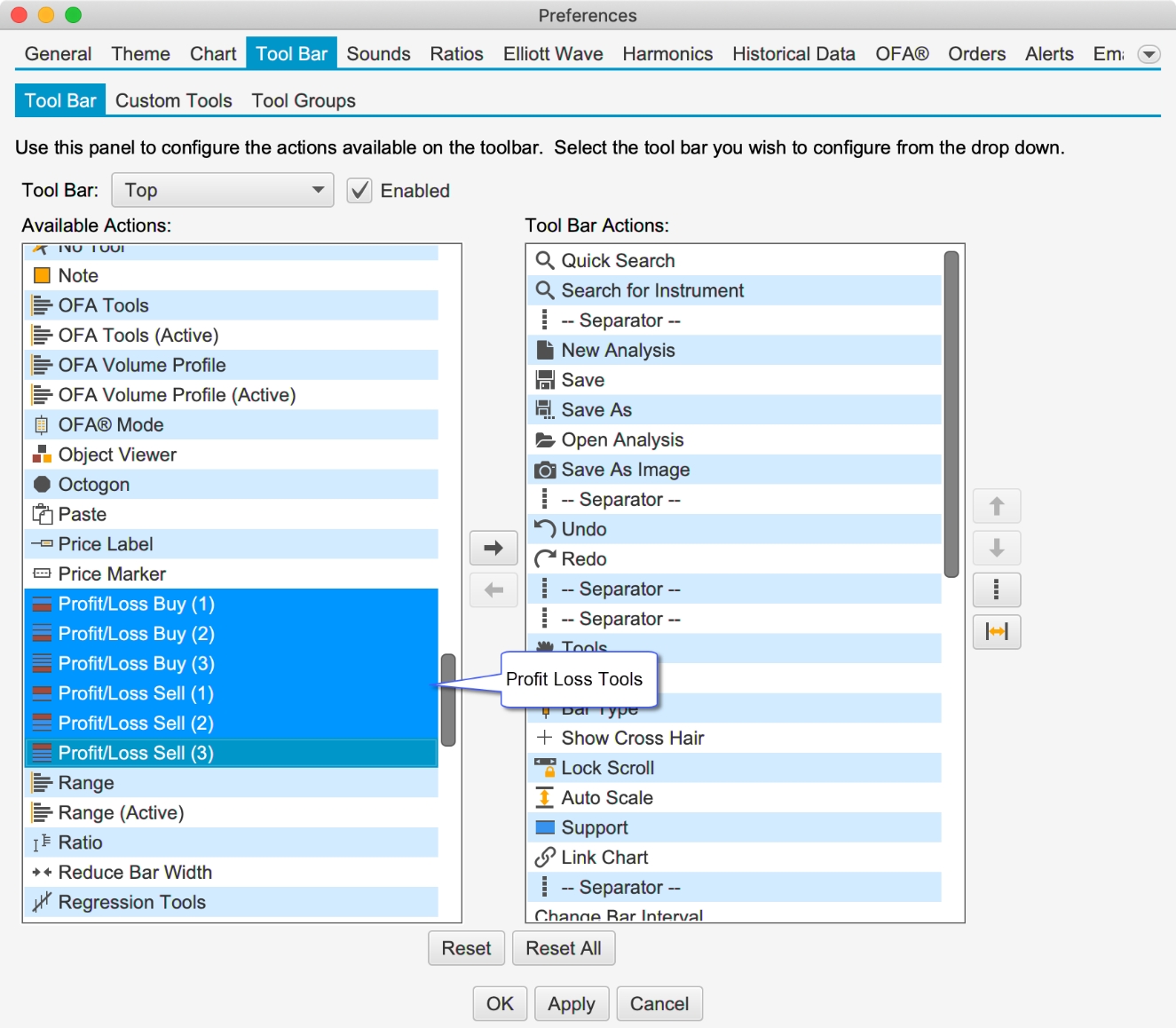

Profit/Loss Calculator

The Profit/Loss calculator component will calculate the potential profit (up to three targets) with a stop loss order. This component can be found under the General tab of the Components Panel. Risk levels can be computed using a percentage of your account or using a fixed amount. Labels shown on the component are shorted (to save space):

T – Target price for a take profit order (these are named T1, T2, T3 if multiple targets are used).

P – Profit Amount and percent of account. Each take profit order will include the total profit realized at that price.

Q – Quantity.

E – Entry price.

P/L – Profit/Loss calculated at the current price.

R/R – Risk/Reward ratio.

S – Stop Loss price.

L – Loss amount and percent of account for the stop loss order.

In the following screen shot, a PL component has been added to the chart with 1 profit target and a risk percent of 0.5% of the account value (50K in this case). Entry and exit quantities are calculated from the risk percent and position of the stop loss target.

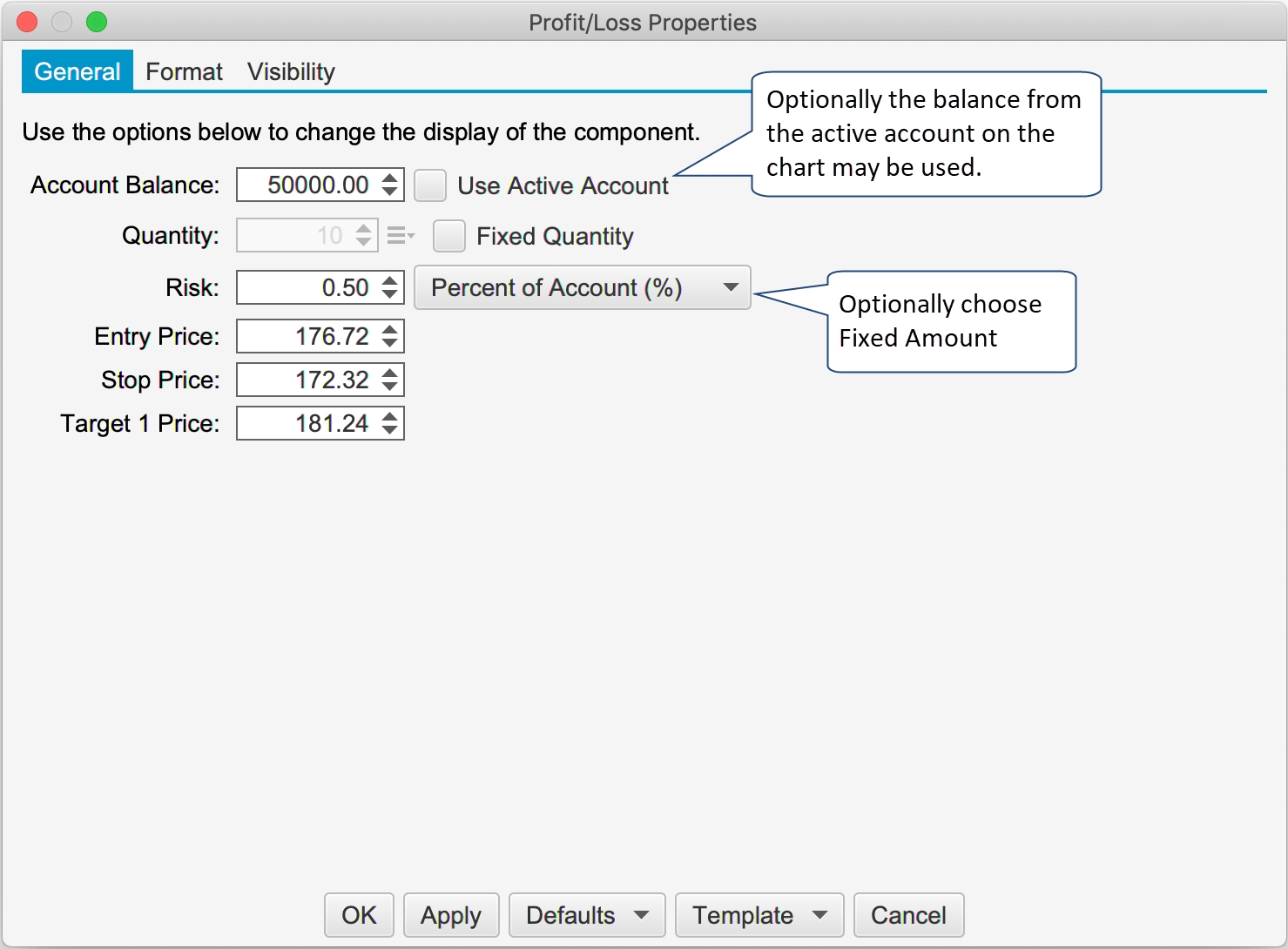

You can change the behavior of the component from the Properties dialog (double click on the component). There two methods available for calculating risk:

Percent of Account – This option will dynamically calculate the amount at risk by taking a percentage of the account balance. This can either by statically defined (such as 50K) or using the current balance of the active account on the chart.

Fixed Amount – Enter a fixed dollar amount to put at risk.

If a fixed quantity is chosen, then the risk is dynamically computed based on the position of the stop order.

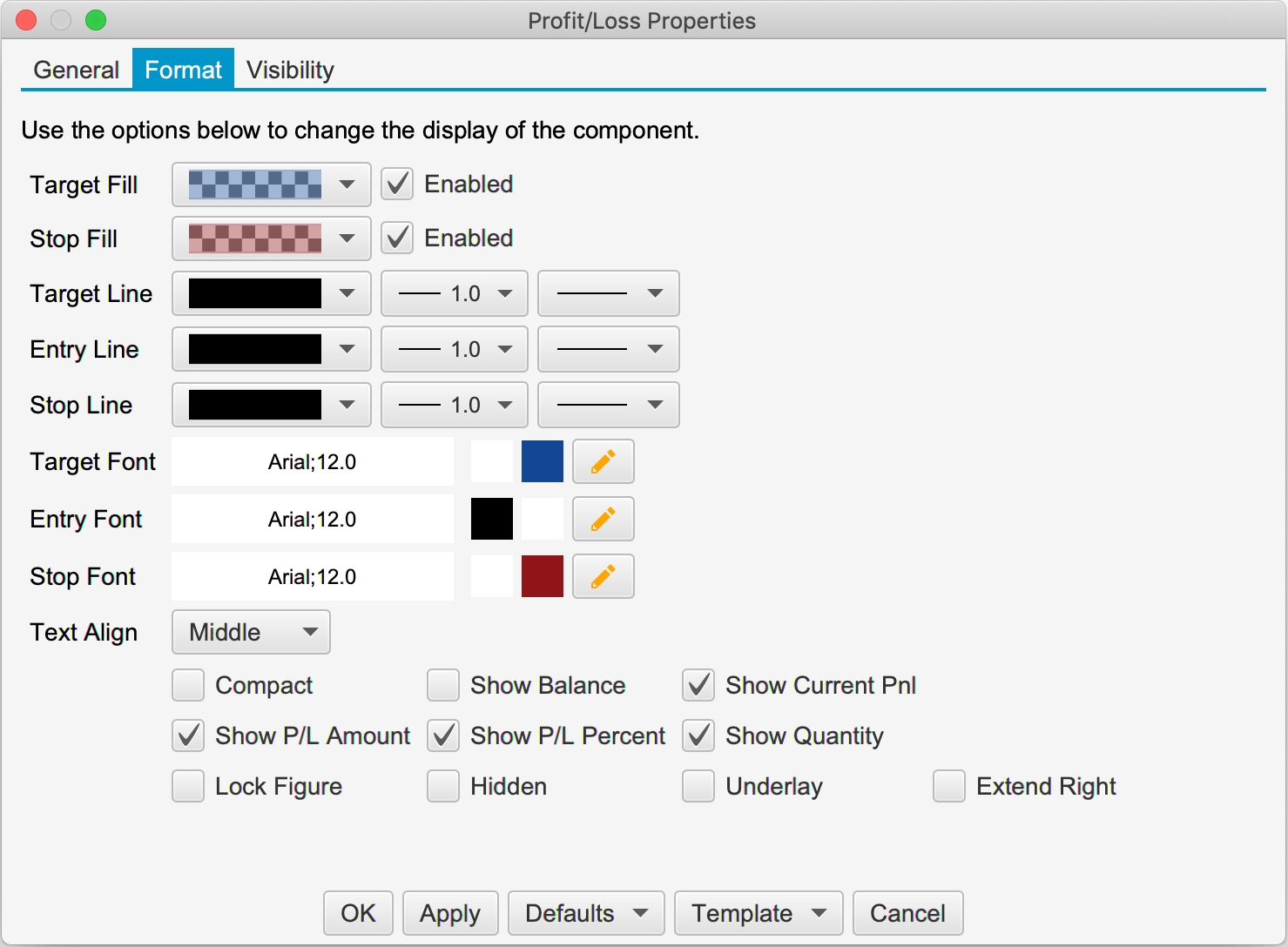

The following screen shot shows the formatting options for the Profit Loss calculator.

Below is an example of a Profit Loss calculator with 3 targets. The profit calculated at each target represents the total profit (as opposed to the profit for the specific exit order). For example the profit displayed at target 2 will be the profit from the target 1 exit order plus the profit from the target 2 exit order plus the unrealized profit from the target 3 order.

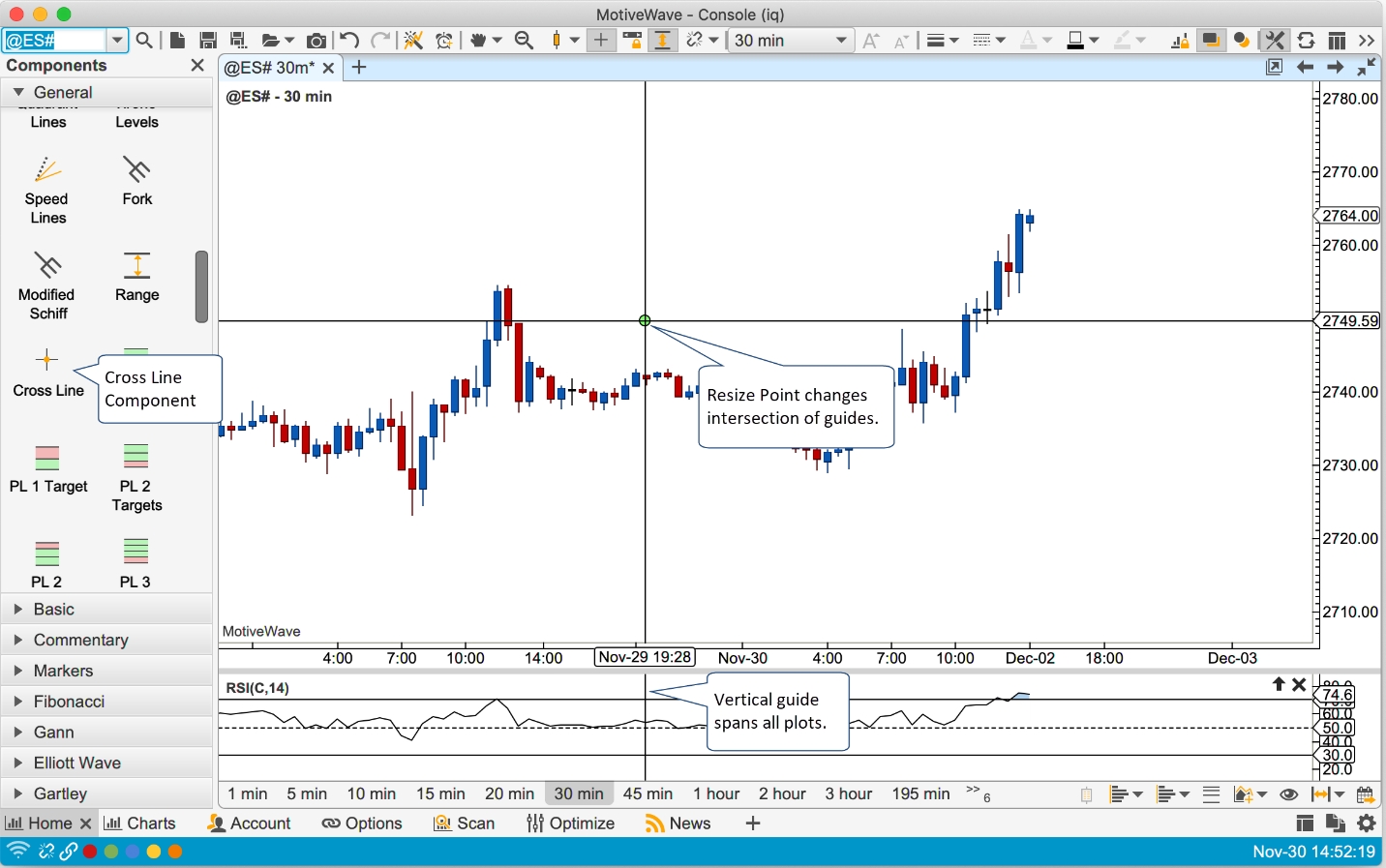

Cross Line Component

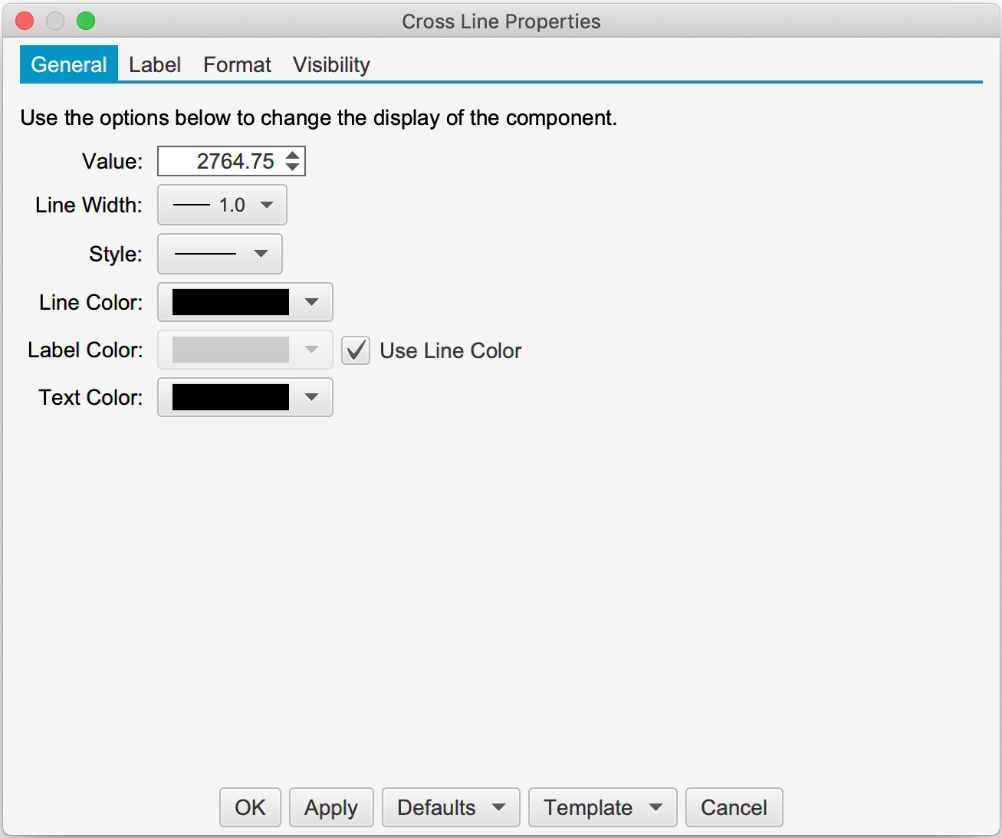

The cross-line component is a combination of a vertical guide and a horizontal guide. This component is available in the General panel. Below is an example of a cross line added to the price graph. Note: the vertical (time) guide will span all plots in the chart.

Double click on the cross line to show the properties (see below):

Labels

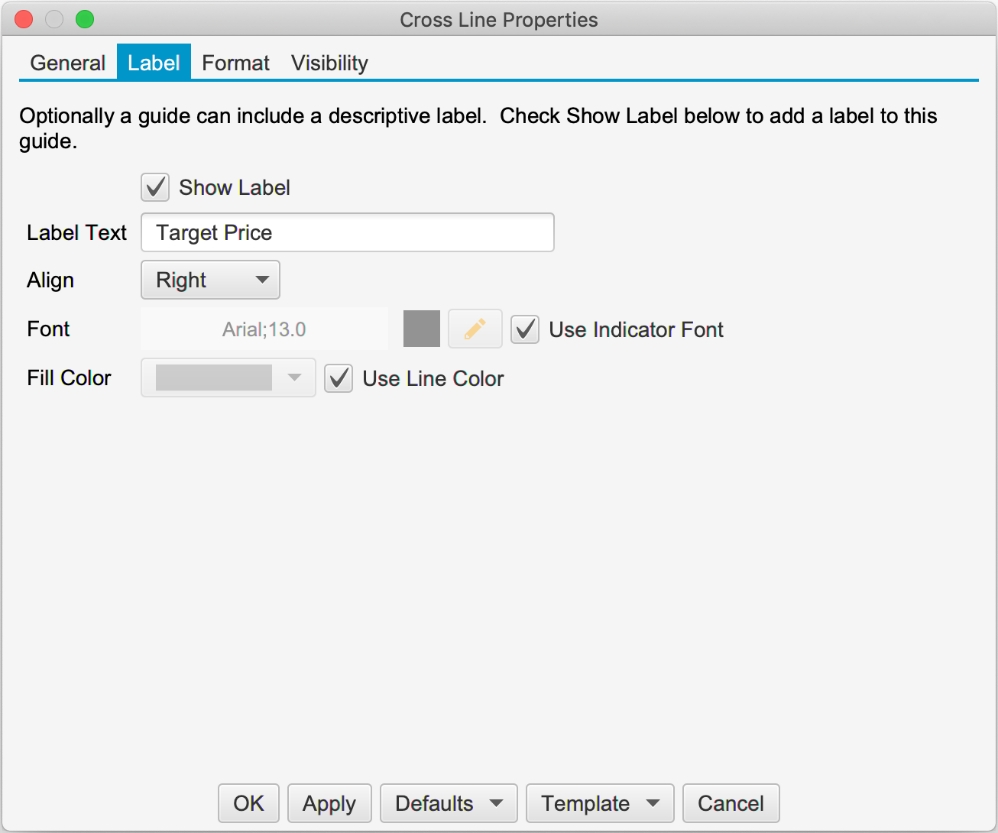

Optionally a label can be added to the horizontal (price) guide to help identify the purpose of the cross line. This option can be enabled from the Label tab of the properties dialog:

Below is the cross line with the label “Target Price” on the price guide:

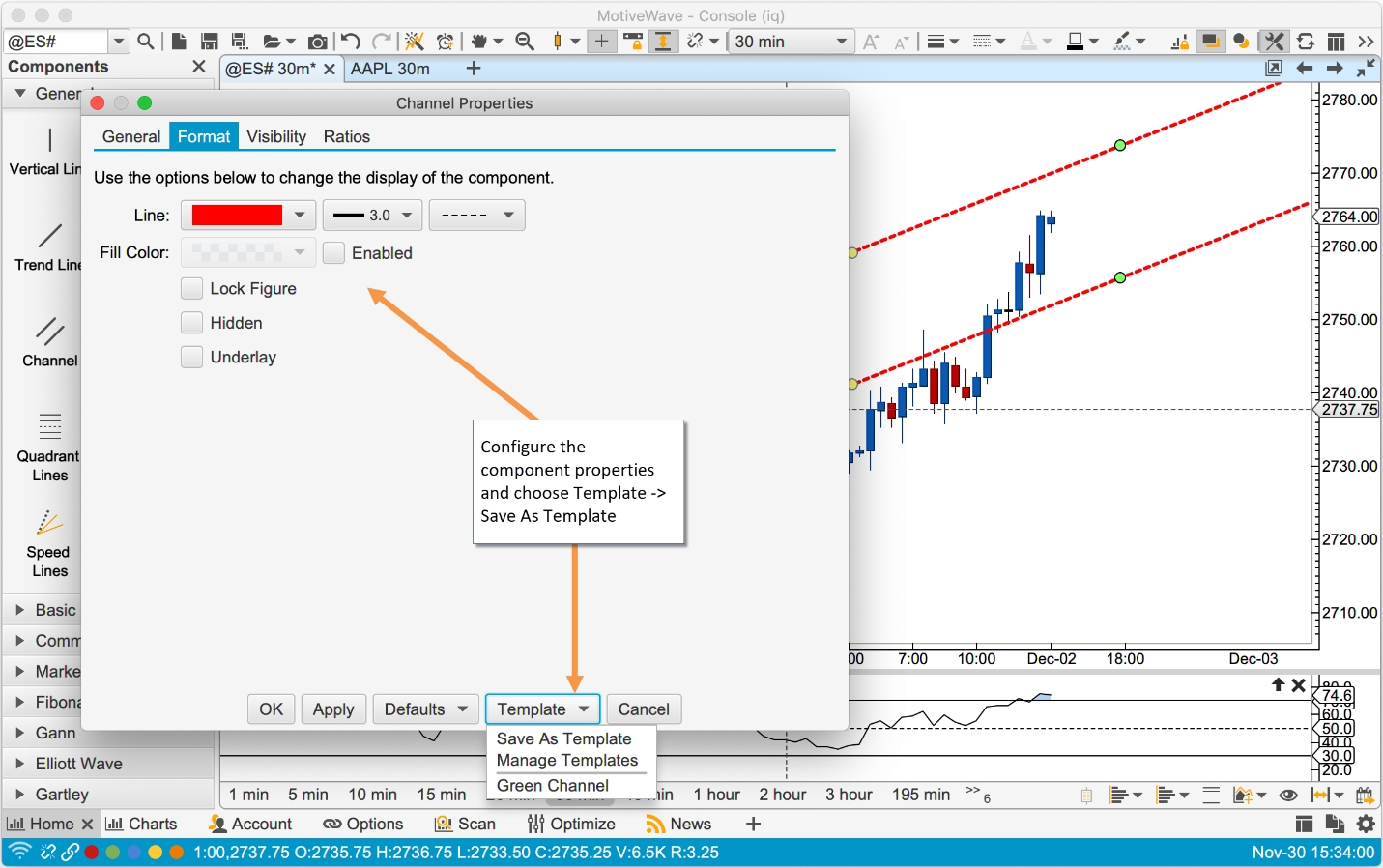

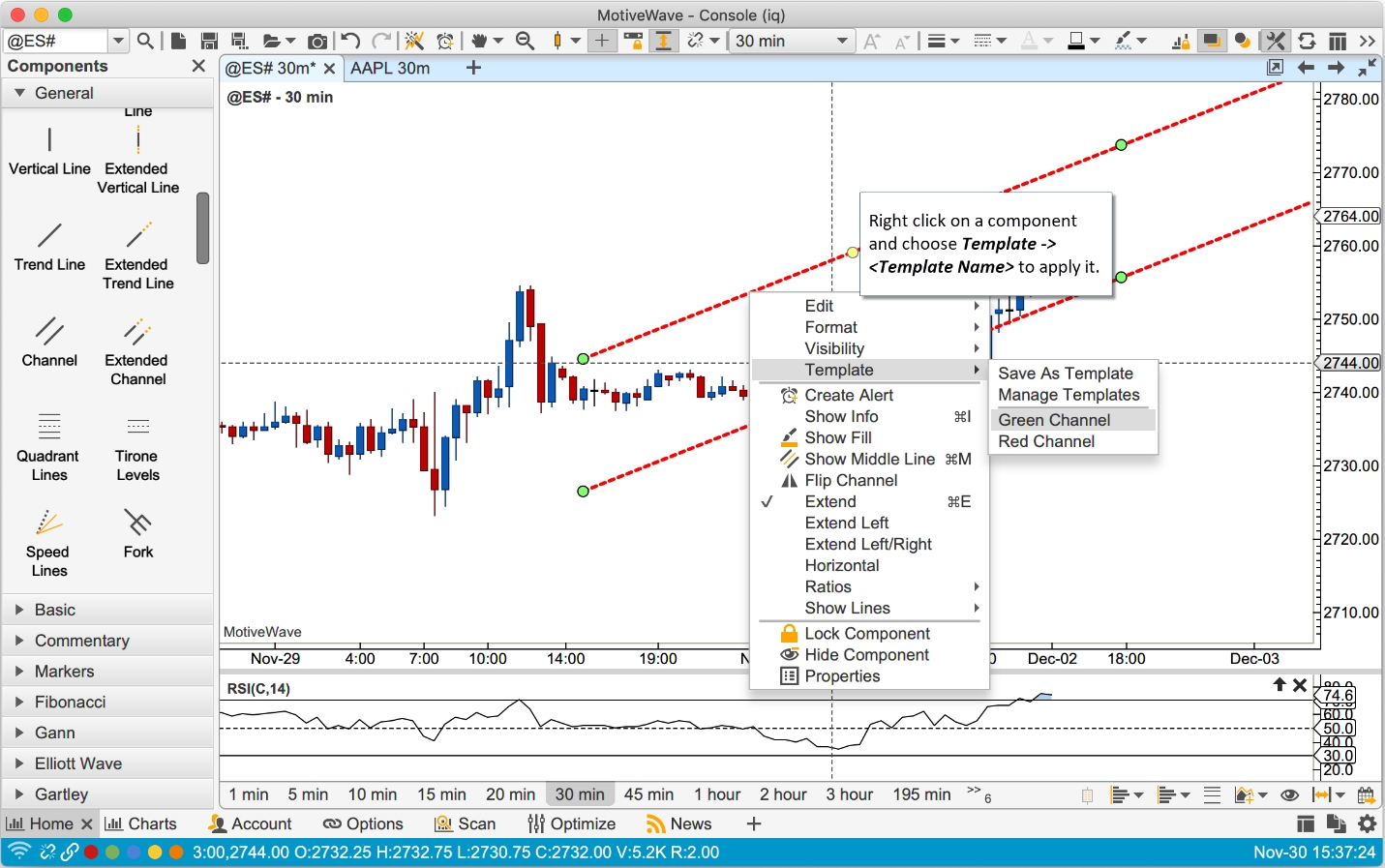

Component Templates

Component templates are similar to study templates in that they allow you to choose settings and formatting for a component and save it for later use. You can apply a component template via the context menu (right click) or from the Template menu button in the properties dialog.

In the example below, the channel component is configured to use a thick red dashed line and the “extend right” attribute enabled. From the Template menu button choose “Save As Template”. Note: existing templates for this component will appear in this drop down. Choose a template to apply it to the active component.

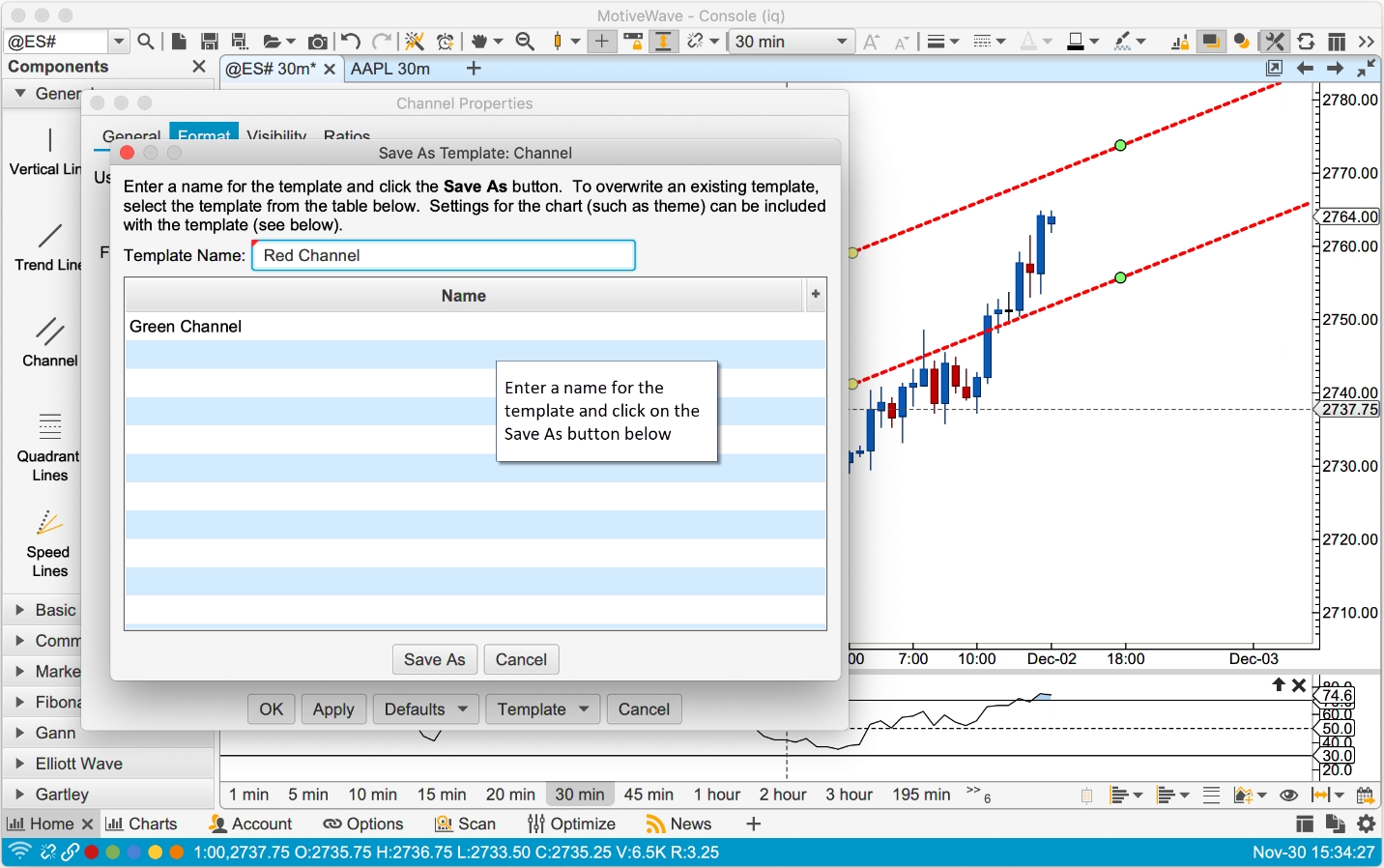

In the Save As Template dialog enter the name of the template. Template names are scoped to the type of component so you can reuse the same name across different component types. Click on the Save As button to save the template.

Right click on a component (in a chart) and choose Template -> Template Name to apply template settings.

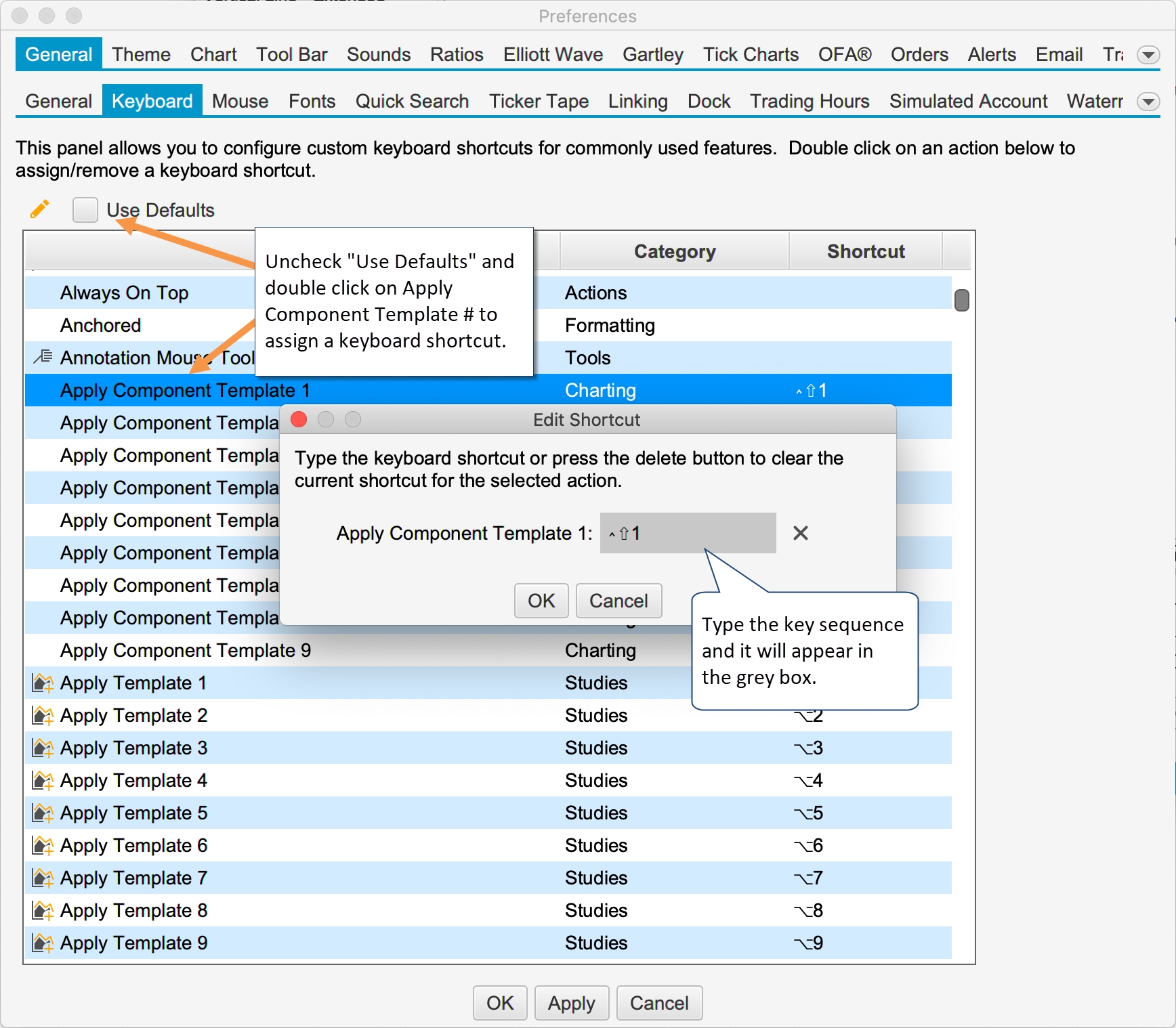

Keyboard Shortcuts

Keyboard shortcuts can be assigned to the first 9 templates. Open the Preferences Dialog (Configure -> Preferences from the Console menu bar) and click on General -> Keyboard. Nine actions are available Apply Component Template 1 – 9 in the action table. Double click on one of the actions to assign a keystroke (Note: you may need to uncheck Use Defaults if this is the first time assigning custom keystrokes).

Studies

We have added a few new studies and updated other studies in version 6.0.

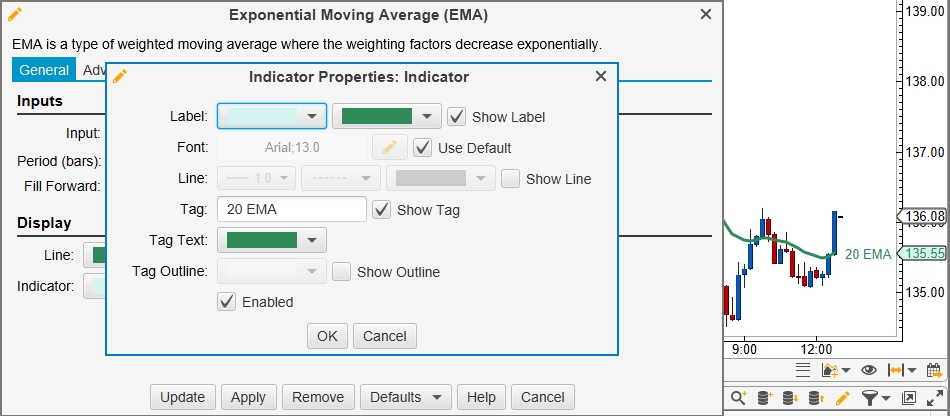

Study Indicator Tags

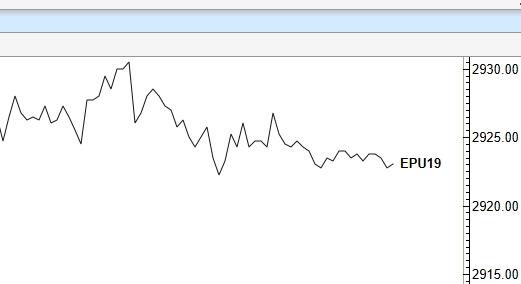

Descriptive tags can optionally be displayed next to the indicators displayed in the vertical axis. Edit the advanced indicator settings (click on the edit button next to an indicator in the study dialog) and check the “Show Tag” box.

TPO Study

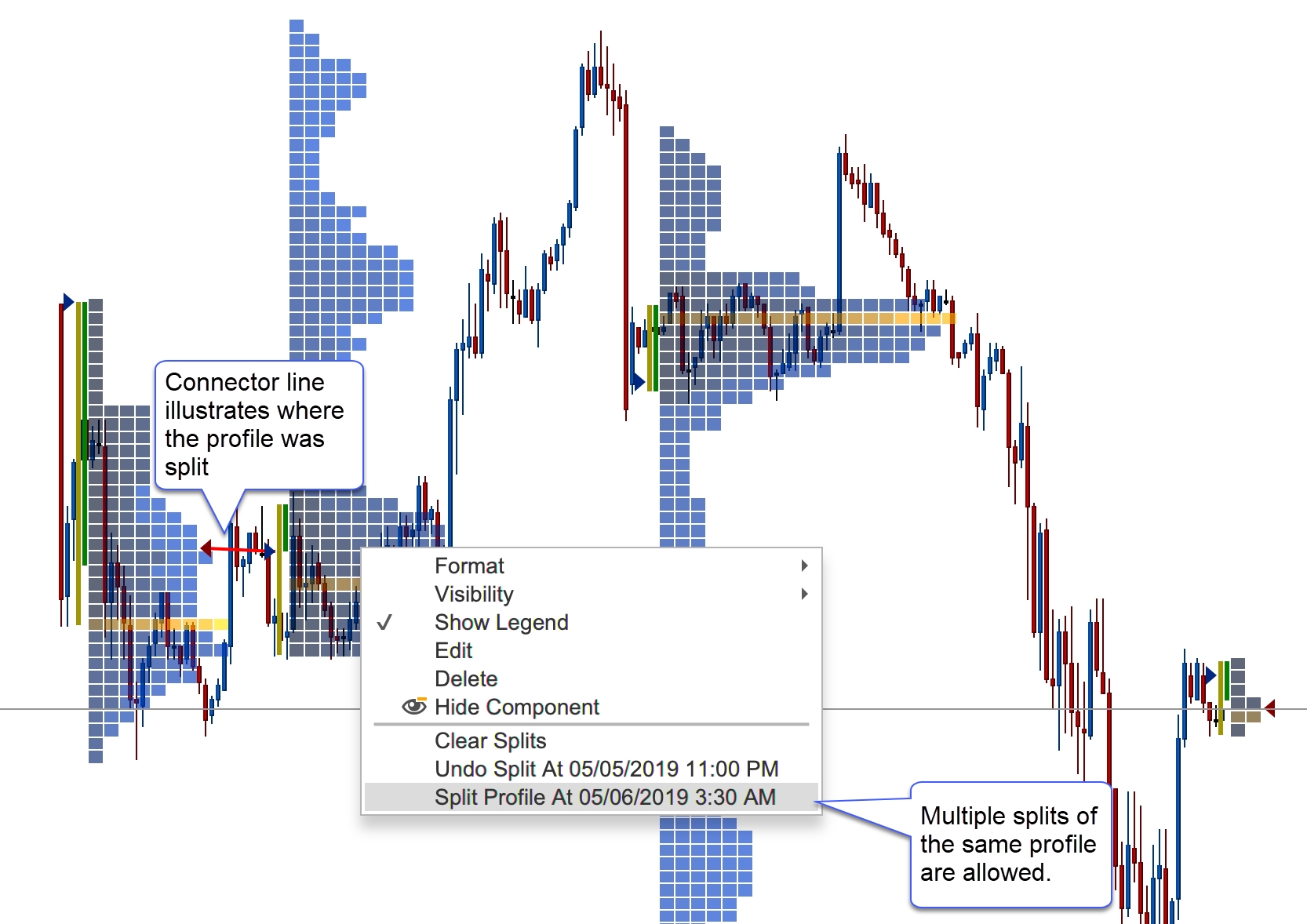

Split

TPO Profile may be split from the context menu (right click on the TPO Profile Cell). The profile will be split at the cell where the context menu was opened.

Split profiles have connector lines to indicate where the profiles were split. A TPO profile may be split multiple times. Splits may also be removed individually or all at once (Clear Splits option):

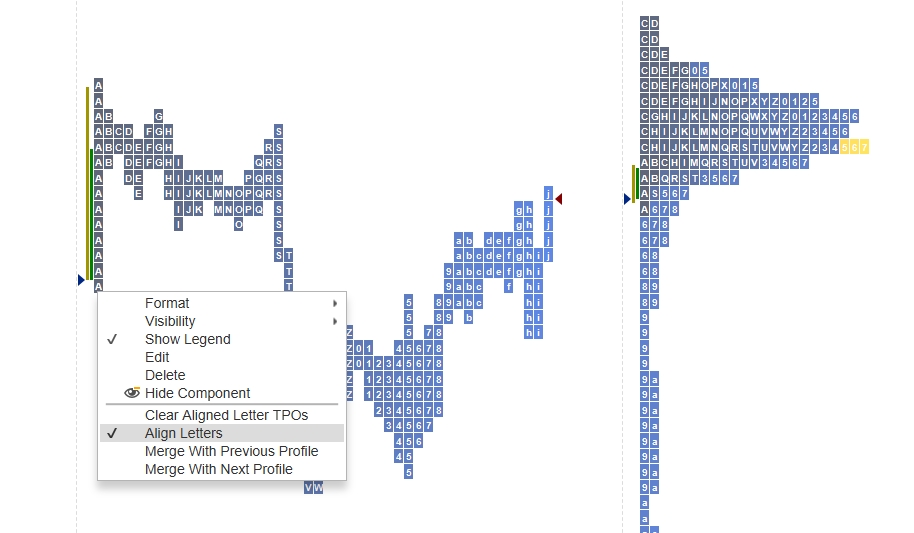

Merge

Merging profiles is similar to splitting profiles. Right click on a profile and choose Merge With Previous Profile or Merge With Next Profile:

Profiles can be merged multiple times. You may also undo a merge (or all merges) from the context menu:

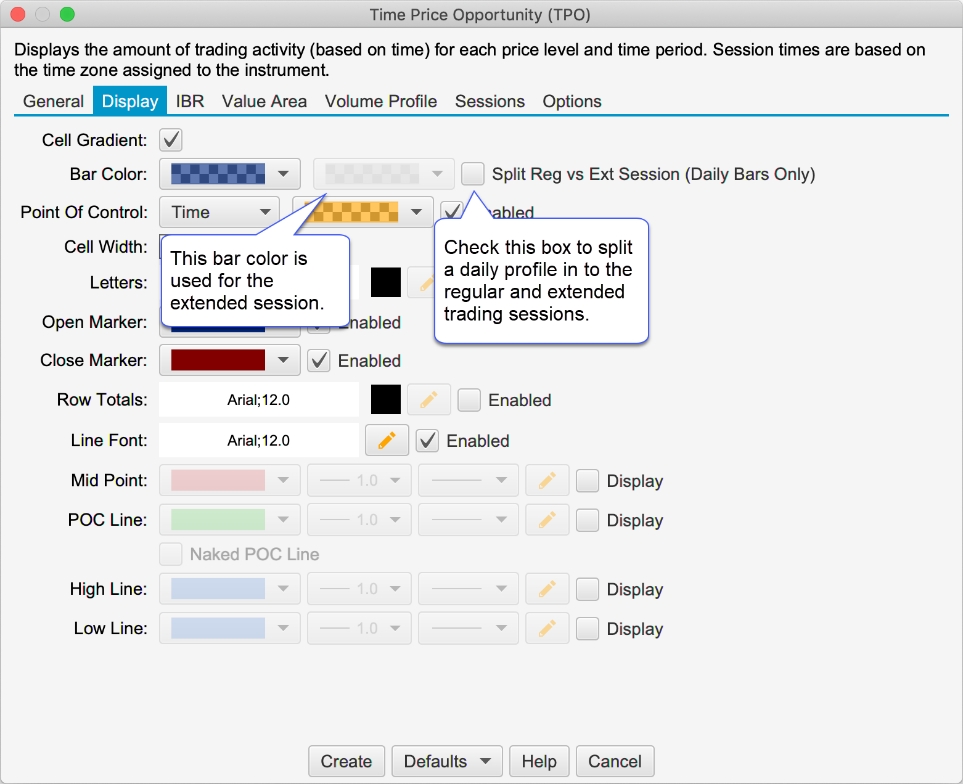

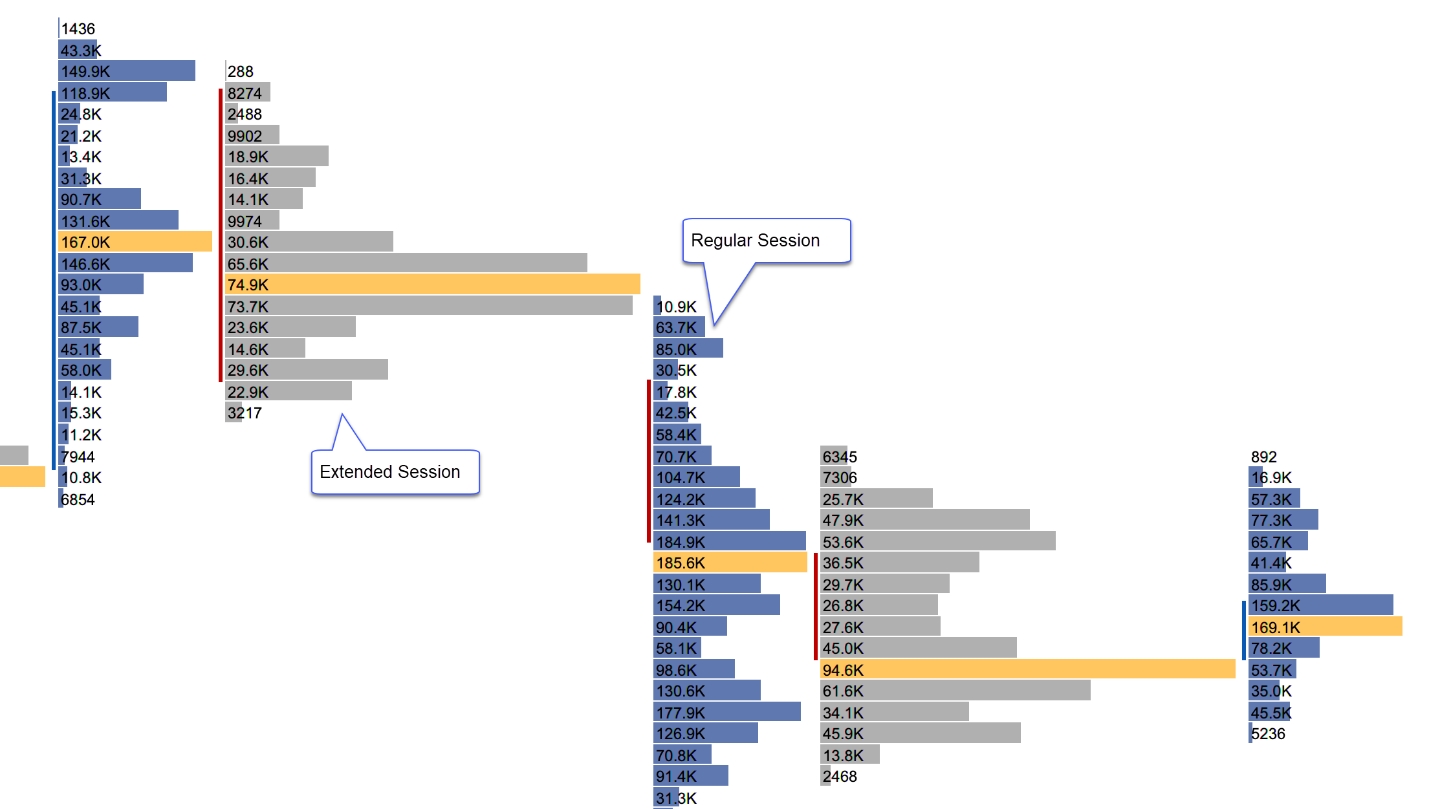

Split ETH/RTH

Daily TPOs can be split into two profiles where the first profile shows the regular trading session and the second shows the extended session. Note: this feature is only applicable to TPOs that have a 1-day timeframe.

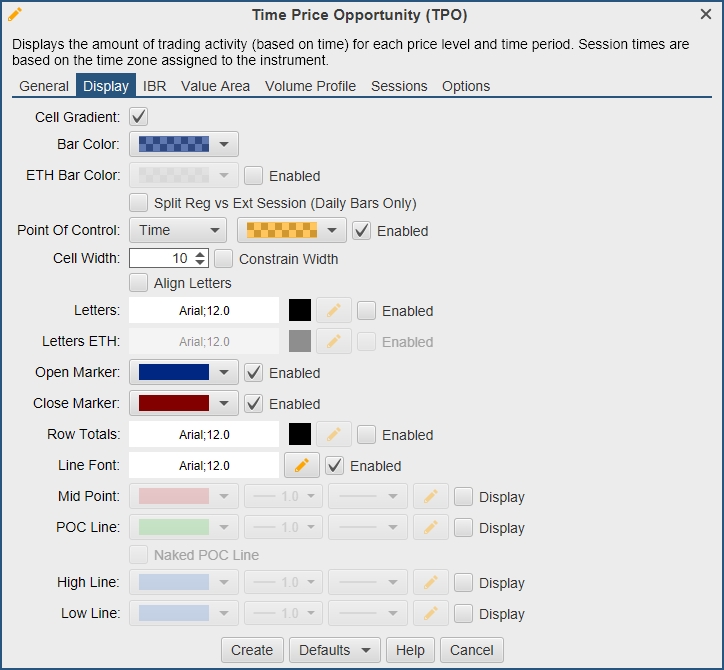

This option can be found under the Display tab of the study dialog (double click on the study):

In the screen shot below, the regular trading session has the blue bars and the extended session has grey bars:

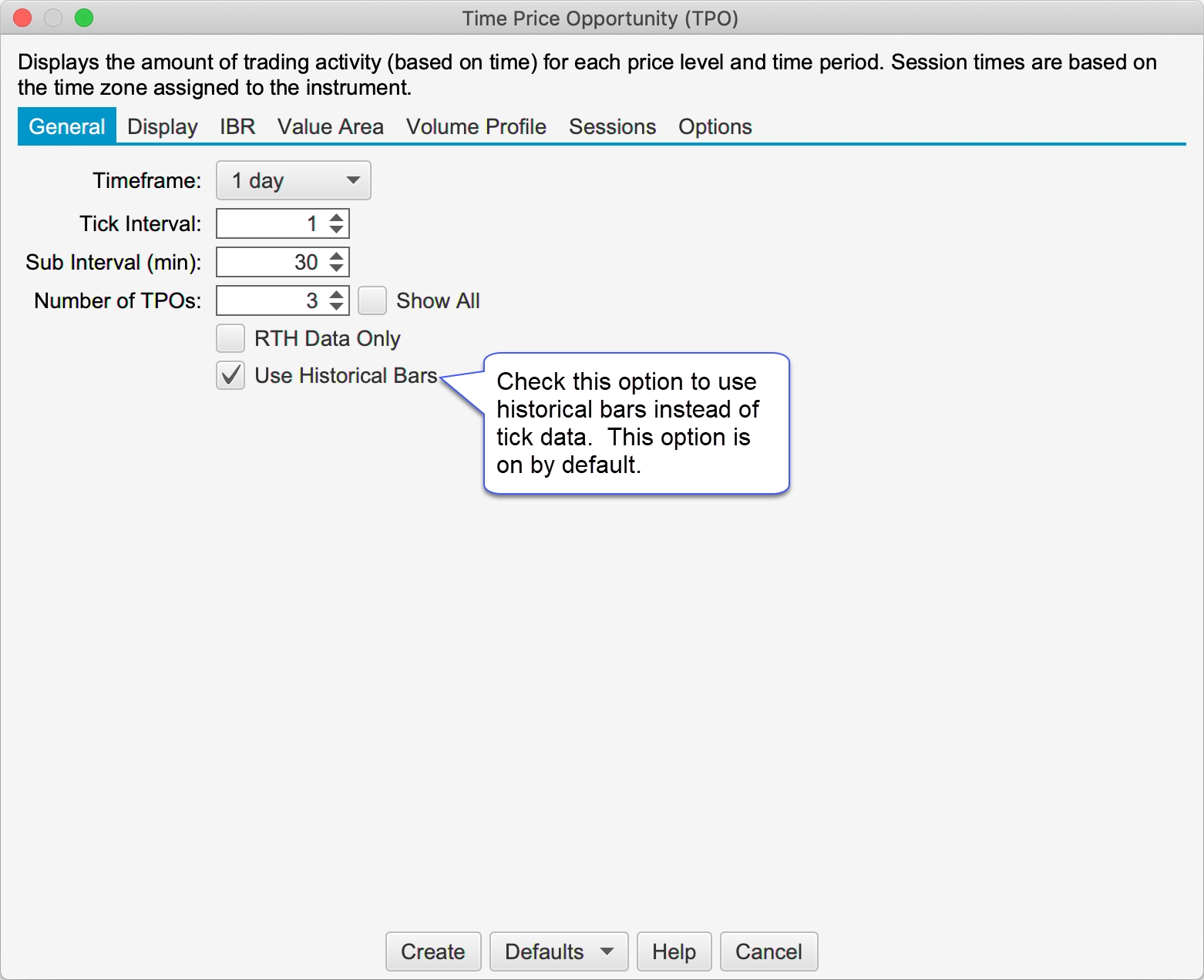

Historical Bars vs Tick Data

Optionally historical bars may be used instead of tick data (on by default). This significantly improves the loading time for the study and provides a greater range of data (at the expense of accuracy).

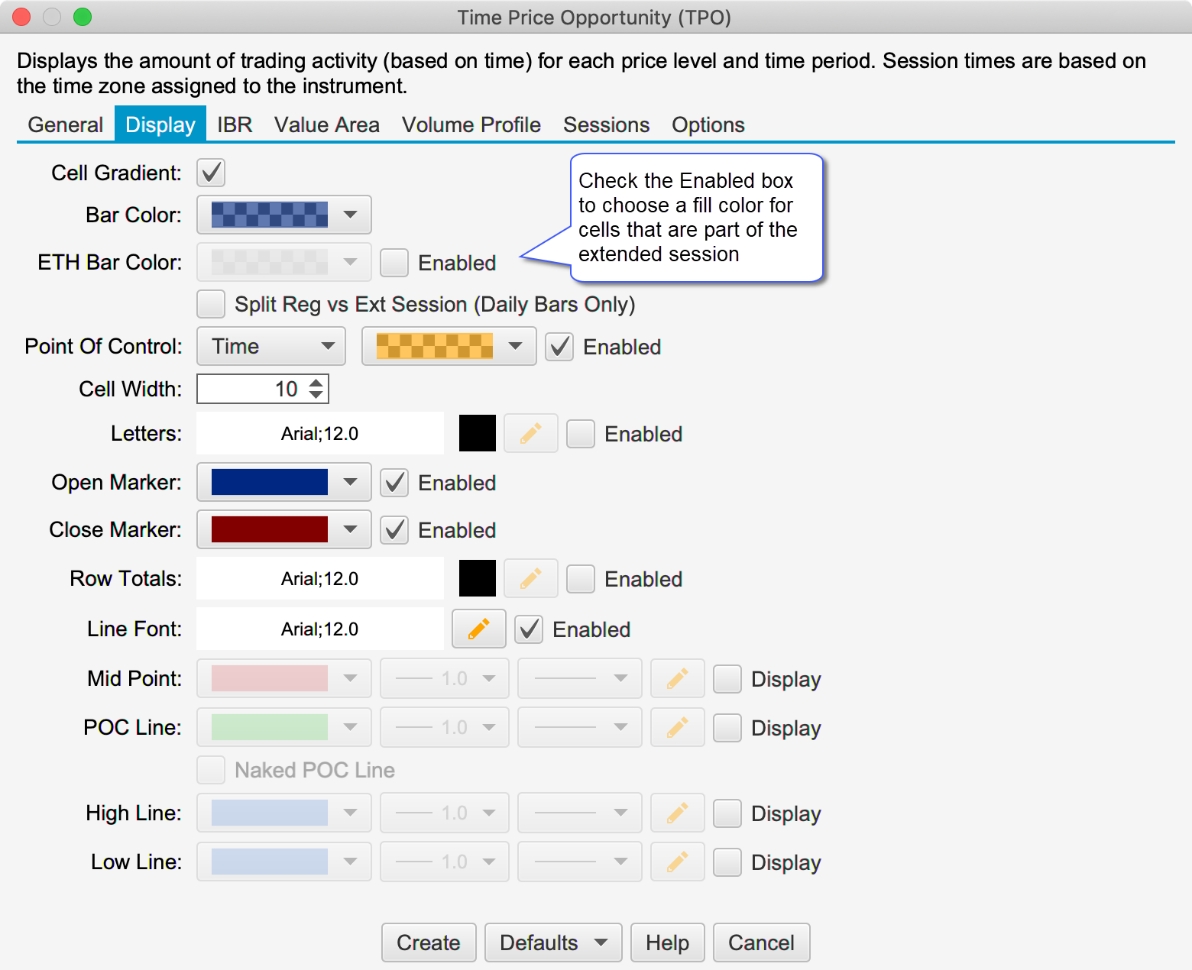

Background Cell Color

An additional option has been added to the TPO study to change the background color for cells that are part of the extended session (see screen shot below).

Font Color

Added a Font/Font Color option for letters displayed in the ETH session (see Display tab -> Letters ETH).

Constrain Width

If this option is checked it will automatically reduce the cell width if the profile overlaps the next profile.

Align Letters in Same Column

This option (see Display tab, Align Letters in Same Column check box) will place each letter in a separate column to better represent the time when that cell occurred.

Volume Imprint Study

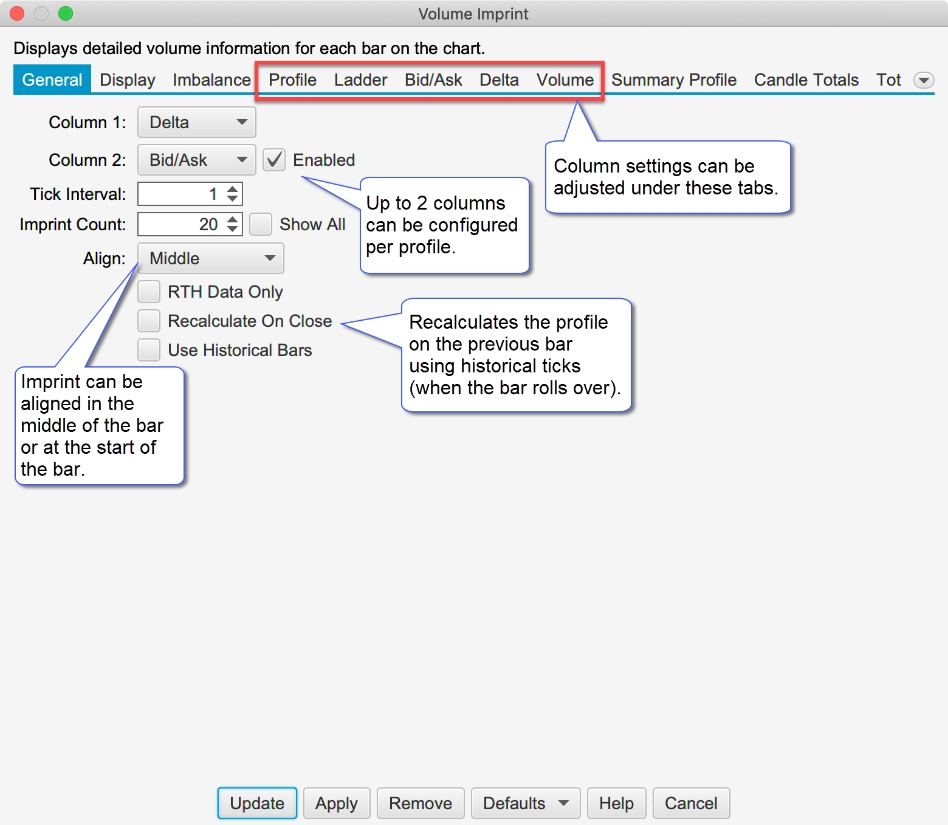

Multiple Columns

Two columns may be displayed for each Volume Imprint bar. This can be configured from the General tab of the study dialog:

Settings can be tailored for each column under the Profile, Ladder, Bid/Ask, Delta and Volume tabs.

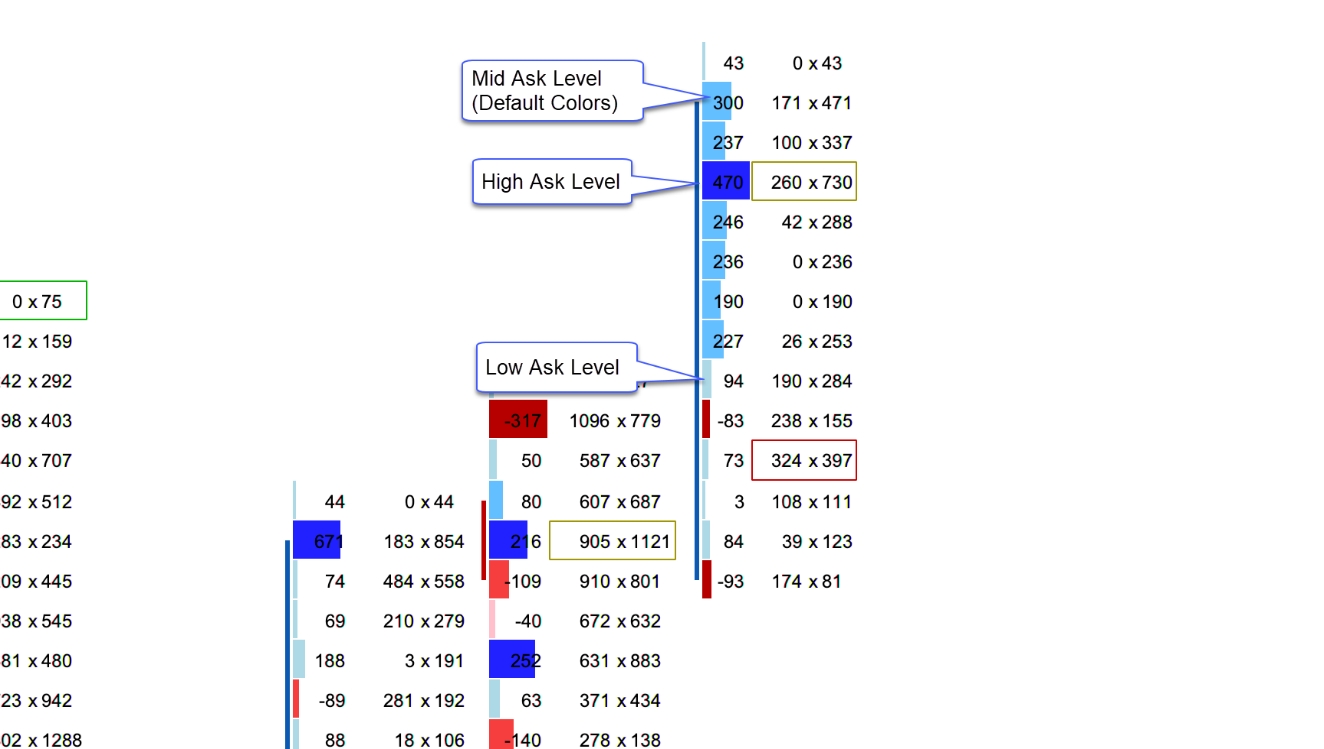

The following screen shot shows a Volume Imprint study with Delta and Bid/Ask columns:

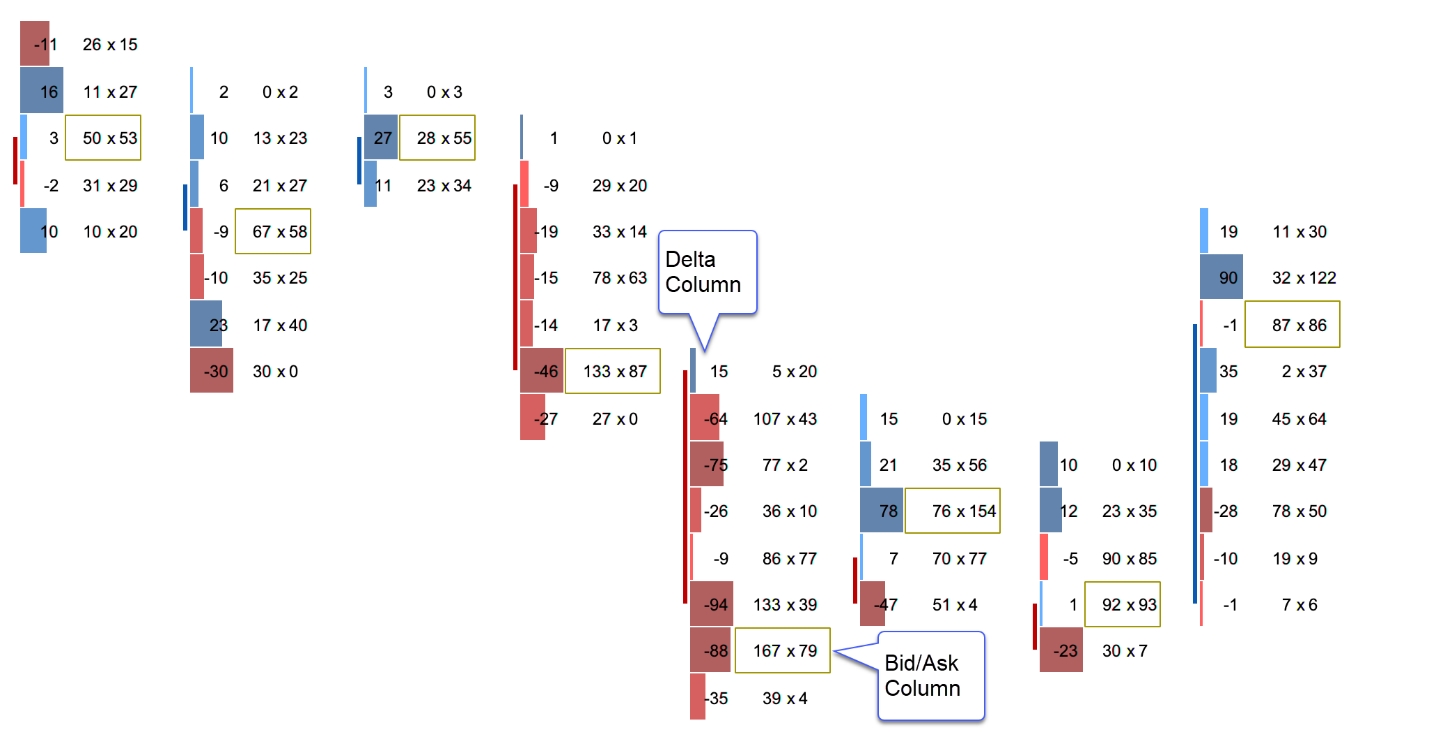

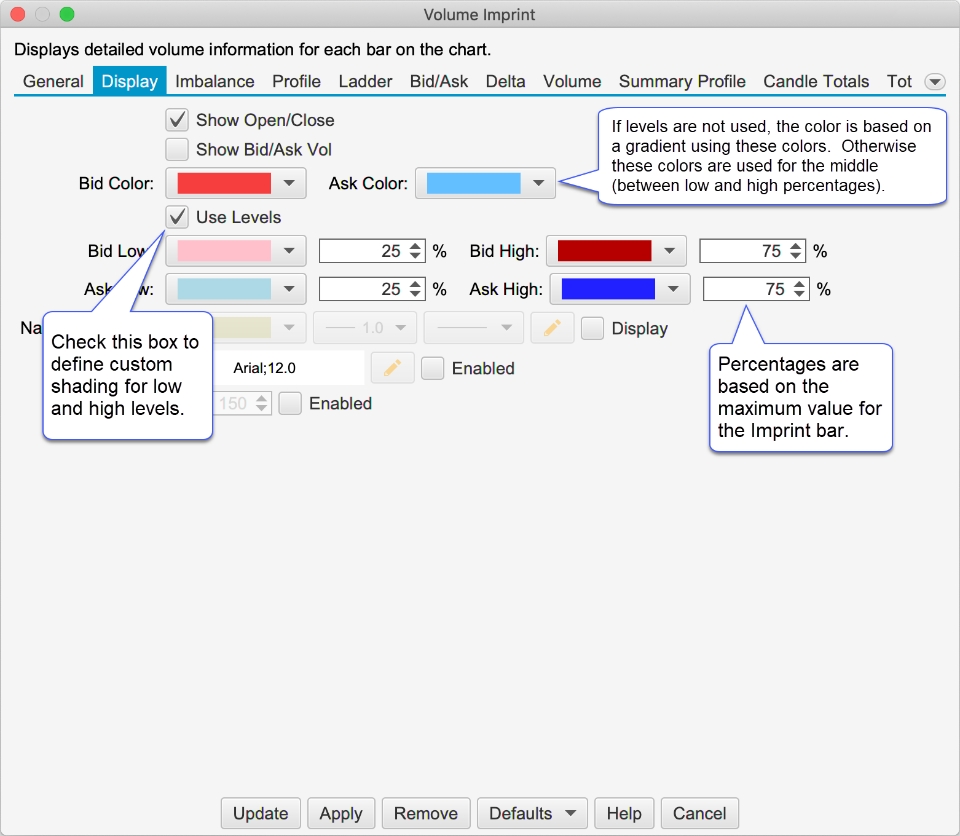

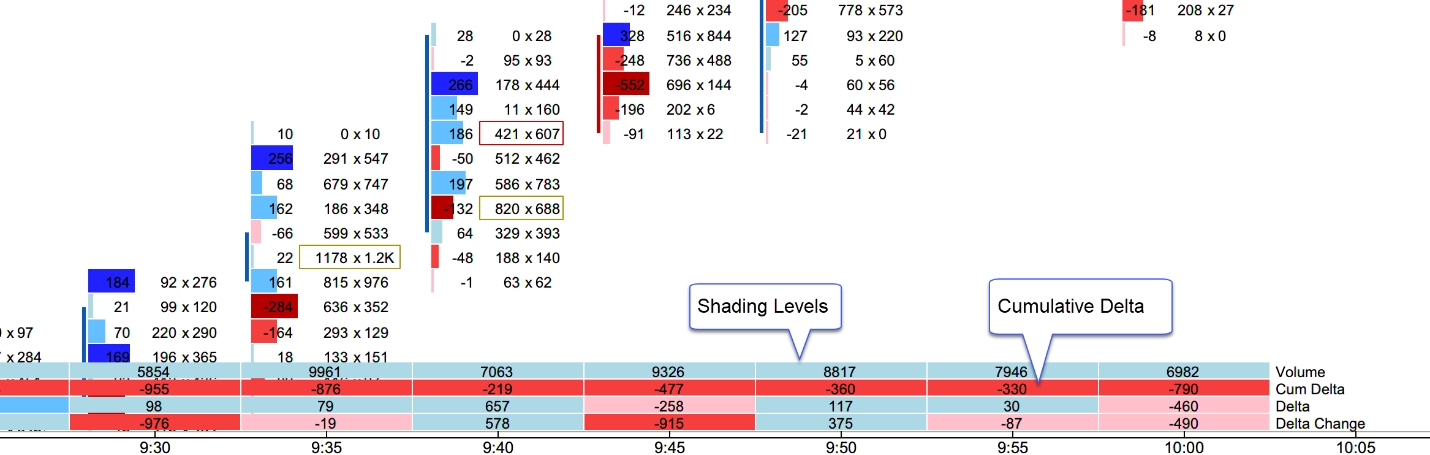

Shading Levels

Shading levels may be customized based on a percentage of the highest value. This can make is easier to spot high or low values. If levels are not used (uncheck Use Levels), then the shading uses a gradient based off the bid/ask colors (see below).

In the screen shot below, you can see the custom shading levels defined in the dialog box above.

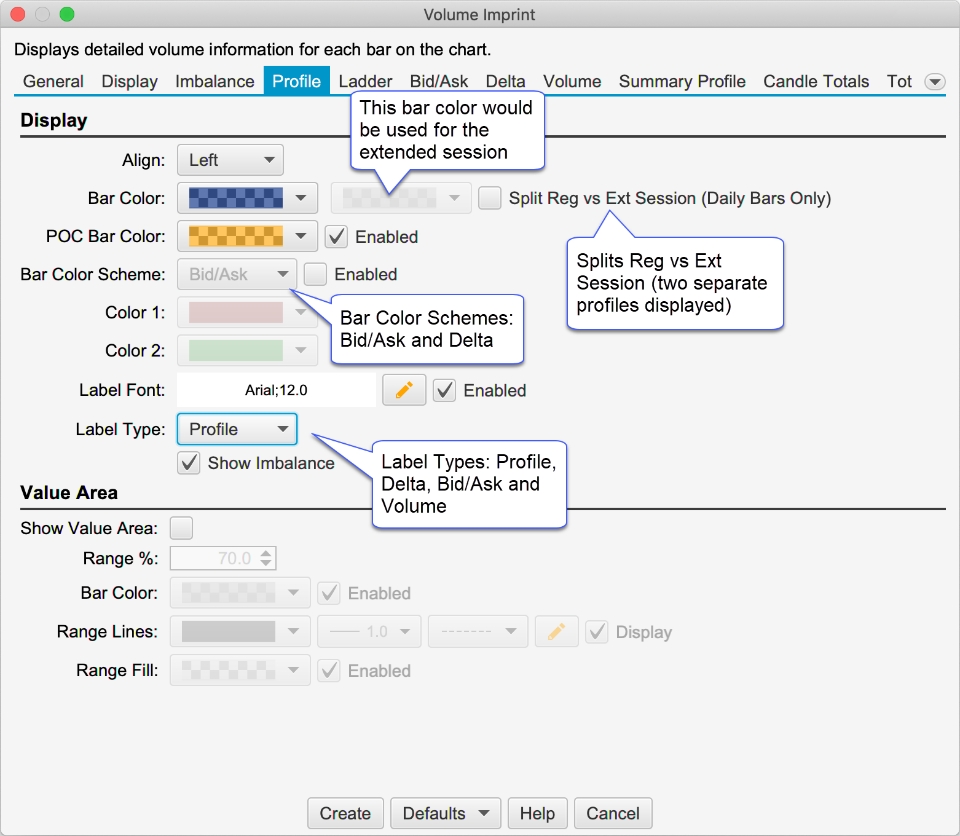

Profile

Several enhancements have been made to the profile column (see Profile tab in the Study Dialog):

Split Reg vs Extended Session – Splits the regular and extended trading session (daily bars only)

Bar Color Scheme – Optionally show Bid/Ask volume or Delta.

Label Type – This option will change the label displayed on each profile bar. Available options include (Note: this option is also available on Bid/Ask, Delta and Volume columns):

Profile – Displays the volume

Delta – Displays the delta value (Ask Volume – Bid Volume

Bid/Ask – Displays the Bid and Ask volume (same as Bid/Ask type)

Volume – Displays volume (using imbalance coloring)

The screen shot below shows the profile split into Reg vs Extended session. Extended session bars are shown in grey:

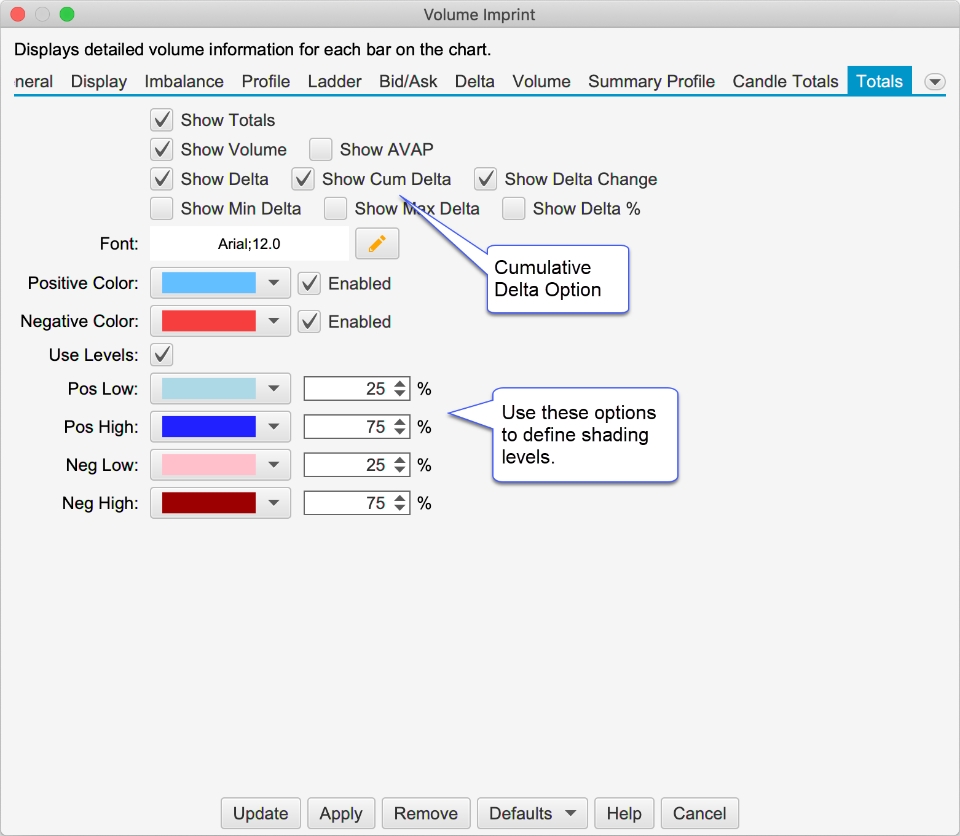

Totals

The following options have been added to the Totals tab of the study dialog:

Show Cum Delta – Displays daily cumulative delta

Shading Levels – Similar to the shading levels for the candle, this applies shading to the totals section at the bottom of the chart.

The screen shot below shows the totals at the bottom of the chart as configured in the dialog above:

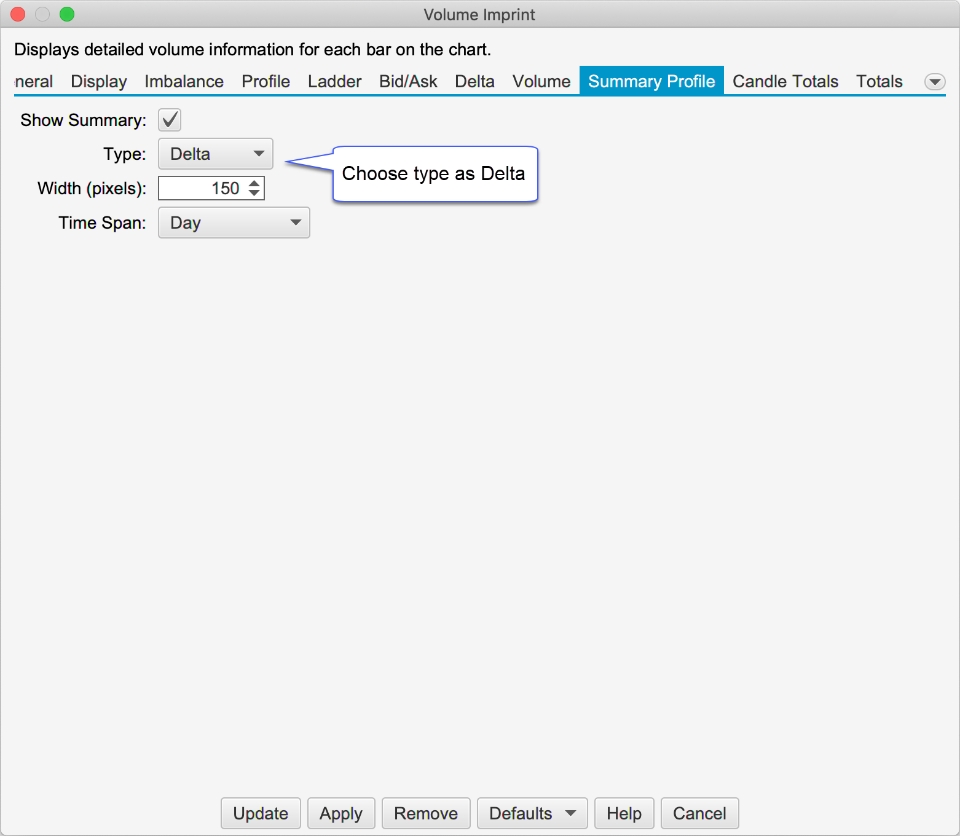

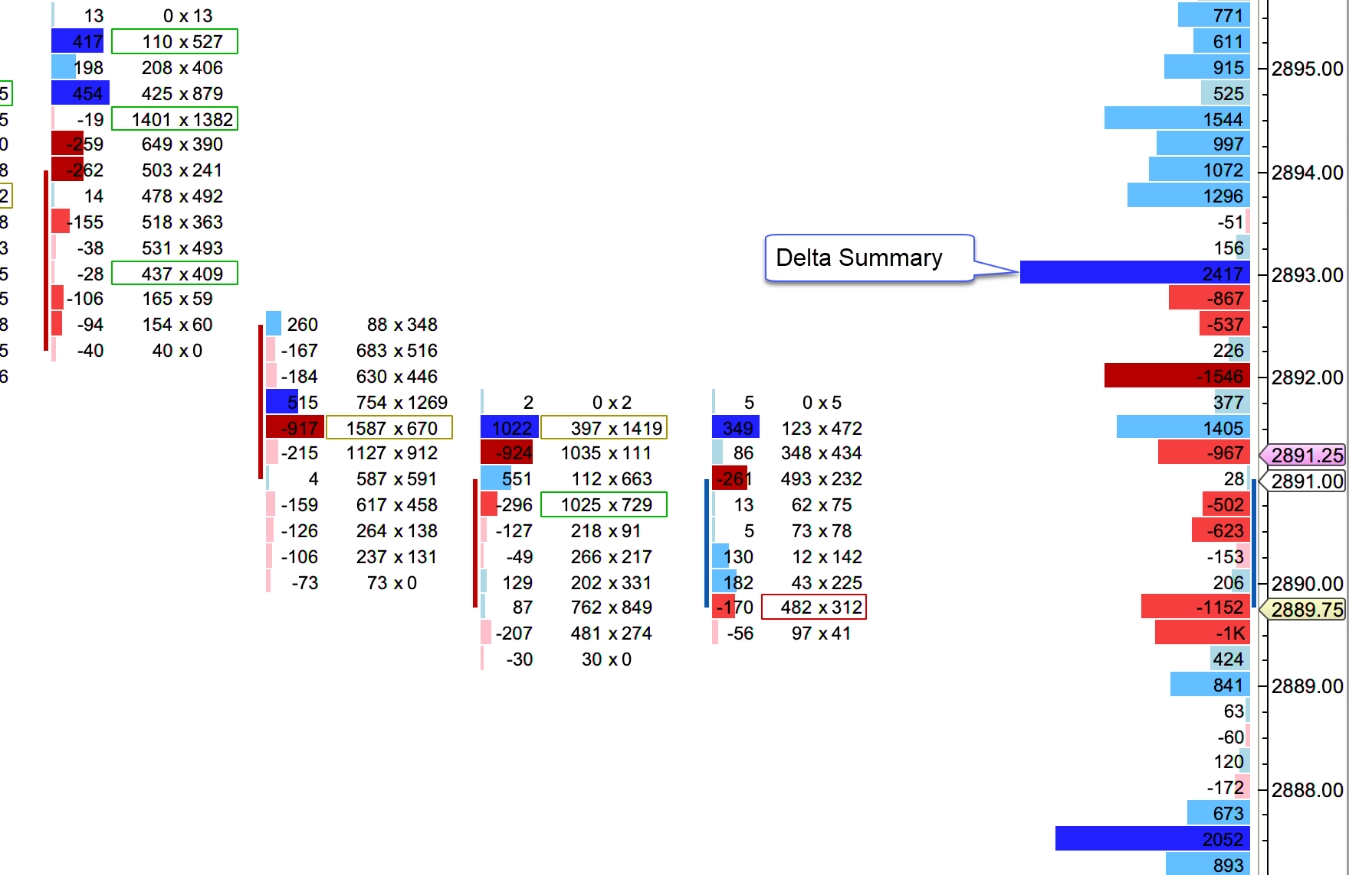

Delta Summary Profile

Delta has been added as an option for the summary profile:

The screen shot below shows the Delta Summary profile on the right hand side of the chart:

Disable Column 1

Added the option to disable Column 1. This will effectively hide the imprints, but allow you to show the imprints totals section at the bottom of the chart.

Font Colors

Added options to change the color for labels in the Volume Profile, Bid/Ask, Ladder, Volume, Delta and Totals.

Summary Profile Totals

Added the option to toggle the display of totals in the Summary Profile (see Summary Profile tab -> Show Totals).

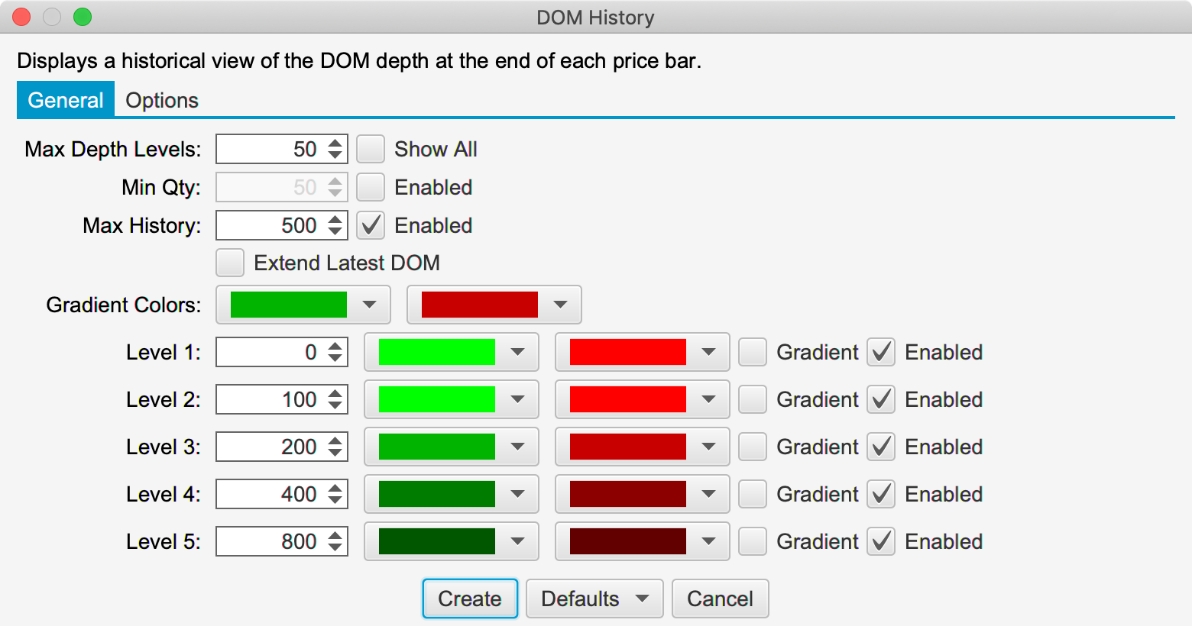

DOM History

Significant enhancements have been added to the DOM History study to improve the performance and add more coloring options. This dialog has the following options:

Max Depth Levels – Maximum number of levels to display for history (default 50). This is mostly relevant for Rithmic™ (which supports unlimited depth levels) but will apply to future brokers/data services that provide more than 10 levels of depth.

Min Qty – Minimum quantity for displaying a depth level.

Max History – Maximum number of bars for displaying the history

Extend Latest DOM – Extends the latest DOM levels to the end of the chart.

Gradient Colors – This field is the same as in previous versions of MotiveWave, but is also the default colors to use if none of the color levels apply (see below)

Level 1 – 5 – These fields allow you to customize how the DOM history is colored for specify quantity ranges. If none of these levels apply, then the default Gradient Colors are used.

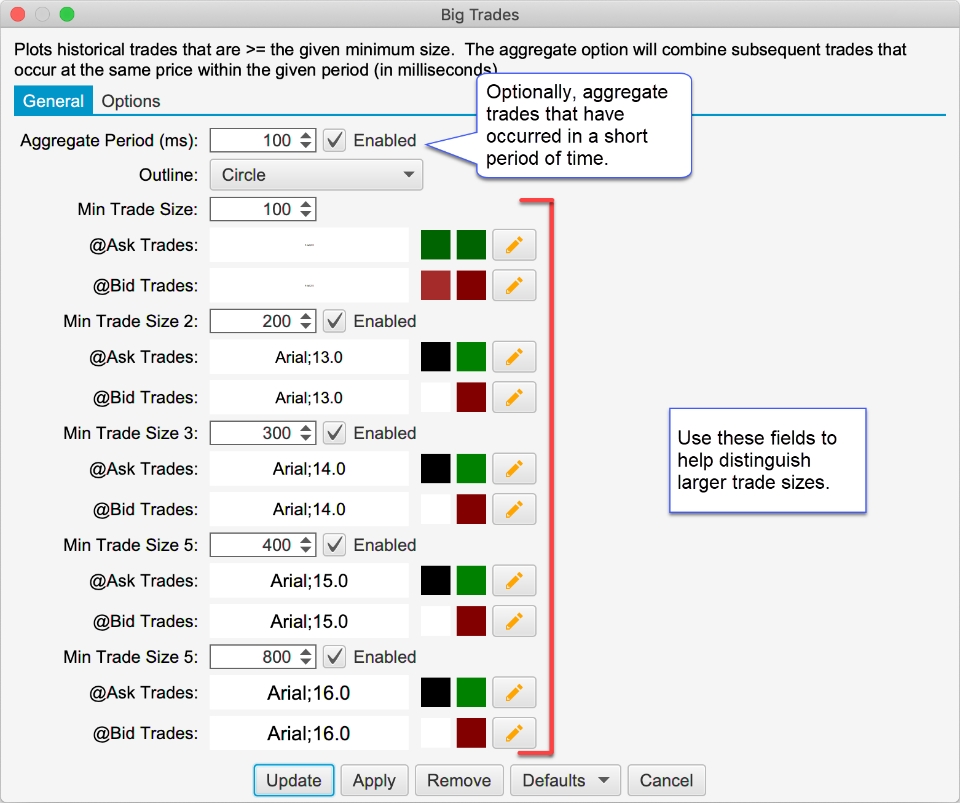

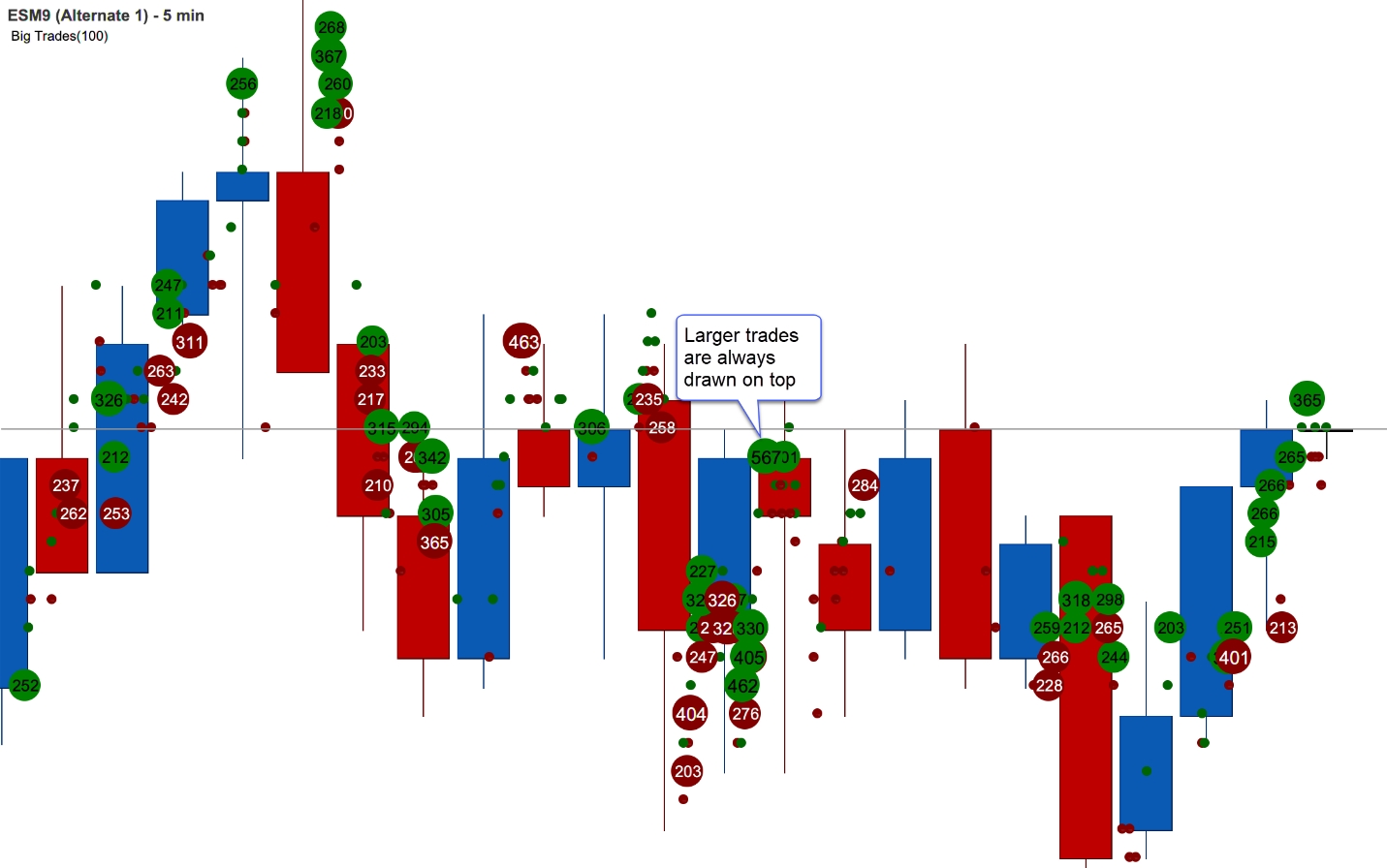

Big Trades Study

This new study shows historical trades on the chart. These are computed using historical tick data. This study has the following options:

Aggregate Period (ms) – Optionally aggregates trades that have occurred within the aggregate period (milliseconds). These trades must occur at the same price and the @Ask flag must be the same.

Outline – Options include:

Circle (default)

Rectangle

Rounded Rectangle

None (text only)

Min Trade Size – Up to 5 trade sizes can be defined to distinguish between smaller and larger trades. Use the Min Trade Size for each level to define the tiers.

@Ask Trades – These fields define the font, font color and background color for trades that occurred at the ask price. The size of the trade can be modified by changing the size of the font. Text can be hidden by choosing the same font color as the background color.

@Bid Trades – Same as @Ask trades, but applies to trades that occurred at the bid price.

The screen shot below shows the Big Trades study with the settings from above. For convenience larger trades are drawn on top (potentially hiding smaller trades underneath). The following limitations are imposed to avoid performance issues with the study:

Max 25000 Trades – The study will only compute a maximum of 25000 trades that meet the given criteria

Max 500 Visible – A maximum of 500 trades will be drawn on the chart at one time.

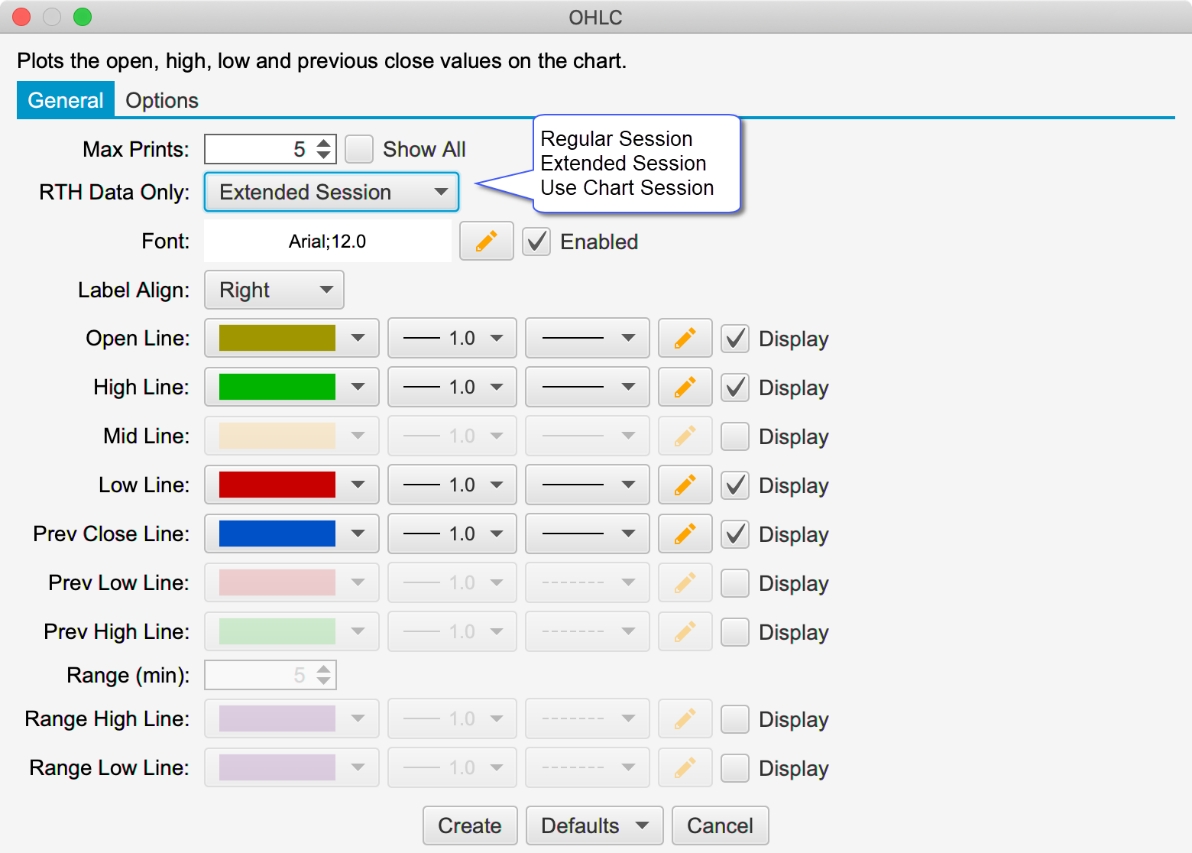

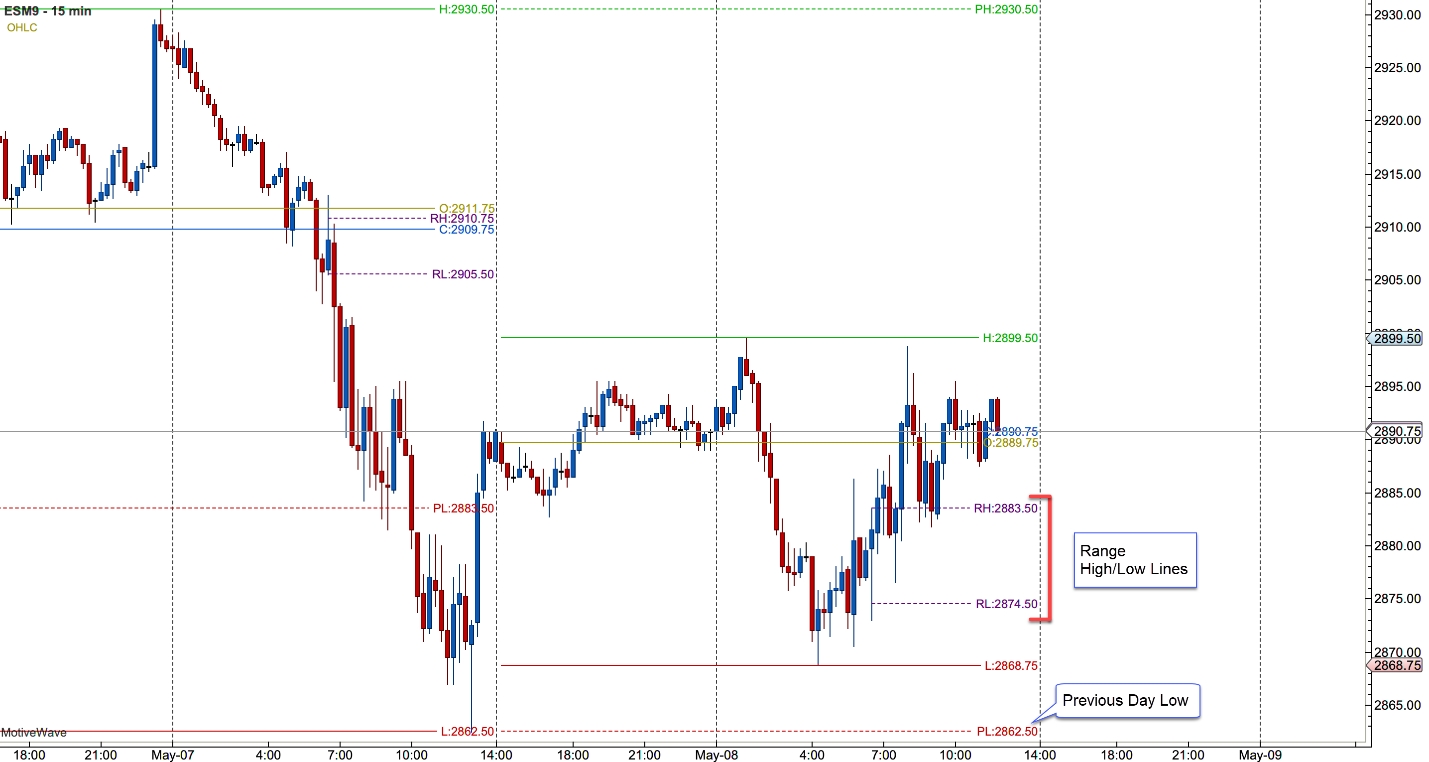

OHLC Study

This new study plots the daily (ETH or RTH) information for the following: Note: this study only works on intraday bars.

Open – Opening price for the day

High – High price for the day

Low – Low price for the day

Prev Close – Close for the previous day

Mid – Midpoint between the high and low

Prev Low – Low price for the previous day

Prev High – High price for the previous day

Range (min) – Time range for computing the Range High/Low lines. The time starts at the opening time for the day (regular trading hours)

Range High – High value for the range defined above

Range Low – Low value for the range defined above

The screen shot below shows the study using the settings in the dialog above:

Volume Profile Study

The existing Volume Profile study has been rewritten in this update to use tick data and define a time range. The purpose of this study is to display a summary volume profile on the left or right side of the chart over an extended period of time.

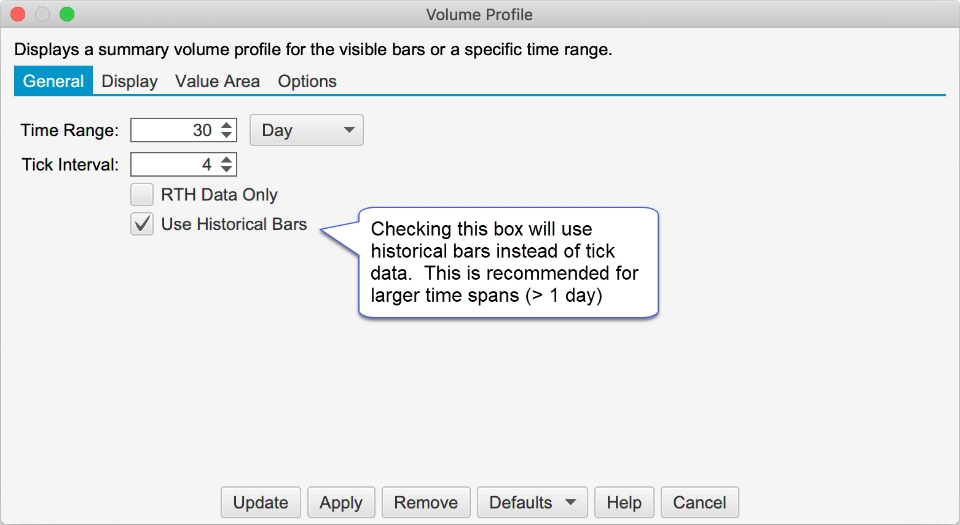

General Tab

The following options are available on the General tab:

Time Range – Specified the time range for the volume profile. The range will “roll over” when it hits the end of the range. For example, if “Day” is chosen, the time range will shift when the start of the next day is reached. Available options include:

Day

1 Min

5 Min

10 Min

15 Min

30 Min

45 Min

1 Hour

Tick Interval – number of ticks that make each bar in the profile

RTH Data – only uses regular trading hours data if checked

Use Historical Bars – Uses historical bars instead of tick data. This is recommended if the time range is larger (greater than 1 day) or tick data is limited from your broker/data service.

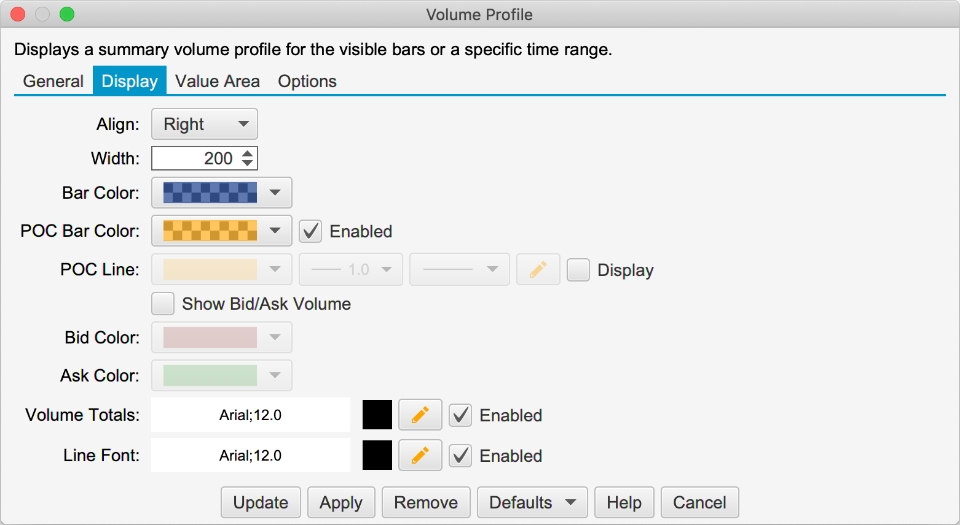

Display

The following options are available in the Display tab:

Align – Displays the profile on the left- or right-hand side of the price graph

Width – Maximum width for the profile bars.

Bar Color – Default color for the bars (not displayed if Show Bid/Ask Volume is checked)

POC Bar Color – Bar color for the bar that is the Point of Control (bar with the highest volume)

POC Line – Optionally displays a line across the chart from the middle of the POC bar

Show Bid/Ask Volume – Separates the Bid/Ask volume in each profile bar using the Bid/Ask colors below

Bid Color – Color for the bid volume in the profile bar

Ask Color – Color for the ask volume in the profile bar

Volume Totals – Toggles the display of the volume totals for each bar and defines the font/font color

Line Font – Toggles the display of the prices for the horizontal lines. This applies to the POC line as well as the Range Lines (see Value Area tab).

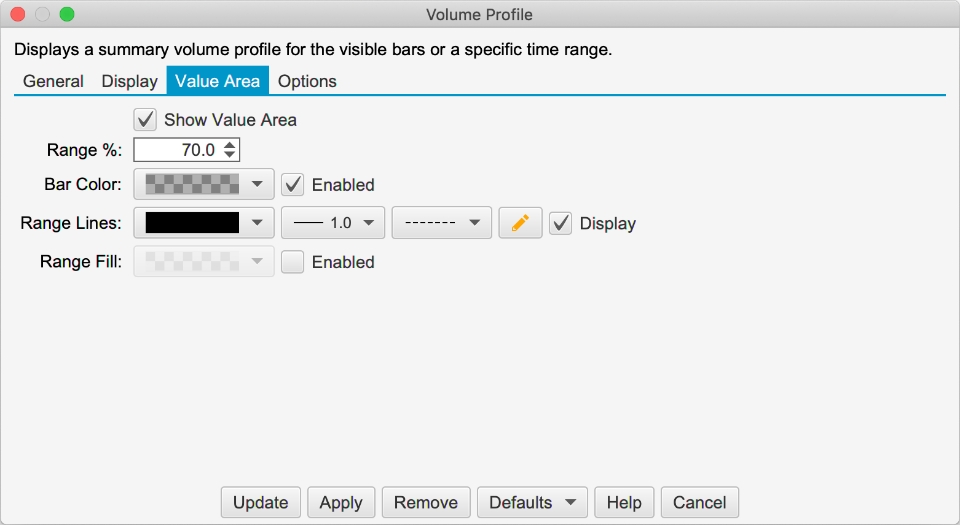

Value Area

Use this tab to display the value area for the profile. It has the following options:

Show Value Area – Toggles the display of the Value Area

Range % - Defines the percentage for calculating the value area. For example, 70% will select the range of bars that encompass 70% of the volume for the profile. This range must include the Point of Control and includes the minimum number of bars.

Bar Color – Bar color for the bars that are included in the value area

Range Lines – Optionally displays horizontal lines at the top and bottom of the value area

Range Fill – Optionally draws the given fill color for the value area.

The following screen shot shows a 30 day volume profile displayed on the right side of the price graph:

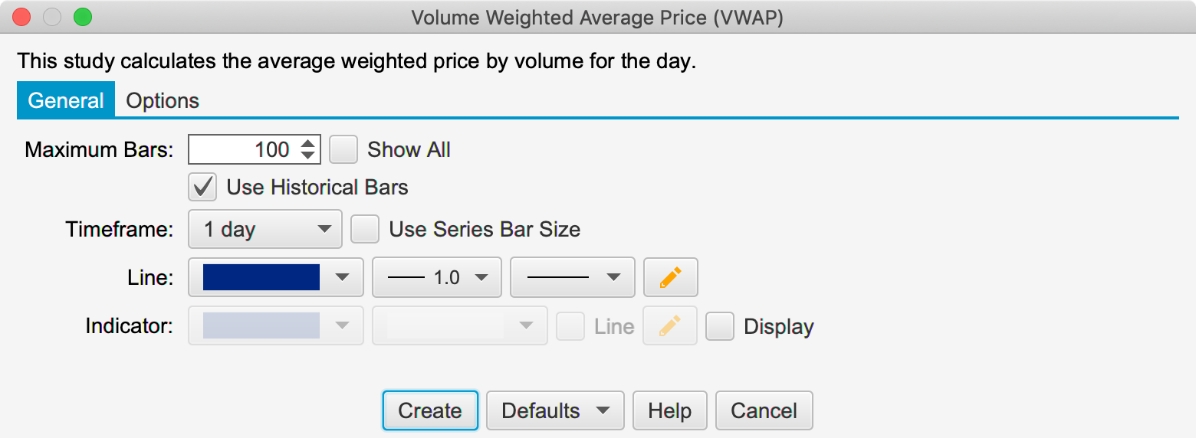

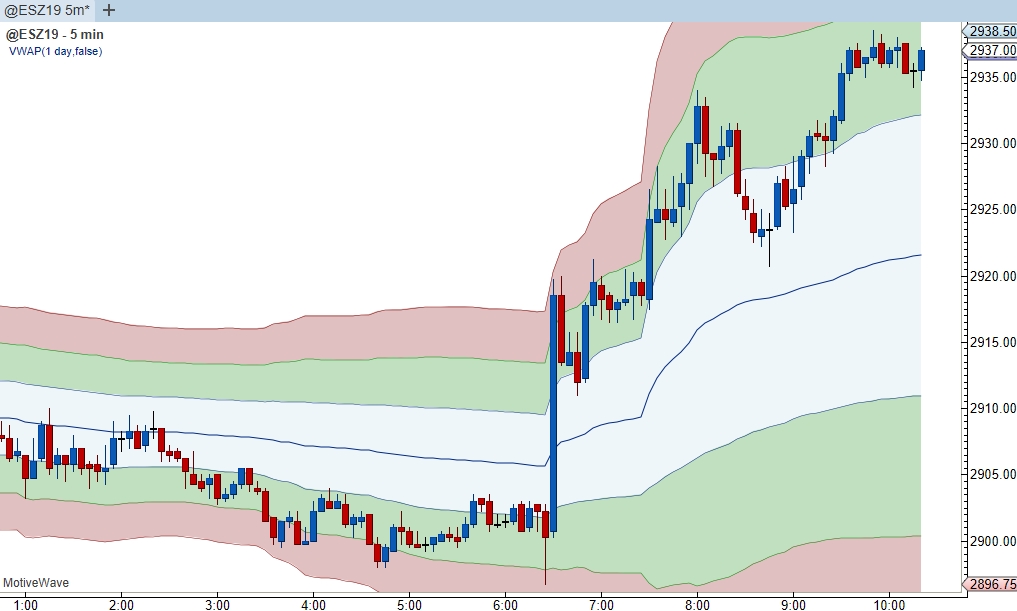

VWAP Study

Tick Data

The VWAP (Volume Weighted Average Price) study has been re-written to use historical tick data (instead of bar data). Optionally, ticks can be generated from historical minute bars (see Use Historical Bars option below).

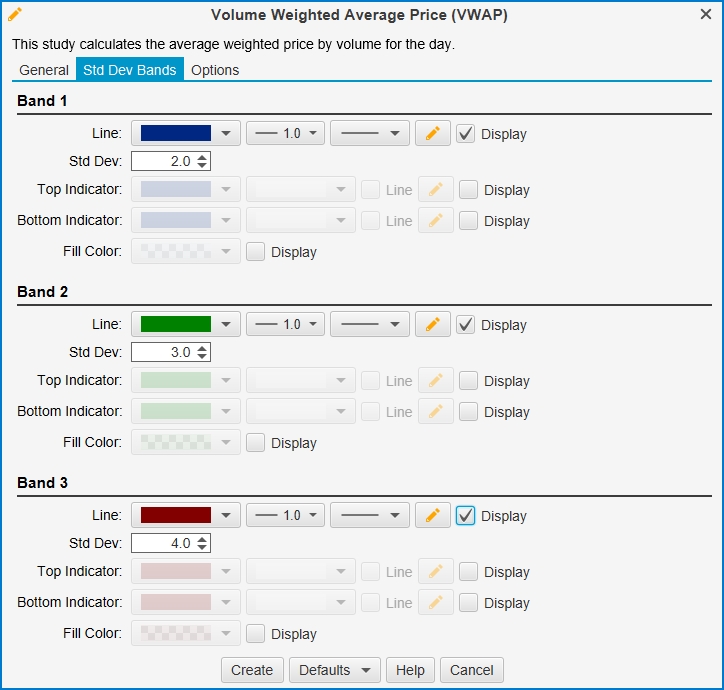

Standard Deviation Bands and Anchors

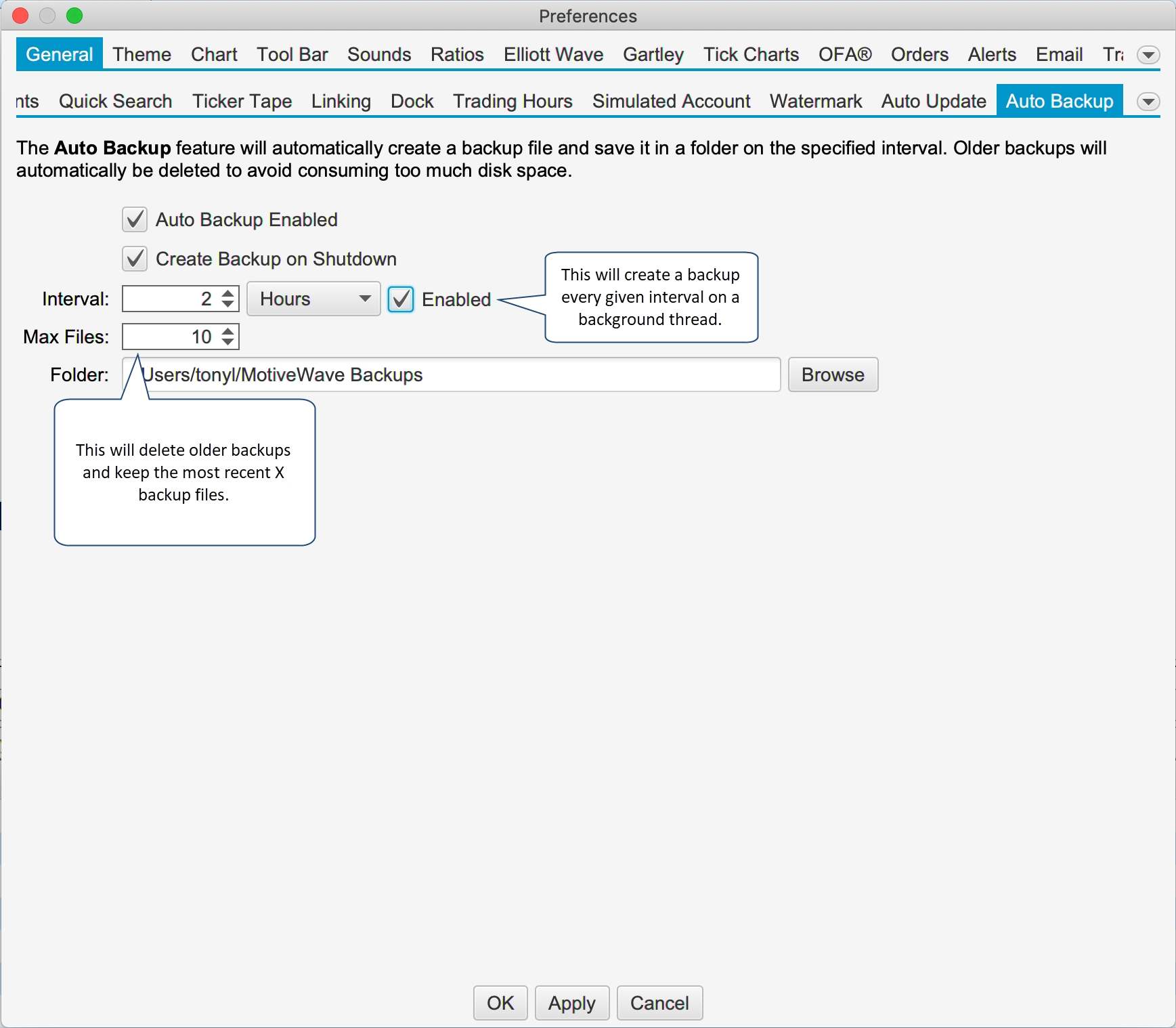

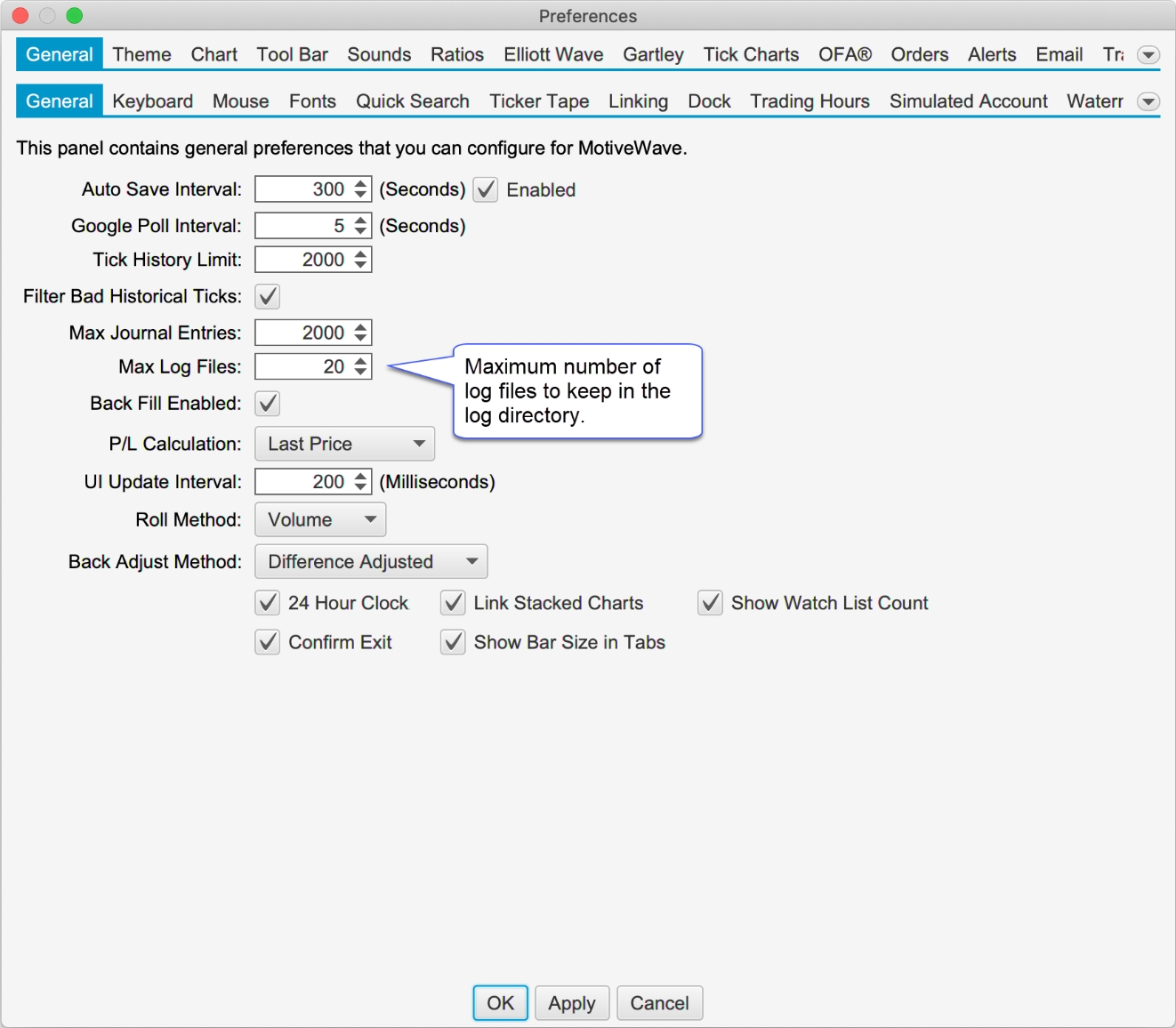

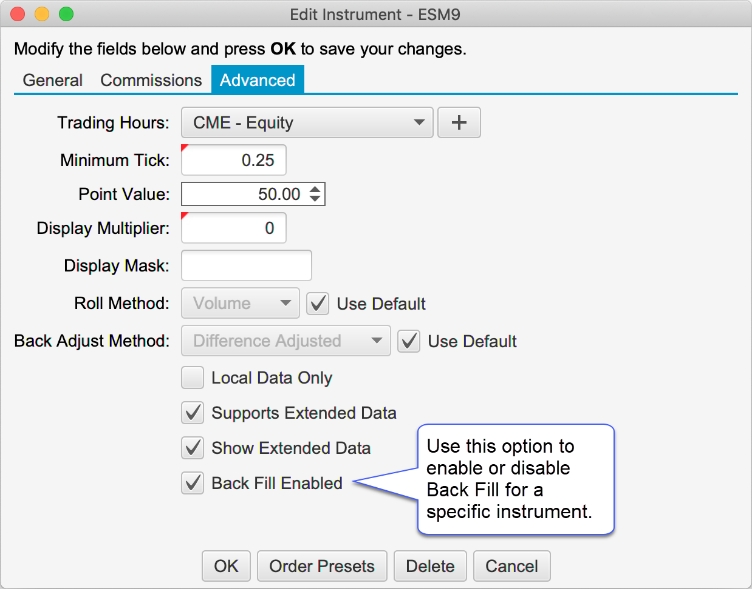

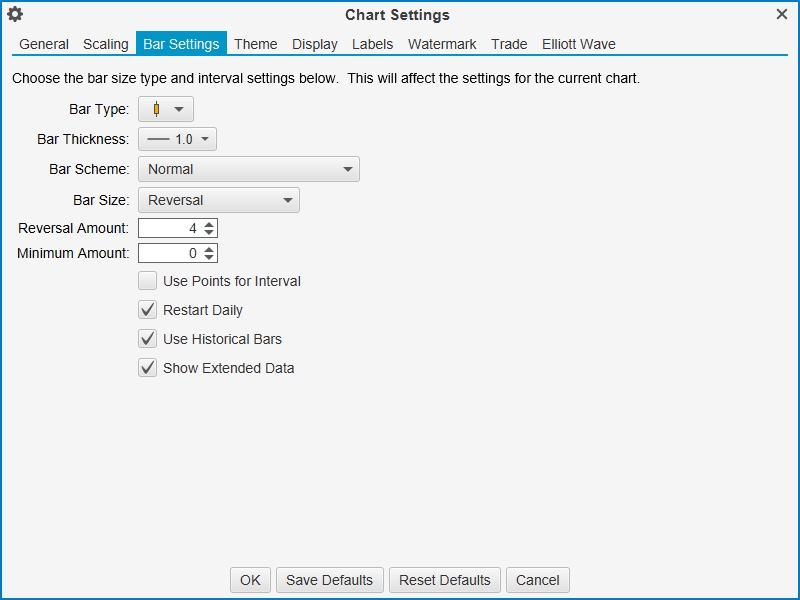

The following enhancements/changes have been added to the VWAP study: